MAP Rewarder: MAPR Payouts to Delegators and Prize Tokens for 24 January 2022 (18.8% APR)

Earn significant passive income with STEEM by investing in the MAPR program.

This week's distributed profits are 0.361%, equivalent to 18.8% APR and 20.9% APY.

General Info

New rules and simple explanations can be found here. Please read it, and links within it, before asking the obvious.

Remember that MAPR has a unique distribution and pricing system. If you look at the MAPR tokens you, as delegator, have received today, multiply that number by the new official BUY Price and you get the real return per delegated SP.

The new rules started on Monday 28th June, 2021. They may change again in the future if the Steem economy warrants such a change.

Bonus Token Winners

As previously announced, we now have two weekly winners of a random draw of MAPR tokens.

@bengy wins 1 MAPR token

and

@funzies wins 1 MAPR token.

Winners MUST CLAIM their bonus token by leaving a comment to this post. Claims expire after 7 days and unclaimed tokens are put back into next week's general fund. Users who fail to claim their prize will also forfeit one week of rewards.

NEW. To further improve income for those paying attention, there is now a penalty for not claiming a prize token - that username will receive no rewards the next payout.

Last week we had 0 MAPR token claimed - that token prize has now expired.

I have now changed the probabilities, in light of (as suspected) very few claims; the first draw will include all those with at least 100 SP, the second draw will include every member. This makes the probabilities even better for those who are still paying attention.

A reminder that the bonus tokens are included in the gross distributed returns.

MAPR: The Numbers

All these numbers relate to a 7-day period (Monday to Sunday) and calculated in STEEM per SP.

Value of Steem upvotes = APR 20.0% [1a], 11.4% [1b], 11.0% [1c]

Value of Steem author rewards payouts = APR 100.0% (270%!!) [2a], 57.0% [2b], 55.0% [2c]

Distributed MAPR payouts = 0.361% (APR 18.8%) [3]

Projected Compounded APY 20.9% [4]

Average APR 18.4% (26-weeks)

MAPR BUY Price: 1.18 STEEM [5]

MAPR Price increase = +0.0% APR

MAPR SELL Price: 1.21 STEEM [6]

[1] Theoretical maximum value of Steem upvotes, assuming 10 full upvotes at 100% power for 7 days, averaged over 7 days and expressed as an APR. This calculation was performed for an SP of 1 million STEEM to be as close as possible to linearity. Your own upvote will be somewhere between 50-100% of this value.

The values are now calculated for three levels of voting power: 1 million SP (a); 10,000 SP (b); and 1,000 SP (c).

[2] Theoretical value of Steem upvote author rewards, assuming 50% curation rewards, 50-50 split of post payouts and SBD print rate, averaged over 7 days and expressed as an APR. Your own author rewards will be somewhere between 50-100% of this value.

[3] MAP Rewarder distributed payout sent to delegators this week as tokens, including bonus tokens, and the MAPR price adjusted to reflect this.

[4] Equivalent compounded yield as an APY for this week's distribution in [3]. We now have enough data to give a better historical picture of progress and have including a 26-week average to give a measure of medium-term returns.

[5, 6] Our BUY and SELL prices are currently fixed until further notice.

Our MAPR distribution [3] is much higher than the average blockchain curation rewards for most users, being half of the values [1a, 1b & 1c].

Profits will be paid today in the new MAPR tokens.

MAPR News

This week has seen income up a bit as the Steem blockchain yield has gone up to that 20% APR mark.

Some good news: income has increased, as have rewards.

I don't wish to keep repeating things, but have no idea if anybody reads these posts. Anyway, one thing that delegators should be aware of is as the buyback price of MAPR tokens drifts downwards, so the number of tokens given in distributions rises. Thus, the real effect is not on the value of new income, but on the value of tokens being stubbornly held for no good reason. We shall halt this at 1.1 STEEM and see how the market and MAPR are behaving at that point.

The only reason to keep MAPR going is to see if and how Steem develops. If SBD should drop further, then MAPR will become highly profitable again compared to other passive sources. Indeed, both SBD and STEEM remain on a downward trend.

All members please see the previous news posts.

Minimum delegation amount is now 100 SP.

Anybody below 100 SP will henceforth receive no token distributions, but they will be eligible for the random bonus token (see above). These bonuses may also be removed if there is just a handful of users left.

We have maintained a total income of around 17-19%, which remains good for a passive source. This is within a system that generates about 20% for a whale vote yield and about 11% APR for a minnow. The unadjusted vote yield continues to drift lower; in six months it has gone from about 27% to about 20% APR.

We shall continue to generate yields that are as high as we can given the economic model.

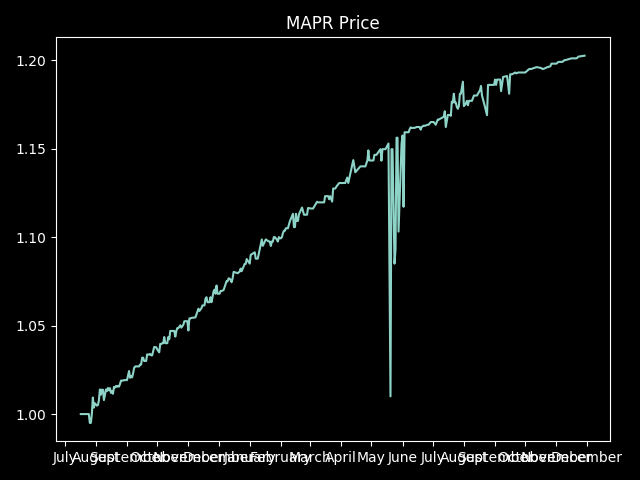

And finally, although our weekly returns are variable, here is a graph of how the token price has been performing since the MAPR token was launched. (Thanks to @gerber for the discord-bot.)

As this is now a historical graph, as the app that generates it no longer works, I shall keep it as a monument.

See you next week!

I hope you all survive 2022!

Next rewards distribution will be on Monday 31 January 2022.

[BUY MAXUV] - [READ MAXUV]

[BUY MAPR] - [READ MAP REWARDER]