SLC | S21W3 | Costs for entrepreneurs - Costing methods.

Hello Everyone

This is @max-pro from, #Bangladesh

Made by Canva

Made by Canva

Assalamu Alaikum steemian friends. Hope you all are well. By the grace of Allah I am also well. So this week I came to participate in this wonderful SLC | S21W3 | Costs for entrepreneurs - Costing methods learning competition organized by our teacher @yolvijrm. Here I will discuss some important topics and try to explain in detail. Stay with me till the end.

| What are costing methods and what is their importance? |

|---|

Costing systems are the techniques and rules by which a business calculates and monitors its production and operating costs. Its main objective is to support business decision-making and increase profits by controlling costs. Below are some steps of different types of costing method discussed in detail.

Cost Allocation Method :- In this method the cost is allocated to various cost centers or departments. It helps to identify how expensive a category or product is.

Cost Control Method :- This method analyzes costs and finds ways to reduce them and increase productivity.

Marginal Costing Method :- Here the cost of producing an additional unit of production is calculated. It is helpful in profitability analysis.

| Importance of costing method |  Source Source |

|---|

| Cost Control | Costing method helps to be aware of all the expenses of running the business which helps to reduce the cost and increase the profit. |

|---|---|

| Pricing | The costing method is very important in determining the correct price of a product or service. |

| Business Planning | Costing methods provide the information needed to develop long-term plans and budgets. |

| Data Analysis | Helps to analyze which products or services are profitable and which are not. |

| Improve efficiency | Cost analysis can determine where improvements can be made in the production process. |

So costing method is not only cost accounting, it helps in making every step of business more efficient and profitable.

| Explain the difference between the job order and process costing methods. |

|---|

Job Order Costing Method :- It is a costing method where separate costing is done for each job, project or order. It is used in customized or project based manufacturing. Such as specialized parts or custom furniture manufacturing.

Process Costing Method :- It is a method used in continuous production system, where one type of product is produced in large quantities. Costs are divided into different stages of production and the total cost is averaged and allocated to each unit. Such as paper, chemical or oil production.

| Differences between job order and process costing methods |  source source |

|---|

| Job Order Costing Method | Process Costing Method |

|---|---|

| It is used when production is conducted on project or job basis. The cost of each order or job is calculated separately. | It is used for continuous and mass production of one type of product. Costs are allocated to different stages of the production process. |

| For project based, customized or small quantity products. | For continuous and large volume production where products are similar. |

| Separate cost sheet is prepared for each job or order. Materials, labor and overhead are added to each order separately. | Costs are recorded at each stage of production and average cost is determined by dividing the total cost by the total units produced. |

| Customized furniture, special projects or construction work. | Production of paper, chemicals, oil or beverages. |

| Each job or order is separately costed. | Costs at each stage are averaged and apportioned to each product. |

| Research and explain, to the best of your understanding, two costing methods different from those explained in this class. |

|---|

Job order costing method and process costing method are two important costing methods which are used for determining and analyzing costs in manufacturing or service providing organizations. So job order costing method is used when an organization provides goods or services based on specific orders or projects. Each job or order is tracked individually and their costs are collected separately.

This is particularly useful when production is customized or customer-specific, such as in the construction industry or printing services. As a mathematical example, let's say a furniture manufacturing company receives an order to make a custom table. The costs for making the table are:

| Cost of materials | $500 |

|---|---|

| Labor cost | 200$ |

| Overhead cost | 100$ |

| Total cost | 500$ + 200$ + 100$ = 800$ |

If a total of 2 units are produced for this table, the average cost for each table will be,

- Cost per unit = Total cost ÷ Total units

- = 800 ÷ 2

- = 400$

Process costing is generally used when products are manufactured in large quantities through a continuous production process. For example in chemical production or food processing. Here costs are collected by department or process and the cost per unit is determined by dividing the total cost by the number of units produced. This method eliminates the need for individual tracking as all products are identical, thereby simplifying the costing process. As a mathematical example, let's say a beverage company produces 1,000 bottles of beverage per day. Production cost includes,

