These two companies grab 52% of the bitcoins produced in 2020

The interest of large investment funds and their institutional clients in Bitcoin and cryptocurrencies seems to be constantly growing. According to an analysis, the funds of the companies Grayscale and CashApp could even have bought half of the bitcoins mined in 2020!

Half of BTC production sold by 2 companies

The division by two of the bitcoins issued with the imminent arrival of the halving - in 4 days - seems to cause a certain “agitation” within the very large investors in cryptoactive.

A few days ago, we had already seen that the crypto-investment fund Grayscale , had seized 48.4% of the ethers produced on the Ethereum network (ETH) since the beginning of 2020.

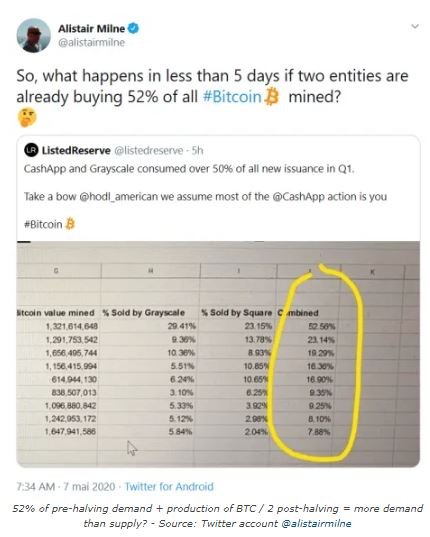

According to Australian fund manager ListedReserve , the same thing would have happened for Bitcoin , since the companies Grayscale and CashApp would have bought the equivalent of 52.5% of the production of BTC issued this year.

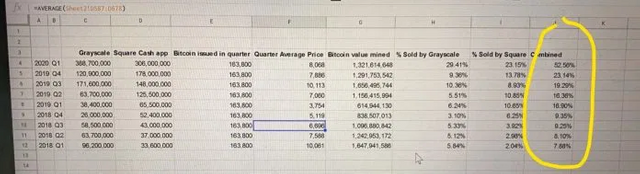

The last column represents the percentage of BTC sold by Grayscale and CashApp compared to BTC mined during this period - Source: Twitter account @listedreserve

Even if it is difficult to know whether the two funds actually bought all these bitcoins in the first quarter of 2020, in any case they sold to their customers the equivalent of 29.4% of the bitcoins mined during this period for Grayscale , and the equivalent of 23.1% for CashApp .

What happens when supply no longer follows demand?

The answer could be summed up by “ BOOM! », Since an explosion in prices is the consequence of a disruption in the supply of an asset subject to too high demand (you only have to see the example of the prices of protective masks in France) .

And precisely, we notice two elements that go in this direction for Bitcoin. First, the percentage of bitcoins sold - by only two institutions - compared to those mined has grown steadily quarter by quarter . Grayscale and CashApp only sold 8% of the mined BTC in the first quarter of 2018, before reaching more than half of production just 2 years later.

Another element, which is reported by trader-investor Alistair Milne : if these two entities are already selling the equivalent of 52% of mined bitcoins, what will happen in 4 days, when half the bitcoins will be issued after the halving?

Even if the demand and sales of bitcoins by Grayscale and CashApp did not continue to grow and stagnated in the second quarter, the two companies would sell 104% of BTC production . A beautiful promise of high price tension .

Of course, this should not be ignited: in addition to these being estimates, it is also necessary to take into account that part of the bitcoins purchased is sold. But neither Grayscale nor CashApp are trading platforms, where BTC would be bought / resold within 5 minutes. The solutions proposed by these companies are rather investments, which are more turned towards the institutional ones.