All we know about the Coinbase Custody service to which the XRP will be added

A number of days ago, many news outlets reported that Coinbase, which offers one of the largest encrypted digital currency platforms, is considering adding 40 coded digital currencies to the Custody Custody service.

Of course, this prompted some news sites to talk that these currencies will be added to the daily trading of individuals soon, including the XRP.

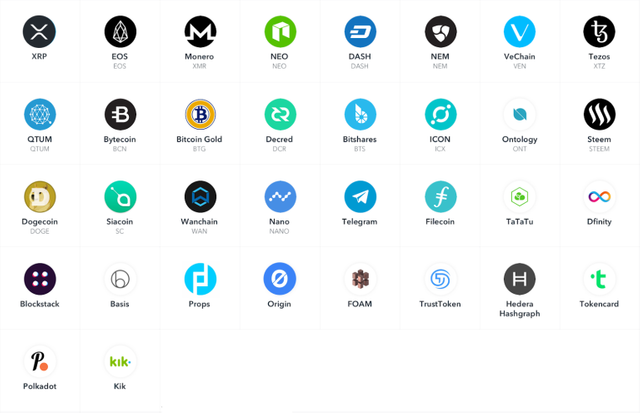

The image the company has posted on its blog actually includes the encrypted digital currency, which ranks third in the largest digital currency at market share.

In fact, Coinbase Custody is different from the main trading platform, but it is very important that we will see it today in full detail in this article.

What is Custody Custody?

One of the special services in the digital currency sector is encrypted, but it is not directed to individuals but to companies and institutions.

Coinbase Custody is designed to provide financial controls for enterprises and companies seeking to trade digital currencies such as Betcuen and Ethrium. And comes after the emergence of many hedge funds aimed at investing in encrypted digital currencies.

Essentially, Coinbase intends to provide institutions with safe and secure means to store digital assets such as encrypted digital currency with transparency and prevent its use in any suspicious activity, being a US-registered company that is accountable to US law, which is keen to combat the financing of terrorism and legally prohibited activities.

The platform provides support for organizations that seek to confirm money transfers and other changes in the account and are intended to support "all major digital assets" - now known as the same assets as Coinbase in its digital portfolio and trading platform - Cash, Ethrium, Litcoin, and other ERC20 codes.

Through the Cointbase Custody platform, the US company is working with hedge funds and large investment companies that intend to buy huge amounts of encrypted digital currency.

If you are wondering about the need for financial institutions, the Coinbase reserve requires a minimum balance of US $ 10 million and a prepaid fee of US $ 100,000 plus monthly fees.

What does the Coinbase Custody mean to businesses and organizations?

This means that the door is open for large companies and investment institutions to enter and invest in the area of encrypted digital currencies.

Many institutions that have huge cash liquidity and want to inject it into this emerging market face legal process problems and fear losing their money through unsecured ways of doing so.

This is why Coinbase Custody comes simply to open the door for companies, institutions and hedge funds to invest in this market safely.

Add 40 other encrypted digital currency

The company currently offers 4 digital currencies for the retail and trading portfolio, which also provides the same number of currencies to companies and institutions through the Coinbase Custody service.

Currently, the company has announced the desire to add 40 digitized digital currency that would be good to be made available on the Custody Coinbase for companies and institutions.

This appears to be especially true with the desire of these institutions to invest in digital currencies other than the digital currencies they provide.

Interestingly, the detected list has the XRP at the top left where it should start reading the names of the currency to be added to the Custody Coinbase.

The list includes other famous names such as #Monero, #Dash, #Tezos as well as #Telegram instant messaging currency.

By adding more encrypted digital currency, Coinbase is poised to increase revenues from its corporate and enterprise service, which is important as an increasing number of companies are now offering commercial trading to individuals and platforms are moving to reduce the fees for those services used by individual traders, These services must be compensated through the service of companies and institutions able to afford the good costs in exchange for large sums.

The spokesman for the firm refused to provide a specific timetable for adding the new assets. The company also says plans to add all 40 assets are not final.