Grab a ball of bytes for fun and profit

Byteball is an interesting new cryptocurrency platform that I am actively building a small stake in as one of my long term investments. It has a relatively small market cap (ranked #40 on coinmarketcap.com at $6.9 million), but has been getting a lot of attention due to the unconventional nature of its initial coin distribution.

Launched last year on Christmas Day, Byteball is the brainchild of Anton Churyumov, a Russian technologist with advanced degrees in math and physics. Anton (or Tony as he is known in the community) conceived of Byteball in late 2014 as a way to solve what he saw as fundamental architectural flaws in cryptocurrencies like Bitcoin. He also wanted to design something that would be friendlier to the KYC (Know Your Customer) requirements of financial firms, and thus easier to integrate with traditional banking.

Features

Anton's invention is packed with a smorgasbord of features. As a veritable crypto Swiss Army knife, it offers something for everyone. Here are a few highlights:

1. No blockchain here... we've got a DAG!

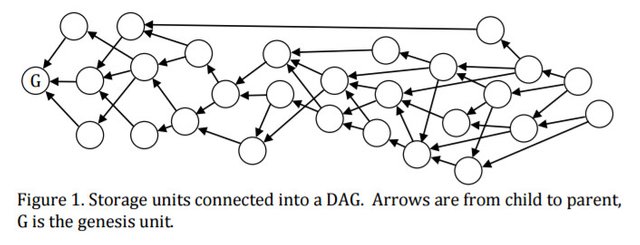

Unlike most other cryptocurrencies, Byteball does not rely on a blockchain or proof-of-work to run its network. Instead, it uses a DAG (Directed Acyclic Graph). All transactions in Byteball are actually messages that create new storage units in the DAG database, which can be visualized as something like this diagram from Anton's whitepaper:

According to Anton, this structure offers some big advantages over Bitcoin: you don't have to wait a long time for transactions to confirm, and the DAG scales better under heavy load (there's no block size limit, so the whole scaling debate that consumes the Bitcoin community these days is entirely bypassed).

The DAG can also store entirely arbitrary kinds of data. For example, a storage unit can represent payments of transferable assets not dissimilar to Ethereum dapp tokens. But it could also be a text document, image data, or anything else you can imagine.

2. Bytes are first-class citizens

Byteball's native cryptocurrency is called... wait for it... bytes. It represents the cost you have to pay for the privilege of storing that number of bytes (now speaking in the usual computer storage sense of the word) into the DAG database.

Your probably won't be surprised to learn that bytes can be grouped in units of KB (1000 bytes), MB (1 million bytes), or GB (1 billion bytes). When purchasing bytes from external sources such as a crypto exchange, prices are usually quoted in terms of GB (1 GB is worth about $58 as I write this).

3. Private transactions

Byteball has a second built-in cryptocurrency called blackbytes. These are similar to bytes, except there are more of them in existence and you can use them for private transactions. This means that when you send blackbytes to someone, no third party can track the transfer. This is completely unlike Bitcoin, which records all transactions publicly and allows anyone to trace the movement of funds from address to address using a blockchain explorer.

4. Other assets

Besides bytes and blackbytes, anyone is free to define their own custom asset by mixing & matching various properties. For example, a bank might integrate with the Byteball network by defining its own asset to represent a bond issuance. It could set a property that requires transactions to be co-signed by the asset creator, thereby allowing transfers only between clients that have satisfied regulatory KYC (Know Your Customer) checks or other requirements set forth by the bank. In this manner, it becomes very easy to slot Byteball into any existing financial regulatory framework.

5. Smart contracts

Smart contracts are all the rage these days, so of course Byteball supports them, in the form of a limited scripting language that can be used to structure DAG messages in a certain way. Example usages include atomic swap transactions (eliminating the need for escrow), voting on polls, decentralized exchanges, and conditional transactions.

Note that Byteball's smart contract language is not as flexible or powerful as Ethereum's Solidity. But that's by design. Anton deliberately wanted Byteball smart contracts to be easy to read & design by non-programmers, and simplicity reduces the chances of making a mistake in the contract code.

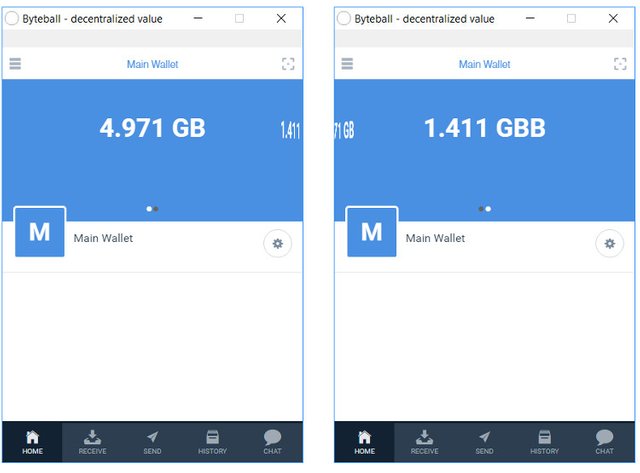

6. The wallet

Last but not least, every cryptocurrency needs some wallet software. The Byteball wallet has a slick user interface that is well thought out and a pleasure to use:

Main screen of the Windows wallet app. There's also an Android version, hence the mobile UI styling. Swiping left & right switches between your assets, in this case gigabytes on the left and giga-blackbytes on the right.

