Buy XRP with a Credit Card in the USA

Have you ever wanted to buy Ripple XRP directly with a credit card? In this guide, I'll show you how to buy XRP using a credit card.

[bctt tweet="If you have bills to pay and are in a squeeze, you can still buy XRP with a CC"]

Are you tired of jumping through hoops to buy XRP with a credit card? Here's a list of exchanges that will let you buy XRP directly using your credit card.

I'll be going over each one of these options and I'll break down the trading limits and fees. Then, I'll show you in detail how to buy XRP using a credit card for each exchange.

Visit the Resources page for other Ripple XRP guides, exchange walkthroughs, and other tools.

Buy XRP with a Credit Card on Changelly

Changelly was founded in 2013 and is currently based in Prague, Czech Republic. It's a crypto exchange service that allows trading between digital currencies.

This is by far the easiest and cheapest method for buying XRP with a credit card. Changelly has a simple sign up process and doesn't require a full identity verification.

This exchange allows buying XRP with a credit card or debit card. So long as the card's brand is VISA or Mastercard.

Here's a video review discussing the many benefits Changelly has to offer. This is currently the best place to buy XRP with a credit card.

Changelly Credit Card Fees

Changelly charges a small 0.5% fee when buying XRP with a credit card. You can purchase with USD or EUR directly. Keep in mind, this doesn't include a fee your bank may charge you.

There's a possibility that your bank will count this payment as a cash advance. Simply call up your bank and get a confirmation whether or not it counts as one.

Deposit and Withdrawal Fees

There are no deposit or withdrawal fees, as Changelly does not hold any of your cryptocurrency. However, when buying XRP, you must enter a valid wallet address and destination tag.

Next, I'll go over the XRP buying process in detail.

Buying XRP with a Credit Card

This method is the best way to buy Ripple XRP directly with a credit card or debit card.

How to Use Changelly

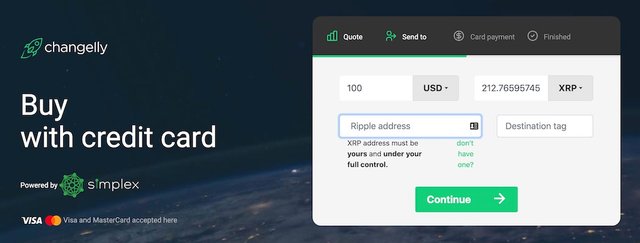

Begin by visiting the Changelly homepage. The form for buying on Changelly is located here. Start by selecting “USD” or “EUR” from the “YOU HAVE” field. Then select “XRP” from the “YOU GET” field.

Now, enter the USD or EUR worth of XRP you want to buy. Notice, the “YOU GET” field will update with the quantity of XRP you'll get. Click the “Exchange!” button to continue.

As seen above, the form following will request your Ripple XRP address and Destination tag. Enter your wallet details and click the “Continue” button.

Once you confirm your wallet details, you'll be asked to enter your credit card information. As soon as you submit your card details, your purchased XRP will be delivered to your wallet address.

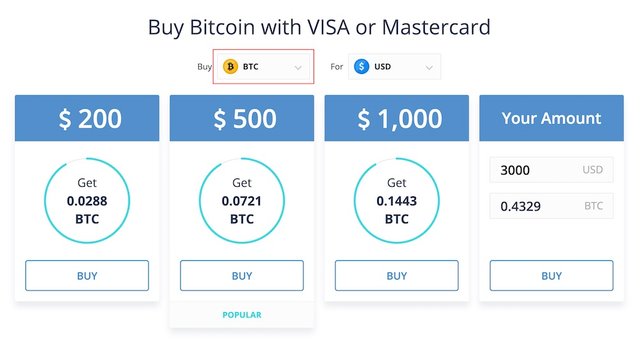

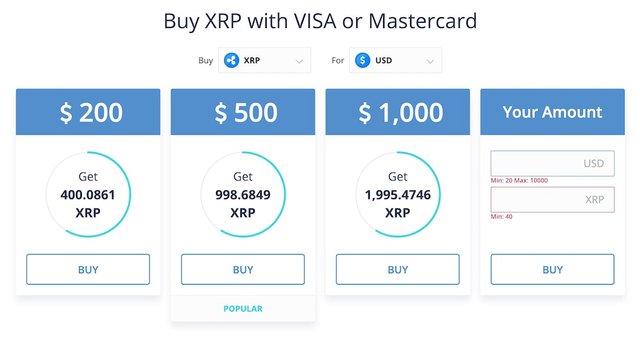

Buy XRP with a Credit Card on CEX.IO

CEX.IO was established in London in 2013 and started out as a cloud mining provider. Now, CEX.IO is a full-fledged cryptocurrency exchange that offers FIAT trading.

