以太坊在两小时内突然暴跌估值下滑约16% 大鲸可能随时操纵市场[Ethereum suddenly plunged within two hours. Valuations are down about 16% whales may be manipulating the market at any time]

加密鲸鱼通常被认为是富有的交易者,然而,最大的鲸鱼不是交易者,而是拥有数百万以太坊的ICO,价值几十亿美元。估计以太坊总供应量的3%以上是在ICO项目方手里,当这些项目兑现时,这些影响可能是巨大的。

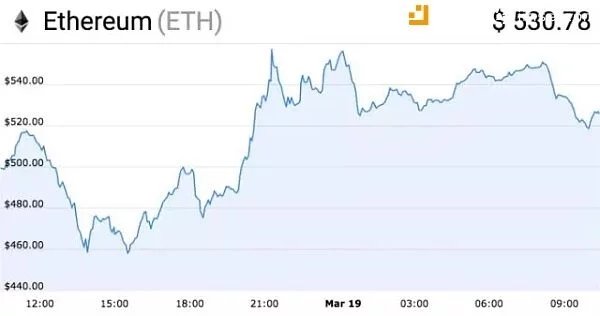

周日,加密市场持续动荡,但以太坊在两小时内突然暴跌,从516美元下滑至464美元。以太坊的闪跌使其成为昨日加密货币前100强中最差的表演者之一,其估值下滑约16%。抛售的原因归因于去年的ICO私募收集的一大部分以太坊。如果是这样,这不会是第一次发生这种事情,它肯定也不会是最后一次。

推断在ICO投资的以太坊总量相对直接。2017年所有ICO众筹的57亿美元中,约三分之二是以以太坊的形式筹集的。这些项目不得不零星地兑现法定货币,以支付无法以加密方式支付的费用。而当他们这样做时,这些项目就能兑现一些法币,但是这样做对长期持有ETH交易者未必是好事。

加密市场的流动性要比传统金融市场少得多。当成千上万的以太在公开市场上出售时, 通常是通过Bitfinex或Kraken等交易所, 它将立即造成价格下跌。所以交易员们发现有丝毫的市场动向迹象,都会非常警惕,因为这些加密大鲸是非常令人生畏的生物。就如同最近对Mt Gox大量抛售比特币所产生的担心。

在周日价格下跌之前12小时,EOS将50,000 ETH移至Bitfinex地址。无法确定这么多币何时会被出售,但是这种行为显然表明有意出售。善于观察的投资者一直在暗中观察项目方的以太坊地址,当这些众筹的以太坊被转到交易平台,那么这些投资者就会认为市场可能要大跌了,我们应该提前抛售。

一名加密交易商称自己看到的数字显示,所有ETH的3.4%,或约34亿美元的代币都在ICO项目里。当这些项目有账单要支付, 或担心市场可能进一步紧缩,他们就有可能会兑现。这些鲸鱼没有义务出售OTC,使用可信任的交易所是首选方案。所有这些都给以太坊带来了下行压力,远远高于其他任何加密资产所面临的压力。

只要以太坊仍然是ICO首选的筹款平台,加密货币将仍然集中在100个左右的项目中,每个项目都有权随时抛售所筹集的代币。虽然每此抛售后,市场都会恢复,但对于那些使用杠杆的交易者来说,可能要承受比较大的损失。然而, 每一朵云彩都将穿透一线曙光,在发生大规模抛售时,也是其他交易者抄底的绝好机会。

The whale is usually considered a wealthy trader, but the largest whale is not a trader but a millions of-square ico, worth billions of of dollars. It is estimated that more than 3% per cent of the total supply of the etheric square is in the hands of the ICO project, and that these effects may be significant when these projects are honoured.

Sunday, the encryption market continued to be volatile, but the Ethernet workshop in two hours suddenly plunged, from 516 U.S. dollars to 464 dollars. The flash of the ether has made it one of the worst performers in the top 100 of the encrypted currency yesterday, with valuations falling about 16%. The Sell-off was attributable to a large part of the Etheric workshop that was collected last year by ICO private. If so, this will not be the first time this kind of thing happens, it certainly will not be the last time.

It is inferred that the total amount of ether invested in ICO is relatively direct. Of the 5.7 billion dollars that all ico raised in 2017, about Two-thirds were raised in the form of an Ethernet square. These projects had to be cashed in to pay the fees that could not be paid in an encrypted manner. And when they do, these projects can cash in some fiat, but doing so is not necessarily good for long-term holders of ETH traders.

The encryption market is much less liquid than traditional financial markets. When tens of thousands of ether are sold on the open market, usually through exchanges such as Bitfinex or Kraken, it will immediately cause price declines. So traders are wary of the slightest sign of market movement, because these big, giant whales are very scary creatures. It's just as worrying about the recent massive sell-off of bits in Mt Gox.

In Sunday, 12 hours before the price fell, Eos moved 50,000 ETH to the Bitfinex address. It is not possible to determine when such a lot of money will be sold, but it is clear that this behavior is intended for sale. Observant investors have been spying on the project's Ethernet address, and when these chips are transferred to the trading platform, the investors will think the market may be going down and we should sell ahead.

A cryptographic trader said that the figures he saw showed that 3.4% of all ETH, or about 3.4 billion dollars of tokens, were in the ICO program. When these projects have bills to pay, or fear the market may tighten further, they are likely to cash in. These whales are not obligated to sell OTC, and using a trustworthy exchange is the preferred option. All this has brought downward pressure on Tai Fong, much higher than any other encrypted asset.

As long as Ethernet is still the preferred fund-raising platform for ICO, the encrypted currency will remain focused on 100 or so projects, each of which has the right to sell the tokens raised at any time. Although the market will recover after each sell-off, it may be a big loss for those who use leverage. However, each cloud will penetrate a glimmer of light, and in the event of a massive sell-off, it is also a great opportunity for other traders to bottom up.