[SOL/USDT-SELL] - Steemit Crypto Academy | S6W1 | Team Trading Contest Post for Crypto-Empires

Greetings

Hello readers and Professors,

So I'm starting my first trade using the EMA, MA and RSI. The strategy is one I developed from reading the various lectures on them by professors like @shemul21 - (MAs), and some others.

The Project

Solana (SOL)

Solana is one of the most used open-source projects in the blockchain world. Its permissionless nature is used to provide DeFi utilities. Anatoly Yakovenko began initial work on the project in 2017, but launched in March 2020 with headquarters in Geneva, Switzerland.

The Solana protocol just like the ethereum, is designed to facilitate DApp creation. Its solution to scalability was introducing a hybrid of proof-of-history (PoH) consensus and proof-of-stake (PoS) consensus. These features have been enticing factors to both traders and investors alike.

Tokenomics

Solana has a fairly massive supply in total of 489 million SOL tokens, similar to that of steem. As at time of writing, about 260 million are already in circulation.

Solana was distributed; 16.23% went towards the initial offering, 12.92% to a founding sale, 12.79% for the team members and 10.46% of tokens for the Solana Foundation. The rest have been released to or are being released to the public.

Solana is ranked among the top10 on the coinmarketcap.

This is as a result of the bull run that saw Solana price gain over 700% in 2021. NFTs, gaming and airdrops on Solana have been driving factors for the price. Solana is also a fan-favorite for its speed and performance, and is steadily hinted to finally challenge the Ethereum blockchain.

Solana can be found on exchanges like Binance, coinbase, FTX, Gate.io, Kraken, etc.

Analysis/ Waiting for a signal

I'll try to be updating us in real time. So I'm watching SOL/USDT on the 5-minute timeframe. First looked at an overview on the 1hr timeframe to confirm a downtrend, currently at a support zone (also an order block). The RSI has warned us of an over -sell, so I'm predicting a buy.

The EMA seems to be working well as a resistance, but there are only two things that can happen from here;

- Price bounces off OB/support, EMA gets broken, EMA crosses MA signalling buy, RSI was correct, I enter a buy.

- EMA resistance holds, Price breaks OB/Support, retests the support and I enter a sell.

I was still drawing that triangle and this occurred, a breakout, and price crosses EMA.

This indicates the bulls building up momentum, and I expect a retest before a proper buy. I hope I stay patient enough to wait for the EMA cross.

Retest is currently occuring

FALSE ALARM!, bears incoming!

The Trade

Guess which strategy saved the day? I'll give you 2 guesses.

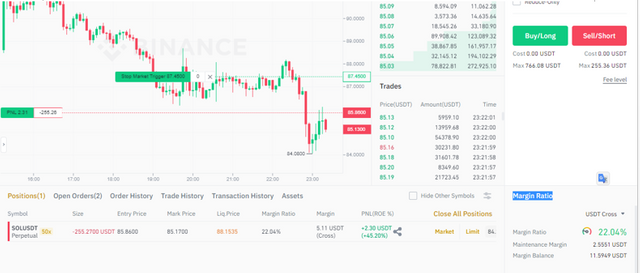

Break Retest Break. A strategy taught in the academy under the topic: liquidity levels by @cryptocraze

I waited for the market to retest the broken support as a new resistance, as soon as it did, I took my entry, as we can see above.

Entry: 85.86

SL: 87.45

TP: 81.38

Risk to Reward: 1:4

The triangle formed and I hoped for a breakout in my favour.

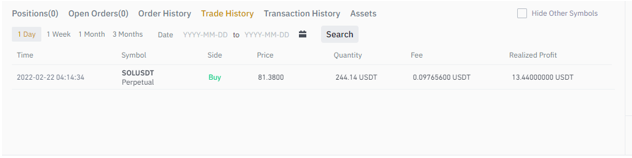

The breakout was in my favour, take profit hit with about 200% profit.

Conclusion

Day trading on solana was a good experience. The indicators played their role well and I managed to turn $5 to $13, almost 200, with a 1:4 trade. Traders who take the academy serious will get good results like these too.