You have more reason to stay away from bitcoin, other crypticurrencies

If you expect Bitcoin type returns from all cryptocurrencies then you are likely to be in for disappointment.

To invest or not to invest - that is the question many of us have in our minds when it comes to cryptocurrencies at the moment. A lot of us are tip-toeing around the idea of investing in them but with all the uncertainty that surrounds them (both in terms of regulations and its legality) we remain cautious.

Other than investing in an unregulated space and the potential risk of losing your money by falling prey to a ponzi scheme, you have more reasons to stay away from such investments.

Here are six more reasons why you should stay away from cryptocurrencies (well, at least until there is more clarity):

- Banks have started stopping purchase of cryptocurrency with their cards

Recently, Citibank in an email notification to its customers has said that its credit and debit cards cannot be used to purchase cryptocurrencies.

Following this, SBI Card has also cautioned customers against risks associated with bitcoin and other crypto-currencies and is in discussions with Visa and Mastercard to put a ban on such transactions with the banks' cards. With a customer base of over 5 million, SBI Card is the second largest credit card issuer in India.

It shouldn't come as a surprise if other banks too, disallow, buying cryptocurrencies with their credit cards.

This would be in line with what is happening globally. Banks and other financial institutions in other countries have also taken similar precautionary measures since cryptocurrencies are highly volatile and customers who purchase these virtual currencies using their credit cards may not be able to clear their dues if they are hit hard by a price crash. In the US, Citigroup and others like Bank of America and JP Morgan Chase have blocked cryptocurrency purchases via credit cards as they are not willing to take the credit risk associated with it.

Risk: The implication of banks restricting purchase of such currencies with their cards is that new investors will find it difficult to buy virtual currencies and existing ones will also face problems in increasing their investments.

- Crypto exchanges halt trading, ask investors to take back money

Two cryptocurrency exchanges - BTCXIndia and ETHEXIndia - said that they will halt trading on March 5. Members have been asked to withdraw their money on or before March 4. In an email notification to its members, BTCXIndia said that it will not accept deposits from investors with effect from January 1, 2018. This is another reason that should worry those already invested and also those looking at investing in virtual currencies. The exchange reasoned that with the government discouraging crypto currency trading, it has "put our business under a lot of stress and putting us in a position where we don't feel that we can continue our business in a professional manner any longer."

Now, if you are not able to withdraw your money before the deadline, you will be in a pickle. With no redressal mechanism and regulator, who do you turn to get your money out?

You may argue that it is just two exchanges, but it is still a red signal that cannot be ignored. It should be noted that in December the tax department had surveyed a few exchanges to get information on investors and traders of cryptocurrencies, and BTCXIndia was one of them. If more exchanges feel the heat due to the prying hands of the tax department and the other powers that be, halting of trade by exchanges could be a trend that we could see.

Risk: With the government, the central bank, and banks turning a cautious stance on everything cryptocurrencies, the ripple effect is that exchanges are feeling the pinch. You do not want to be in a position where your money is stuck and you have nowhere to turn to get it out.

- Not all cryptocurrencies will give you sky-high returns

In cryptocurrencies, price is determined solely on the basis of demand and supply, and speculation is what drives their price.

For instance, bitcoins being the most popular crypto is most expensive, priced over $ 9,000 as on February 26, 2018. In January 2014, the bitcoin was priced at around $900 and within four years the price surged to over $9000 by February 2018 - around a 900 per cent growth.

On the other hand Ripple, which is not as popular as Bitcoin is priced at less than a dollar! In January 2014, it was priced at $0.0290 and after four years, in February 2018, it is at $0.0949 - around 227.24 per cent growth.

Besides, there can be unlimited number of cryptocurrencies, but within each currency there can be self-imposed limits on how many units will be issued. Bitcoin was invented to be a peer-to-peer digital cash system with a limited supply of 21 million bitcoins. If CoinMarketCap is to be believed, there are over 1,500 cryptocurrencies with different market caps and prices. Ethereum, Ripple, Litecoin, NEO, IOTA, Bitcoin and Bitcoin Cash are popular ones.

