Liquidity Network || A Blockchain-based Protocol to drive a fast, Secure and Scalable Payment and Transaction Network

Preamble

In the first decade that blockchain technology has existed so far, it has consistently churn out ground-breaking statistics that have it rival one of the greatest revolution of the last century, the internet, this comparism has earned it the great feat of being touted as the next wave of technological revolution after the internet that will be relevant globally. And just like the internet which started in 1960's via ARPANET before it gained worldwide adoption in the late 90's, the blockchain technology is at that stage where many dark clouds needs to wash away before it reaches its full potential.

And one of the child elements which must encounter a fast-paced revolution are exchanges because they constitute the primary gateway between the physical world and these technologies to interact when it pertains to cryptocurrency as a means of transaction(in a crypto-to-fiat fashion or vice-versa). This theory also holds true for establishing communication between adjacent blockchains as well(in a crypto-to-crypto fashion).

Even at that, the blockchain has seen little developments in the way of transactions that can be completed per seconds ( measures in tps) and a look at brief comparism of these technology with similar payment solutions shows that it still has a long way to go. And if this huge gulf in the system efficiency is not addressed in the near future, it is highly likely that the future of the technology might be left in limbo.

In view of this, it is best to seperate some of this actionable activities (such as transfer) from the blockchain without compromising the security and speed of the overall exchange process. A revolutionary concept which can help to arrest some of the troubles associated with interactions on a generic public blockchain is private channels, Private channels are the generic term used to describe a method of communicating using a blockchain ledger with a subset of network participants. The communication paradigm is the same a regular blockchain except the peer communication is encrypted over a TLS connection and decrypted at the endpoints Source.

Private channels would have being perfect if users don't need to go on-chain every time payment channel is depleted. This inherent feature amongst other issues constitute the bottlenecks of the existing payment system. While a centralised option is not sufficient since users cease control of their assets to a third-party leaving their accounts less secure and susceptible to being hacked, as opposed to the water-tight security offered by the blockchain. It is obvious that a trade-off needs to be reached inorder to combine the best of this two worlds,centralised systems vs decentralised systems, and that is what we are set delve in as we talk about the Liquidity network, its concepts, characteristics and how it has successfully built an exchange that models its protocol of a fast, secure and scalable network.

But first,

Blockchain Modifications, Challenges so far

Via the concept of private channels, many modifications has being made to the way value is being exchanged on these decentralised technology all in a bid to ensure transactions are processed in real-time without compromising security in the process. But with private channels, a network is restricted to two users and there is no way for the channel to be refunded in this off-chain mode except the channel is closed and taken on-chain, thereby opening the door for a host of blockchain-related issues to be re-introduced into the transaction process, some of which are expantiated below

[1] High Transaction cost

In a private channel, cost of a network are primarily restricted to the network bandwidth and internet latency whereas an on-chain transaction has far reaching cost for an average user since the cost of the network will depend on alot of factors including the network difficulty, consensus mechanism, miners fees amidst others. Factors that are not going to improve anytime soon as more people join the blockchain and gets the network more congested. Inevitably, either we derive a high cost network or one with infinitely poor latency; none of which represents a good proposition for users, businesses who are looking to use the blockchain as a means of payment in the near future. Example of networks that have implemented a similar concept (private channel) thus far are Raiden and lightning networks

[2] More channels, less organisation

One of the major loophole of existing payment networks like Raiden is their inability to achieve rebalancing in an off-chain mode which means that upon channel depletion, channels are closed and a new channel have to be created once refunded making the system less redundant as the network becomes more complex. This renders the network less scalable for mass adoption since each payment channels are maintained independently.

But now, Liquidity network goes one step further to circumvent the issues discussed above while helping the underlying blockchain network to solve inherent problem such as speed, cost and scalability, relevant to mass adoption of the technology.

Liquidity Network Overview

Liquidity Network is a secure, private and transparent network built on the ethereum blockchain designed primarily to ensure its users derive the full benefit of running or transacting in fast, secure and scalable environment . Their method is based on the concept of private channels but tweaked a little bit differently to existing solutions inorder to avoid the intermittent need for on-chain hosting; an approach which holds a lot of advantages to the average cryptocurrency user, trader, enterprises e.t.c.as enumerated below.

Centralized computational power; this is the gateway to achieving real-time cryptocurrency asset transfer to rival that of centralised systems

Decentralised Blockchain; to ensure users enjoy the water-tight security of the blockchain for their assets.

