How to value a crypto-asset

Modifying Connor Leonard’s approach to value investing and tailoring it to better understand the value proposition of coins in the crypto-asset marketplace.

If there is only one thing you take away from this post it should be this: Do your own due diligence and conduct proper research before investing in any crypto-asset.

Connor Leonard is a public securities manager at Investors Management Corporation and was recently featured on the Invest Like the Best podcast. In this featured episode, Mr. Leonard discusses how he finds and values securities in public markets. Mr. Leonard breaks down his investment process into two parts:

- Put on your board member hat

- Pull up the most recent SEC 10-k filing.

- Find the three to five key variables that really matter in the business (what drives revenue growth, what product/services are profitable, how does management view the industry).

- Warning: do not get bogged down in the nitty-gritty details as it is very easy to get lost and overwhelmed in these filings.

- Put on your Journalist hat

- Once you have identified the three to five key variables you should become obsessed with finding what people inside and outside the organization are saying about them.

- Check message boards, find customer reviews, call suppliers, read analyst reports, find research documents.

- For products: ask yourself - Where would I buy this from and why?

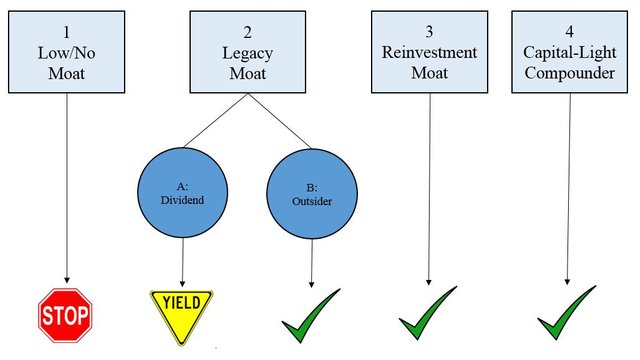

Once Mr. Leonard has evaluated and completely understands part one and two he steps back and reviews his decision-tree:

If the boxes are checked and he decides the investment is right Connor will proceed with building a position and will hold it for a long time (typically 5-10 years).

Now, I know what you are thinking. This process is all well and good but how can we adapt it to analyzing and evaluating the crypto-asset marketplace?

Let's give it a shot.

Here is an example of how you can adapt Mr. Leonard’s two-step value investing approach to the crypto-asset market:

- Put on your speculative gambling hat

- Open the white or blue paper from the developer's website.

- Determine what problem the coin is trying to solve (If it has anything to do with organic bananas please avoid it).

- Estimate the coin’s value

- What causes coin ABC’s price to increase or decrease?

- Calculate the coin’s supply and market cap

- What is the circulating, total, and max supply?

- Is the coin inflationary (Bitcoin), deflationary, or neither?

- What percentage of the total supply do the coin founders hold? Why?

- Evaluate the Team

- What kind of experience does the team have? Are any members experienced in the industry the project is attacking?

- Is the team engaged with the community and are they providing timely updates?

- Are they keeping on track with their road-map from their white paper and/or website?

- Review the Investors and Partners

- Investors and partners should be listed on their website

- Having the support of well-established investors is a good sign for the project.

- Put on your journalist hat

- Again, once you have identified these five key variables you should become obsessed with finding what people inside and outside the organization are saying about them.

- Follow the team, its investors, and the partners on social media channels.

- Check message boards, ask respected investors their opinion on the coin and/or industry.

- Attempt to write an investment thesis in one paragraph and explain it to someone that doesn’t have any investing experience.

- If you are having trouble succinctly writing out your thesis, try using a decision journal (I have found these to be incredibly helpful especially when I am revisiting a decision at a later date).

- Again, once you have identified these five key variables you should become obsessed with finding what people inside and outside the organization are saying about them.

There you have it - a simple two-step process for evaluating crypto-assets. While this process may not yield 1,000x results it will at least get you on the right track to managing risk and understanding what you are investing in.

I have to stress this point again, Please do your own due diligence and conduct proper research before investing in any crypto-asset.

Disclaimer: Author is not an investment professional. This article is not an investment recommendation, do your own research, it is your sole responsibility to make your own financial decisions. This blog does not constitute, create or form a professional-client relationship of any kind, or in any manner, it places sole accountability and responsibility on the user or reader if they make any legal, financial or other decisions based on the information obtained. This information is purely a non-professional opinion, and thus should not be used in making any decision to buy/sell/hedge any investment in the mentioned cryptos.

If you enjoyed this article please consider following me on any of my social media channels:

Steemit: https://steemit.com/@ryanbo

Twitter: https://twitter.com/Ryan_Boselo

SeekingAlpha: https://seekingalpha.com/author/ryan-boselo/articles#regular_articles

Wishing you the best,

Ryan