🔊 NEW! Neocash Radio podcast ep186: Central banks destroy money, A.I. runs a hedge fund, and the “Welfare Cliff”

Our friend Pedro joins Darren, JJ, and myself in-studio to talk about cryptocurrency mining. The European Central bank will do less quantitative easing in the future. The Federal Reserve raises a key interest rate to curb price inflation. Numerai is paying anonymous coders bitcoin to help create an artificial intelligence hedge fund brain. Coinbase loses the court battle but a user is stepping up to stymie the efforts of the IRS. Dash now has its first BitPay-like service. Zero knowledge Proofs and zkSNARKs. Randy has a report on the welfare cliff and how mobile commerce is helping lift people out of poverty.

All this and more on the Neocash Radio podcast, episode 186 -- Wednesday December 14th, 2016!

Stream this podcast episode:

or Direct Download the podcast as an MP3 – Neocash Radio episode 186

Tune in to Neocash Radio every Wednesday night and

RETWEET ALL THE THINGS @NeocashRadio!

RETWEET ALL THE THINGS @NeocashRadio!

| Traditional Markets | Crypto Markets |

| Gold $1,143 | Bitcoin (BTC) $773 |

| Silver $16.80 | Litecoin (LTC) $3.58 |

| Oil $50.77 | Zcash (ZEC) $43.73 |

| Dow Jones 19,792 points | Ethereum (ETH) $8.20 |

| 30Y UST Yield 3.179% | DASH $9.08 |

| Euro (EUR) $1.05 | Monero (XMR) $8.39 |

| Chinese Yuan (CNY) $0.14 | Augur REP $3.08 |

| British Pound (GBP) $1.25 | 1 Doge = 1 Doge |

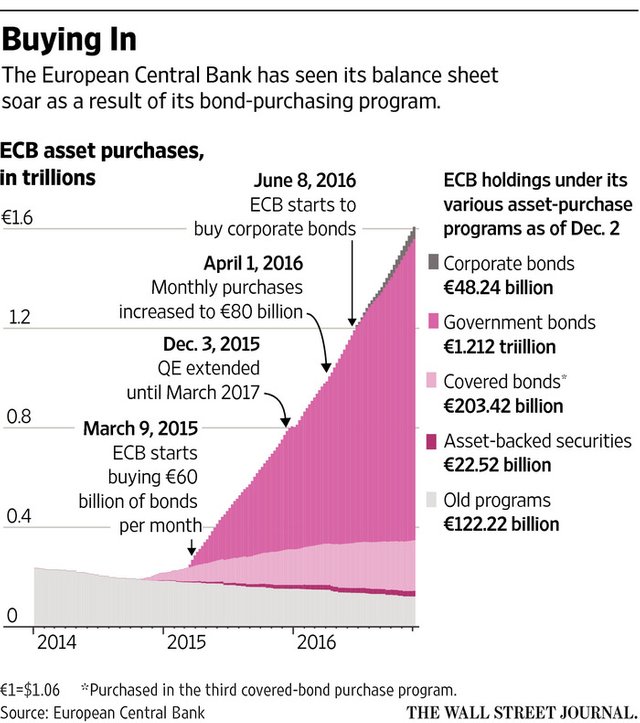

European Central Bank extends (but scales back) Quantitative Easing “stimulus”

The European Central Bank said it would be extending its quantitative easing program for nine more months, until at least the end of 2017. But starting in April, the bank will reduce the value of government and corporate bonds it buys per month from €80 billion to €60 billion. The so-called “stimulus” package—if it wraps up at the end of next year—will now total more than €2.2 trillion ($2.36 trillion) of money created out of thin air, devaluing every euro in circulation in the process.

But it seems unlikely that it will end then; ECB president Mario Draghi stressed that the bank’s decision shouldn’t signal that they were tapering off or winding down their quantitative easing. He warned that eurozone inflation remained too weak and said the ECB would keep buying bonds for the foreseeable future: “There is no question about tapering. Tapering has not been discussed today.”

This at a time when ECB interest rates have been held at a record low of -0.4%... and just weeks ago, Draghi issued a warning that these artificially low interest rates had created “‘fertile terrain’ for financial-market risks, including a buildup of debt and excessive risk-taking.”

“Right now, the greatest risk comes from impaired growth,” said Draghi, “from the possibility our recovery doesn’t firm and growth stalls”. Draghi has also recently flagged “significant vulnerabilities” in eight European real-estate markets, citing potential pricing bubbles as a result of rising debt levels or excessive valuations.

Federal Reserve raises key interest rate for second time in a decade

The Federal Reserve raised its benchmark interest rate slightly higher today, moving from the current 0.25-0.50 percent to a range of 0.50 and 0.75 percent. The vote to raise the benchmark interest rates higher was unanimous across the Fed’s Board of Governors.