CEX.IO makes it easy to buy XRP with a credit card. However, the verification process needed for each credit card can be daunting. If you have one main credit card you use, the verification process isn't too bad.

Keep in mind, you're limited to VISA or Mastercard branded credit cards.

Also, I recommend you first check with your bank before using your card to buy XRP. This is because sometimes your bank will count this type of purchase as a cash advance.

CEX.IO Credit Card Fees

You'll be charged a 2.99% commision fee When buying with your credit card on CEX.IO. This is in addition to whatever fee(s) your credit card provider charges.

CEX.IO Withdrawal and Deposit Limits

Withdrawal Limits

There are no fees when withdrawing your XRP from the CEX.IO exchange. This is the best way to buy XRP with a credit card if you don't have a wallet available.

Credit Card Deposit Limits

Basic Account

Daily limit: $1,000

Monthly limit: $3,000

Verified Account

Daily limit: $3,000

Monthly limit: $30,000

Verified Plus and Corporate Account

Daily limit: $5,000

Monthly limit: $100,000

Setting Up Your CEX.IO Account

Begin by signing in to your CEX.IO account. If you don't have an account, you can easily login with your Facebook or Google account. Otherwise, create an account by clicking the “register” link at the bottom of the sign in page.

Once you're logged in, you'll need to add a credit card to your account.

Add a Credit Card to your CEX.IO Account

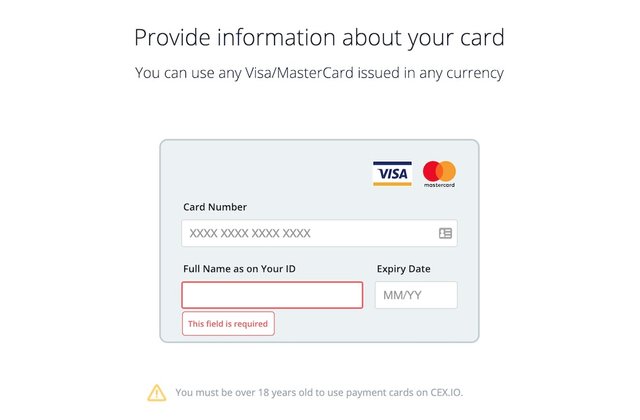

First, click the “CARDS” link in the header menu. Then, click the “Add new card” button near the top right corner of the page. You'll be presented with an entry form for your card details.

Now, you'll enter your credit card number, full name, and card expiration date. Then, click the “Proceed” button to add the card to your account. All that's left to do now is verify your newly added card.

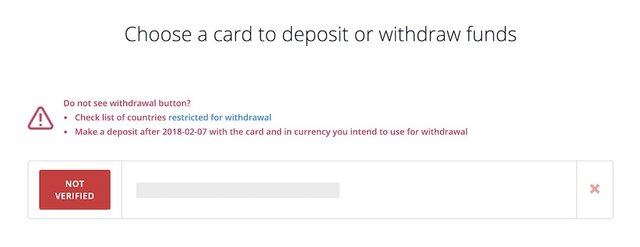

Verifying Your Credit Card on CEX.IO

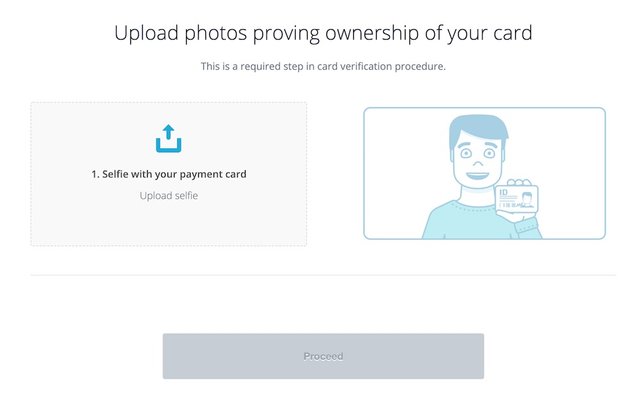

You're required to take a selfie holding your credit card to verify it. Begin the verification process at the “CARDS” page. On this page, your cards will be listed.

