In My Lamborghini Speeding, You A Golf Cart – A Lack Of Common Knowledge

As a technology, asset, philosophy, narrative, cult, or however you like to label it, crypto-assets (as I like to call them) remain insulated from broadly accepted common knowledge. As any behavioral economist will tell you, common knowledge is the single most important factor in any given narrative's failure or success.

To this day, crypto-assets are considered a fringe investment vehicle primarily because they remain outside of the domain of common knowledge.

For an informative primer on common knowledge, read more here.

Once it becomes common knowledge that everyone is interested in something, the value of said “something” skyrockets. Consult your nearest grandparent, parent, or history book for countless examples of this.

To quote the late Mac Miller, “In my Lamborghini speeding, you a golf cart.”

Even though the Lamborghini has become a symbol of the crypto millionaire mockery, the reality is that crypto-assets are still viewed as the golf cart when it comes to investment vehicles. Outside of a select few major money managers, crypto-assets are not being taken seriously. At least, not yet.

Well then, what is considered the Lamborghini?

The major money managers of the past several decades have all had their bread buttered in already established assets. Just like a Lamborghini has proven superior performance when compared to that of a golf cart (or Tesla), these other assets are considered proven when compared to the new entrant to the market, crypto-assets.

Money managers love proven strategies. It allows them to sleep well at night for two reasons:

If they are right, the strategy will continue to prove itself and they will appear intelligent.

If they are wrong, they can keep their job because they were just doing what everyone else was, and "nobody could have predicted this" will be the mantra.

There is a committed, die hard set of people who believe wholeheartedly in crypto-assets. However, this group is a small one, and it is increasingly interconnected with one another as time passes and those who are not “die hard” enough are removed from the group.

Thus, you have increased concentration of interaction amongst fewer individuals, especially as this bear market continues its course. Pareto’s Law in action.

Those who are within, or on the periphery, of this group all interact with each other whether it be through reading the same blogs, listening to similar podcasts, following the same newsletters, receiving the same daily project updates, weekly industry updates, and market outlooks.

We all like, follow, and retweet each other on Twitter, mingle with one another via Slack, Telegram, Reddit, Github, Steemit, or other platforms.

Much as I have described in this post, we are experiencing a time when believers (hodlers) in the value of crypto-assets represent something along the lines of 0.1% of global population.

There is considerable adoption upside here, wouldn’t you say? The beauty of adoption upside is the financial upside it carries along with it. Back to the concept of common knowledge.

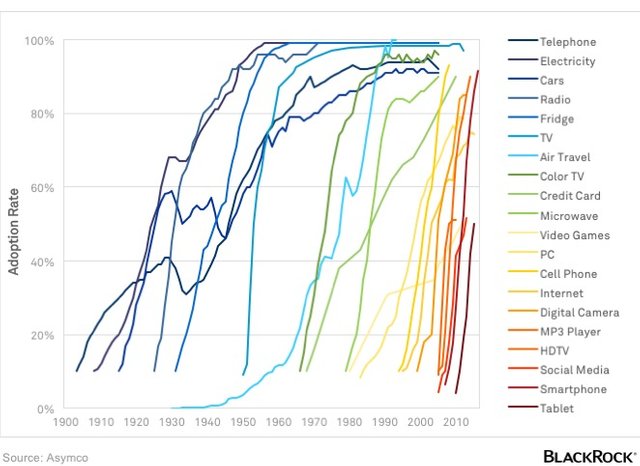

Many cite the chart above to illustrate how quickly new technologies are being adopted, and specifically use it to predict that crypto-assets will be adopted at the fastest rate we've ever seen any technology adopted.

While I tend to agree with the notion that we live in an accelerating world where we can witness a video go viral within minutes, a song or dance become a global phenomenon, or even a Tweet cause a prominent figure to resign, my inner skeptic likes to take this sort of prognostication with a lump of salt.

Rather, let’s take the inverted chart of this adoption curve acceleration and what you have is how quickly people abandon adoption when it does not allow them to purchase a Lamborghini using last month’s lunch money. These are the speculators, the tourists; those who are not necessarily in for the long haul.

Hence my comparison to today’s crypto-asset investment vehicles being valued as if they were golf carts. All of the tourists have left the island for the season, the golf carts have been warehoused for the winter, and only the locals remain doing maintenance and preparing for the next tourist season.

The next tourist season is the one. The next bull run is the mega-run. This is what we all secretly tell ourselves. Fall-Winter 2017 was just an appetizer. This may be the case, but as I’ve stated before what is more likely is a much more gradual, longer term process barring the elusive Black Swan.

Make no mistake, human momentum creates the opportunity for things that have never been done before to be done. History is a testament to this. And as the 0.1% of global adoption of crypto-assets increases, there is certainly considerable evidence to suggest that we exceed the previous high-water marks in market capitalizations.

As we stand, the flood gates remain poised to open in all arenas of crypto-assets: common knowledge, narrative development, physical adoption, transaction volume, regulatory et. all. And as they say, it's best to purchase your life raft before the flood.

DISCLAIMER : This content is for informational, educational and research purposes only. This post is not to be taken as personalized investment advice.

I upvoted your post.

Keep steeming for a better tomorrow.

@Acknowledgement - God Bless

Posted using https://Steeming.com condenser site.