3 Reasons the Global Cryptocurrency Exchange Market is Maturing

Underlying bitcoin and ether's all-time-high price rallies in Q1 was a dramatically shifting global exchange market.

So far in 2017, trading volumes have seen big changes, ones that indicate a reshaping of the global market.

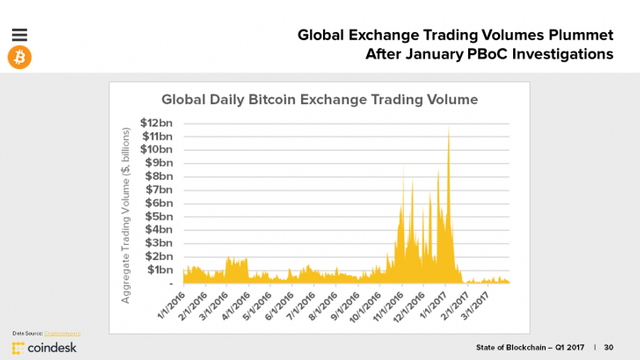

Global exchange volume for bitcoin, for example, plummeted in January after the People's Bank of China (PBoC) issued guidance to domestic exchanges around their regulatory and operational policies. The development led to periods where withdrawals and margin trading were stalled, and trading fees were instituted after years of no-fee trading.

Despite the substantial shifts, here are three trends that CoinDesk Research has highlighted as signs of a maturing overall market in Q1 and the period since.

- The decline in Chinese volume lead to more distributed global trading

The PBoC’s impact on the Chinese 'Big 3' exchanges in January sent worldwide trading volume figures tumbling to levels lower than seen in years.

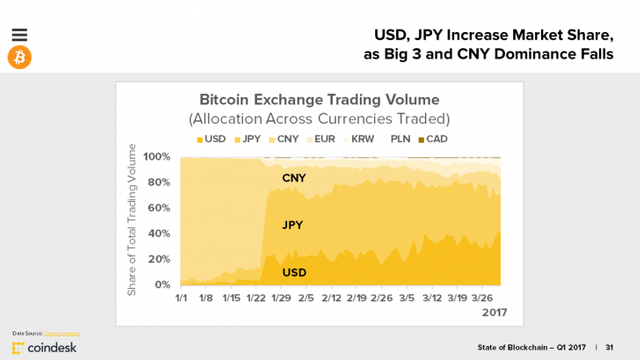

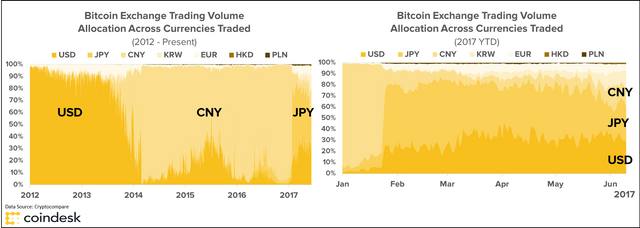

The drop in CNY volume however made room for USD and JPY markets to develop as major constituents of global trading in Q1.

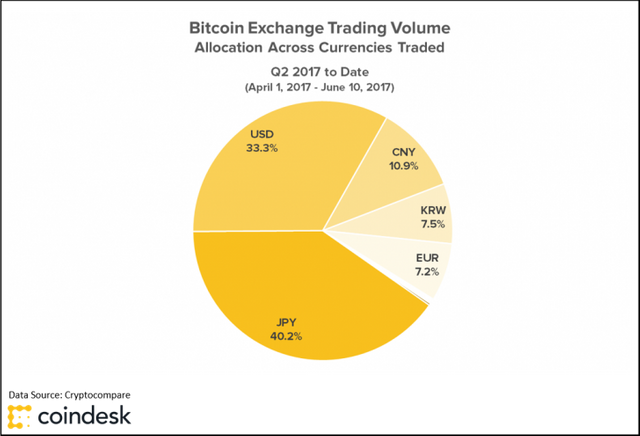

Since the end of the first quarter, the Japanese yen (JPY) has continued as the leading fiat currency traded for bitcoin (following legislation recognizing bitcoin as a legal payment method), with USD trailing narrowly.

Chinese yuan (CNY) volume has dropped to about a quarter to a third of that of JPY and USD, and South Korean won (KRW) and euros (EUR) are now not far behind, comprising one of the most diverse allocations of global trading the industry has ever seen.

