Coronavirus & the World Economy

View this post on Hive: Coronavirus & the World Economy

In mid-February 2020 Justin Sun acquired the shares in Steemit Inc and proceeded centralise the blockchain under his control, improperly using Steemit's founders stake (intended for development and decentralisation of the blockchain) and tricking exchanges into initially supporting his power grab.

After extensive efforts to resolve the dispute failed, the community revolted and formed a new, fully decentralised blockchain - Hive - without the pernicious influence of Justin Sun and his minions.

Because of Open Source licensing, Hive was legally able to duplicate all the code and content on Steem.

The vast majority of the community and decentralised applications and projects moved to Hive and Hive was listed on many cryptocurrency exchanges without having to pay the normal listing fees.

On 19 May 2020, a Steem hard fork (0.23) designed to steal the Steem from 65 accounts associated with creating Hive became public.

My position on this hard fork can be found here: https://peakd.com/hf23/@brianoflondon/letter-to-exchanges-do-not-run-steem-hard-fork-23-hf-0-23-0

This was the final straw for my involvement with Steem.

I will now post exclusively on Hive at https://peakd.com/@apshamilton/posts

All my old Steem content can also be found on Hive.

First the good news:

Coronavirus, though deadly (~100x more than flu) and highly contagious (like common cold) will not kill off the human race.

I recommend you read @lukestokes analysis of Coronavirus.

Pathogens need hosts to survive so even the deadliest diseases evolve to be less so as they spread. Modern medical technology should limit deaths to much less than the 1918 Flu Pandemic (which killed over 50 million).

Now the bad news:

Coronavirus will trigger the largest and longest economic contraction in modern history.

Depression isn't even an appropriate word.

For all of modern economic history, the populations of economically strong nations have been growing and the global consumer base has been expanding.

That is an essential condition for real economic growth. This essential condition has conclusively and irrevocably ended.

People in the 18-65 age bracket in 1st and 2nd world countries represent both the workforce and the consumer base of the global economy.

It is important to remember the natural cycle of human life: consumption rises in from age 18 to 45 as people start working, move out of home, buy apartments, cars, furniture and white goods, get married, have children. Consumption peaks from age 40-50 as earnings peak. Then consumption starts falling as older people need less, already have what they need and are not interested in new fangled things.

So even where absolute populations are not falling rapidly, the ageing of a population naturally reduces demand.

This 18-65 age bracket has been in decline in East Asia for many years now and also in Europe. Almost the entire second world has also followed the first world into demographic decline. First Japan, then South Korea, then China went negative as well below replacement fertility rates and declining childbearing demographic combined for the perfect storm. Chris Hamilton's (no relation) Economica Blog (https://econimica.blogspot.com) provides a wealth of analysis and statistics on this phenomena.

One of his best recent posts is this one on how financialisation has cemented low fertility

The stark reality is that the number of births is falling in nations comprising 91% of world GDP and, with very limited exceptions, rising only in extremely poor nations that play virtually no part in the global economy.

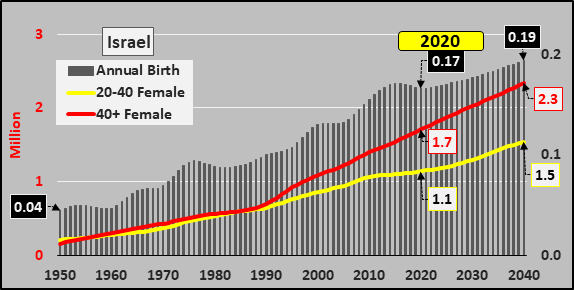

There is only one first world nation with above-replacement fertility and a growing work force and consumer base: Israel.

There are only two or three second world nations (with a share of world GDP of over 0.25%) which have above-replacement fertility and a growing work force and consumer base: Egypt, Pakistan and the Philippines.

These four countries currently account for only 1.4% of world GDP. They are not going to be able to save the world, but they can probably save themselves.

Central Bank Magic Tricks

So you may ask, why have economic measures such as national statistics and the stock market continued to show growth in this situation?

The answer is massive money printing, record low interest rates, "quantitive easing" and the other financial slights of hand used by central banks to paper over this massive crisis and temporarily preserve the illusion of growth.

With super cheap money:

- companies have bought back their shares pushing stocks to record levels despite weak earnings

- consumers have bought more things that they don't really need

- businesses have invested in additional capacity to meet a demand that will never exist

- builders have built apartments and offices that will never be filled.

This massive overhang of surplus capacity is no more evident than in China - the main engine of global growth since 2008.

Whole cities full of apartments that are empty. Freeways to nowhere. Massive zombie debt investment in plant and equipment that will never be needed.

