Colorado PERA is a Nightmare! I want out!!!

I am a public sector employee. And, as with every public sector employee in Colorado, I am a member of the Public Employees Retirement Association. They call themselves "Colorado's Best Investment" but they are a liability, not an asset. They cost money.

I am supposed to receive employer match of 14% but only get 10.15%. After doing the math, I called for about two months getting the run around before finding about about the AED and SAED programs. That 3.85% goes to PERA not my own retirement.

I am a member of the DC (Defined Contribution) Plan. In this plan, I receive the money into an account and make my own purchases. I see the money show up, then buy. The paycheck payments, i.e., my money, are constantly late! They've gone from 8 days after payday to over 80 days.

I've called and complained to PERA numerous times. I talked with management who tried to convince me I had a mental health issue because 2+2=5. He would say the AED and SAED money are not mine, but he finally stated it comes "foregone salary increases." The money is mine. And yours!

I finally got to the Director one day. He was very nice and tried to be helpful. In the conversation, I said, "I feel like you are taking money from new investors and paying those purported returns to early investors." He laughed, and said, "that's exactly what we are doing!"

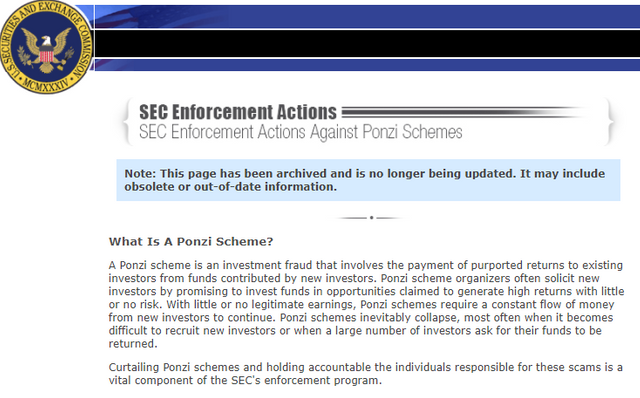

This is from the SEC:

Source: https://www.sec.gov/spotlight/enf-actions-ponzi.shtml

PERA is operating in a way the SEC calls a "Ponzi Scheme"

After hearing him say that, my suspicions were true. He admitted, directly, the payment of purported returns to existing investors from funds contributed by new investors. There had to be something I could do, so I decided to report them to the SEC.

This is where I found out not even the Department of Justice has oversite over PERA.

I called the SEC, he informed me they do not have jurisdiction and to call the Department of Labor. I called them and they said they only have oversite over private companies. Typical. I, finally, called a lawyer who told me, "I will look at the case for $10,000" and you will likely get nowhere.

He explained to me that Colorado PERA #COPERA was found guilty of securities fraud in 2007; meaning the investments of high returns and little risk did not exist. But ... a higher court ruled that the Department of Justice has no oversite.

It continues with no accountability

I still have not received my payment from the end of last month. It's the 19th today. They take out $50 per year, plus charge me money to move my funds into a Self-Directed Brokerage Account. My payment arriving 25 days late last

month cost me $7 in missed dividend from a stock I bought.

PERA is a liability and the only people with oversite, Colorado legislature, just gave them another $380 Million this year. This sounds like PERA is making taxpayers the "greater fool." After a while, the state may stop contributing more and more. Then, they may come for our retirements.

They did it in Cyprus back in 2012. All accounts with a retirement amount of value had half of their value taken out. I do not want this to happen to me and my family. The only options are to quit public sector work, beg the legislature or try to draw attention to the issue.

Have you ever had a negative experience with PERA?

Let me know if you've had some bad experiences as well. I talked with the forensic pension investigator and author, Edward Siedle, and he said he has had calls from multiple people in Colorado with complaints about PERA. He said to fundraise and try to get enough crowd-sourced money to do a forensic analysis. I've first started a Facebook group, Colorado PERA Watchdogs.

If you are upset with PERA, please, consider joining that group so we can learn from each other. If there are many with this experience, perhaps we can help each other and, at least, discuss it some.

And, to end this out, here is an interesting podcast on Who Stole Your Pension?