Exchanges built ontop liquidity network need not hold customers fund in their wallet making them Non-Custodial in nature

The above factor ensures values are ONLY transferred between users in a peer-to-peer fashion, removing the need for any third-party functionalities which mostly results in extra cost for the network

Private keys are always held in owners custody ensuring account security at all times

Smart contract-enabled; which means that instructions are executed correctly, leaving no room to change what has being permanently regiatered on the blockchain

Ability to run multiple transactions concurrrently on a single hub network while anyone can run their own hub server independently

Host of redundant channels to ensure easy routing and achieve a network of high scalability, suitable for mass adoption.

Offchain transaction Settlements

Off-Chain Transaction Settlements Off-chain transactions can be separated into two main categories. The 2-party transactions are between 2 users, while N-party transactions are between more than 2 users: * 2 party payment channels * N-party payment hubs The following are different types of 2-party channels: *Unidirectional* A unidirectional channel is between two parties; one of which deposits collateral of some sort (e.g. ether). The deposit is a security that encapsulates the maximum amount that will travel through the off-chain channel. Funds can only travel in one direction in a unilateral channel. *Bi-directional* A bidirectional channel is one between two parties that both deposit collateral. This channel allows funds to be sent in both directions. The risk with bidirectional off-chain transactions is that an illicit node on that channel (one of the two parties) can invalidate the previous transaction and steal fund from other party. *Linked payments* Linked payment channels are used in the case where two peers are not directly connected. Every member deposits some collateral in this network. With linked payments topography, the following considerations are taken into account: route finding, channel maintenance, transaction security, and congestion balancing. *2-party payment Hubs* A 2-party payment hub is an extension of the above types, which includes more than just two people participating in a direct transfer of funds. 2. N-Party Payment Hubs N-party payment hubs remove much of the computational work that 2-party hubs require as pertains to rebalancing collateral. This makes transfers cheaper, faster, and allows more users to participate in the hubs. Liquidity Network Hub offers free offchain channel registration. Comparing to 2-party payment channels which requires complicated routing topology, Liquidity Network Hub offers simple routing N-party payment hubs lower the barrier of entry that are necessary to join a hub, thereby creating more liquidity!

Understanding the major technology concept behind the Liquidity Network

Inorder to achieve the characteristics highlighted above, Liquidity Network has find a subtle way to combine the best functionalities of two worlds; centralise and decentralised by adopting this irreverent approach to asset managements and transfer via the Liquidity Network Nocust hub and Revive Protocol respectively.

Nocust Hub

Nocust stands for Non-Custodial; which enables off-chain access of the wallet by the Liquidity Network . This ensures that the user has full control over how his assets are managed instead of keeping it with a custodian or third-party. Therefore, a member of a network can choose to withdraw his deposited funds, which makes him a valid member of such network hub anytime he deems fit and is also free to join any hub network he so choose.

This feature guarantees the security of the users account which can never be compromised by anyone, makes payments almost instantaneous and also relatively cheap!

Revive Protocol

This protocol complements the off-chain, non-custodial nature of the users account by building a redundant network around these independent payment channels(collectively called hub) so that there is no need to take the process on-chain when funds gets depleted in a single payment channel (explains the existing options) as other channels within the hub can rebalance the network in the off-chain mode. This approach helps to avoid network congestion while improving the scalability of the overall network without compromising the speed or security of the network.

REVIVE is the first rebalancing scheme for payment channels, which allows a user to use any other channel to rebalance a particular channel. If all the rebalancing participants are receptive (ie, honest), rebalancing with REVIVE is free. Therefore, REVIVE increases the transaction scalability of block chains without permission by reducing the frequency at which reimbursement of the channel in the chain is necessary. REVIVE is independent of the payment channel, that is, it can be applied to different underlying payment networks.Source : Revive Network PaperApart from this, the Revive protocol ensures the process does not attract extra cost due to on-chain hosting in existing system.

**

A good example of the potentials seething in the Liquidity Network is the Liquidity Exchange, an hybrid-built cryptocurrency exchange platform that features all the characteristics of a full-fledged liquidity network. This exchange employs the best features of decentralised account balances and with a centralised fast order matching to solve numerous trade issues albeit communication is done on a 2nd-Layer protocol via the help of private channels.

