Bitcoin Surges Back Above $8500 As Goldman Doubts Cryptocurrency Survival

Content adapted from this Zerohedge.com article : Source

by Tyler Durden

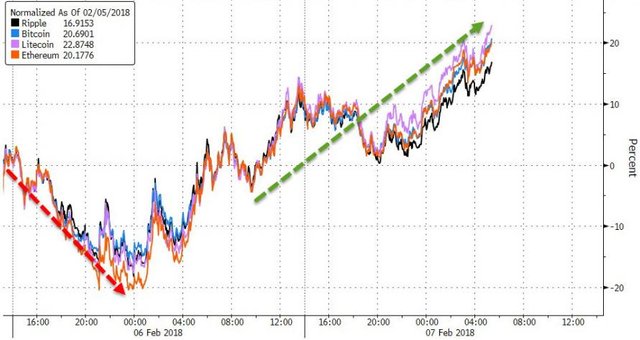

Following reassuring words from US securities regulators yesterday, Bitcoin has extended its rebound back above $8500 (from below $6000), shrugging off Goldman Sachs' latest report questioning cryptocurrencies' long-term existence.

Bitcoin is up over $2500 from its anxious lows ahead of yesterday's US regulatory hearing...

As Mike Krieger noted last night, the Chairman of the U.S. Commodity Futures Trading Commission (CFTC), Christopher Giancarlo, said at today's hearing with the Congressional Committee on Banking, Housing, and Urban Affairs.

In case you missed it, here's his opening statement:

With your permission, I'd like to begin briefly with a slightly different perspective, and that is, as a dad. I'm the father of three college age children, a senior, a junior and a freshman. During their high school years, we tried to interest them in financial markets. My wife and I set up small brokerage accounts with a few hundred dollars that they could use to buy stocks, yet other than my youngest son who owned shares in a video game company, we haven't been able to pique their interest in the stock market. I guess they're not much different than most kids their age.

Well something changed in the last year. Suddenly they were all talking about Bitcoin. They were asking me what I thought, and should they buy it. One of their older cousins, who owns Bitcoin, was telling them about it, and they got all excited, and I imagine that maybe members of this committee may have had similar experiences in your own families of late.

It strikes me that we owe it to this new generation to respect their enthusiasm about virtual currencies with a thoughtful and balanced response, not a dismissive one, and yet we must crack down hard on those who try to abuse their enthusiasm with fraud and manipulation.

That's just about as good as you're gonna get from a government regulator.

And the entire crypto universe is notably higher on the relief...

And the extended gains appear to be shrugging off a widely distributed report from Goldman Sachs questioning the existential viability of cryptocurrencies.

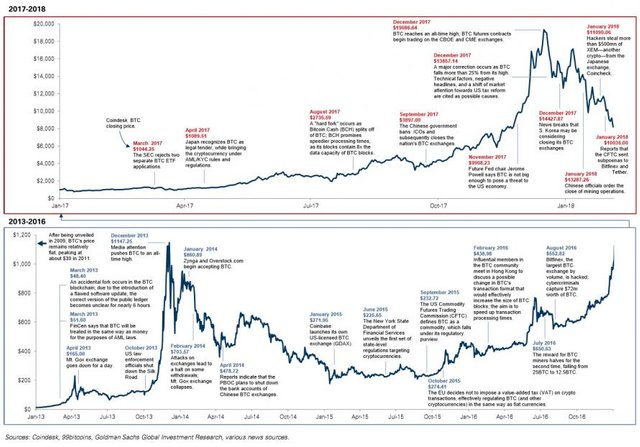

Steve Strongin, Head of Global Investment Research, argues that that the current generation of cryptocurrencies is unlikely to survive even if blockchain technology endures.

**Whether any of today's cryptocurrencies will survive over the long run seems unlikely to me, **although parts of them may evolve and survive.... To my eye, they still seem too primitive to be the long-term answer.