Click the “NOT VERIFIED” button beside the card you wish to verify.

Then, a form will popup with instructions on taking your verification selfie.

Click the the button “1. Selfie with your payment card” to upload your selfie. Find and upload your selfie and submit. Once submitted, your card will have “VERIFIED” next to it on the Cards page.

How to Buy XRP with a Credit Card

Once you have a verified credit card, you can use it to make deposits on CEX.IO.

Begin by clicking the “BUY/SELL” link in the header. On the Buy page, you'll be given options on how much of what to buy.

Click the “Buy” dropdown to select “XRP”. Then, select the amount of XRP you wish to purchase. Note, the minimum amount of XRP you must buy is 40.

[bctt tweet="Buy XRP with VISA or Mastercard"]

Video Guide: Adding a Credit Card and Buying on CEX.IO

In case you need a better demonstration, here's a video guide. This guide will walk you through adding a credit card and verifying it. It even goes over how to buy using your credit card on CEX.IO.

Buy XRP with a Credit Card on Uphold

Uphold is a cloud-based digital money platform headquartered in Charleston, South Carolina. Their services allow buying, selling, and holding as many as 30+ currencies.

Uphold Supported Currencies

- U.S. Dollars (USD)

- Euros (EUR)

- Pounds (GBP)

- Yuan (CNY)

- Yen (JPY)

- Swiss Franc (CHF)

- Indian Rupee (INR)

- Mexican Pesos (MXN)

- Australian Dollars (AUD)

- Canadian Dollars (CAD)

- Hong Kong Dollars (HKD)

New Zealand Dollars (NZD)

- Singapore Dollars (SGD)

- Kenyan Shillings (KES)

- Israeli Shekel (ILS)

- Danish Krone (DKK)

- Norwegian Krone (NOK)

- Swedish Krona (SEK)

- Polish Zloty (PLN)

- Argentine Peso (ARS)

- Brazilian Real (BRL)

- United Arab Emirates Dirham (AED)

- Philippine Peso (PHP)

Precious Metals

- Gold (XAU)

- Silver (XAG)

- Platinum (XPT)

- Palladium (XPL)

Cryptocurrencies

- Bitcoin (BTC)

- Litecoin (LTC)

- Ethereum (ETH)

- Basic Attention Token (BAT)

- Bitcoin Cash (BCH)

- Dash (DASH)

- Bitcoin Gold (BTG)

- XRP (XRP)

Here's a video review of Uphold that notes some of the key benefits to using Uphold. The reviewer (Josh Domsky) also goes over some Uphold F.A.Q's.

Uphold Credit Card Fees

Uphold charges a 3.99% fee when using a debit or credit card to fund your account. This is in addition to the exchange fee Uphold charges. Below is a list of common exchange currencies, along with their fees.

Uphold Exchange Fees

| US Dollar, Euro, British Pound | 0.65% |

| Australian Dollar, Canadian Dollar, Danish Krone, Hong-Kong Dollar, Japanese Yen, Mexican Peso, New Zealand Dollar, Norwegian Krone, Singapore Dollar, Swedish Krona, Swiss Franc | 0.95% |

| Bitcoin | 1.05% |

| Chinese Yuan, Indian Rupee, Litecoin, Ethereum, Bitcoin Cash, XRP | 1.4% |

Visit Uphold pricing page for the full list of currencies with their exchange fees.

