SLC | S21W2 | Costs for entrepreneurs - Cost elements.

Assalam-o-alaikum!!!

Designed in Postermywall

Greetings to my all STEMEIT members. hopefully you all are fine and doing very well done job on STEEMIT. Today I am going to share contest post

- Expense Recognition:

Expenses are recorded in discretionary accounting and when expenses are incurred, this means that companies that spend or invest money on inventory or other business needs, then these expenses are incurred. In financial statements, what we call specifically the income statement is the time to recognize it by following accounting principles such as the matching principle that matches expenses with the revenues that helped generate them.

- Cost Classification:

Accounting also helps to understand their impact on profitability and this classification can include both direct costs and indirect costs such as operating gross profit. Profit and net income can be calculated and accurate classification of costs is very important so its stay is very important for shareholders to understand where and how companies spend their money and assets.

- Inventory Valuation:

Valuing the inventory requires a lot of costing. Our accounting software from the balance sheet determines the value of the inventory and also obtains information on its cost and costing methods such as the first. The team is first-out and last-in first-out, or always divorces this division, which affects the cost of goods sold and revenue.

Budgeting and Forecasting:

The cost data that budgets always support in forecasting efforts can form its own method of accounting cost data that management can use to set budgets for future costs and finance projects. It can also play a very important role in planning and is very important when companies are managing cash flow. It would have been useful to guess isDecision-Making and Financial Ratios

Cost game information also interprets the decision-making process and financial ratios such as gross profit margin and operating margin are used to estimate the company's performance more precisely. The minister interprets the costs more closely and guides the decisions

Both these fixed and fixed costs are a fundamental type of cost that businesses do not face, and understanding the differences requires understanding forecasting and profitability analysis.

- Fixed Costs

Fixed costs remain constant at the risk of increasing production levels and sales volume, and they seem to account for fluctuations and fluctuations in business activities within a certain range, and we do not allow fluctuations within them. Because of this, it makes the ability and budget much easier

- Example:

- Rent:

Monthly payments for office or warehouse space remain the same regardless of how much is produced or sold - Salaries:

Salaries for permanent staff are generally fixed as opposed to hourly wages regardless of production output

- Variable Costs

variable Cost kept as production level or sales volume keeps on fluctuating. When production increases, it means the keeping is also high and when the production is low, its expenses are accordingly very high. are reduced

Example:

Raw Materials:

This means that the more units produced, the more actions will be required and the area that was directly covered will be tied to the volume.

- Direct Labor:

Now the hour or piece at work will vary with the amount of work they do or the time we spend, so if more units are produced, more labor will be required, and if more labor is required, So the cost will increase again

So let's go, let's build a company and take it to the room to use, here we are going to prepare our order, see how we will do it.

- Direct Costs

These are the raw materials that are made in each company and the basic material and graded double and eco-friendly for this are provided with mostly little graphs in each cup and cardboard box for eco-friendly and each cup. can be used to package for retail sale and the wages of employees who assemble the cups on the production line to inspect and do what is done Time spent in non-hourly wages of assembly workers Female The ready role is also basically played from the unit and it is ensured that it can meet the criteria or not.

- Indirect Costs (Overhead)

It is very important to do but cannot be a part of Arshad products. The reason is that these items are used and, in addition, items such as gloves or gloves that may be useful enough to support the assembly process and the wages of employees who are not directly involved in production but are We work and support during the manufacturing process and we also ensure that the machine is working properly and regularly goes for service and materials. For women products we have inventory handled or not

- Fixed Costs

Here the rental cost is looked at and the cost of the equipment is covered if the cost of the equipment is spread over time. There is something else, these go for the expenses, whether they are again the loss of the level of production, the fluctuation of the profit and loss, but these things must be done.