China's authoritarian government has suppressed coverage of this reality and continued to prop up its economy with more and more radical and draconian measures to preserve the illusion of growth in the face of a clearly declining consumer base and work force.

It is obvious when you get down to basics:

- demand is people buying stuff

- fewer people need less stuff

- older people need less new stuff

- people buying less stuff means economic decline rather than growth.

Ultimately no amount of financial magic can disguise this reality.

Coronavirus ends the magic show

Coronavirus is out of control in China. More than 1% of the world's population in Wuhan and Hubei are being held in draconian lockdown. In this apocalyptic hell there is virtually zero economic activity. Elsewhere in China, street and shops are empty, self quarantine is being used as an excuse not to work. Consumer and business confidence is destroyed.

Flights from China are being banned and cancelled. Soon there will be little commercial air traffic from China and with passenger flights ending, freight capacity will plummet (most air freight goes passenger flights - hat-tip @brianoflondon). Goodbye Alibaba!

Central bank magic tricks won't work on an economy in this state.

All the measures used to artificially stimulate fake economic growth over the last decade will make the reckoning far worse.

Over capacity in every area will cause a sudden, massive shrinkage of demand once people realise the Emperor has no clothes.

In an era of continually less and less global consumers, only companies and nations producing new, innovative high tech products that no one already has and products for the aged care market will be able to achieve growth.

Producers of raw materials and durable goods (cars, white goods, industrial plant etc) will see shrinking markets for at least a generation.

Winners and Losers

Unfortunately most nations and people are losers from the end of global economic growth.

The only solution is for people to have a lot more children. But even if overnight every fertile woman in the first and second world decided to have extra children it would take more than 20 years for this to have an impact. Because of declining fertile age populations current birthrates would need to almost triple to restart real growth before 2050.

Sadly, Australia, my birth country, will suffer particularly badly from all of this because its top 3 export markets (China, Japan & South Korea) are the worst of the worst when it comes to low fertility and demographic decline. As a resource export based economy in an era of declining need for resources, it is trapped, despite being demographically better off than most other advanced economies.

Fortunately, Israel, my adopted country, is best placed to survive the coming storm.

Israel's economy is highly skewed towards innovative high tech products for export that will see continued demand.

Its fast growing population, with fertility almost triple the EU average, will drive strong growth of its domestic economy.

As the only advanced economy with a rapidly growing and skilled population and consumer base, it is attractive for overseas investment and companies seeking new markets for their products in a world of decline.

It is also well placed next to Africa, the only region of the earth with strong demographic growth. Although most of this growth is in people who will always be too poor to be global consumers, there is a rising middle class in places such as Nigeria that is beginning to join the global consumer base.

In case all this leads to truly apocalyptic scenarios, Israel's military and civil defence is strong enough to defend its people.

Unfortunately we've had lots of practice in defending ourselves from people trying to kill us!

As I've written previously, Israel is a nation of preppers where for almost 30 years every new apartment and house has had an bomb and nuclear, biological and chemical weapon proof safe room.

I don't need to worry about surgical masks for coronavirus as I have bioweapon proof gas masks provided by the government and an NBC safe room standard in my newish apartment in central Tel Aviv.

Professionally I hope to be OK as litigation is generally a counter cyclical thing. When things go bad more people start suing. When things are good, people are too busy making money to sue.

The Cryptocosm - a light at the end of the dark tunnel

While I can't be sure of this, I believe that crypto currencies and decentralised applications like Steem will arise from the ashes as the new model of money and economic interaction. Based on sustainable money, real economic activity and decentralised human interaction, the cryptocosm can ultimately empower the demographic growth engine of Africa and return the world to growth in the second half of this century.

Here's an article with a lot of evidence out of China of complete economic shutdown. https://www.zerohedge.com/geopolitical/calm-storm-how-will-coronavirus-really-impact-markets

Curated for #informationwar (by @apshamilton)

Delegate to the @informationwar! project and get rewarded

Hi @apshamilton!

Your post was upvoted by @steem-ua, new Steem dApp, using UserAuthority for algorithmic post curation!

Your UA account score is currently 4.517 which ranks you at #2156 across all Steem accounts.

Your rank has improved 1 places in the last three days (old rank 2157).

In our last Algorithmic Curation Round, consisting of 87 contributions, your post is ranked at #4.

Evaluation of your UA score:

Feel free to join our @steem-ua Discord server

Hi @apshamilton

Did you see chinese markets opening yesterday? Slaughter :/

I wonder what's your impression about this virus impact on world economy one week after your publication @apshamilton

Cheers

Piotr

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.