Risk: All cryptocurrencies won't give you similar returns so you need to be a very well informed and researched investor to get into this gamble. So, if you expect Bitcoin type returns from all cryptocurrencies then you are likely to be in for disappointment.

- Tax trouble

On the books, income tax laws do not mention how cryptocurrency gains should be taxed. However, in the recent past, not just the government has raided bitcoin exchanges but also issued about one lakh notices to people who have invested in cryptocurrencies like Bitcoin and made profits without declaring these in their income tax returns.

Further, the government has clearly said it will tax gains from cryptocurrencies. A news report by IANS quoting CBDT Chairman Sushil Chandra says, "People who have made investments (in cryptocurrencies) and have not declared income while filing taxes, and have not paid tax on the profit earned by investing, we are sending them notices as we feel that it is all taxable."

Although some experts believe that it could be either taxed as business income or as capital gains depending upon the holding period, but there's no clarity on this from the income tax department yet.

Risk: Even though there is so much ambiguity regarding their tax status, the taxman's lens is firmly fixed on those investing and making gains from cryptocurrencies. One may never know when the taxman will come knocking on one's door. Many investors have already got tax notices. So, it is likely that you would have to pay tax on gains from these

- Government's averse stance

Government clearly expressed its averse stance on cryptocurrencies like bitcoins, etherum and so on when Finance Minister in his budget speech said the government does not consider crypto-currencies legal tender or coin and will take all measures to eliminate use of these crypto-assets in financing illegitimate activities or as part of the payment system.

Reportedly, RBI warned banks about cryptocurrencies in January, telling them to step up scrutiny of financial transactions by companies and exchanges involved in the trade of bitcoins and similar digital tender. However, the apex bank is yet to declare such transactions illegal. The central bank has asked banks to understand how these currencies work before dealing with such companies.

Also Read: RBI warns banks about crypto risks, wants higher scrutiny

Risk: If purchase or trading of cryptocurrencies are banned in India existing exchanges will have to shut down and global prices are likely to fall. Consequently, you would lose money on your investment. Globally bitcoin prices declined sharply when FM Arun Jaitley made the above announcement in the budget.

- KYC timeline and volatility in prices

Cryptocurrency exchanges require that a person signing up for a wallet with them complete KYC by providing his/her Aadhaar, PAN and bank details. The turnaround time for KYC verification is different for different wallets. Sometimes it is done within a couple hours, in some cases it takes a few days or even a month. Needless to say, cryptocurrencies are highly volatile. So, for first time investors, the price difference, at the time when they sign up for the wallet and the time when they are able to buy after KYC approval, could be huge.

Sample this:

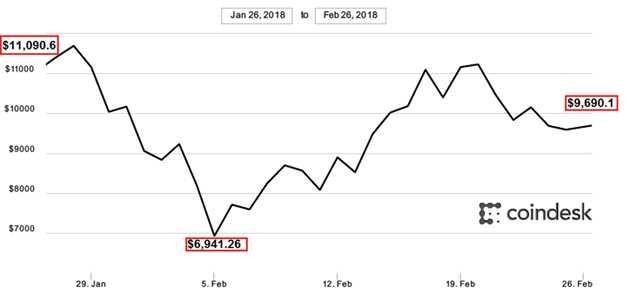

Bitcoin price on January 26, 2018 was $ 11,090.06 and on February 5, within 10 days it crashed to $ 6,941.26, and as on February 26 it is $9,690.01.

BTC

Risk: Higher the volatility, greater is the risk.

Should you buy?

Earlier for a long time, bitcoin wallets and cryptocurrency exchanges argued that the Indian government has not declared virtual currencies 'illegal' and investors shouldn't hesitate to invest. True, the status-quo continues, but in the present scenario buying and redemption are becoming major issues for investors. Therefore, considering these developments and the fact that in the absence of a regulator you cannot approach anyone for redressal you should think twice before buying cryptocurrencies.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://economictimes.indiatimes.com/wealth/invest/you-have-more-reasons-to-stay-away-from-bitcoins-other-cryptocurrencies/articleshow/63113045.cms