The death of the American dream

Nothing symbolizes the success of western civilisation like the American dream. Unfortunately, that dream is about to vanish. There are things that are inescapable. We can safely say economic laws are one of those things and if you keep trying to ignore them, sooner or later you will run into a wall. In my lifetime, I’ve seen quite a few nations crumble from ignorance of those laws. History is replete with still more tales of economic arrogance that ended oh so badly. So if you think western civilisation is exempt from those rules, you are sadly mistaken. I fully expect to witness its inevitable downfall unless deep changes occur and I doubt very much they will come in time. To truly understand the how and the why our civilisation is dying, one has to understand the lifeblood of any economy: money.

But what is money?

Not such a simple question. Few people nowadays really have a good understanding of money. So let me give you a brief history. Let’s start with the fact that all humans are not equal in capacity. All of us are born with different talents and different skills which make it hard for anyone of us to produce everything that we need efficiently. It makes more sense to do what we’re best at and then trade for whatever else we need with those who can produce these things better than we can. In the beginning, we used to barter. However, bartering has certain limits. If you make shoes and I raise egg producing chicken, I might be able to trade some of my eggs for a pair of shoes. But what if you don’t need eggs and you’d rather have some butter instead? Then I guess I have to find someone willing to trade me butter for eggs and then trade butter for shoes. I’m sure you see how things will get more complicated. To every problem, however, there is eventually a solution and the market’s solution to this particular problem was to pick one commodity that everyone will accept as a medium of exchange. A number of different commodities were used to fill that role, but It turned out to be gold and silver that were chosen. This is how money was invented. As a convenient commodity that everybody was willing to take in exchange for anything.

What’s the difference between a commodity-based currency and a fiat currency?

All currencies are based in confidence. The certainty that it’ll be accepted in a trade for any goods or services. Gold and silver didn’t become money by government decree. They were chosen because actors in the market valued them as such. Confidence in them is based on millions upon millions of trades. On the other hand, confidence in fiat currency resides in the state’s guarantee that it will be tradeable for any good or service, mainly because people in the market are forced to accept it by legal tender laws. Therefore, it wasn’t chosen by market actors, it was imposed. An important distinction as we’ll see.

How the state took control of money

The market loves gold and silver as money but having to weigh gold nuggets for a transaction is kind of inefficient, so somewhere along the line, someone invented coinage. Then we had weighed quantities of gold and silver that can be conveniently carried. Of course, it wasn’t too long before kings and warlords saw the advantage in appropriating the coinage and monopolizing it. Being the kind of people they were – sociopaths – kings and warlords also were quick to find ways to cheat people with their coins. First, they divorced the coin from its weight by giving it a name. Originally, a dollar was a measure of weight of gold equivalent to 1/20th of an ounce of gold. By calling it a «dollar», we tend to forget that there’s any link to its gold content as opposed to having a «0.05 ounce» coin, for instance. Then they clipped the edges and pocketed the clippings, the re-minted the coins and made them smaller, but passed them off as having the same nominal value. Or they mixes an alloy metal with the gold and silver and diminishing the gold and silver content over time. Then goldsmiths started to rent space in their safe for people to keep their gold and people started using the paper receipts they were given as a substitute for real gold. And then the goldsmiths realized that they could issue receipts without them being backed by gold in their vault. It was fraudulent, but the fraud wouldn’t be discovered unless everyone wanted to claim back their gold at the same time. But as it usually happens there did come a day when people suspected they were being ripped off and started demanding their gold back and it all fell apart. Yet, lords and kings took notice and saw the potential of such a scheme, so of course, they struck a deal with the goldsmiths and made it legal, for a piece of the action, it goes without saying. Thus fractional reserve banking was born. But since bank runs continued to occur, the state eventually allowed bankers to renege on their obligations and stop redeeming their bank notes. Another legalized fraud. Eventually, governments added central banks – the one bank to rule them all – to allow banks to inflate in concert. Eventually, they did away with gold completely.

The problem with such a system, aside from the fact that it’s built on legalized fraud, is that it’s not subject to market discipline. The market really exists to benefit the consumers. The competition between producers within it fosters creativity and innovation to always offer better products at a lesser cost to respond to consumer demand. The monetary system produces money, but not in response to consumer demand. It responds to other imperatives, some of them very political in nature. When the amount of money grows in response to consumer demand, its purchasing power –the amount of goods it can buy - stays the same, but if it grows faster, it causes prices to rise. It’s what we call inflation, although in reality the inflation is just the term for the increase of the monetary mass. The rise in prices is just an effect of that increase. If the amount of money grows more slowly than consumer demand, then its purchasing power actually rises and your money actually buys you more stuff – we call that deflation - which in my view, shouldn’t be considered a problem unless it’s unusually high. Fluctuations in the purchasing power of money tend to confuse some people. When there’s deflation, people might start to feel they’re getting poorer because their salaries don’t increase. They don’t really realize that they can buy more with what they get. Similarly, when there’s inflation, they’re under the illusion that they’re getting richer because their salaries are increasing, but they don’t see that their purchasing power keeps dwindling.

