The Gumption Of Growth – The Genesis Of Unicorns & The Global Construction Boom

So much has been said on the topic of quantitative easing, I find it foolhardy to rehash here. For a quick refresher, I recommend revisiting my posts on the topic here, and here.

One of the most significant consequences of quantitative easing is a loss of price discovery.

A healthy marketplace is one that is deeply liquid, has a wide variety of individual actors, opinions, positions, trades, etc. across various timelines, asset classes, strategies, borders, etc.

In other words, a healthy market is one that allows for all-natural, non-GMO price discovery.

To use an analogy, quantitative easing is equivalent to a mobster (central banker) walking into a functional casino (healthy marketplace) and taking over the floor.

Except what we have in reality is more like a gang of mobsters as the central bank coalition of the Americans, Europeans, Chinese, and Japanese – and let us not forget emerging economies who have feasted on the debt fueled breadcrumbs of their larger cohorts – enter the market at a scale never seen before and dictate who gets to play what game and, more importantly, at what price.

What central bankers have done to markets is really no different than what The Rock does in the following scene from the film, Walking Tall:

Who are the guys The Rock is pulverizing?

Those are your non-central bank investors; everyone else within the greater marketplace ecosystem who relies on the ability (or delay thereof) of markets to discover real prices.

Internalizing the rather violent visuals provided above, what is clear is that the marketplace has lost its path. It is unhealthy because it has been commandeered by all-powerful centralists.

So where has the capital that was traditionally earmarked for a healthy bond and equity marketplace been flowing to instead?

Many market participants have been forced into making investments in niche sectors, narratives, and assets.

Which brings me to...

Unicorns and real estate.

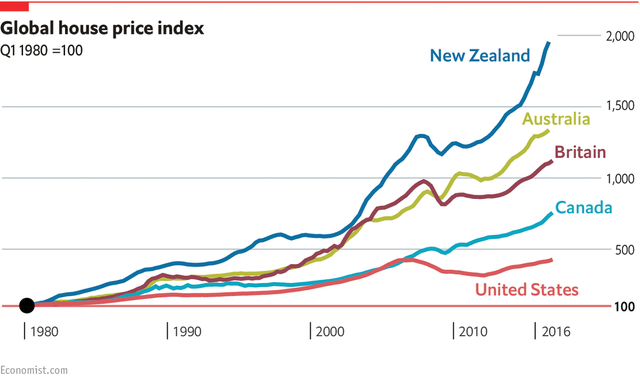

While I can touch on real estate, I find it's more readily grasped since one rarely hears mention of next month’s rent going down. Not to mention the fact that no matter which city you travel to around the world, you will encounter dozens of tower cranes and construction crews building at a pace that makes everyone a bit nervous.

A very substantial amount of capital that traditionally played in the "casino" left the game completely and decided to go into commercial real estate, land development, high-rise construction, tenant improvements, new offices, co-working spaces, you name it. Just take a stroll through your nearest city and you will understand exactly what I mean. It is a very uncomplicated indicator that most recognize, even if they are not aware of why it is happening.

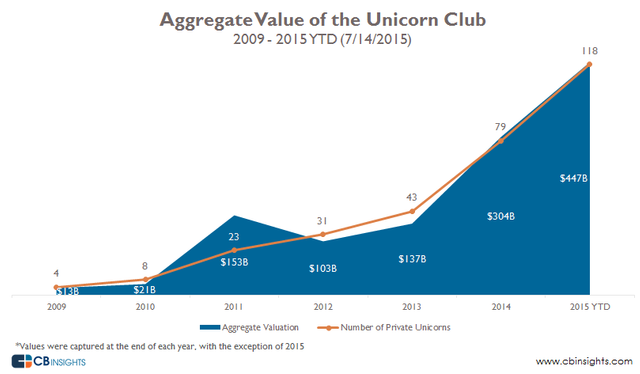

What I wish to focus on instead of real estate is the fact that the other major avenue this dislocated capital has taken was/is into the private market to fund companies with one goal in mind: growth.