Fed Chair Janet Yellen told the Federal Open Market Committee that she expects the Fed to raise rates three more times in 2017, with “only gradual increases.” Yellen also said the Fed expects the U.S. GDP to grow by a rate of 2.1 percent in 2017 and by 2 percent in 2018. (It’s currently at 1.9 percent)

The federal funds rate has fallen sharply from its most recent high of 5.25 percent in June 2006. As we discussed on Neocash Radio episode 183, the U.S. national debt is quickly approaching $21 TRILLION, and if the Fed’s interest rate ever returned to even 5 percent, U.S. taxpayers will be paying MORE THAN A TRILLION DOLLARS A YEAR IN INTEREST ALONE.

And as we also discussed in episode 183, the future of the Fed could be quite interesting. As soon as Trump enters office in January, he’ll be able to submit nominations for two vacant Fed governor seats and for the vice chair of supervision, a powerful position that oversees the United States’ biggest banks. And Yellen’s term as chair will end in February 2018, quickly followed by the end of Stanley Fischer’s vice chairmanship in June 2018, leaving Trump responsible for filling four of the seven Federal Reserve governor chairs during his four-year term.

7,500 Faceless Coders Paid in Bitcoin Built a Hedge Fund’s Brain

San Francisco-based Numerai has built an artificially intelligent hedge fund that masks their trading data before sharing it with thousands of anonymous data scientists.

Using something akin to homomorphic encryption, this tech works to ensure that Numerai’s scientists can’t see any details from any of the trades, but they can build machine learning models that analyze the anonymized abstract data to theoretically learn better ways of trading stocks and other financial securities.

Several big Wall Street hedge funds have been exploring the use of machine learning algorithms for some time now, but Numerai is making new efforts to crowdsource the creation of these algorithms. “Anyone can submit predictions back to us. If they work, we pay them in Bitcoin,” Numerai founder Richard Craib told WIRED magazine. And by using Bitcoin, the identities of the people making the predictions is masked.

About 7,500 data scientists are involved, building a total of around half a million models that drive about 28 billion predictions. These data scientists compete to build the best models, and through a statistics and machine learning technique called stacking or ensembling, Numerai can learn to combine the best of all the algorithms to create a more powerful tool than any of the individual parts.

Each week, one hundred scientists earn Bitcoin through Numerai, which has reportedly paid out over $150,000 in the digital currency so far. If the hedge fund reaches a billion dollars under management, founder Richard Craib says Numerai would be paying out over $1 million to its data scientists each month.

A discussion about cryptocurrency mining with our friend Pedro

Our friend Pedro joins us in the Neocash Radio podcast studio once again, this time to discuss his experiences mining cryptocurrency as an enthusiastic hobbyist. Pedro began mining Bitcoin in 2013 and has also mined Litecoin, Ethereum, and Zcash; be sure to listen in to our chat on some of the mining tools that are out there.

Want to learn more about Bitcoin, mining cryptocurrencies, and blockchains? Check out our intro video: “Decrypting Bitcoin: Blockchain Technology Explained”

We will be producing more in-depth videos to explain Ethereum, Dash, and the Federal Reserve soon! We’re also building a video podcast room here at Neocash Radio HQ! Until that’s finished, we’ve started uploading our audio feed to our new YouTube channel! We hope to have video added to the podcast by year’s end!

Federal judge orders Coinbase to turn over bitcoin user data

The U.S. Internal Revenue Service recently demanded that Coinbase—a popular cryptocurrency exchange and wallet app—turn over all Bitcoin users' identities and transaction data from 2013-2015. In a previous blog post, Coinbase said: “We are extremely concerned with the indiscriminate breadth of the government’s request,” and, “in its current form, we will oppose the government’s petition in court.”

Well, a federal judge said too bad and is forcing Coinbase to turn over all the data anyway. But just yesterday, Los Angeles-based lawyer Jeffrey Berns submitted a filing to dispute the legitimacy of the IRS' blanket "John Doe" summons, in an effort "to protect the interests of all of Coinbase’s customers who are subject to this overbroad summons, even though the IRS has made no showing that any of them have engaged in suspect tax-avoidance conduct,” according to the filing.

Related listening: In Neocash Radio episode 182, we discussed a searing 31-page report from the U.S. Treasury Inspector General for Tax Administration that summarized a nine-month audit of the IRS’ (gross mis)handling of virtual currencies, like Bitcoin.

Dash's First BitPay-Like Service Just Launched

Amanda Johnson of “DASH: Detailed” reported yesterday that DASH has just gained full merchant integration with London-based SpectroCoin. While SpectroCoin has offered a DASH wallet app, DASH exchange, and a DASH-funded debit card since June, the recently launched integration now allows merchants to offer a “Pay with Dash” feature at their stores and websites, and SpectroCoin will allow them the option of immediately converting those funds to U.S. dollars, Euros, or Bitcoin for a 1% fee. SpectroCoin has offered similar services for Bitcoin since 2013.

“zkSNARKs in a nutshell” - Ethereum blog post about zero-knowledge proofs

Zero-knowledge proofs allow someone to prove knowledge of facts about hidden information, without ever revealing the actual information to any other party. We've previously talked about zero-knowledge proofs on Neocash Radio episode 180 in our discussion about Zcash and the “Zerocash over Ethereum” capability.