| Cost of materials | 3,000$ |

|---|---|

| Labor cost | 1,000$ |

| Overhead costs | 500$ |

| Total cost | 3,000$ + 1,000$ + 500$ = 4,500$ |

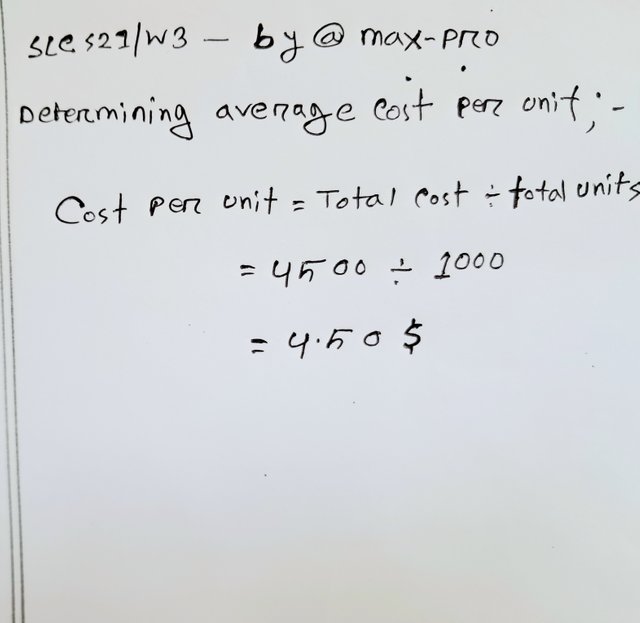

Determining average cost per unit,

captured by @max-pro

captured by @max-pro

Both methods are used in different manufacturing industries depending on their own characteristics. Job order costing method is more suitable for customized and small production, and process costing method is more suitable for large and serial production.

| Perform the costing by work orders, according to what was explained for a cake manufacturing business. |

|---|

Let's give an example of costing using the job order costing method for a cake manufacturing business. Let's say a custom cake order is received, and the following costs are included in making that cake.

- Cost of Materials:

| Flour and Sugar | 30$ |

|---|---|

| Eggs, milk and other ingredients | 20$ |

| Decoration Materials | 10$ |

| Total Materials Cost | 30$ + 20$ + 10$ = 60$ |

| Labor Cost | Labor time and wages for cake preparation | 50$ |

|---|---|---|

| Overhead Costs | Electricity, water bill, use of oven, etc. | 20$ |

| Total Overhead Cost | 20$ |

|---|

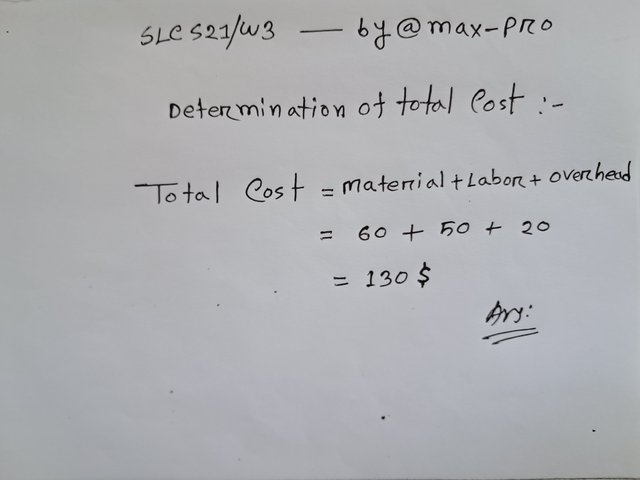

- Determination of Total Cost :-

captured by @max-pro

captured by @max-pro

- Cost for each cake :-

| If this custom order is only one unit (a cake), the cake will cost | 130$. |

|---|

Thus costs for custom orders are determined using the job order costing method, where the costs of materials, labor, and overhead are added to the specific order.

Finally, job order costing and process costing are two important costing methods used for different types of manufacturing processes. The job order method is commonly used in custom and project-based manufacturing where costs are fixed to specific orders. Process costing, on the other hand, is used in the production of large quantities of similar products where costs are averaged over the various stages of the production process.

Choosing the right method depends on the company's production process and level of customization, which is essential for cost analysis and management. So it was a very nice competition where I participated and learned a lot with the help of our teacher.

So I am Inviting my lovely Steemian friends @kouba01, @selina1, @shohana1 to Participate in this Competition.

Twitter share link : https://x.com/maxpro1412/status/1856917292329963978?t=fR3Y9VbBpkSfgs4W1jJMLQ&s=19