PNGME : AN INNOVATION WITH THE SOLUTIONS TO THE POOR LENDING STRUCTURE IN THE DIGITAL MARKETPLACE.

INTRODUCTION

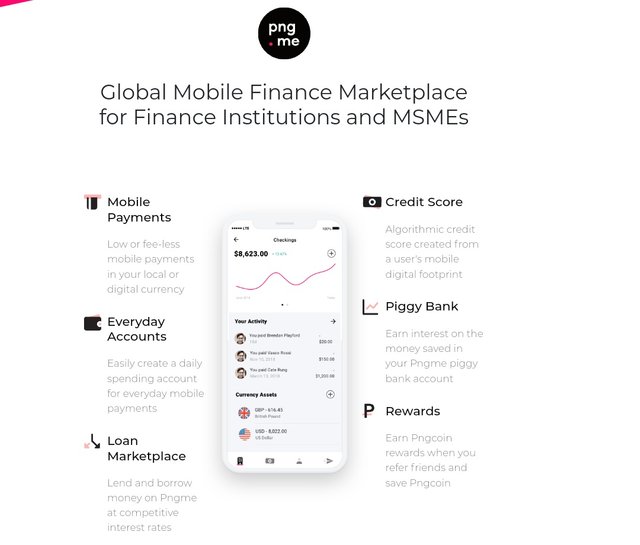

There is no doubt that this new platform has the solution that perfectly address the difficulties in getting crypto loans especially when the same crypto would be used as collaterals. The faults that have been discovered but yet remain difficult to address in the financiaI world will now be addressed with Pngme's Strategy that give hope to the MSMEs that have been trivialized all along.

THE SOLUTIONS PROVIDED BY PNGME

This platform with its solutions now has a perfect lending structure with great banking infrastructures integrated in it. It has the blockchain as support and by its standard is able to use the infrastructures to it has to control the use of assets, loans and how they can serve as collaterals. Now there is a perfect scheme that makes borrowers meet with their lenders to have them agree based on the operation of the algorithm. That eliminates the risks that has for long been associated so that now the operations can be based on the digital credit score that prevent the risks. This platform uses a risk metadata that strengthens the digital bond between the borrowers and lenders such that they can capitalize on the data to price the coupon rates of their bonds in the marketplace. This is what helps the lender to perform a lot more better than before.

A BETTER LOAN PROVISION FOR BORROWERS

The borrowers now have a better version of a lending platform where they can have their loans when their bonds have been listed. They just have to list their bonds which would have the present coupon rates which the borrowers must have set within the bonds.

The loans to be gotten by borrowers can be obtained using digitized collaterals in form of the digital assets from the borrowers and that helps. This has the advantage of protecting the purchasers of the bond because by default they are prune to any risk. The lenders on the other hand look forward to having good bonds from the borrowers.

When auction is made for the digital bond, the coupon rates of the bond and thw borrowers APR will be set by the bidder to make sure the lending rates are efficient as set by the lenders and not necessarily any group. It is important to set the price in this manner to ensure the low cost of capital or the APR for the borrowers involved in the process and to increase the APY capital for the lenders. This reduce the risk and also expose them to the different types of digital bonds.

The blockchain plays a big role in this platform as it ensures a perfect audit trail and transactions that are done with low cost of border settlement. Moreover, smartcontracts allows an organized a loaning through the digital assets used as collaterals. It supervises and support especially when any foreign base operations are to be done. This establishes a perfect exchange that allows the swapping of crypto from the local assets to the foreign money. It allows the use of fiats as well and makes sure there is full backup for the coins.

CONCLUSION

PNGME is now the first mobile platform that takes over this finance operations to bring up so many MSMEs in the different market of the world today. It is now very much accessible and will be providing low cost credits through the impact of its technology. This process will be beneficial to the customers who will have savings on and will assure them of a perfect relationship with the platform.

USEFUL LINKS

Website: https://pngme.com/

Whitepaper: https://docsend.com/view/x4ts5tm

Telegram: https://t.me/pngmecommunity

Twitter: https://twitter.com/pngmemobile

Facebook profile: https://www.facebook.com/pngme

AUTHOR'S DETAILS

Bitcointalk Username: Dannev

Bitcointalk Profile Link: https://bitcointalk.org/index.php?action=profile;u=2317961