Building A Crypto Trading System For Institutional Investors:Caspian

Introduction

Cryptocurrency has been the next big thing since bitcoin was introduced in 2009. Especially since 2017, several blockchain technologies have emerged and many more continue to join this growing trend in blockchain business. Consider some figuress that support this growth:

- 18 billion+ USD - the average daily exchange-trading volume across all cryptocurrency assets since 2017.

- 325 billion+ USD - estimated market cap for blockchain instruments as of April 2018.

- 200+ - active cyptocurrency exchange platforms.

- 1 billion+ USD - combined daily trading volume of five cryptocurrency exchange platforms combined.

- 1 billion+ USD - combined market caps of top 16 coins alone

While we welcome current progress made in blockchain technologythe numbers above suggests that more is coming the way of blockchain technology in terms of individual and corporate involvement and the development of blockchain as a whole. Each progress made in any field of human endeavor comes with challenges. We begin this article by taking a look at how the numbers above are both exciting and challenging.

Absence of Security

All cryptocurrency merchants know about the security chances that at present exist in obtaining digital resources (cryptocurrencies). Trades are powerless against programmers (hackers), a risk that has been conceived out in a progression of robberies bringing about the loss of more than 4 billion USD. Existing exchanges need a considerable lot of the client insurances offered by exchanging stages in customary markets. These incorporate the counterparty hazard that is available while executing on any singular trade. Dealers must make possibilities to moderate the probability that a trade will all of a sudden come up short, taking financial specialist reserves with it. Market members should likewise represent liquidity hazard.

The Problem

A very large and growing number of blockchain platforms provide the environment to drive growth. However, it is a double-edged sword. The problem is in the numbers. For example, There are more than 200 cryptocurrency exchange platforms that offer differing rates and coins. It is nearly impossible or not practical to get the best rates and deals by comparing all of them. Again, to complete a single cryptocurrency transaction, a user may require several tools hosted on different platforms. It is usually challenging to trade a cypto asset by going through multiple platforms with different features and tools. It is also risky to transact on many exchanges because of frequent cases of hacking where digital assests are stolen. There is no single, secure and integrated ecosystem that provides everything needed for investors to do blockchain business efficiently. This greatly discourages individual users and corporate investors from doing blockchain business and many prefer traditional financial trading as a result. It also reduces the growth rate of blockchain technology and global mass acceptance.

At a glance, the three major problems affecting today's cryptocurrency platforms are as follows:

- Unreliable trade execution because tools are scattered across multiple platforms.

- Lack of a Comprehensive Reporting and Compliance system.

- Insecurity of digital assets due to recurring cases of hacking and intrusion.

There should be a way to securely harmonize cryptocurrency assets management and trading in one platform and that is what this project is all about. Let is explore why Caspian is unique and what it hopes to accomplish!

Caspian - Introducing a unique platform.

Caspian is an integrated cryptocurrency asset management solution that makes available all the tools and resources needed to do cryptocurrency business on one platform. Caspian provides a single gateway to access all major cryptocurrencies. It enhances blockchain interoperability by giving users the features and capacity to trade all cryto assets without leaving the immediate environment. With Caspian complete suite of sophisticated

trading algorithms, redundancy in the crypto space is all but eliminated and the cumbersome nature of today's crypto trading is enormously simplified. Consider how Caspian uses its integrated tools to tackle each of the major problems facing today's crytocurrency systems.

Caspian Cutting-edge Tools

Caspian provides a complete suite of tools to simplify each activity in cryptocurrency management and trading. Take a look:

- Caspian Order Execution Management System(OEMS): This product tackles the main hurdle facing crytocurrency traders and investor - tools spread across multiple platforms. OEMS creates access to all the functionality in each cryptocurrence exchange platform; giving users the capacity to reach out to each tool when they need them. With this unified trading center, crypto users and investors, need not worry about harmonizing the output from each exchange platform since the features and functionalities of each of them is unique. Consider three of the many benefits of OEMS:

- Access to selected major digital asset exchanges through a single interface. For each specific exchange, OEMS enables access to all order types, asset types, and ticket sizes supported by a given exchange.

- APIs allowing traders to stage and send orders and slices; obtain order, execution, and position information; and receive pricing information, exposure breakdowns, and other transaction information. In the future, the API will be enhanced to allow access to margin information, additional Smart Order Router (SOR) control, and other

metrics. - Ability to view prices, bid/ask, and depths for each exchange to the smallest available ticket size.

See more benefits of OEMS on page 10 of Caspian Whitepaper

Here is a Caspian OEMS demo video that provides further insight into this invaluable feature

- Caspian Position and Risk Management System: Another big challenge of current systems is that a users data and portfolio is spread across several platforms that were used for crypto assets trading. It becomes nearly impossible to keep a comprehensive record of one's activity because of the cubersome nature of data spread across multiple channels.

Caspian solves this unique challenge using its Position Management System (PMS) and Risk Management System (RMS). These features enhances informed decision-making by creating a dynamic comprehensive report of a users current and historiacal trades in one view. An investor has the capacity to view all of its position and historical data on the go. This simplifies the complex task ofmonitoring and analyzing positions, keeping records of profitable or non-profitable transactions across several platforms, etc. Users can now make predictable decisions on when to invest, increase their current trades volume or pull out their funds.

Intraditional financial trading, several parties involved in completing a trade reconciles their records to ensure that trading has been done as agreed. It happens in the digital space too. But with current systems, this is a complex task and it takes time to harmonize records across multiple platforms. Caspian simplifies this process with its reconciliation feature. With this tool, Caspian reconciles a users position across each individual exchange. This harmonizes the positions in Caspian and the individual exchanges, making sure that they are the same.