Initial Coin Distribution

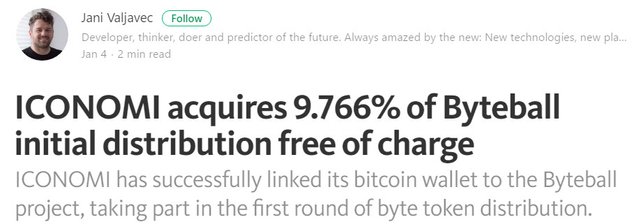

I found out about Byteball in early January when I stumbled upon this headline from the ICONOMI blog:

ICONOMI, another project I've been keeping an eye on for quite some time, is a cryptocurrency investment fund management platform that will allow financial specialists to roll their own funds and market them to investors. When the platform launches hopefully in a month or two, it'll kick off with 2 funds managed by the ICONOMI team. One of them, the performance fund, invests in new projects & ICOs that have potential for large long-term valuations. So anything that ICONOMI acquires is worth paying attention to.

The part of the headline that really perked me up was "free of charge". Say what? How did they get a free chunk of Byteball's bytes? Well, unlike most new cryptocurrencies that distribute coins through an ICO or some mining scheme, Anton decided to give away bytes for free to all Bitcoin holders. Yes, that's right. Just for owning some Bitcoin, you can get free bytes!

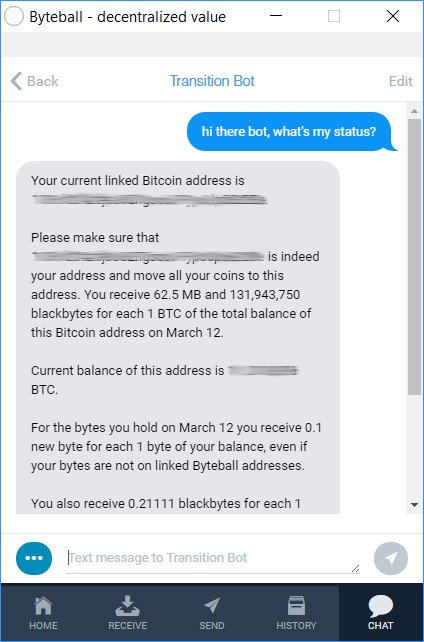

In order to participate in the giveaway, you have to link your Byteball and Bitcoin wallets, essentially proving that you own some Bitcoin and thus are entitled to receive bytes in proportion to the amount of Bitcoin you actually hold. You do this by the novel method of using your Byteball wallet's chat feature to talk to a "transition bot":

After finishing this process, you can check to see if your Bitcoin address is listed on the transition page that shows all linked addresses:

Look for your specific address using the search box at the top right side of the page.

But Byteball has already launched! Is it too late to get in on the fun?

Not at all. Bytes are being distributed slowly through several rounds stretching across many months. The first couple distributions are over, but the next round is coming up just a week from now. Quoting from the official Byteball web site:

In the first round, over 70,000 BTC was linked, and we distributed 10% of all bytes and blackbytes according to linked Bitcoin balances in the first Bitcoin block timestamped Dec 25, 2016 (Christmas block). In the second round, we distributed another 1.76%, over 120,000 BTC was linked.

In the 3rd round, which is scheduled for the full moon of March (March 12, 2017 at 14:54 UTC), we'll distribute 62.5 MB for each 1 BTC of linked balance and 0.1 new byte for each 1 byte you already hold.

Where to get some

In addition to linking all my Bitcoin, I decided to buy bytes before the distribution so that I'll get another 10% free (0.1 new byte for each 1 byte you already hold) on the distribution day.

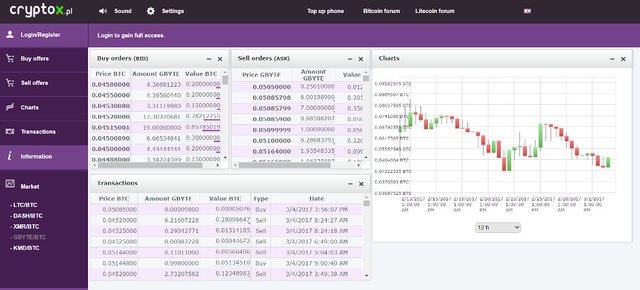

Bytes are not traded yet on the big, popular cryptocurrency exchanges. Fortunately, there is one fairly easy to use exchange that offers them: Cryptox. It's a small exchange, ran by just a single individual I suspect, and prone to frequent maintenance outages. I wouldn't leave large amounts of Bitcoin sitting around on Cryptox for any extended period of time. But it works well enough, and withdrawals / deposits are reasonably fast, making it perfect for a quick in & out purchase.