Uphold Withdrawal and Deposit Limits

| Channel | Deposit Cost | Deposit Limit | Withdrawal Cost | Withdrawal Limit |

| Debit/Credit Car d | 3.99% | Min: $50/day Max: $500/day | -- | -- |

| Bank Transfer ACH | Free | Min: $50/day Max: $500/day | $3.99 flat rate | Min: $50/day Max: $10,000/day |

| Bank Transfer SEPA | Free | Min: €75/transaction | $3.99 flat rate | Min: €10/day Max: €50,000/day |

| Bitcoin, Litecoin, Ethereum, BAT, BCH, DASH, BTG, XRP, LBA | Free | None | $2.99 flat rate + 0.0003 BTC 0.003 LTC 0.005 ETH 10 BAT 0.0003 BCH 0.0003 DASH 0.001 Dash Instant Send 0.0003 BTG 0.1 XRP 50.00 LBA | Min: 0.00001 BTC 0.25 LTC 0.001 ETH 0.00001 BCH 0.0001 DASH 0.0001 BTG 0.001 XRP, LBA |

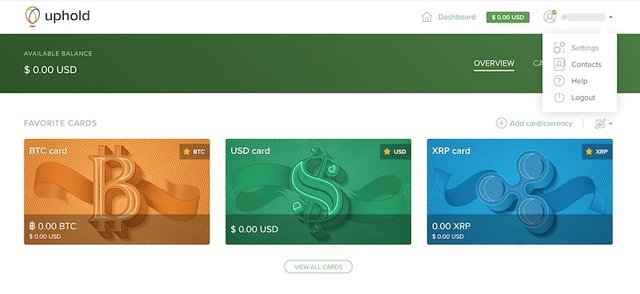

How to Buy XRP with a Credit Card on Uphold

Before starting, you should be aware Uphold only accepts VISA and Mastercard branded credit cards. Also, be sure to ask your credit card provider if this type of payment counts as a cash advance before continuing.

It should be noted, Uphold doesn't allow funding to your “XRP card” directly with a credit card.

In order to fund your “XRP card”, you must first add funds to your “USD card”, “EUR card” or “GBP card”. Once those funds are deposited, you can trade those funds to your “XRP card”.

When you're ready, begin by going to the Uphold website and logging in to your account. Once you're logged in, click your username and select “Settings” from the drop-down.

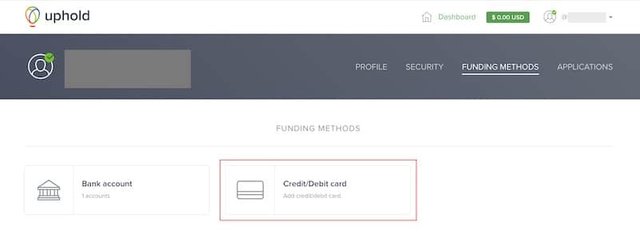

On your Uphold account settings page, click the “FUNDING METHODS” link.

Then, select the “Credit/Debit card” option from the funding methods list.

Now, you're ready to enter your credit card details. On success, your card will be added to your account. You can now use this card to fund your USD, EUR or GBP cards.

This funding process takes up to 24 hours to complete. Once your USD, EUR or GBP card is funded, you can trade for XRP.

Using the Uphold App to Buy XRP with a Credit Card

If you need help getting started, check out my guide on buying XRP quickly and easily. I go over how to navigate the Uphold app and how to fund your XRP card.

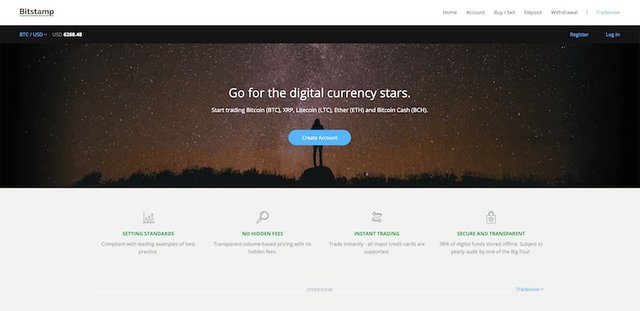

Buy XRP with a Credit Card on Bitstamp

Bitstamp is a bitcoin exchange founded in 2011, based in Luxembourg. It's safe to say this exchange has been in the crypto space for a Bit...

Bitstamp was made to be an alternative to the Mt. Gox exchange for the Euro client market. It's one of the oldest, most established cryptocurrency exchanges.

