Cryptocurrency Daily News___ June 26

Cryptocurrency Daily News___ June 26

1. Germany: CDU and CSU Union to Integrate Blockchain Into Public Services

In Germany, the CDU and CSU Union wants to integrate blockchain technology into public services, Cointelegraph’s German-language version reported on June 25.

The CDU and CSU Union represents the centre-right Christian democratic political alliance of two parties in Germany, the Christian Democratic Union of Germany (CDU) and Christian Social Union in Bavaria (CSU).

https://www.investing.com/news/cryptocurrency-news/germany-cdu-and-csu-union-to-integrate-blockchain-into-public-services-1907431

2. Square Is Expanding Access to Bitcoin Deposits for Cash App Users

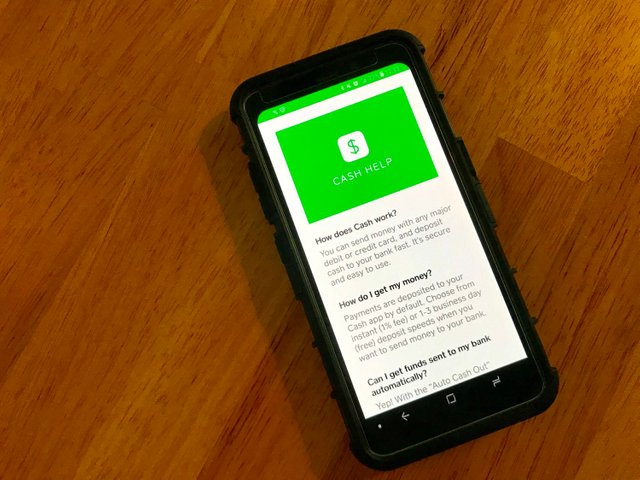

Payments company Square is rolling out bitcoin deposits for its mobile Cash App.

The app, available on both Android and iOS, now supports deposits for at least some users, according to Twitter posts by bitcoiners and a check by a CoinDesk reporter of his own Square account Tuesday. Previously, users could purchase or sell bitcoin, as well as transfer the cryptocurrency to another wallet.

Square first began allowing select Cash App users to purchase and sell bitcoin in November 2017, announcing a few months later that it would roll that feature out to all users.

It is unclear how long Square has been adding the deposit feature; as of press time, not every Cash App user had the ability to deposit bitcoin.

Podcaster Marty Bent tweeted a screenshot indicating he could accept deposits on June 18, suggesting that the company may be releasing this feature to a select audience in advance of a full lunch.

According to a support page on Square’s website, “support for bitcoin deposits to third-party wallets is coming soon.”

“In the meantime, you can transfer profits from selling bitcoin to any bank account or debit card linked to your Cash App,” the page says.

The company itself has been investing heavily into bitcoin and its ecosystem, bringing in $65.5 million in revenue through the world’s largest cryptocurrency by market cap in the first quarter of 2019 alone (though the actual profit was a more modest $832,000).

Square Crypto, the company’s new bitcoin-focused arm, is also hiring developers to specifically develop tools for the bitcoin blockchain. Former Google director Steve Lee was recently named as the first new hire for this team, though his role has not yet been specified.

Square CEO Jack Dorsey – who also founded the social media giant Twitter – has long been a proponent of the cryptocurrency, having said in the past that he expects it to become the world’s currency.

Square did not immediately respond to a request for comment.

Image via CoinDesk archives

https://www.coindesk.com/square-is-expanding-access-to-bitcoin-deposits-for-cash-app-users

3. Hedge Funds Are on the Losing Side of the Bitcoin Futures Bet Lately

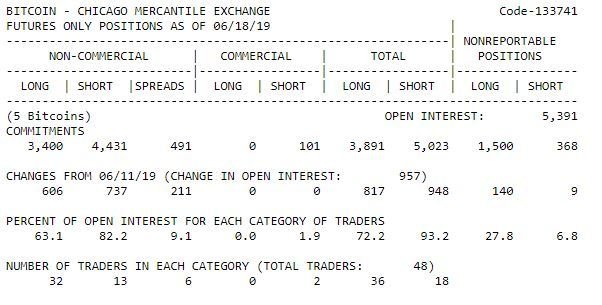

As speculative interest has returned to bitcoin futures markets, so too have short sellers. According to the most recent CFTC Commitment of Trader’s (COT) report, hedge funds may have been getting roasted by BTC/USD’s meteoric rise through $11,000.

[ ]

]

Hedge Funds Still Bearish Bitcoin Futures Despite Rally

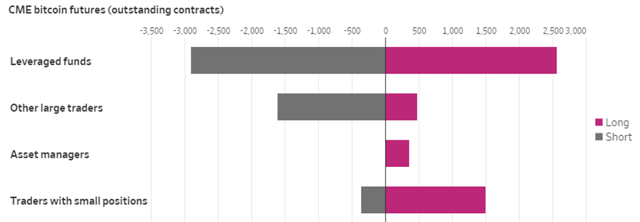

A parabolic ascent is something that tends to attracts aggressive short-sellers, and the COT data for CME bitcoin futures seemingly confirms that reasoning. While individual traders overwhelmingly use the BTC derivatives market to go long, the bulk of large traders are positioned for a drop in bitcoin’s price, according to CFTC data. These traders are predominantly large hedge funds, which is why they control such a large share of the futures market.

[ ]

]

ME Still One of the Only Ways To Short BTC/USD

There are some clear explanations as to why hedge funds might appear to have so much short exposure to bitcoin. The first is that there aren't many other ways to short BTC. This would make CME positioning appear more bearish than overall market sentiment. Consolidated Trading Crypto Analyst L. Asher Corson told The Wall Street Journal:

“CME right now is providing a unique ability for the larger players to have massive short positions with very low counterparty risk.”

LedgerX Wins Approval From CFTC

CME won’t have a monopoly on bitcoin futures for long, however, as several institutions are preparing to wade into the fray. LedgerX is in the headlines today, as its BTC derivatives platform won approval from regulators in another sign of goodwill from U.S. financial regulators toward crypto.

Copyright © 2018 BITCOIN DOLLAR, All rights reserved.

Warning! This user is on my black list, likely as a known plagiarist, spammer or ID thief. Please be cautious with this post!

If you believe this is an error, please chat with us in the #cheetah-appeals channel in our discord.