Where the Hell is My Decentralized Exchange?

Options out there for us today (for a lack of a better word) suck. We need a DEX we can trust.

I, like many of you, spent an insane amount of time researching, reading and learning about blockchain and crypto prior to jumping in with my ‘precious’ fiat dollars. The potential and current pace of adoption made this an easy decision for me and many others. However, after making my decision, I was met time and time again with denials for account creation based solely on the country and the U.S. state I live in. Welcome to crypto in a crypto-ignorant, highly regulated country. I fought through these headaches, waited my appropriate two-week verification and off buying and selling I went!

As my confidence both as trader and investor grew, it became clear to me — I need a decentralized exchange to match my now decentralized cryptocurrency. Surprise was on me. Nothing viable even exists. How could that be? After the many debacles, hacks and controversies from the centralized exchanges how can we not all be trading non-stop on a DEX platform? Much like blockchain itself, the DEX market is immature and still growing. I decided to dig deeper into the working DEX platforms and see which ones have the best possibility of success in the future.

So, I share with you all my experiences, key learnings and takeaways from today’s DEX platform options.

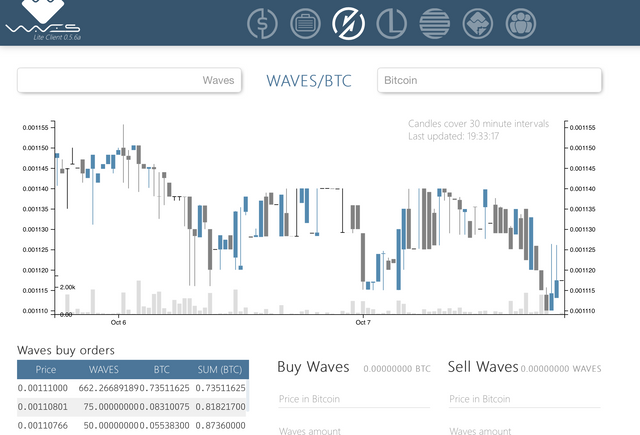

Waves Platform

Without question, Waves stands atop the list of options as one of the most well-known DEX platforms on the market. Waves has both an online and downloadable client for users. The enrollment process is quick and super easy, within seconds you are up and running — big plus. Beyond that, there is little to get excited over. First, I still to this day have a very difficult time understanding what coin options are available to trade. Second, volume is so low I refuse to even attempt a trade (if I could — more on that in a moment). Is anyone even on this thing? Lastly, the online client is far from perfect, or even working. Using Safari browser, I cannot view the full page and cannot scroll to the bottom — problem here, I cannot view any button to select ‘buy’ or ‘sell’ to execute a trade. The screenshot above is the exact view I had. I think I understand why there is no volume here, and (in my opinion) not much of a future until they get themselves a better UI. The charts offered make the Bittrex charts look great, professional even.

OpenLedger/Bitshares

Before I write much about them, I am an Apple guy and I enjoy my Safari browser. Saying my Safari is an ‘Unsupported Browser’ (regardless of any valid reason they may have) just pisses me off.

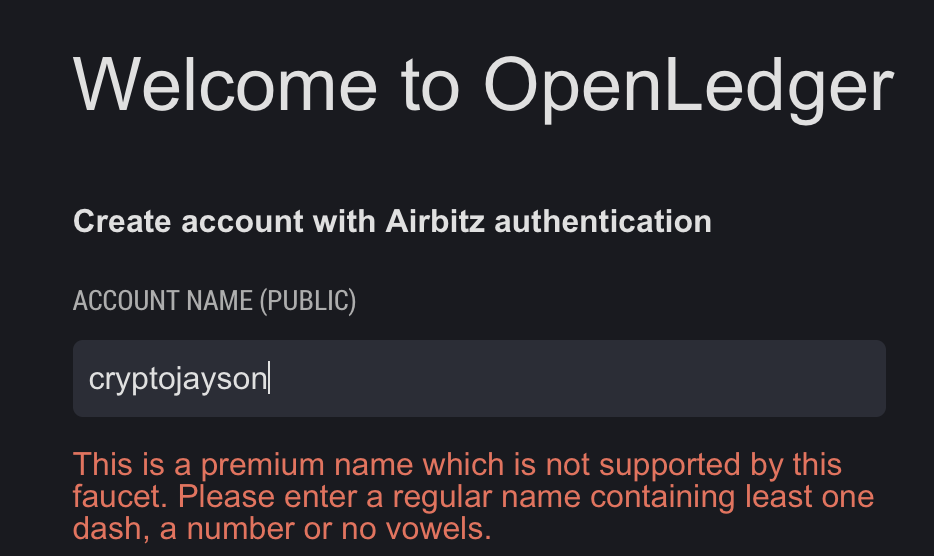

So, let’s look at OpenLedger and Bitshares. For those wondering why I combined these two, they are the same platform just with thier own name. Enrollment was super easy like Waves. First issue starts with our user name. It can only be 2 letters and numbers/symbols. As they state ‘premium names are not supported’. I have included a screenshot of this below. This really bothers me for some reason - no vowels? Really.

