How far crypto ecomonics can go?

Let's make a simple calculation. Special for people who calling crypto economics a bubble.

Let's take dot-com bubble size, it was $6.6 trillion at the peak: http://blogs.reuters.com/data-dive/2015/03/11/nasdaq-looks-different-15-years-after-its-peak-then-and-now/

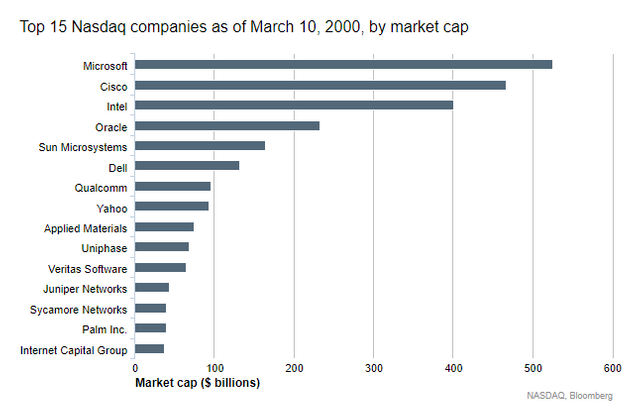

It is worth noting that most companies in Nasdaq Composite are American. Take a look at the top 15:

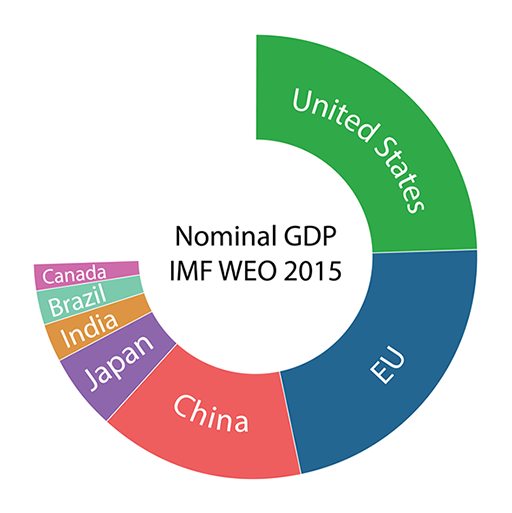

All top companies were based in the US. But crypto industry involves all countries. By 2015 the US share in world's GDP was 25%:

So expected size of crypto bubble now is: 6.6 * 4 = $26.4 trillion

But wait, do you remember about the inflation? Assume, that average rate is 3% per year and bubble will burst in 2022 (5 years from now):

$1 in 2000 → $1.65 in 2022 according to http://www.in2013dollars.com/2000-dollars-in-2022?amount=1&future_pct=0.03

So we finally got our result: 26.4 * 1.65 =

$43.56 trillion

Now, take a look at current Bitcoin capitalization, it's $60 billion now.

Microsoft the leader in the industry was about $500 billion at the time of crush, in other words about (0.5 / 6.6) * 100 = 7,5% of total capitalization.

In this case, the capitalization of Bitcoin can be 43.56 * 0.075 = $3.267 trillion. And the price (3267 / 60) * 3700 =

$201465