Watch this video that explains more about portfolio management

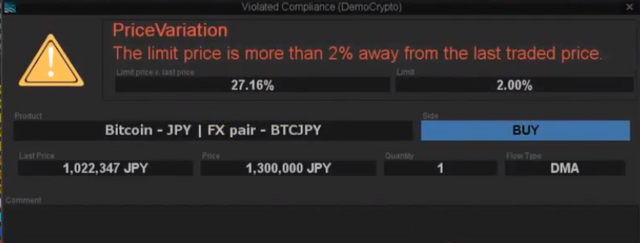

- Caspian Compliance: In the traditional markets, finacial trading rules must be obeyed and limits acknowledged. It happens in cryptocurrency too. Caspian takes care of this. It provides unique layers of functionality defining the limits and rules of workflow for each user. Caspian compliance is swift and efficient as embodied by this statement:

The Caspian Compliance server checks tens of thousands of simultaneous orders against dozens of complex portfolio-based compliance rules with 0.0005 seconds of latency or less.

There are two types of limits in this system: Pre-trade limits and post trade limits. Pre-trade limits are implemented at various stages of a trade. These limits must be acknowledged otherwise the execution of a trade order could be delayed. There are three limit types in pre-trade limits:

(A): Warning limits - to alert the user that he has broken a rule. This limit could be ignored.

(B): Approval limits - a supervisor must approve the order before it can be executed.

(C): Absolute limits - must be acknowledged and can never be ignored.

Post-trade limits includes alerts, monitoring, and reporting. Alerts and reports can be delivered to users via email or other mechanisms, either on a schedule or as they occur.

This is a screen grab of a compliance window

.png)

This is a screen grab of a compliance alert

.png)

- Caspian Reporting : one major challenge facing crypto traders today is the lack of a comprehensive reporting system that cuts across all boards. Because of the volatile nature of the cryptocurrency markets, exchange rates, coin values and other metrics change constantly. Without a proper reporting system, an investor could lose out an opportunity to invest, make more profits, withdraw his funds or avoid disaster.

[Caspian](https://caspian.tech reporting system keeps you duly informed. It provides all the data you need to know about executions, orders, compliance limits, positions, exposure, etc. The flexible nature of the reporting tool ensures that critical data is available to investors in several formats such as pdf, interactive dashboards, Excel format or Powerpoint. The web-based dashboard is especially invaluable since it gives users real-time insight of what is happening to their investments.

- Caspian Algorithms: To achieve optimal results in today's crpto space, the processes involved in exchanging, trading and managing crypto assests are largely manual and require high technical skills as well as time. Caspian hopes to lift this burden off your shoulders by fine-tuning workflow strategies to achieve great results. It does this through standard algorithms that automate most processes.

Here are the key features of the Caspian Algorithms

- Complete suite of institutional grade trading algos including VWAP, TWAP, Implementation Shortfall, and Volume In-line.

- Pairs algo that can trade pairs across multiple exchanges and crypto currency pairs with each leg being potentially traded on different venues in different currencies.

- Intelligent Smart Order Router technology takes both commission and at exchange fiat and crypto balances into account.

- Integration of algos with distributed exchanges and OTC desks, driving liquidity to DEX’s

- Comprehensive post trade TCA reporting capabilities to analyse algo performance/exchange execution quality

Position & Risk Management.

Caspian makes it easy to compare positions, divest, reinvest and track gains and losses in multiple accounts.

Compliance.

Caspian , has integrated compliance functions that ensure that users can establish various rules and limits in their business strategies.

Compliance consists of three types of limits:

• Warning limit

As the name implies, a warning that suggests a rule is about to be broken.

• Approval limit

This requires the supervisor to enter a password to void the compliance alert.

• Absolute limit, The absolute limit is a limit that can not be canceled in any way.

These compliance levels allow users to create and comply with the rules that are appropriate for their risk-reward assessment and ability to resist variation. All infractions are completely tracked and registered.

Reporting.

The Caspian reporting product allows users, through a dynamic web-based tool, to use, create, format and receive graphical reports on their current business and position in multiple formats such as PDF or Excel, providing an easy snapshot of the state current fund through various indicators

Token Ecosystem

The Caspian token (CSP) is an ERC-20 complaint token to be issued on the Ethereum blockchain. The CSP token model has been intended to serve a few foremost destinations. In the broadest sense, the objective is to connect Caspian's best-in-class usefulness with a token that boosts stage usage and what's more, the improvement of remarkable outsider instruments and highlights. In particular, the token is expected to make a rich, participatory biological community where stage clients too progress toward becoming network individuals with a functioning enthusiasm for the stage. This is achieved by giving the token client to-stage utility (markdown and administration) and client to-client/designer utility.

Use-Case.

Caspian, serves a wide range of users. Unknowingly, many cryptographers are merchants and their own personal fund managers.

The interface combines all the largest exchanges, has the financial tools with which traders and fund managers are already familiar, and even tracks business data and history for accurate accounting and tax preparation

About Caspian and Institutional Trading Investors, you can also watch in the following videos:

#Caspian and Institutional Trading Investor

#Caspian Show and Tell – Token Summit III NYC 2018

More Information & Resources About Caspian

CASPIAN2018

This post has been submitted for the @OriginalWorks Sponsored Writing Contest!

You can also follow @contestbot to be notified of future contests!