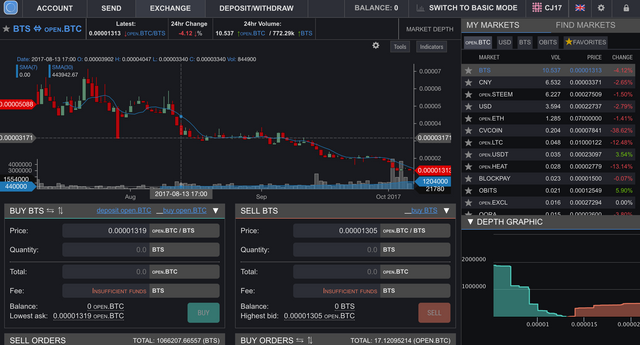

Once you are logged in, there are market options I simply could not figure out. In the second screen shot from OpenLedger, you will see BROWNIE.PTS, REALITY and a few others. For the life of me this makes zero sense. My main point being, if they are targeting the mass market, how about using names those on centralized exchanges can understand? As for the UI, I did enjoy the colors and the charts, much cleaner than Waves.

Still, not a viable solution at this time (or even close). There is slight promise with this UI. As with Waves, the extreme low volume prevents any of us from even slightly considering this as a trading platform in the short term as well. However, OpenLedger and Bitshares are well off my radar long term. Even with the nice UI both share. The copycat UI on two platforms really turned me off and left me with a strong lack of trust. I was actually half surprised my account login from OpenLedger did not work on Bitshares. Disappointed.