For those interested in a simpler explanation, check out "How to explain zero-knowledge protocols to your children"

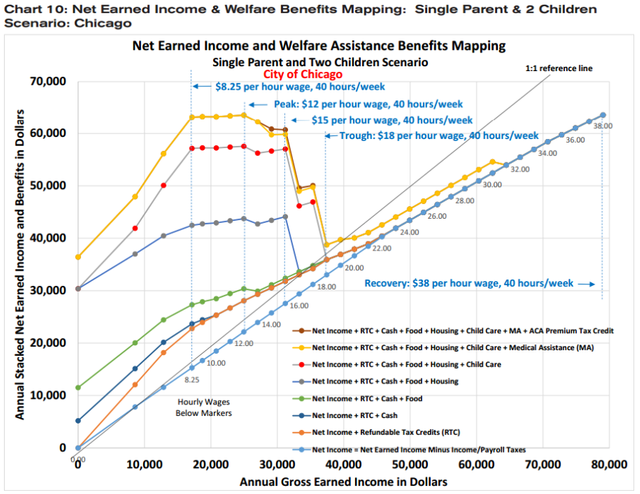

The Welfare Cliff And Why Many Low-Income Workers Will Never Overcome Poverty

A recent article from LearnLiberty.org takes a deep look at a “clear, thorough, fascinating, and appalling study” called Modeling Potential Income and Welfare Assistance Benefits in Illinois and discusses “welfare cliffs” (aka “the low wage trap”) which can actually keep families in poverty.Peering into wage and welfare data in Chicago, if you were working $12 an hour full-time, you would be bringing home $22,121 a year after taxes, but you’d also be eligible for refundable tax credits, food assistance, housing assistance, child care assistance, and medical assistance worth $41,465 combined, which would bring your earned income up to $63,586 a year.

But if you were to be offered a generous raise to $15 per hour, you’d be making $27,572 a year—$5,451 more after taxes—and you’d also become eligible for an Affordable Care Act (ACA) premium tax credit, but your other benefits would decrease by $8,336, more than the increase in your net pay, decreasing your annual earned income from $63,586 to $60,701.

Not that large of a decrease, but if you keep performing well at your job and later get offered another generous raise to $18 an hour, you would take home $33,023 after taxes. But (as you might have guessed) your refundable tax credit and ACA premium assistance would be reduced, and your cash assistance, food assistance, housing assistance, and child care assistance would all go away, yielding a loss of $26,820 worth of government benefits, decreasing your annual earned income from $60,701 to $39,332!

To get back to the same level of earned income you once enjoyed at $12 an hour plus government assistance—$63,586—you’d have to work your way up to making $38 per hour sans welfare.

This kind of “welfare cliff” isn’t unique to Chicago; it’s present across the country and it is easy to see the kind of perverse incentives that keep people poor and reliant on government “assistance” programs.

Wonder how people could actually help the poor without government “assistance”? Check out “Welfare before the Welfare State” from the Mises Institute for a thought-provoking discussion on voluntary mutual-aid societies and other free-market solutions.

New study: "The long-run poverty and gender impacts of 'mobile money'"

A new study published in Science magazine takes a look at the impacts of “mobile money” in Kenya. Mobile money, a service that allows monetary value to be stored on a mobile phone and sent to other users via text messages, has become ubiquitous in Kenya. M-PESA is the most popular mobile money platform in Kenya, though it certainly isn’t the only one. Launched about 10 years ago, mobile money is used by at least one individual in 96% of Kenyan households. (There are a total of 5 million households in the country, 96% of which have a mobile phone.) These individuals have access to 110,000 agents who provide deposit and withdrawal services, compared to a mere 2,700 bank ATMs throughout the country.

“We estimate that access to the Kenyan mobile money system M-PESA increased per capita consumption levels and lifted 194,000 households, or 2% of Kenyan households, out of poverty. The impacts, which are more pronounced for female-headed households, appear to be driven by changes in financial behavior—in particular, increased financial resilience and saving—and labor market outcomes, such as occupational choice, especially for women, who moved out of agriculture and into business. Mobile money has therefore increased the efficiency of the allocation of consumption over time while allowing a more efficient allocation of labor, resulting in a meaningful reduction of poverty in Kenya.”The study also points out results from other studies, showing very limited economic impact from microcredit loans—typically targeted to female clients—found very limited impacts on economic outcomes (and in some cases negative impacts on business activities and subjective well-being). “In contrast, more basic financial services such as the ability to safely store, send, and transact money—taken for granted in most advanced economies, and which in the form of mobile money have reached millions of Kenyans at unprecedented speed over the past decade—appear to have the potential to directly boost economic well-being.”

Solutions like mobile money are a great tool for helping the world’s estimated 4 billion unbanked people climb out of poverty. Bitcoin and other cryptocurrencies were not mentioned in this study, though their increased adoption could be another tool that would aid in facilitating the storage and transfer of funds, especially for international remittance payments.

We don't give advice to buy sell or mine anything!

This is an interesting summary. I'll add this to my podcast queue and give it a proper listen.