Who Is the Next Bitcoin?

What Is the Big Next Cryptocurrency?

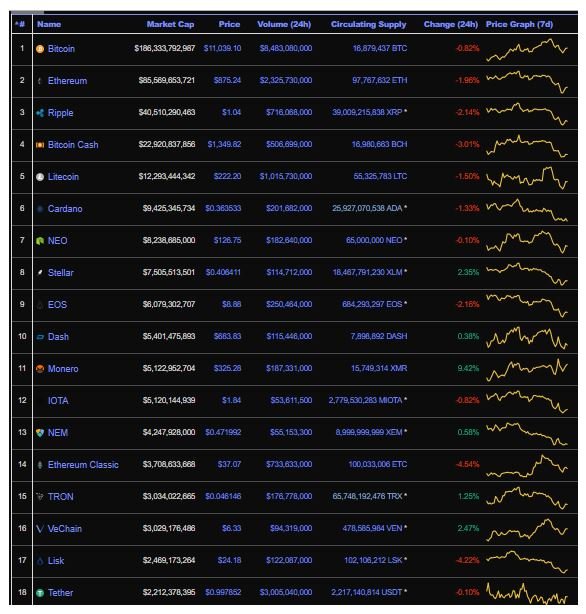

Bitcoin has been traditionally called the best Cryptocurrency since its inception in 2008. However, the last year has seen a lot of ups and downs in the world of cryptocurrencies, with many projects offering unparalleled advantages to the general populous. This has prompted the value of several cryptocurrencies, apart from Bitcoin, to rise up. Dash, Ethereum, Ripple, Neo are just some of the big players that have emerged since then. As of 22/02/2018, the market caps of the top 18 cryptocurrencies are as follows.

However, just judging a project by its market value will not guarantee a safe or workable Bitcoin-like currency. To further understand this concept, we first have to look at the industry leaders, Bitcoin.

Reasons behind Bitcoin’s Rise

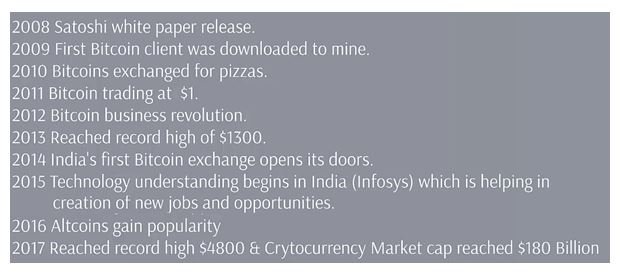

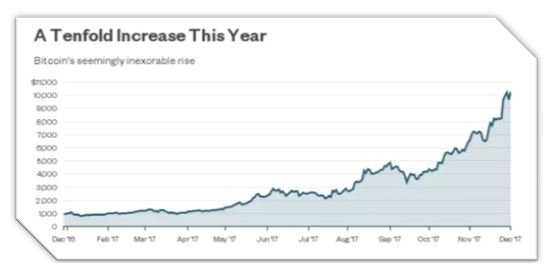

Bitcoin’s exponential price rise can be attributed to a number of factors last year, and similar factors have driven it similarly ever since. At one point, Bitcoin’s price has tripled, extending from $450 in mid-2016 to almost $1800 to $2000 in May 2017. By the end of the year, the figure had reached $4800. Indeed Bitcoin has overcome high degrees of scepticism, volatility, and rejection, becoming a noticeable entity in the eyes of world governments and regulatory bodies.

Several Factors are Responsible for this Meteoric Rise, as Explained Below:

1. Bitcoin’s Creation:

#Bitcoin came at a time of great financial crisis, specifically during the 2008 global crisis. The main aim of its creation was to break the shackles of governmental control, and the influence of banks and financial institutions on currency value. However, not all nations actively participated in this movement, nor were they confident about Bitcoin’s viability as a legitimate currency. Some countries even started banning it or making it illegal, while some remained observant. However, with time, Bitcoin got recognition, starting from #Japan.

A while back, Japan officially recognized Bitcoin as a legal payment method, albeit classified as an asset. Similar steps have been taken in other south Asian countries, in particular, South Korea.

Other countries like India are still examining the present status of virtual currencies like Bitcoin, hoping to implement it as an anti-money laundering step.