Is the market accurately pricing the likelihood that several—if not most—of the current cryptocurrencies will ultimately fail?

I don't believe it is. People seem to be trading cryptocurrencies as though they're all going to survive, or at least maintain their value. The high correlation between the different cryptocurrencies worries me. Contrary to what one would expect in a rational market, new currencies don't seem to reduce the value of old currencies; they all seem to move as a single asset class. But if you believe this is a "few-winnerstake-most" situation, then the potential for retirement depreciation should be taken into account. And because of the lack of intrinsic value, the currencies that don't survive will most likely trade to zero.

Is there a useful role for cryptocurrencies in financial markets today?

As it relates to the underlying technology, there is clearly a role for improving the ledgers that underlie financial transactions. Substantial investment is being made in leveraging blockchain technology to more efficiently and quickly settle contracts, confirmations, and related transactions. But the current technology does not yet offer the speed that will be required for market transactions. Now, if the question is whether there is a fundamental need for a currency that is not tied to a central bank, the answer in my opinion is "no" in most cases, at least within the regulated markets. **Even if transaction times improved, the notion that people would prefer cryptocurrencies for everyday transactions seems like a stretch. **There is perhaps a slightly more compelling case for their use as a store of a value. >

Cryptocurrencies are well-suited in particular for the many documented use cases in dark markets. They are cheap to store, easy to conceal and hard to trace. So it is plausible that cryptocurrencies may have a long-term role to play in these markets, but even that is not assured. And the possibility of cryptocurrencies catching on in the dark markets has little to no implication for their applications elsewhere; it is very difficult to turn an asset that was optimized for dark markets into one suitable for lit markets. Is it possible? Yes. But in my view, it is unlikely.

However, Goldman does attempt some 'fair and balanced' reporting by interviewing Dan Morehead, founder and CEO of Pantera Capital, an investment firm focused exclusively on cryptocurrencies and one of the largest institutional investors in crypto to date.

Not surprisingly, Morehead is a diehard crypto aficionado who believes that cryptocurrencies have enormous disruptive potential across financial services and money transmission.

**My passionate belief is that most of the largest blockchains today will survive. **That doesn't mean that 90% of the altcoins and ICOs being issued right now won't go to zero; I believe they will. But blockchains like bitcoin and Ethereum and Ripple will almost certainly still be very important in 10 or 20 years.

He sees cryptos as competitors to correspondent banks, credit card companies, conventional stores of wealth like gold, and fiat currencies. Assuming bitcoin captures some market share from each of these incumbents, he estimates its fair value could be roughly $500,000.

If I had to take a really big-picture view of the terminal value of bitcoin, I think it's roughly a half a million dollars per bitcoin. How do I calculate that? By taking into account some of the markets that bitcoin will disrupt.

In Morehead's view, it is therefore difficult to call recent cryptocurrency price action a bubble. And the potential for new market entrants in the form of institutional investors - which are essentially non-existent in the space today - gives him confidence that the price of cryptos will be substantially higher a year from now.

** I do not believe this is a bubble. Cryptocurrencies are clearly very volatile. **And anything that can go up 10 times in six months can easily go down 50% in a week. So I have no idea where it's going to be in the short run. >

But it's very difficult for me to believe that we are in the midst of a bubble given that almost all institutional investors have zero exposure to it. That said, I do expect a substantial wave of institutional investor flows into the space over the next 18 months.

What could quash his enthusiasm? Adverse regulatory action.

** I think the main risk is that regulatory bodies around the world issue rulings that are excessively harsh in their treatment of cryptocurrencies. **This risk is particularly high for ICOs, which are very speculative—like early-stage venture capital—but are also a very important way to fund new projects. That said, overall, US regulatory bodies have been reasonable in allowing the cryptocurrency market to develop while coming down on bad actors like the Silk Road. And it has been a long time now since I've worried about the long-term future of blockchain. I think that has to do with the general population really embracing this new technology, learning how it works, and getting used to it. I have no doubt that blockchain will be important 20 years from now.