Here's a list of countries Bitstamp supports.

- Switzerland

- Norway

- Monaco

- Montenegro

- Serbia

- Turkey

- Andorra

- Moldova

- Gibraltar

- Iceland

- Greenland

- Liechtenstein

- Isle of Man

- Faroe Islands

- Åland Islands

- San Marino

- Hong Kong

- China

- Singapore

- Taiwan

- South Korea

- Australia

- New Zealand

- Japan

- Argentina

- Brazil

- Israel

- South Africa

- Chile

- Kuwait

- Cayman Islands

- Qatar

- Saudi Arabia

- India

- Lebanon

- Puerto Rico

- Peru

- Madagascar

- Mozambique

- Dominican Republic

- Curaçao

- Dominica

- Jordan

- the Bahamas

- Bahrain

- French Polynesia

- Ecuador

- Trinidad and Tobago

- Barbados

- Réunion

- Jamaica

- Paraguay

- Brunei

- New Caledonia

- Guadeloupe

- Martinique and Sint Maarten

If you are in one of the countries listed above or in the EU 28, you can use Bitstamp. Learn more about using debit/credit card payments on Bitstamp.

Bitstamp Credit Card Fees

Bitstamp will charge you a 5% fee for using a credit card. This is in addition to the fee your credit card issuer may charge you.

Bitstamp Withdrawal and Deposit Limits

There are no withdrawal limits on Bitstamp. However, Bitstamp may ask questions when depositing or withdrawing. You may be required to provide bank and income statements.

On a verified account, you are limited to credit card deposits of $1,500 daily and $15,000 monthly.

How to Buy XRP with a Credit Card on Bitstamp

Begin by visiting the Bitstamp deposit page after logging in to your account. If you don't have an account, check out my guide on registering and getting verified on Bitstamp.

Once on the deposit page, you'll have a left sidebar with different deposit methods Bitstamp offers. Click the Credit Card tab to open the credit card deposit page.

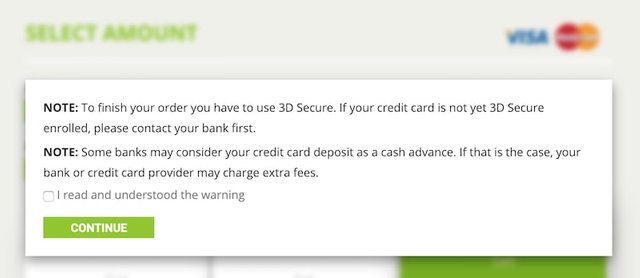

If you haven't already confirmed, Bitstamp will ask you to confirm that your credit card is 3D Secure.

What is 3D Secure?

3D secure stands for 3 Domain Server, there are 3 parties that are involved in the 3D Secure process.

- The company the purchase is being made from.

- The Acquiring Bank (the bank of the company)

- VISA and MasterCard (the card issuers themselves)

3D Secure Accepted Cards

- VISA

- VISA Delta

- Mastercard

- Mastercard Debit

- International Maestro

- UK Maestro

- Laser

- VISA Electron

Additionally, Bitstamp warns you that your bank may count your credit card deposit as a cash advance. To be sure, call up your bank to confirm whether or not this deposit will count as a cash advance.

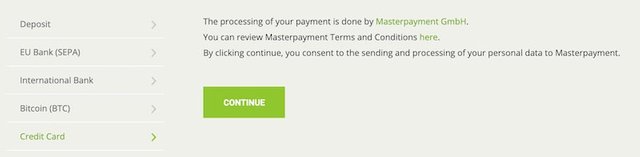

If you acknowledge the warning, check the “I read and understood the warning” box. Then, click the “CONTINUE” button to proceed.

Bitstamp Credit Card Purchase Error

Upon deposit, you may receive this error: “Unfortunately, your transaction was declined by your card provider. Please review your credit card data and contact card issuer.”

To further explain, this error is telling you that your bank blocked your credit card deposit. You will have to call your bank to authorize the payment.

So there's a high probability that your bank will initially block your credit card deposit. This happened to me when I used my credit card on Coinbase.

If this happens to you, call up your bank and tell them to authorize the payment. If possible, tell your bank to also authorize any future payments to Bitstamp.