Achieving unicorn status.

"Growth/Scalability" and market share are the only two heuristics that investors have been able to base their portfolios on for the past decade.

Why is it that growth has become the ultimate valuation metric?

Because a growing company creates its own self-fulfilling narrative machine. You hear these self-generated narratives every day on the street, a testament to their influence on market psychology:

While these narratives have taken a breather in recent months, the fact remains that growth is the number one investment criteria across the board since there is no longer any price discovery in the market.

When there is no price discovery, there’s limited opportunity to carve out a select strategy, arbitrage mispriced assets, and the like. It then becomes a game of relative performance, and the only way to measure this is to find that which is distinct about an investment.

Is any indicator clearer and more easily measured than growth metrics??? Asking for a friend.

By the way, just as previous organizations before them these tech behemoths will eventually plateau, consolidate, and mature into a horizontally integrated infrastructure rather than shooting vertically for the moon. Although, we do live in a world where Bezos and the billionaire boys club have nothing they'd rather do than actually land on the moon and Mars, a bit ironic.

Some examples to consider are IBM, Microsoft, Cisco, GE, etc. Heavy hitters who have weathered a cycle or two, perhaps a war, several government regimes, you name it. These matured companies have endured, unlike their younger, unproven counterparts who have only known a casino marketplace that is dominated by a strong man (or four) with a robust plank in hand.

While chasing growth for the past decade has been en vogue, as I have mentioned before I have no interest in following the herd.

Why not?

Because it is what most others are doing. Meaning the value in this strategy has been arbitraged out both quantitatively and qualitatively.

Of course, while we have our fair share of individuals pounding the proverbial table on how our market is doomed to crash, the reality is that we will likely see more extreme market distortions prior to any major economic event.

This is the primary driver behind my thesis that investing in small asset classes with negative sentiment is the most prudent thing any investor looking to catch alpha can position for. Alpha, asymmetry, or whatever buzzword you prefer is the goal here. What it is really is finding the one machine that The Rock has yet to beat to hell with his plank and patiently playing the game.

And just as you do with any game based on odds, you do not simply go all in at once, but rather study the game, study your opponents, and look to capitalize when you sense having an advantage.

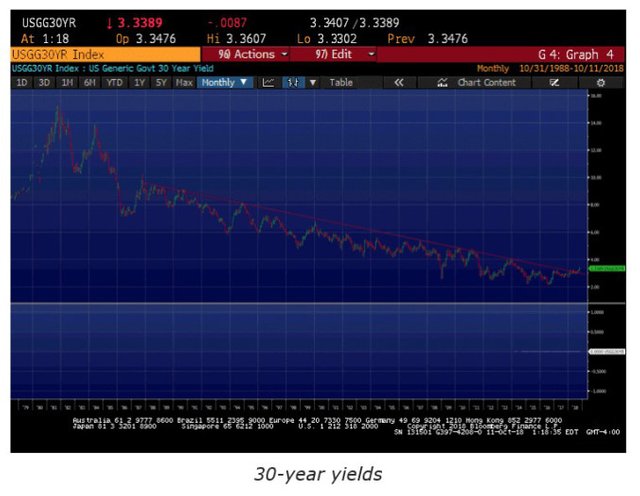

As the current environment within the public bond market deteriorates in health and ripples through every sector, especially private equity, capital will flee these overvalued markets in search of relative safety. Relative really being the key word here.

Where this fleeing capital will likely find safety is in assets that have been beaten down, are undervalued, and stand a reasonable chance at achieving that all-important growth. In other words, they will find safety in assets where a reversion to the mean has an upward trajectory.

In the end, it boils down to taking the path less travelled and having patience. It does not mean disregarding the crowd and ignoring what they do, but rather paying close attention to the crowd and attempting to anticipate what the crowd will anticipate, how they will behave, and which positions we can enter now ahead of major capital inflows searching for safe harbor during a violent storm.

