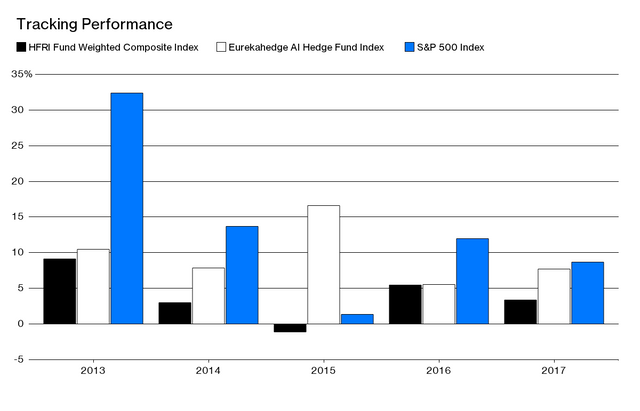

AI beat a lot of hedge fund managers, but still can't outperform the S&P 500 index. 人工智能在投资股市可以跑嬴王牌基金经理, 但并不能跑赢大市

Photo source: Bloomberg https://www.bloomberg.com/news/articles/2017-06-28/machine-learning-s-mediocre-gains

当AI 正在图像分析, 文字分析等方面大有突破时, AI发展却在财经市埸上"衰退"了. 在经历2015 年的黄金期后, AI 再没有为对冲基金带来爆发性的收入, 并持续跑输美国股市.

Eurekahedge AI对冲基金指数跟踪12个AI对冲基金的代表,自2013年以来表现优于对冲基金同业,但仍未能超过标准普尔500指数。

但其实这也不能完全怪责AI, 在近年美国股市要获取Alpha 非常困难, 由于AI操作经常依赖短期交易, 要在每次交易上获取充分利润, 就难上加难了.

While AI has a strong momemtum in image processing as well as natural language processing this year, AI development is in "recession" in the financial market. After the peak in 2015, AI have yet brought another surprising return to their clients and kept losing to the market index.

Eurekahedge AI Hedge Fund Index, which tracks 12 hedge fund using machine learning, has outperformed hedge fund peers since 2013 but failed to beat the S&P 500 Index.

But this is not completely AI's fault. In recent years, Active investors find it extremely hard to seek Alpha in US stock market. Becuase short-term investment relies entirely on high-frequency trading or short term speculation, secure certain profit in every trade is literally impossible.

Thank you for your post Jim, this bring out good point that is AI is great but when comes to making the good bundle of decisions, they cannot out win a group of human. I think nowadays the stock or financial sector relies a lot on short trades which deviated from the original concepts of holding stocks. I think AI in this case would have a upper hand if it were to buy stocks for long run!! In that case i believe that the AI could analysis much better than a group of humans could and nail us on the potential big whale! Thanks again for the post, steem on!!

會不會市場上真的有能獲取暴利的 AI 只是人們都私下用不公開。因為人是自私嘛。

As far as i concern, they never disclose their trading algorithm but they definitely will disclose their performance to their shareholders / clients every year in that the board / directors rely on the investment return to increase their remuneration.

This post received a 1.2% upvote from @randowhale thanks to @jimsparkle! For more information, click here!

Upvoted. So in the end, all those people that still adhere to just buying the index trackers may be right.

Yes. This is absolutely correct.

Actually I think that it is just alright that can't catch up the stock market. As no one can even predict the trend. But as long as there is profit for the AI than I think that will be worth to invest. I think it at least win most of the losing MPF fund manager in Hong Kong already.

大神,请支持我减少在#cn 的spam

https://steemit.com/cn/@incrediblesnow/tag

@jimsparkle you were flagged by a worthless gang of trolls, so, I gave you an upvote to counteract it! Enjoy!!