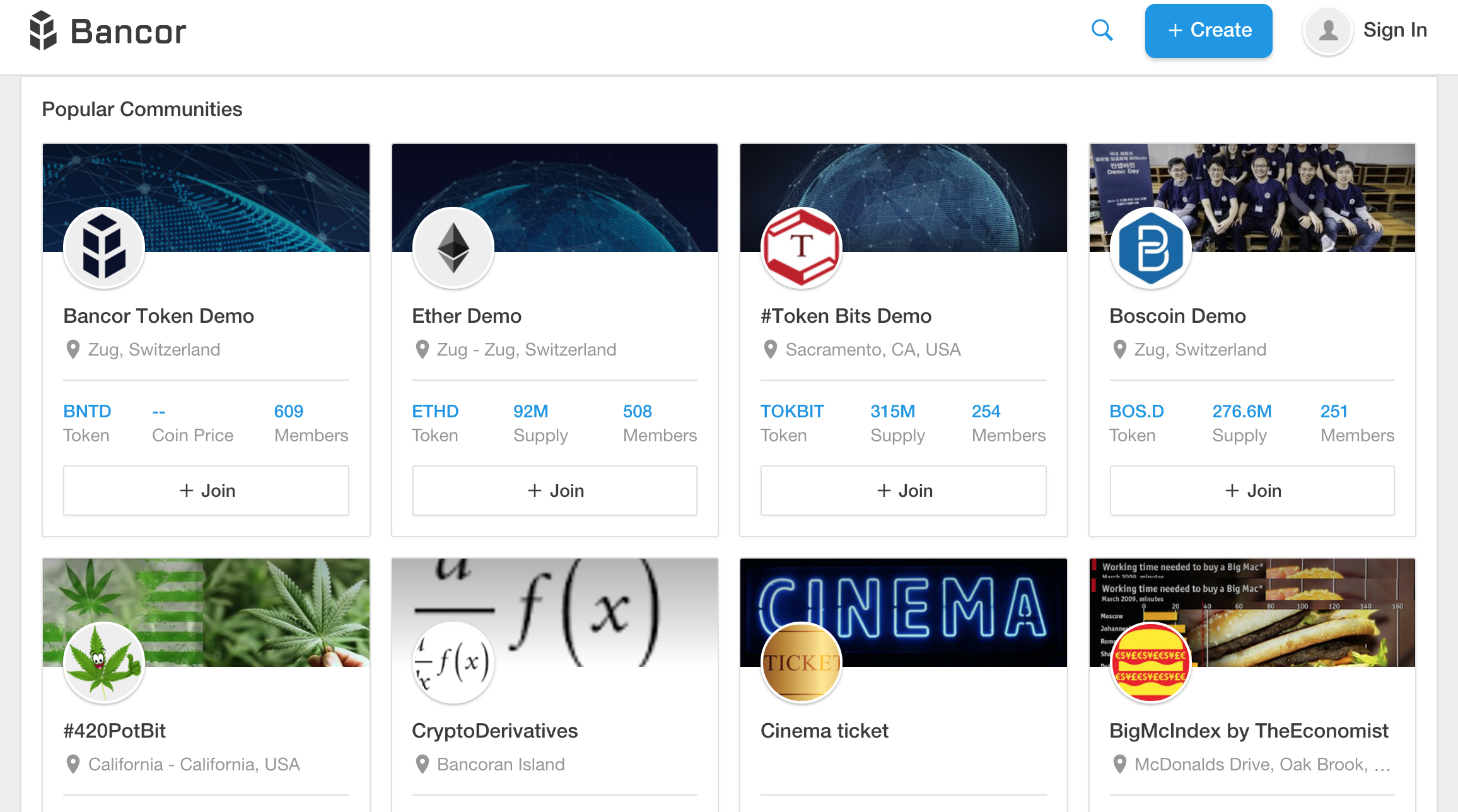

Bancor

In fairness, Bancor is not fully functioning as of yet and their demo app is somewhat interesting only for its uniqueness. Bancor will use ‘Smart tokens’ to hold one or more real world tokens in reserve (e.g. BTC, ETH) to enable the instant purchase/exchange of the coin you are looking to buy or sell. The concept seems like it would work, however the demo app just seems kind of scammy (to me at least). I chose not to sign up as I did not want my Facebook messenger account tied to this (it was the only option for me, I do not have Telegram). I also am unsure on how I feel about what looks and feels like a Facebook/Twitter landing page as my main source of crypto trading. I get the P2P aspect, but this seems a bit overboard to me. Sorry Bancor, but seems what I have heard about you is true. Still looking for my DEX platform a trader can fall in love with. On to the next.

Shapeshift

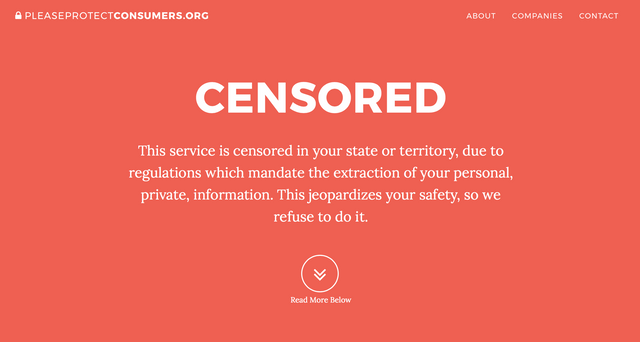

This is a rather popular platform I know has been used by many. However, it is not a DEX. Looking into Shapeshift, I was able to find that they actually use a centralized server infrastructure and, in many cases, have ‘lost’ users coins in the process. Not only that, I was kindly greeted with this warning when visiting their page without my VPN on.

Sorry Shapeshift, US cannot use you. In fairness, Shapeshift has really not positioned themselves as a true DEX, more of a way to move coins from one type to another with minimal fees. Great concept a year or two back, however the market (in my opinion) is demanding a solid DEX platform, not a coin washing service.

Loopring

My final thoughts land on Loopring. Tons of buzz on this coin after its ICO for sure. I was super excited about this coin as well…until I learned that this is not a DEX platform at all. Repeat, it is NOT a DEX platform. It is a protocol that relies on existing exchanges to execute trades. True, to the end user this solves the requirement to store or even open an account on a centralized exchange. However, the fact remains, Loopring still relies on centralized infrastructure to execute trades. So, which exchanges are used? Any exchange that the Loopring coin is traded on can use the Loopring protocol to execute trades. Meaning, that you will never know which exchange is used to execute your trade. Maybe a minor point to some, however to me I like to know where my coins are going before I send them. That is a main reason I never used Shapeshift. I will say that Loopring’s protocol is rather impressive. Of all the options I have listed, its by far the strongest project for future growth. If we cannot land a solid DEX platform, then Loopring is honestly our best option.

So, this is it. These are the only real decentralized exchange options for our decentralized currency. Not exactly exciting. Sure there are a handful of others I could have wrote up, but those were so bad I found no reason to even mention them.

We need a major project to launch that provides us with as many options (or close to) as the centralized exchanges we use but decentralized. There are many projects launching, I know. I’ll save that write-up for another day. Maybe one can stand tall amongst the rest and push us into our decentralized world. We need it. Hell, we demand it. And what the market has given us thus far, is well, crap.

~CryptoJayson~

Follow me on twitter @crypto_jayson

Donation Addresses:

NEO: AXZ5AiCHXeEefG5Zo45waEV2QHdrqA93qc

ETH: 0x84f95A68FE5Ff16BB7e047c1484f4cd07fd1cB0a

BTC: 19uUE9K4ybS6zMMxCcjzDx9cz6cazh2ZTx