Privacy; Unlike conventional blockchain which only offers users anonymity at best, private channels ensure total privacy of its users which is ideal for any enterprise to launch its business on the blockchain. Liquidity network is built to help such businesses comply with basic trade rules such as privacy of its customers.

Real-time execution of orders; coupled with water-tight security measures ensures businesses and users enrol to the network thereby driving an industry-wide blockchain and cryptocurrency adoption.

Low setup cost, low maintenance cost and ability to handle multiple transactions at a time also contribute to the improved scalability of the overall network.

Increased participation will drive high liquidity within the networks

Liquidity Network via the payment feature will be able to serve as a great micropayment channel for trivial task like Airdrops

Highlighting the Full benefits of Liquidity Network to its users

Final Thoughts

Liquidity Network is an adaptable network for all participants on the blockchain because it is fast, secure and scalable for cryptocurrency transaction. Hence, its relevant for adoption in many fields of human endeavour as highlighted below

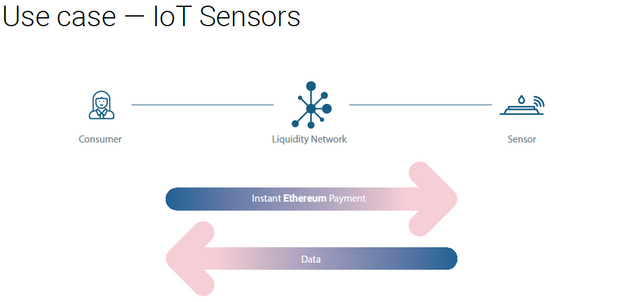

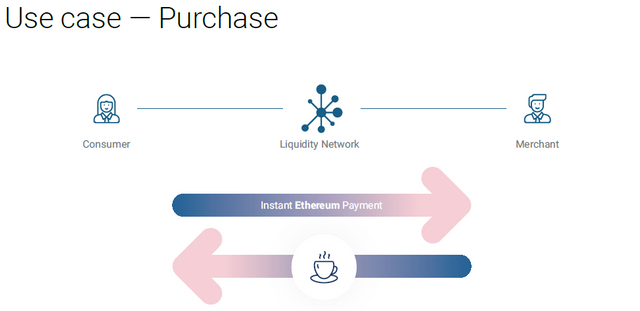

Use Case

E-Payment Reloaded

In the present E-payment system, one of the obvious challenges in addition to being costly is cross-border transaction limitation, multi-currency constraints and possibility of manipulation due to centralised structure while privacy is at risk since some outlets collects customers info.

However a E-payment channel driven on Liquidity Network will ensure most of this drawback are not feasible since the blockchain runs a unified fiscal system. Transactions can be managed in a private mode at all times that ensures good business practice where needed.

Online Money Transfer

This is the sister feature of E-payment where a product is not expected only a service is offered. Therefore, this should not attract high fees but infact it does attract high fees more than a purchase being made especially in cross-border transfer.

But with Liquidity Network there is an escape route for individuals to make such transfers instantaneously at relatively zero cost.

Synopsis

Vs Other Exchanges

Vs Other Off-chain solutions

Vs Other Payment solutions

- *Liquidity Network Application Prototype

*Mobile

- Desktop

Watch this video

- Liquidity Website

- Liquidity Whitepaper

- Liquidity Nocust Paper

- Liquidity Revive Paper

- Telegram

- Github

lqd2019

Nicely written! May I know how to insert the image on right/left corner and written part just parallel to it?

I am Still learning on this platform:)

Thanks @praditya for visiting my blog

You can use this code to switch image left or right

This post has been submitted for the @OriginalWorks Sponsored Writing Contest!

You can also follow @contestbot to be notified of future contests!

Congratulations @proofreade! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @steemitboard:

Thank you so much for sharing this amazing post with us!

Have you heard about Partiko? It’s a really convenient mobile app for Steem! With Partiko, you can easily see what’s going on in the Steem community, make posts and comments (no beneficiary cut forever!), and always stayed connected with your followers via push notification!

Partiko also rewards you with Partiko Points (3000 Partiko Point bonus when you first use it!), and Partiko Points can be converted into Steem tokens. You can earn Partiko Points easily by making posts and comments using Partiko.

We also noticed that your Steem Power is low. We will be very happy to delegate 15 Steem Power to you once you have made a post using Partiko! With more Steem Power, you can make more posts and comments, and earn more rewards!

If that all sounds interesting, you can:

Thank you so much for reading this message!