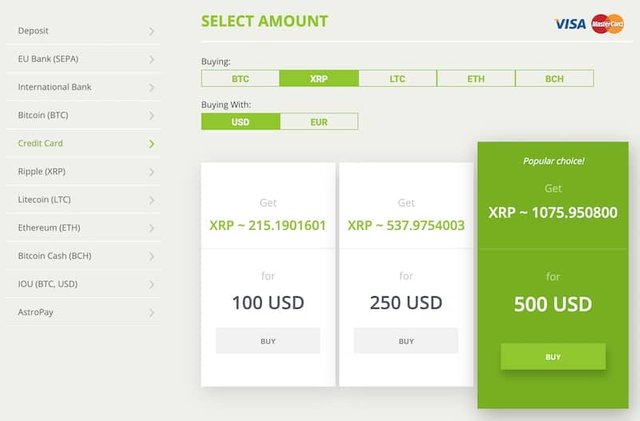

Select Your Deposit Amount

When depositing via credit card on Bitstamp, you'll be given six options. Five of which are fixed dollar amounts, one custom entered amount.

Now, ensure the “XRP” option under the buying field is selected. Then choose or enter the amount you wish to purchase.

After selecting, you'll be asked to click the “CONTINUE” button to consent to the sending and processing of your personal data to Masterpayment.

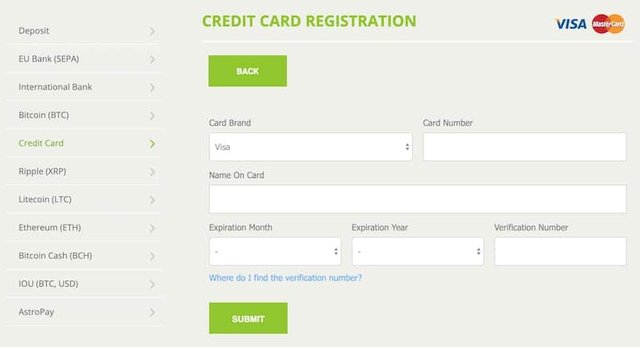

After, you'll be taken to the Credit Card Registration form. Finally, enter your credit card brand, number, name on the card, expiration date, and verification number. Once completed, click the “SUBMIT” button.

Once submitted, an instant order will be placed. Then, the purchased cryptocurrency will be credited to your account balance. Visit your Account Balance page to view your new XRP balance.

Buy XRP with a Credit Card on Paybis

Paybis is a UK based digital currency exchange founded in 2014. They are best known as being the facility for buying crypto with credit cards. You will be required to verify your identity before buying on Paybis.

Paybis verification requires a high-quality photo upload of the front and back of your government issued ID.

In comparison to other popular exchanges, Paybis is lacking in the design department. Additionally, they don't have live chart data, trading screens or price alerts.

Paybis doesn't allow storing your XRP on their exchange. You will need an XRP wallet address to send your purchased XRP to.

If you don't have a wallet, I recommend getting the Ledger Nano S. If you need a free option, I recommend the Toast wallet app for IOS or Android.

Paybis has an easy to use interface for buying XRP with a credit card. Below is a list of cryptocurrencies you can buy with a credit card on Paybis.

- Bitcoin (BTC)

- Litecoin (LTC)

- Ethereum (ETH)

- Ripple (XRP)

- Bitcoin Cash (BCH)

Restricted Locations

Paybis cannot provide service for the following countries/states.

- United States

- New York (NY)Georgia (GA)Connecticut (CT)New Mexico (NM)Washington (WA)Hawaii (HI)

- Democratic People's Republic of Korea (DPRK)

- Ethiopia

- Iran

- Pakistan

- Serbia

- Sri Lanka

- Syria

- Trinidad and Tobago

- Tunisia

- Yemen

- Iraq

- Afghanistan

- Botswana

- Bahamas

- Ghana

The following locations cannot use the credit card purchase method on Paybis.