Trading on Cryptox is done in units of gigabytes under the GBYTE/BTC market:

The above chart shows price action over the past couple weeks. Now is a good time to buy as prices are hovering in the lower end of the recent trading range. Just be careful not to buy too much at once. Volumes on Cryptox are fairly low, so large orders can easily move the market. If you want to establish a large position, it's better to do it with a series of small orders spread out over a few days.

In conclusion

Byteball is a refreshing newcomer in the crypto space, borrowing features from some of the best aspects of more well known Bitcoin 2.0 platforms but approaching them from a completely different perspective, while also trying to fix Bitcoin's most glaring flaws. It has a small but growing community and is included in the upcoming ICONOMI performance crypto fund. It's too early to tell if it will experience the explosive growth necessary to be declared a success, but the chances look better than most altcoins and hey, who can complain about getting free coins?

There's really nothing to lose by taking part in the coming distribution rounds with whatever spare Bitcoin you happen to have on hand, and potentially a lot to gain.

Links for further study

My introduction to Ethereum: https://steemit.com/ethereum/@cryptomancer/ethereum-for-dummies-introducing-the-next-great-technological-leap-forward

Byteball essential references:

- Official Byteball web site

- Byteball whitepaper

- Bitcoin linking transition web site

- Bitcointalk thread

- ICONOMI blog about acquiring some of the initial Byteball distribution

- Byteball community Slack

- Cryptox cryptocurrency exchange

Background knowledge on Anton Churyumov is sourced from this article on the German blog site Altcoinspekulant.

For more posts about cryptocurrency, finance, travels in Japan, and my journey to escape corporate slavery, please follow me: @cryptomancer

Image credits: title image is an edited graphic taken from Pixabay and used under Creative Commons CC0. The DAG visualization is taken directly from the Byteball whitepaper by Anton Churyumov. All other images are screen shots from my desktop PC.

Achievement badges courtesy of @elyaque . Want your own? Check out his blog.

Just heard about this! So disappointed I didn't hear about it sooner!

The full moon is about to happen so i am ready for it when it does now! ;D

Well it's not too late to get in on the fun! Byteball has been having a good run this year, and interest seems to be increasing with every distribution round that goes by. I've noticed the pattern is pretty much holding to what I expected: a price pump leading up to the distribution followed by a sell off afterward. But there are enough people holding long term to benefit from the distributions that the average price has been staying high, which is encouraging to see.

This is cool. Upvoting!

Thanks for your support!

As a thank you for being active on TradeQwik we are upvoting your most recent post at 100% power. Thank you for choosing tradeqwik.com

Thanks, it's been exciting so far getting familiar with the ins & outs of TradeQwik and I expect it will be a very important addition to my trading toolset going forward.

wow great :)

Glad you liked it!

Very interesting, thanks for sharing!

So you say that it is a long term investment, do you believe the price will increase due to the smaller number available, or are there other reasons?

There are some opposing forces to take into account here. First of all, the current supply of coins is very limited as just a bit more than 10% of the total number of bytes have been distributed so far. Over time, as more coins are released, the supply will increase and we can expect to see some downward pressure as people sell their free bytes. However, that could be offset by "buy the rumour / sell the news" style waves of buying before each distribution round, as people try to establish positions so they can effectively get bigger cost basis discounts from the distribution. We already saw one such large price increase before the February distribution, followed by a sell off afterwards.

So one possible strategy I will explore is to ride the waves before the distributions, selling a portion as the waves crest and buying back once the price goes back down, thereby increasing my total stash.

Overall, I will continue holding until at least all the bytes have been given out, to maximize the number of coins I get. Beyond that, price should be largely determined by fundamentals: is Byteball usage increasing, are additional assets being added to the platform by third parties, etc. Just as the number of successful dapps on Ethereum should contribute to the value growth of Ether, I expect something similar could happen with Byteball if the devs can attract interest from third party developers. Byteball is designed to be very friendly to integration with the existing financial system, so if any banks can be persuaded to experiment with it, that could also be a catalyst for explosive growth.

Basically, the platform has a lot of potential but it could be a long time before that potential is realized, and before fundamentals can assert themselves we have to get past all the distribution rounds, which will have the largest impact on the price in the short term.

Wow! What a reply!

Thanks so much for the info, @cryptomancer - I will definitely look in to this.

You're welcome. By the way, I noticed your profile says you are a freelance graphic artist. As such, you may be interested in this design contest for the VIVA economic system, another crypto project I will be writing more about soon: https://steemit.com/contest/@vivacoin/viva-contest-so-you-think-you-can-graphic-artz

Thanks for this post:) i'm keeping a sharp eye on hedera hashgraph. what are your thoughts? Will this be 2019 when it emerges, making this year blockchain year? or will Bytes etc come into its own over time...