SLC | S21W2 | Costs for entrepreneurs - Cost elements

What is the relationship between costs and financial accounting?

I see the relationship between cost and financial accounting as a key link in understanding the financial health of a company. In my analysis, I see financial accounting as allowing us to compile and present comprehensive financial information at a given point in time, giving a complete picture of the company’s position that includes items such as the balance sheet and income statement, which are critical to external stakeholders such as investors and regulators.

When I look at cost accounting, I realize that it gives us a more detailed and specific view of how resources are allocated within the company. Using cost accounting we can analyze how expenses related to production or service delivery are distributed across different sectors or projects, a method that helps us identify areas where improvements can be made to reduce costs and increase efficiency.

To summarize briefly, I consider financial accounting and cost accounting as complementary in the management approach, while the former provides with an overview and periodic reports and the latter provides with valuable details to make strategic decisions on a daily basis. I believe that both aspects are essential to keep the company on the path to profitability and sustainable growth.

Establish the difference between fixed costs and variable costs, providing examples of each.

We start with fixed costs which are expenses that do not change according to the level of production or sales, taking the example, if I run a company that manufactures furniture the rent of the workshop remains constant whether I produce 10 or 1000 furniture pieces per month. Similarly, salaries for permanent employees, such as production managers or accountants are part of fixed costs because they are paid regularly, regardless of the quantity produced. Other examples include insurance, property taxes and depreciation of equipment such as machinery or computers which remain stable in the short term.

On the other side for variable costs, they increase or decrease depending on the volume of production or sales, let's take the example, if I make furniture the wood and fabric needed for each piece of furniture are variable costs. The more furniture I make, the more raw materials I have to purchase, which increases costs. Similarly, if I hire hourly workers to assemble furniture their wages are part of variable costs because they depend directly on the number of hours worked that is itself affected by the volume of production. Transportation and shipping costs, which increase depending on the number of orders delivered, are also variable costs.

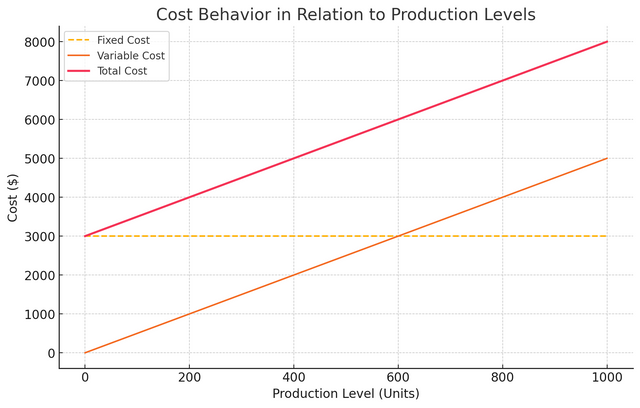

We can say that the main difference between fixed costs and variable costs lies in their behavior in relation to production and sales. Fixed costs such as rent and salaries of permanent employees do not change with increases or decreases in production. On the other hand, variable costs such as raw materials, hourly labor and transport costs vary proportionally to the activity of the company. This distinction is crucial for me when I need to make financial forecasts calculate the break-even point and adjust the company's strategy to maximize profitability.

In a real or fictional case, identify the cost elements in manufacturing a product or providing a service.

In the case of manufacturing a product such as a wooden piece of furniture:

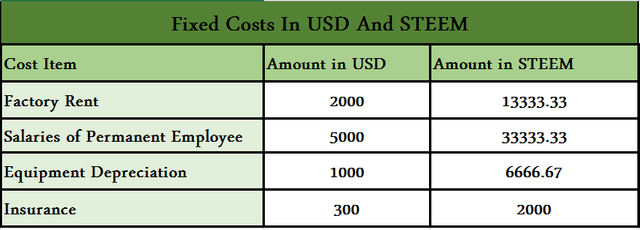

Fixed costs include the factory rent which is fixed because it must be paid regardless of the volume of production. The salaries of permanent employees, such as those of production managers or foremen, are paid on a fixed basis regardless of the number of pieces manufactured. Investments in equipment, such as wood-cutting machines or specialized machinery have costs calculated over a long period and fixed monthly by depreciation. Insurance costs for the factory and equipment are also considered fixed costs.

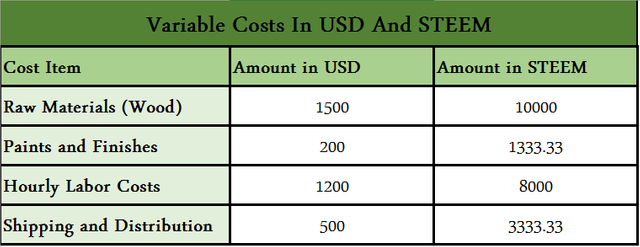

Variable costs include raw materials, such as wood used in furniture manufacturing where costs increase with the number of pieces produced, also paints and finishes are variable because their costs change depending on the quantity used in production. Hourly labor costs are incurred when workers are hired on an hourly basis to assemble furniture, making their wages variable. Shipping and distribution costs depend on the number of pieces manufactured and sold, and vary depending on the size of the orders.

I have presented the detailed fixed and variable costs in both USD and STEEM (1Steem=0.15$).

The chart above illustrates cost behavior to production levels, we look fixed cost line remains constant regardless of the production level while the variable cost line increases proportionally as production rises. The total cost line which combines both fixed and variable costs shows a gradual upward trend by reflecting how total expenses grow as production increases.