That might not seem very important in the short-term, but when you compare the value of your dollar against gold, you realize that the piece of paper you’re holding, which started out at 1/20th of an ounce when the Federal Reserve came into existence and then dropped to 1/35th of an ounce when Nixon severed its last tie to gold; is now worth less than 1/1000th of an ounce today. «In the long-term we’re all dead» as John Maynard Keynes, one of the staunchest proponents of inflation, used to say. Well he’s dead now and we’ve paid dearly for his short-sighted theories.

A hidden tax for the benefit of the elite

«I care not what puppet is placed upon the throne of England to rule the Empire on which the sun never sets. The man that controls Britain’s money supply controls the British Empire, and I control the British money supply.» – Baron Nathan Mayer Rothschild

It’s no accident that the state wants to control the money. If you control that, then you control all of the economy. If it’s true that this cozy arrangement between politicians and bankers gives a lot of power to the bankers, as Baron Rothschild stated, it’s also true to say that the «puppet on the throne» - who still has the power to pull the plug on the scheme, it goes without saying – benefits greatly as well. Economist Murray Rothbard often said that inflation is a hidden tax that redistributes wealth from the poor to the ruling elite because inflation spreads unevenly and the government and those close to it get the newly created money before everyone else and before the prices begin to rise, whereas prices have already risen by the time it finally trickles down to you and me.

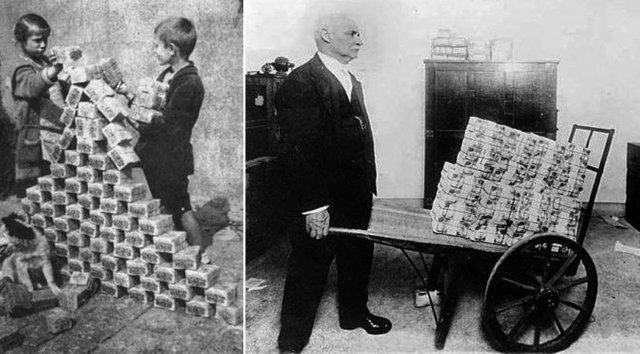

Without that system, governments would never have been able to finance two world wars and the dozens of smaller ones throughout the 20th century. They never could have financed the total waste of the arms race during the cold war. Without it, politicians wouldn’t have been able to buy your votes with all those social programs and pork barrel spending. It allows for ever bigger –and more privileged- bureaucracies and a ballooning national debt that is payed back with an ever more debased currency, until it becomes mathematically impossible to repay it. And then people will lose confidence and will spend their bills on anything rather than keep it in their pockets. It’s what Ludwig von Mises called the «crack up boom», the complete destruction of a currency. It happened to France more than once. It also happened in Weimar Germany after WWI up to the point where in 1923, you needed a whopping 4.2 trillion marks to buy one single solitary US dollar and people walked down the streets literally pushing wheelbarrows full of bank notes, more worried about having the wheelbarrow stolen than its contents. More recently, it happened in Argentina and Zimbabwe and it’s happening now in Venezuela.

Much like communism, if we point out this history of failure, they say «Well it wasn’t done the right way. We’re smarter now, it’ll work this time». And every time, it lays the economy to waste. A day of reckoning is coming for the US too. But whereas in the past, a crack up boom only affected one country or a handful of countries, this time the US will probably bring down most of the world with it. It’s only a matter of time. Nobody can say for sure when, but it’ll be sooner rather than later.

Conclusion

If you’re looking to blame capitalism for this, you’re sadly mistaken. The free market chose gold and silver as monies and they’re the only truly capitalist currencies. The market never chose fiat Monopoly money, government did. It and only it empowered banks to create it out of thin air. The free market gave us sound money that actually gained purchasing power over time. Government was always the one to cheat you with constantly debased money for millennia. While prices were quoted in gold or silver ounces, everything was transparent. Only when the state took over the control of money did it become opaque and a tool for fraud.

Philippe David is an IT consultant from Montreal, Quebec who is also the editor of the french-language libertarian news site contrepoids.com and the french-speaking voluntaryist community site projetv.org