ForkLog: GEO: Decentralization and Privacy Without Blockchain

Once bitcoin and other cryptocurrency networks have emerged, decentralization and privacy of transactions started to be associated with the concept of blockchain. Over the course of the bitcoin ecosystem’s development, the trend of centralization was gradually becoming apparent.

It turned out that bitcoin transactions are neither free, nor instant, whereas block size would only make the tendency to centralization stronger. Besides, as transaction explorers like Chainalysis were developing, it became quite clear that privacy of pseudonymous transactions is rather conventional.

BOOSTING DECENTRALIZATION AND PRIVACY

Attempts to solve the aforementioned problems are being made within bitcoin ecosystem as well as via creating altcoins. In Bitcoin, the ban on block size increase is about protecting the current level of decentralization, whereas bitcoin mixers and CoinJoin combined with Confidential Transactions are about enhancing transaction privacy. Recently announced Mimblewimble solution is a further development of CoinJoin and Confidential Transactions and may be employed both as a bitcoin softfork or as a sidechain.

Zerocash is arguably the most anticipated “anonymous” altcoin, as it provides anonymity of transactions using the so-called zero knowledge proof. As for more or less established altcoins, Dash could be a good example as it offers greater privacy and faster transactions using PrivateSend and InstantSend technologies, while the overall network centralization used to be halted with X11 hashing algorithm. ASIC for the latter has entered the market recently.

Anyway, once there is a blockchain recording all transactions, this means there is a possibility to track these transactions. Using PoW and PoS algorithms keeps the impetus to increase the computational power share or the overall number of coins in the network, which leads to more centralization.

The conclusion here may seem absurd or even heretical: in order to enhance the network’s decentralization and transaction privacy, one should abandon mining and blockchain altogether.

However, this idea will look less absurd once you remember off-chain transactions projects with Lightning Network standing out from the rest. Still, LN does not break up with blockchain completely as it is built on top of it. Secondly, it has been designed as a means to scale bitcoin and not to enhance privacy or prevent centralization. Bolt, another announced recently project, seeks not only to improve bitcoin scalability, but also to support anonymity of off-chain transactions. Yet, just as LN, Bolt is a mere add-in too.

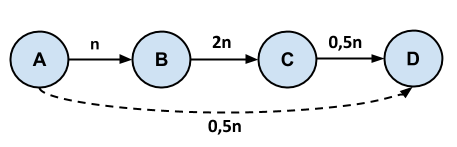

And then there is GEO, a decentralized credit network first presented at Bitcoin & Blockchain Conference Kiev 2016. Similar to Lightning Network or Ripple, GEO transactions are built on atomic transactions. For instance, if there are payment channels AB, BC and CD, node A may transact to node D via a chain of atomic transactions AB, BC and CD. Still, in the context of decentralization and privacy, GEO is substantially different from both Lightning Network and Ripple.

WHAT IS GEO?

Essentially, GEO is a protocol which may underlie a decentralized credit network. In a credit network, nodes transact obligations instead of money with each node creating its own obligations. Whatever is the substance of such obligations (these may be bonds, promissory bills, coupons, etc), the issuing node may exchange them for goods or money with the nodes that agree to accept them. Unlike national currency systems, each node within such network decides upon which nodes to accept obligations from, and to what extent.

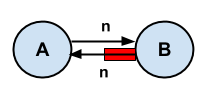

A credit line between two nodes is the basic relation within a decentralized credit network. Node A agrees to accept obligations from node B to the overall amount of n, whereas the amount of a credit limit may be denominated in any equivalent. Node B may have a credit from node A within the stipulated amount. Then node A requests node B to settle the obligations, which it does in a way that depends on the substance of such obligations.

Node B, in turn, may also agree to accept obligations to the amount of n. This increases the sum of transactions between the nodes. For instance, if node A receives obligations to the amount of 0.5n from node B, now it is entitled to receive goods or money to the amount of (0.5n + n): repayment of the credit to the amount of 0.5n plus the credit to the amount of n.