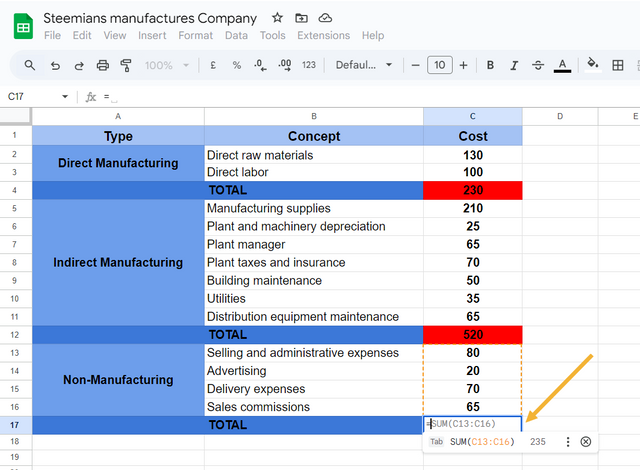

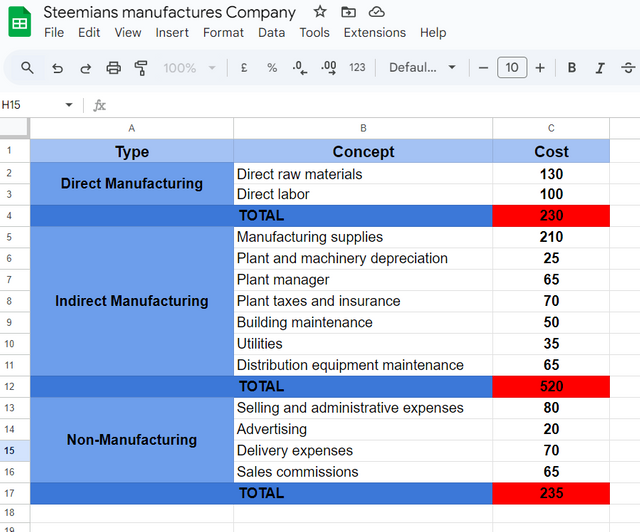

The company Steemians manufactures a single product. During a given period, the following costs were incurred:

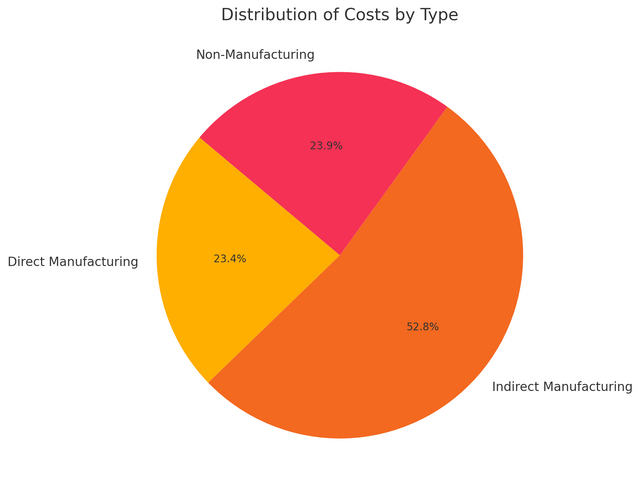

I have classified costs into direct, indirect and non-manufacturing categories and presented the results with direct manufacturing costs total $230 while indirect manufacturing costs total $520 and Non-Manufacturing total $235, I used the built-in sum() function to automatically find amounts.

The pie chart below represents the distribution of costs by type, showing the proportion of direct manufacturing, indirect manufacturing, and non-manufacturing costs.

Thank you very much for reading, it's time to invite my friends @khursheedanwar, @stream4u, @fombae to participate in this contest.

Best Regards,

@kouba01

Greetings @kouba01

1.- You have adequately established the importance of costs for financial accounting, being an important source of information for decision making, and at the same time you have explained some important aspects of the accounting treatment of costs.

2.- You have pointed out very well the difference between fixed and variable costs, giving examples of each of them, and bringing them to reality. The fixed costs do not vary without important the production levels, on the other hand the variable costs are subject to constant changes based on the production.

3.- You have identified the cost elements in the manufacture of furniture, segregating correctly each of the elements of cost and explaining in detail each one of them.

4.- You have classified each of the costs incurred by the Steemians company, identifying each group to which they belong, presenting graphically the behavior of the same.

Thanks for joining the contest

@kouba01 - you set the beneficiary to @burnsteem25 instead of @null.

Congratulations, your post has been upvoted by @scilwa, which is a curating account for @R2cornell's Discord Community. We can also be found on our hive community & peakd as well as on my Discord Server

Felicitaciones, su publication ha sido votado por @scilwa. También puedo ser encontrado en nuestra comunidad de colmena y Peakd así como en mi servidor de discordia

You have categorised all the costs correctly. And the use of the graphical charts is enhancing the understanding of the different costs. The cost behaviour chart is also very predictable and in this way the production costs are increased.

Your post is very informative and wonderful @kouba01. You have beautifully illustrated the relationship between costs and financial accounting. Explanation of fixed and variable costs and their examples are very helpful. Inclusion of graphical charts has made the post more interesting. This information is extremely useful for entrepreneurs, who want to better plan their business and monitor expenses. I pray for your success