- Ethereum is close behind, gaining significant market share and supporting numerous assets

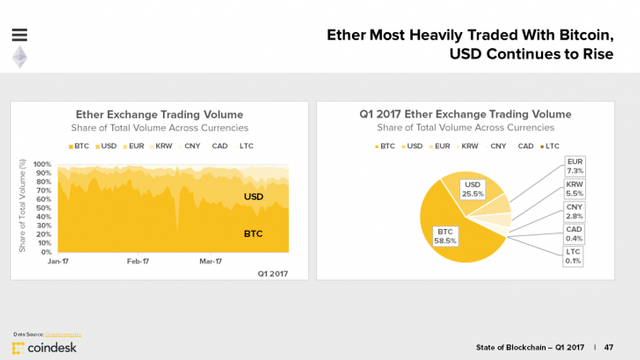

Markets for ether followed a different trend as prices and volume both spiked at the end of Q1.

Trading throughout the quarter was dominated by BTC, with USD steadily gaining traction.

Regarding exchange trading volume, Poloniex led BTC volumes by a large margin, while Coinbase narrowly edged out Bitfinex for dominance over USD-based markets in the first quarter.

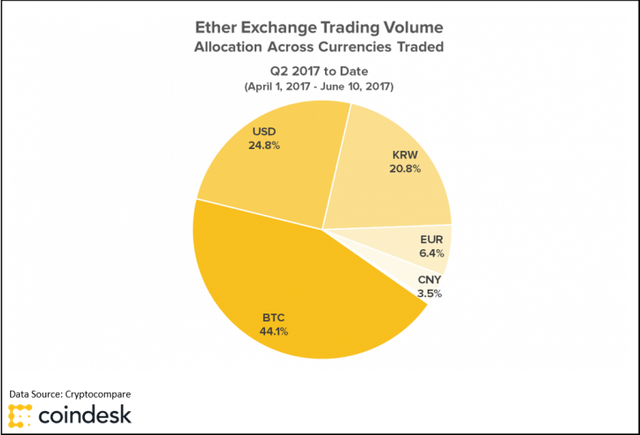

Since then, exchange dominance has remained relatively consistent, but currency rankings have shifted as KRW-based trading rallied into the third place position.

The global composition of ether trading is similarly now the most diverse it has ever been.

Features • Exchanges • Other Public Protocols • Bitcoin • Ethereum • Markets News

1

This article highlights findings from CoinDesk Research's new Q1 2017 State of Blockchain report, and expands on the composition of bitcoin, ethereum and other exchange trading volume into Q2.

Click here to view the slides in your browser.

Click here to download the slides as a PDF.

Underlying bitcoin and ether's all-time-high price rallies in Q1 was a dramatically shifting global exchange market.

So far in 2017, trading volumes have seen big changes, ones that indicate a reshaping of the global market.

Global exchange volume for bitcoin, for example, plummeted in January after the People's Bank of China (PBoC) issued guidance to domestic exchanges around their regulatory and operational policies. The development led to periods where withdrawals and margin trading were stalled, and trading fees were instituted after years of no-fee trading.

Despite the substantial shifts, here are three trends that CoinDesk Research has highlighted as signs of a maturing overall market in Q1 and the period since.

- The decline in Chinese volume lead to more distributed global trading

The PBoC’s impact on the Chinese 'Big 3' exchanges in January sent worldwide trading volume figures tumbling to levels lower than seen in years.

The drop in CNY volume however made room for USD and JPY markets to develop as major constituents of global trading in Q1.

Since the end of the first quarter, the Japanese yen (JPY) has continued as the leading fiat currency traded for bitcoin (following legislation recognizing bitcoin as a legal payment method), with USD trailing narrowly.

Chinese yuan (CNY) volume has dropped to about a quarter to a third of that of JPY and USD, and South Korean won (KRW) and euros (EUR) are now not far behind, comprising one of the most diverse allocations of global trading the industry has ever seen.

- Ethereum is close behind, gaining significant market share and supporting numerous assets

Markets for ether followed a different trend as prices and volume both spiked at the end of Q1.

Trading throughout the quarter was dominated by BTC, with USD steadily gaining traction.

Regarding exchange trading volume, Poloniex led BTC volumes by a large margin, while Coinbase narrowly edged out Bitfinex for dominance over USD-based markets in the first quarter.

Since then, exchange dominance has remained relatively consistent, but currency rankings have shifted as KRW-based trading rallied into the third place position.

The global composition of ether trading is similarly now the most diverse it has ever been.

Ethereum now serves as the base protocol or infrastructure layer for many decentralized applications as well as acting as a cryptocurrency (now with a combined market cap of several billion dollars alone), further positioning itself as a major backbone of future projects and trading.