- Variable Costs

Cost of fiber-to-silicone and vectoring has the potential to increase with the increase in the volume of raw materials used for the first night of electricity and water consumption on a first-come, first-served basis. It will definitely be different. Also, when we spend all the money we spend on getting the salespeople to know that we've added more units, the sales reps get a commission based on the volume of sales. These prices may vary for direct sales

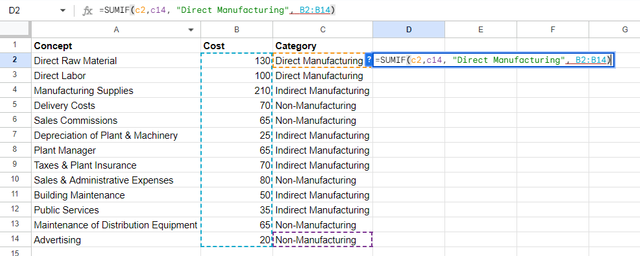

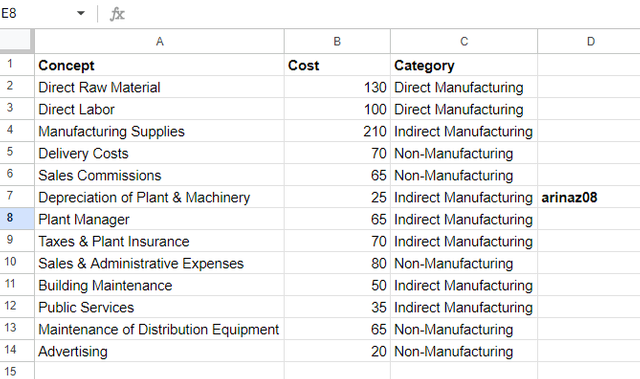

Direct Manufacturing Costs:

This is what is directly attributable to the production of the product, such as direct labor or direct labor

Indirect Manufacturing Costs:

Also known as Manufacturing Overhead, it is used heavily to cover the costs necessary to support the manufacturing process, but for each unit directly manufactured, it is the destination. Can't connect

Non-Manufacturing Costs:

We do not relate these costs to production but management to sales and distribution

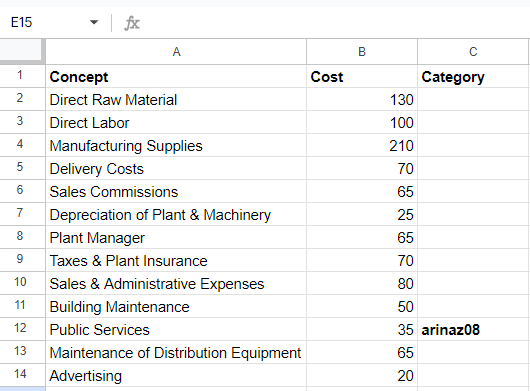

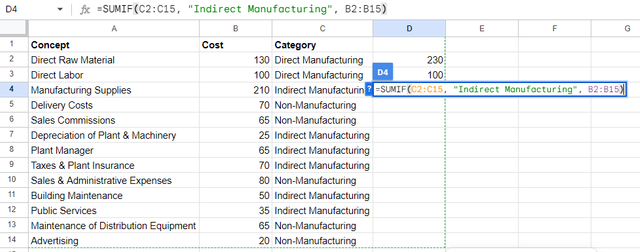

Now I will calculate it by7 using Google Sheets

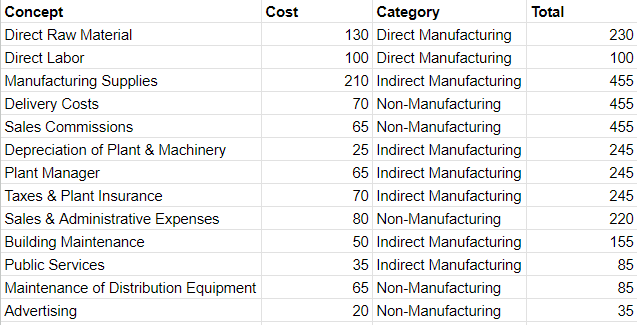

Now we can calcutate the total Direct and Indirect Manufacturing

|  |

|---|

So here is the Total that I do in Google Sheet

Special Thanks to @yolvijrm

Invite Friend: @ahsansharif , @abdullahw2 , @josepha