Taking The Cryptoverse By Storm — The New WallStreetBets DeFi Portfolio

How heavy are your DeFi bags?

Are you full-on degen FOMO?

Or pussyfooting around the edges…

Well ape, don’t miss out. DeFi is on one hell of a ride.

Institutions are hopping on the train and project fundamentals are stronger than ever.

However…

Researching and juggling between dozens, if not hundreds, of project opportunities to catch profits is a head-spinner for any ape.

They’re fixing that right now:

WallStreetBets is making it easy for crypto degens to grab DeFi tendies without having to ‘science the shit’ out of it.

They’ve done that bit for you.

Their smooth-brained and wrinkled-brained trading apes have just voted on an ideal product for profiting on Ethereum’s meteoric rise.

Introducing the DeFi Exchange Traded Portfolio

First, get your ape brain around the core concept…

ETPs (exchange-traded portfolios), are baskets of digital assets that can include tokenized versions of real assets such as stocks, commodities, and in this case, cryptocurrencies.

Different to traditional ETF’s (exchange traded funds) because ETP’s are:

• Community Run — Completely managed by you, our community of traders, that together decide the asset allocation, voting on proposals with WSB token.

• Diversified — Gaining exposure to a wide array of assets, without having to invest in an ETF run by greedy finance Ph.D’s on Wall Street, who only look out for themselves.

• Non-custodial — You and you alone hold the keys to your coins. Traders can make deposits and withdrawals at any time. No permission needed.

• No intermediaries — ETP’s gets rid of the middle man, no longer are traders bound by the shackles of centralized finance.

• Fully collateralized — all tokenized assets in the ETP are backed via assets held by a smart contract.

• Transparent — they have nothing to hide. All the details and technicalities that you’d want to know are at the trader’s disposal

• Real-time Reporting — price and performance stats are available in real-time, instead of waiting for the market close like the fine folk on Wall Street do.

The DeFi ETP — All You Need To Know

Born out of a partnership with BNC Index Services, a leader in data and cryptographic solutions. WallStreetBets gained a license to use the BNC Blue Chip DeFi Index as the basis of the WSB DeFi Exchange Traded Portfolio (ETP).

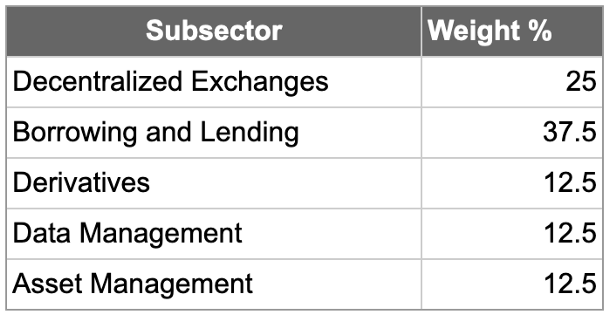

The basket of assets is made up of ERC-20 tokens in the following crypto sectors:

Perfectly lined up to take advantage of all the current trends in the DeFi space, the ETP diversifies into what will be the future of our economy.

So let’s take a look at the ETP token composition:

We picked the leaders of each sector, those that seem likely to deliver.

Decentralized exchanges (UNI and SUSHI), Borrowing and Lending protocols (COMP, AAVE, and MKR), Derivatives & Synthetic Assets (SNX), Asset Management (YFI), and Data indexing solutions for blockchains (GRT).

Big names, doing big things. In the forefront of the fight against centralized finance and its goons on Wall Street, it’s thanks to them that DeFi is winning.

The quest to decentralize finance is no walk in the park, but these projects are leading the pack. And without a doubt, the price is showing it, and with altcoin season upon us who knows how high they can skyrocket. Both the long and short-term price indicators are pointing up, straight to the moon. That’s why we choose them.

Ethereum 2.0 is slowly but surely due for arrival, while ETH just hit an all-time high, anyone with eyes cannot help but be hopeful for the future.

You can now own all of them by trading the WSB DeFi ETP, set to release on Balancer on November.

Conclusion

At the WSBDApp, they are building their home in the decentralized world of the future, and the DeFi ETP is one of the blocks.

Together with their Macro Hedge ETP the DeFi ETP is the second addition to our growing selection of passively managed investment vehicles, that are standing up to the might of Wall Street. Democratizing finance and making sweet profits on the way. That’s how we win.

Together with their Macro Hedge ETP the DeFi ETP is the second addition to our growing selection of passively managed investment vehicles, that are standing up to the might of Wall Street. Democratizing finance and making sweet profits on the way. That’s how we win.