A surprise development was Russia’s decision to back cryptocurrencies. Russia, who had remained a staunch critic of the Bitcoin concept, has expressed interest in implementing cryptocurrencies like Bitcoin to combat financial anomalies. With major nations taking a dig at Bitcoin and #Cryptocurrency adoption, the sentiment remained positive helping it to grow in value.

2. Bitcoin Adoption and Use Cases:

Bitcoin’s valuation and popularity are also directly linked to approvals of investment products which use Bitcoin. This, however, can go both ways. For instance, when the SEC disapproved of the Bitcoin ETF by Cameron and Tyler Winklevoss, Bitcoin’s price fell dramatically from $1300 to about $900. However, the #SEC had a positive outlook for the future which made the value subsequently rise.

The growth in demand can thus be attributed to the efforts to introduce Bitcoin-based products, with experts believing that Bitcoin’s price will keep on rising.

Bitcoin Overtaken by Competitors (How to Spot Them?)

Bitcoin’s undisputed position as the top Cryptocurrency was first challenged by the emergence of several similar cryptocurrencies, especially Ethereum, Dash, Ripple etc. Amidst the mania behind Bitcoin, its competitors are also gaining traction. Investors everywhere have started searching for the next big Cryptocurrency which is a difficult task as there are close to 1800 cryptocurrencies in the world. For this reason, a list of crucial factors that can help an investor spot a prospective #“next-gen Bitcoin” has been compiled below.

Keeping an Eye out for the Price: Price levels are an important factor when searching for the next Cryptocurrency sensation. For average to small-scale investors, currencies which have a lower price rate can be more suitable for profit making. Although this point is overlooked by larger investors, diversifying with low priced coins can prove profitable in the long run.

Total Supply: The majority of cryptocurrencies in existence today have a pre-determined maximum supply, which forms the basic principle behind Bitcoin. When the maximum is reached, tokens are no longer produced. In such a case, if the interest maintains while the supply is fixed, this, in turn, can spearhead the price to grow exponentially. This is also a contributing factor to Bitcoin’s meteoric rise, as there are less than 20% of Bitcoins to be mined in the world. Hence, total supply and current circulation volumes should be considered before making any choices.

Prospects for Adoption and Implementation: As an investor, if he or she can identify a Cryptocurrency which has an upper hand over its competitors and can be widely adopted, it is a sure sign of a good investment. This is affirmed by Ripple, which in 2018 experienced a massive growth because of its widespread chances of adoption. It indicates that Ripple has a strong potential to be productive outside of the Cryptocurrency speculation world. One of this includes Ripple’s underlying technology, which promises to develop a system of settlement for central banks and other financial institutions. As a result, interest in Ripple remained at high levels, which was reflected in its price.

Price and Volume: Up-to-date and fresh information about the current price and volume levels is a great asset in the Cryptocurrency space. Normally, digital currencies which have a steady price and volume have the potential to become big in the near future. Of course, this is not a fool-proof method and there is no guarantee that they will be successful. However, combining this with the aforementioned factors can give investors a clear idea about investor interest in the market.

Advantages of Other Currencies over Bitcoin

Over the latter months of 2017 and the first few months of 2018, the Cryptocurrency world has seen the rise of many competitors who have challenged the position of Bitcoin. Ethereum, Monero, Ripple, etc are all posited to be the next best thing after Bitcoin. Many analysts have also speculated that bitcoin’s bubble will explode, allowing other cryptocurrencies to claim the second place. Below is a list of the best cryptocurrencies to look out for after Bitcoin.

1. Ethereum(ETH)

Current Market Cap: $85,569,653,721 (as of 22/02/2018)

Price: $875.24 (as of 22/02/2018)

Founder: Vitalik Buterin

Developed in 2014, #Ethereum was funded through a crowd sale with 11.9 million coins pre-mined. An internal transaction pricing mechanism called “gas” is used to mitigate spam as well as allocating resources on the Network.

Advantages: Like Bitcoins, Ethereum is also underwritten by a blockchain network. Its main aim is to offer even further decentralization than any other Cryptocurrency that exists today. It is thus an open and decentralized software platform, with Ether as the main currency.