The two nodes that have opened credit lines to each other are not the sole participants of the network transactions as the network allows for transactions between the nodes that do not trust each other once a chain of trust between them is created. This chain works on the principle of trust transitivity. For instance, if node D trusts node C with the amount of 0.5n, node C trusts node B with 2n, and node B trusts node A with n, then node A may have a credit of 0.5n from node C. Node C assigns the right to use node C’s credit line to node A.

If node C, aside from the node D’s 0.5n credit line, has the latter’s obligations to the amount of 0.5n, then node A may have a credit from node D to the amount of (0.5n + 0.5n). In this instance, node C assigns not just the right to use node D’s credit line, but also the right to request settlement of node D’s obligations.

Keeping the theory of six handshakes in mind, each node has to trust only its nearest neighbors. This way it will be able to transact to a wider group of unknown nodes it does not trust. GEO’s main difference from systems like Ripple is that it has no blockchain or internal currency. As opposed to Lightning network, GEO is not an add-in of any blockchain.

DECENTRALIZATION AND PRIVACY IN GEO

As mentioned above, GEO is a decentralized credit network with no single center for issuance of obligations, and there are no obligations that all nodes have to accept. Moreover, there is no group of nodes that may theoretically usurp the issuance. Each node may issue its own obligations and use them in transacting only with those nodes that have opened a credit line for it, and only within the credit limit.

Absence of a single ledger of all transactions in the network, a copy of which are stored by each node, solves the problem of centralization and privacy. In GEO, none of the nodes store all the data on the network’s transactions as the nodes store only information on their own transactions.

Absence of blockchain entails absence of mining. To act as a node and process your own transactions in GEO network one needs only a smartphone or a laptop. Thus, there is no incentive to centralize mining. Absence of internal currency dissolves the problem of PoS-like centralization.

Besides, there are no transaction fees involved: neither the network’s administration, nor intermediaries, nor those representing credit lines get any reward for running the transactions.

Therefore, GEO allows for decentralized creation and exchange of various obligations denominated in various equivalents. Exchange of obligations implies trust for a debtor. Trustless arrangement of the entire system in Bitcoin or LN is certainly advantageous, but does it actually mean that GEO is less preferable than, say, Lightning Network?

TRUSTLESS VS TRUSTED

Systems like Lightning Network or WebMoney allow for transactions only once the specified amount of money isdeposited in the payment channel or to the account of the centralized issuer of e-money. In this case, a user may transact only within the limits set up by the available amount without having any credit from the counterparty.

Still, crediting is a mandatory economic relation within the capitalist system. A crediting system does not supersede but supplements the monetary system as money is a means of credit repayment. GEO allows for creation of both monetary obligations and bonds denominated in any preferable way (including cryptocurrency).

Though Ripple’s current positioning implies it is a solution for inter-bank remittances, in technical terms the protocol is quite applicable for creating and exchanging bonds. However, Ripple is a public blockchain system for pseudonymous transactions with internal currency that every node requires to transact the bonds.

GEO’S TECHNICAL CHALLENGE

In technical terms, the most interesting goal set by the GEO developers is an algorithm for real-time calculation of the available credit between any two nodes of the network.

According to Max Demianiuk, the project’s founder, the task proved to be quite complex, so the developers are now mostly focused on completing the algorithm. The complexity is in the fact that, out of all trust chains from node X to node Y, one has to choose the combination that allows for maximum amount of a transaction.

As Demianiuk told ForkLog, currently the GEO team is testing the second version of the algorithm. Once the simulation proves successful, the developers intend to run the system in test mode in yet to be chosen city in Ukraine. Max Demianiuk also stresses that GEO is an open source projects, and invites those interested to join the developers team.

Dmitry Bondar

Original publication: http://forklog.net/geo-decentralization-and-privacy-without-blockchain/

Hi! I am a content-detection robot. I found similar content that readers might be interested in:

http://bitcoinschannel.com/geo-decentralization-and-privacy-without-blockchain/

Very interesting. I would like to research this further. Is there any way currently to invest in this project/ technology?