And judging by yesterday's hearings, that is less of a problem now (though definitely still a worry).

That's not how this works...that's not how any of this works.

Difficulty is driven by the amount of hashrate on the network and algorithmically strives to maintain an average blocktime of 10 minutes.

As more miners join the network, the difficulty will adjust higher in order to make it harder to mine a block.

As miners leave the network, the difficulty will adjust lower in order to make it easier to mine a block.

In both cases, all the difficulty cares about is maintaining an average block time of 10 minutes.

If the price falls and some miners become unprofitable (i.e. they are mining in the red) then they will stop mining and the difficulty will drop (fewer miners mining). The miners who remain will get a larger share of the blockreward and it all just sorts itself it.

At the end of the day it's a dynamic and self-correcting system.

you expect a journalist or regulator to actually do their homework on something like this? :)

journalist, doing actual research? lul

WE REACHED OUT TO WWW.ZEROHEDGE.COM AND RECEIVED CONFIRMATION THAT THEY ARE NOT AWARE THAT THEIR CONTENT IS BEING USED ON STEEMIT AND THAT THEY DO NOT CONSENT FOR IT TO BE USED HERE FOR PROFIT.

Copying/Pasting full texts without adding anything original is frowned upon by the community.

These are some tips on how to share content and add value:

Repeated copy/paste posts could be considered spam. Spam is discouraged by the community, and may result in action from the cheetah bot.

If you are actually the original author, please do reply to let us know!

Thank You!

More Info: Abuse Guide - 2017.

It's time to buy and Hodl , " Goldman Doubts Cryptocurrency Survival " . Obviously they would doubt the survival of Btc and spread their worldwide FUD again . Goldman doesn't care about us , they want to spread Fud . They want make people panic sell so that they could buy cheap cryptos . After they accumulate their target , they would release positive news about crypto . They may pump it to new all time high then they will again release new FUD . This cycle will keep on repeating . Hodl and enjoy the drama .

Indeed, respecting the enthusiasm of the new generation builds the world economically as they get deeper into financial knowledge making it hard for them to waste resources.

Dan Morehead being the founder and CEO of Pantera Capital, an investment firm focused exclusively on cryptocurrencies and one of the largest institutional investors in crypto to date, makes me trust he's report. Some alt coins and ICOs will go to zero and some will remain in the market for a very long time. People are starting to transact a lot of products using bitcoin which is now proving a challenge to the banks, credit card companies, conventional stores of wealth like gold, fiat currencies showing there is no way cryptocurrency will not survive long term. More investors are entering the market and that can not be over looked.

With yesterday's hearings and Dan Morehead's analysis we the public are confident we are in the right market with the investments we made, despite the criticism from people like Goldman Sach, whose report is killing the enthusiasm and confidence in the cryptocurrency.

Goldman thinks crypto will not survive?

Wow that is interesting coming from the banksters.

Me thinks they are trying to spread some more FUD.

The truth is they have done a good job of it. Many of the weak hands got scared. There might be more downside to go. However, the slingshot after things reverse will be powerful. Bitcoin will lead the way with the alt-coins following. Bitcoin took a lot of punches the last 6 weeks publicly....when the reversal happens, all will follow.

Resources with knowledge of the subject indicated that Goldman Sachs would build a unit to be found in crypto money transactions, such as bitcoin. According to the information from the two sources, the bank is planning to start digital currency transactions before the end of June. Another source reported that Goldman was trying to solve security problems, such as how to view digital money assets that would still be available.

Goldman Sachs is on its way to becoming the first Wall Street company to create a crypto money market. On the one hand, the bank, Cboe Global Markets Inc. and several large companies that are traded on CME Group Inc.'s BitCoin floors.