2. Litecoin (LTC)

Current Market Cap: $12,293,444,342 (as of 22/02/2018)

Price: $222.20(as of 22/02/2018)

Founder: Charlie Lee

Conceptualized in October 2011, Litecoin’s network went live later that month. It was a fork of the original Bitcoin Core client with the only difference being a decreased block generation time compared to the former. It also offered increased maximum number of coins as well as different sets of hashing algorithm.

Advantages: Litecoin is billed to be the silver to Bitcoin’s gold. The main advantage lies in the decreased transaction time offered by it. Litecoin makes it easy for everyone to participate by tweaking the way most cryptocurrencies are mined. Litecoin has a bigger maximum limit: 84 million compared to Bitcoin’s 21 million coin limit. More than 54 million coins are in circulation today, which leaves a room for significant mineable tokens.

3. Monero(XMR)

Current Market Cap: $5,122,952,704 (as of 22/02/2018)

Price: $325.28 (as of 22/02/2018)

Founder: Bitcointalk forum user only known as “thankful_for_today”

Monero’s launch was rather mysterious and not much is known about its formation. Originally packaged as BitMonero, the supporters opted to shorten the name to “Monero”. It has experienced rapid growth in market caps as well as transaction volume throughout 2016

Advantages: Monero’s appeal lies in the great degree of anonymity it offers. Every transaction detail including the sender, receiver and size information is recorded on a public ledger. However, these blocks of information are obfuscated to make them untraceable. This results in the creation of a system where no outsider can identify the sender, receiver or size of the transaction.

Monero would allow big financial entities like corporations to move money around without their competitor’s knowledge. Monero has also recently added close to 50 musicians including famous stars such as Dolly Parton and Lana Del Ray. Monero does not have a fixed maximum supply, making it very profitable.

4. Ripple(XRP)

Current Market Cap: $40,510,290,463 (as of 22/02/2018)

Price: $1.04 (as of 22/02/2018)

Founder: Arthur Britto, David Schwartz, Ryan Fugger

Ripple’s predecessor payment protocol called Ripplepay is considered to be the building blocks of the current Ripple network. Started in early 2004, it slowly evolved into the currency it is today, attaining significant success in 2014. 2014 was the year Ripple also focused on the banking market, with Munich’s Fidor Bank being the first.

Advantages: Ripple has been described by the New York Times as a “cross between Western Union and a currency exchange, without the hefty fees”. Ripple thus is not only a currency but also acts as a platform for other cryptocurrencies to be traded. The main aim of Ripple is to develop a system which connects banks, digital asset exchanges, corporate and payment providers.

Another advantage is the widespread adoption #Ripple has experienced. Ripple has already licensed its technology to over a hundred banks. A new hedge fund has also been announced. Ripple’s anti-bank, the anti-government stance is sure to encourage even more widespread adoption among the general populous.

5. Bitcoin Cash (BCH)

Current Market Cap: $22,920,837,856 (as of 22/02/2018)

Price: $1349.82 (as of 22/02/2018)

Forked From Bitcoin

The latest addition to this list, #BitcoinCash was created from a fork on the Bitcoin network on August 1st, 2017. The main goal of this fork was to increase the block size limit to eight megabytes.

Essentially a new version of Bitcoin, Bitcoin cash answers user’s prayers. It has considerably lower fees and faster processing times. However, for it to be valuable, it has to be adopted along with its main rival Bitcoin. It also needs to convince more miners to participate in transaction clearing processes. IT also has a maximum supply of 21 million.

Final Thoughts

There is no definite answer to the question, “what is the next Bitcoin”. Picking a clear winner in the quest for finding the “next Bitcoin” can never be done with 100% assurance. Various factors like world events, regulations and investor sentiment govern Cryptocurrency movements, which are very difficult to predict. That being said, the blockchain implementation has seen extensive growth in numerous industries around the world.

Bloomberg analysts have stated that hardforks from popular cryptocurrencies are best positioned to gain benchmark status in 2018. Even smaller forks like Bitcoin Gold, Bitcoin Cash, Ethereum Classic are expected to rise in value since hard forking is not possible in traditional finance. Whatever the case is, it is clear that Bitcoin is no longer the best representation of cryptocurrencies, mainly because of its comparative technological inferiority as compared to the others.

Original Article Source: CryptoOrders

Disclaimer!

All information found here, including any ideas, opinions, views, predictions, commentaries, suggestions are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. Conduct your own due diligence, or consult a licensed financial advisor before making any and all investment decisions.