- The 'long tail' of digital assets is growing, leading to diversity in overall valuations and trading

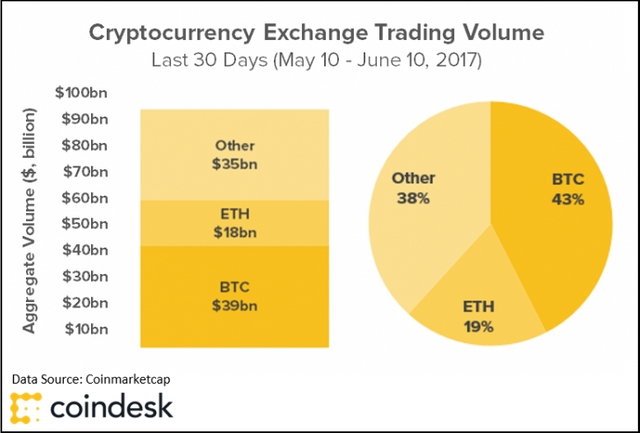

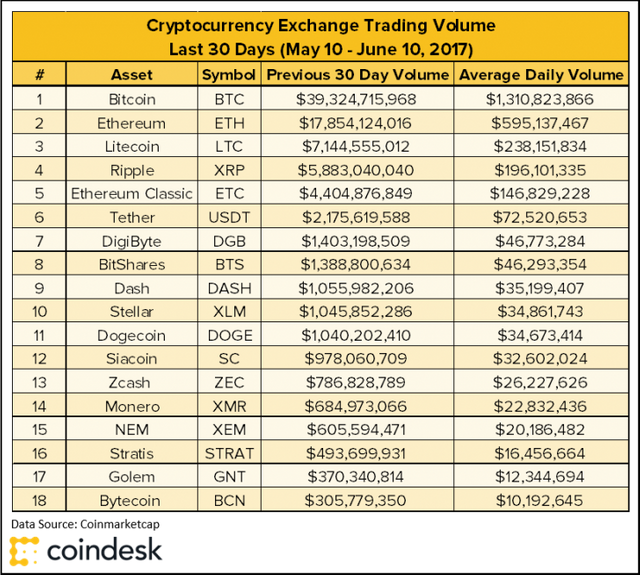

The aggregate market cap of all blockchain tokens now exceeds $100m (or more depending on how you evaluate supply), currently dominated by bitcoin, ether and ripple.

Over 130 tokens now have an implied valuation of north of $10m, comprised of new blockchains like zcash, monero or litecoin and tokens created on top of existing blockchains (like ethereum or waves) such as golem, augur or gnosis. Just four years ago, only two tokens had a market cap over $10m, bitcoin and litecoin.

In the last month, 18 tokens averaged over $10m in daily trading volume.

As alternative blockchains and assets have grown in popularity, many large exchanges have extended trading support to profit from the trend – fueling their rise in trading and quoted valuations.

Leading global digital asset exchanges such as Coinbase, Poloniex, Kraken, Bittrex, Shapeshift and Bitfinex now support numerous markets for tokens and fiat currency pairs. Further, an emerging market of decentralized exchanges and protocols like EtherDelta and 0x is growing, all of which diversifies what was once a centralized and bitcoin-dominated trading market.

The demand side of the equation has also seen increased inflows as all-time-high prices and increased media attention led to new users pouring into the cryptocurrency space, with major exchanges like Poloniex and Coinbase experiencing record growth and trading across assets.

Conclusion

The allocation of cryptocurrency trading across exchanges and currencies has changed markedly over the years due to sentiment, regulation, hacks and business decisions by exchanges to support new trading pairs.

In March, the SEC rejected two bitcoin ETFs, citing the lack of significant regulated markets and industry concentration in China. Around the same time, the markets saw a notable decrease in volume from China and an increase from South Korea and Japan after significant regulatory guidance.

Since, trading volume compositions have remained more diverse than ever across bitcoin and ethereum, and the industry has seen both pushes to reconsider a bitcoin ETF and consider a new ethereum ETF. We will undoubtedly see future initiatives for new types of structured products as the market continues to mature.

The biggest change, however, could continue to be the sharp decrease in bitcoin's dominance should ethereum and other tokens capture a larger percentage of overall trading in a more diverse set of markets.

View CoinDesk Research's full Q1 2017 State of Blockchain for more analysis on cryptocurrency trading volumes and other market statistics.

Disclosure: CoinDesk is a subsidiary of DCG, which has an ownership stake in Coinbase and zcash.

source : CoinDesk

this is a bunch of statistics

Coin desk really had some great research, i can see the restriction of cny would have huge impact of crytocurrenct in china and end result is that their exchange really offer cheap spread unlike taiwan and hk, i hope we will catch up so we can be on same playing field.