One of the sources said Goldman Sachs would form a team in New York. The bank has not yet decided where to place the unit.@zer0hedge

The only thing that can stop cryptos, is stringent regulation, but it seems like the regulators love blockchain, and you can't separate cryptos from blockchain!

Bitcoin and the broader digital currency market are on a steady rally after a crazy week of declines, with bitcoin exceeding the $ 8,000 barrier in today's trading.

Tuesday's bitcoin gains kept this momentum in early trading on Wednesday, with gains of 25% in value over the past 24 hours, from the time of publication. After falling below $ 6,000 (on the Bitfinex platform) early Tuesday, the currency rebounded to $ 8,238 at 11:00 GMT.

For many, the improvement came as a result of discussions at the US meeting on Tuesday that raised the possibility of digital currency regulation. The discussions, which publicly publicized the intention of SEC Chairman Jay Clayton and CFTC Chairman Christopher Giancarlo, to focus supervisory efforts on the currency support operations (ICO) and the regulation of trading platforms on Federal level, rather than current laws at the state level only.

Finally tell you the digital world is the future Thank you sir for the excellent topic a lot.

@zer0hedge. :D

Spamfinderbot found a series of multi accounts of a same owner is following your articles to cheat your generous rewards. nderbot found these accounts are suspicious & can be multi accounts of a single owner. Conclusion is based on last 30 days transactions:

nderbot found these accounts are suspicious & can be multi accounts of a single owner. Conclusion is based on last 30 days transactions:

Spamfi

@faissalchahid

@seniorpower

well, @seniorpower -- what do you have to say for yourself?

I do not know what this says I'm selling my sbd to me Mr. @faissalchahid

And he does not know what would be why he interferes with what he does not mean, but I have the right to sell the harm that person angered me

I will retire steemit me and have a mindset with us

In addition there is no legal action taken here in the Steemit community

He also copies the same commentary in all the publications in concise messages

That's perfect. @zer0hedge Quite frankly, the digital currency community sees this as a development that could hurt the digital currency markets. Instead, the observations made at the hearing proved to be encouraging in such a way as not to hamper regulatory scrutiny at all, and that it would not inhibit the development of digital or blockbuster technology. The Chairman of the Commodity Futures Commission, Christopher Giancarlo, took a step forward in educating the Commission by highlighting the inseparable nature of the Betcuin and the technology of the pluchein, saying:

"It is important to remember that if there is no bitcoin, there will be no blocin"

In addition to bitcoin, a large part of the broader digital currency market is showing much satisfaction with high price hikes, as the market capitalization is approaching $ 400 billion after a drop of $ 275 billion on Tuesday.

Spamfinderbot found a series of multi accounts of a same owner is following your articles to cheat your generous rewards. found these accounts are suspicious & can be multi accounts of a single owner. Conclusion is based on last 30 days transactions:

found these accounts are suspicious & can be multi accounts of a single owner. Conclusion is based on last 30 days transactions:

Spamfinderbot

@faissalchahid

@seniorpower

Steve Strongin, Goldman Sachs Investment Research Manager, said cryptic money on the market in the last month, about $ 500 billion, will get worse.

In a report dated February 5, Strongin warned investors that they should be prepared to lose all the value of crypt money. Strongin also predicted that most of the crypto money would not be able to survive the rapid rise earlier.

Recorded sudden fluctuations in prices pointed to "balloon risk", there was no estimate of the duration of serious depreciation in crypt money.

I do not think it will be like that. Okay, there was a balloon on the market. Everyone knows that. But the balloon did not explode just missed the air. Normal plastic balloon. It swells more easily when inflated a second time. The first inflating increases the flexibility of the balloon. The same order is valid within the market.

The balloon lost air, but at the same time it gained flexibility. This indicates that it is suitable for inflation, that is, for investment. So it is up to us to save the markets again. Thanks to the investments of us and whales, the markets will be fully revived. It will return to its old days.