Countinghouse Fund: Blockchain-Powered Fiat & Crypto Hedge Fund

Whenever another fiat vs. crypto dispute arises, there is one argument that stays firm: cryptocurrencies beat fiats at volatility. The decentralized character, room for manipulation due to the lack of regulation, vulnerability of crypto wallets due to the unprecedented value of just one asset unit such as Bitcoin or Ethereum, novelty and adolescence of the market alongside other reasons make crypto an asset that quickly comes, goes, and comes back at another price.

https://www.countinghousefund.com

This volatility represents vast opportunities for fintech companies that haven’t yet been used at their fullness. Ergo, many try to come up with efficient holding, trading, and whatnot solutions, often seeing this as a chance to jump on the gravy train. Some are developing from the ground up, others are building upon an established business. The project we take a look at in this post, Countinghouse, belongs to the latter type.

Foreign exchange direct hedge fund

Countinghouse positions itself as a long-established foreign exchange direct hedge fund. They enable profiting from the volatility in the market through the use of coded algorithms and mathematics. They plan to transpose the technology to the cryptocurrency market featuring much higher volatility than the traditional ones and upgrade to a fund that works both coins and fiats.

https://www.countinghousefund.com

Direct investment

The new investor’s capital will go directly into Countinghouse’s existing trading accounts. Unlike many other ICOs, they will reserve no capital to cover the costs of starting the project because the fund is already operating. Investors will get a chance to use Countinghouse’s proven architecture and technology to trade coins and fiats. Countinghouse promises its investors to secure steady growth and yielding consistent returns.

FinTech maths meet blockchain

Mathematical risk management

Countinghouse uses math-based methodology to manage and reduce risks associated with trading. This includes:

Long term crypto-trading viability

The cryptocurrency arm of the fund is located in the Seychelles. This will enable unrestricted transfer between fiats and crypto which is required to properly execute arbitrage trading.

Competition

The number of crypto hedge funds has been growing quickly lately, from 37 in early 2017 to more than 200 in February 2018. This means that Countinghouse is facing a rather stiff competition. According to their whitepaper, the key competitive advantage with the platform is the team’s ten-year-long experience in operating their own forex direct hedge fund. They claim to have tested and excessively used their own unique math-based technology to provide seamless experiences through this period. Countinghouse Fund is designed to be an extension of the established fintech platform to the crypto market. However, it is hard to say how unique this is for the industry. Countinghouse could help us find that out if they had presented a research of the competitive environment.

Also, the beginning of this year saw the decrease in the number of crypto hedge funds. According to Bloomberg, there are at least nine funds that ceased to exist in 2018. Some of them have disappeared completely having their websites, Twitter and Facebook accounts deleted. The analysis of the situation in this exact market would help better understand threats, while the vision of how these pitfalls can be avoided would demonstrate the team’s awareness.

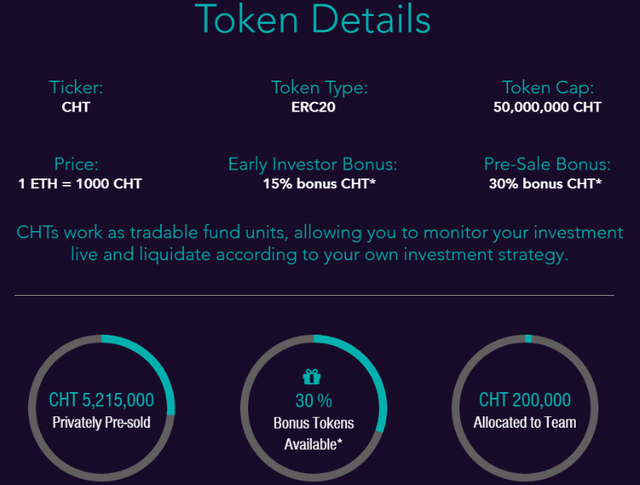

CHC token sale summary

Conclusion

Countinghouse is not a brand new solution. On one hand, the fact that the market exists indicates that there is a demand present. On the other, this market has recently begun to quickly squeeze following a booming growth in 2017. As of today, it is difficult to say yet whether it is a natural trend that will lead to the formation of a solid pool of crypto hedge funds or a sign of failure with the whole market. We believe that Countinghouse should analyze the situation and make their findings public. This would demonstrate potential investors their awareness of the current state of things in the market and where they find themselves amidst all the uncertainty.

Although Countinghouse claims that the company was established in 2013 as an extension of a private partnership of three traders, DPP, we couldn’t find information on the company’s activity until November 2016 when they launched their Facebook page. This could obviously be due to the lack of marketing during the period before they announced their ICO project.

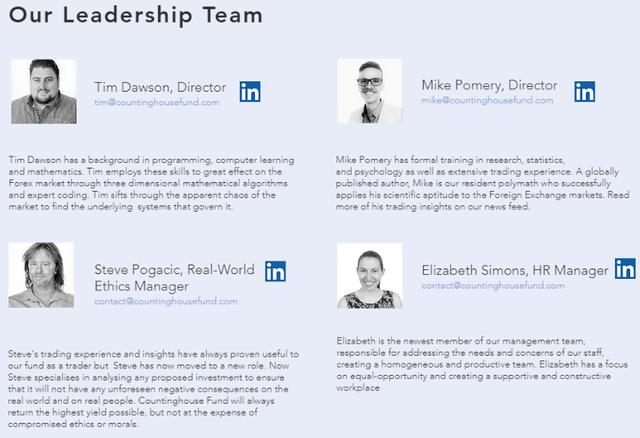

However, the founding team is comprised of three experienced traders who have been in the business since 2008. We expect, therefore, that they have extensive practical knowledge and skills in the target industry. In addition, they have conducted volatility tests throughout 2017 which demonstrated potential in cryptocurrency as a source of volatility that can be profited from.

Links:

Website: https://www.countinghousefund.com

Whitepaper: https://www.countinghousefund.com/whitepaper

Telegram: http://t.me/Countinghouse

Facebook: https://www.facebook.com/Countinghouse-289073354768908/

Twitter: https://twitter.com/CountinghouseFd

Medium: https://medium.com/@contact_28273

ANN: https://bitcointalk.org/index.php?topic=3116930.new#new

Author: https://bitcointalk.org/index.php?action=profile;u=2049300

Disclaimer:

This review by Bonanza Kreep is all opinion and analysis, not investment advice.

Thank you for sharing

our pleasure sir!