In terms of timing, I always want to reiterate that nobody knows when or how things will ultimately play out. That is why patience is the single most important skill that any serious investor needs to reflect upon and develop. Put on your position, and then forget you’ve done so. Come check back in a few years and the odds are in your favor you will be pleasantly surprised.

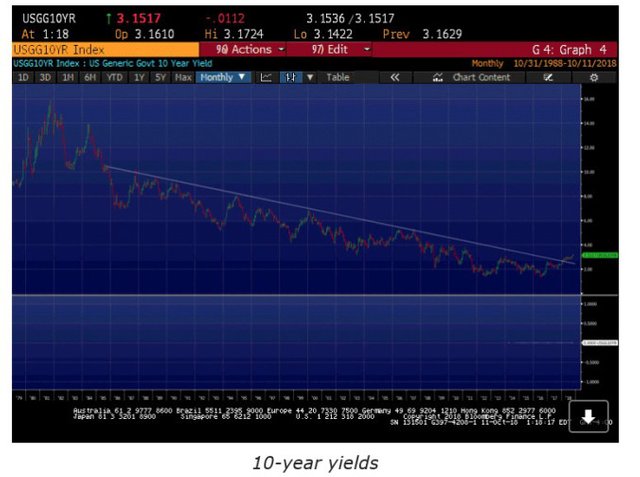

That said, I do find the chart below very fascinating and perhaps a useful timing indicator to suggest what so many others are already suggesting: we are in the final innings of this credit expansion cycle, business cycle, central bank stimulus of bond market cycle, and the over-arching market psychology of “buy the dip” all converging in a time of US withdrawal from a Bretton Woods organized world order.

Fascinating times to be alive, to say the least. A major reason why I find people who tell me they are bored so unattractive to be around.

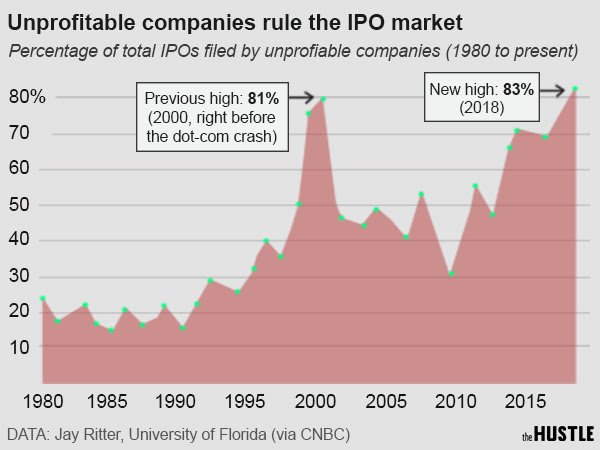

Something else to consider is 2019 being the year that Uber plans to IPO. Not to mention Palantir, Airbnb, Saudi Aramco, Lyft, Slack, and numerous other big fish.

In fact, these fish are so big that they appear to be the complete and total opposite of all-natural and non-GMO.

Seems a bit frothy, no? Why decide to go public now? Is it to cash out and disperse their risk unto the public? Hmmm….

The valuations of the aforementioned companies perform inversely to the two charts above. They have thrived in an environment of declining yields (meaning loose credit and cheap money), yet as rates enter a regime of upward movement the cost of capital will increase, meaning it will become less available.

This means all of the money that has flown into these ridiculously overvalued companies in the private market will have to rethink where it sits. This rethinking has led them all to believe now is as good a time as ever to liquidate and go public. They want to realize their gains ahead of the coming changes and increase liquid capital on hand while unloading their risk.

Do your research and do not end up being the one left holding the bag.

"I grew up in this town, people used to walk tall in this town, they wouldn't have traded the mill for a crooked casino and they wouldn't have stood around while drugs were being sold to kids." – Chris Vaughn

DISCLAIMER : This content is for informational, educational and research purposes only. This post is not to be taken as personalized investment advice.

Revisiting this post 11 months later and we have our poster child (at the intersection of real estate and unicorn startups) in the debacle that is WeWork (aka Softbank).