- Bosnia and Herzegovina

- Cuba

- Lao People's Democratic

- Republic

- Sudan

- Uganda

- Vanuatu

- Lebanon

- Algeria

- Bangladesh

- Bolivia

- Cambodia

- China

- Kyrgyzstan

- Macedonia

- Nepal

- Nigeria

- Taiwan

- Thailand

- Ecuador

- Jordan

Paybis Credit Card Fees

Paybis charges a $5 credit card fee and a 5% commision fee on your total purchase.

Here's a video demonstration of buying crypto with a credit card using Paybis. Of course, you can follow this video and just substitute “Bitcoin” with “XRP”.

Now, here's how you buy XRP with a credit card on Paybis.

Begin by visiting the Paybis home page. Then, click the “LOG IN / SIGN UP” link in the header to get an account and/or log in.

If you don't have an account, it's easier to login with your Facebook or Google account. You'll see those login options at the top of the signup page.

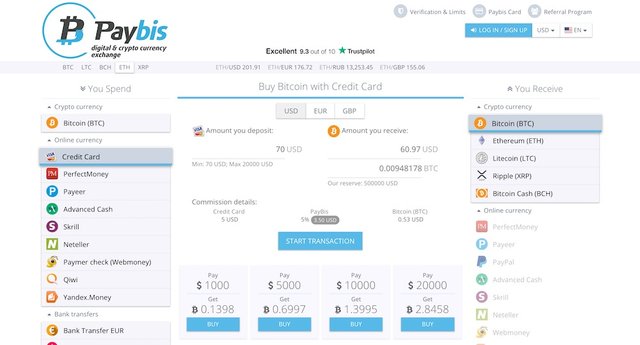

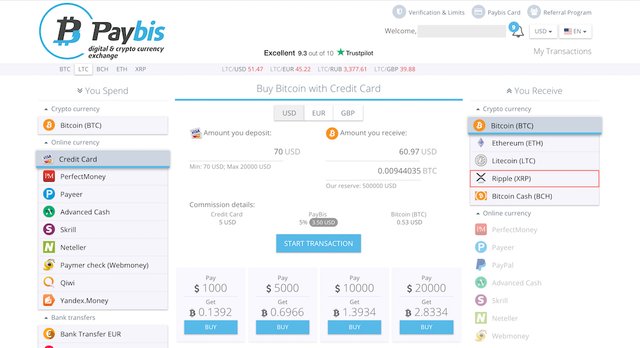

Once you're logged in to your account, you'll be taken to the purchase form. Here, you'll select “Ripple (XRP)” from the right sidebar as seen below.

Once you're on the XRP buying page, you'll enter the amount you wish to purchase and click the “START TRANSACTION” button.

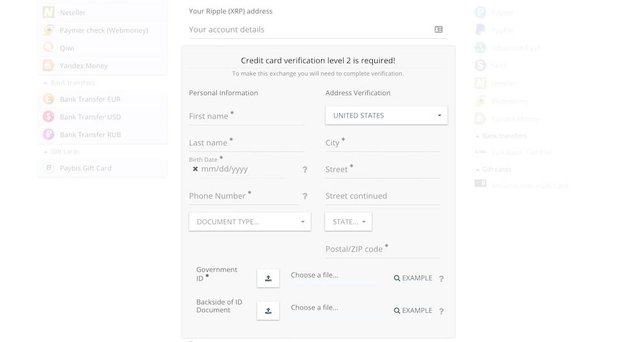

First, you'll enter your Ripple XRP wallet address. If you haven't been verified, you'll be presented with a verification form.

On the verification form, you'll enter your name, birth date, address, and phone number. Then, you'll upload your ID document front and back. Finally, check both agreement boxes at the end and click the “CONTINUE” button.

Conclusion

You now know of four great exchanges you can use to buy XRP with your credit card. In addition, you've learned the fees involved in using a credit card with each exchange.

Next time you're in a bind and need to buy XRP, you now know of four exchanges to buy from. If you feel this guide was helpful to you, please share it with others.

[bctt tweet="You can now easily buy XRP with a credit card"]

Have you ever purchased from one of these exchanges? What was your experience like? Also, when buying XRP with a credit card, which exchange would you most likely use next time?

Check out my other useful guides and tools on the Resources page.

Posted from my blog with SteemPress : https://xrpontop.com/buy-xrp-with-credit-card-usa/

Congratulations @chamillion! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!