Cryptocurrencies Are A Scam and Are Dead. I'm Sorry, I Was Wrong.

Juuuust kidding!

It has been a rough year for cryptocurrencies… exactly as we expected and told subscribers and said publicly since December of last year.

In fact, almost exactly one year ago to the day, I put out this video titled, “It’s Time to Rotate Crypto Gains Into Forgotten Gold Stocks” and followed up on December 15th with THIS video advising people to take profits on cryptos and buy gold.

The very next day, bitcoin hit it's all-time high near $20,000 and has been sliding ever since.

It wasn’t “easy” to make this call. In fact, I was lambasted in the comments and called an idiot for suggesting to take profits on cryptos with bitcoin near $20,000 and invest in gold.

Like this comment for example.

Or this one.

And this.

We told subscribers all through last December, January and February to take profits.

At this year’s TDV Summit in February (click HEREfor Cyber Monday sale for 25% discount on the upcoming Summit), TDV’s Senior Analyst said he was bearish on the cryptos for the short to medium term.

In the June issue of TDV, Ed Bugos was very frank in his bearishness, saying:

“But regardless, I expect another 6 months or so of weakness in the crypto space, a lot of failures in the next year or so, and lots of hate and doubt to come. For those who think we’ve had FUD, you ain’t seen nothin’.

In terms of these things, I still think the future will get darker before the dawn.

The implication is bearish and argues for a price target of around $3500 - $4000 in the intermediate term, i.e., maybe a few months in bitcoin time”

So far, he has absolutely nailed it!

We’ve been covering bitcoin since it was $3 in 2011 and we said were going to enter into a bear market at about this time last year with a price target of $3,500-$4,000.

This is actually very elementary. This is how markets work. A massive, hockey stick chart gain from under $1,000 to $20,000 in one year is never sustainable. There will always be a massive pullback afterwards.

Bitcoin has seen this numerous times in its history.

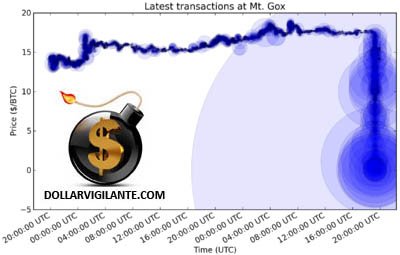

The first one was in June, 2011, when I wrote, “A Wild Few Weeks for Bitcoin” after it rose from $3 to over $30 in less than a month.

It then, on Mt. Gox, briefly fell to $0.01 as concerns about the soon-to-be defunct exchange began to spread.

.jpg)

Then, in 2013 it rose from below $100 at the start of the year to hit a high over $1,300 by January…. And then fell to near $200.

.png)

So, this is perfectly normal behavior for bitcoin to fall from near $20,000 to near $4,000 now.

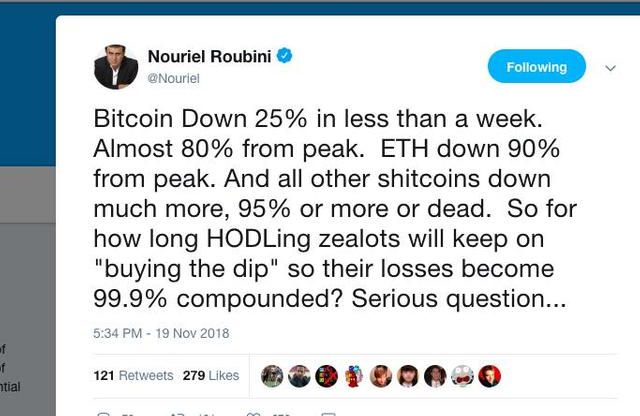

Yet, people like Nouriel Roubini, are acting as though bitcoin has died.

.png)

There’s just one problem, they have been doing this since bitcoin was $60.

.jpg)

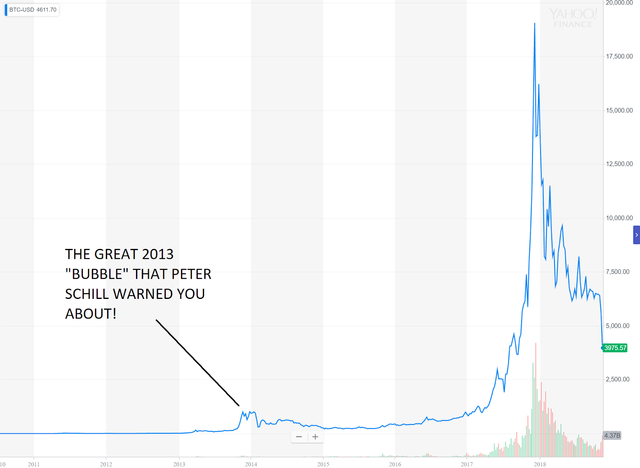

Peter Schill, who comes out of the woodwork anytime bitcoin goes down, is also back at it.

.png)

The same old story he has been saying since 2013, when he said, “Bitcoin is Tulip mania 2.0—not gold 2.0”.

In that interview, with bitcoin near $300, he said, “A bubble is a bubble. And there’s a bubble in bitcoins.”

And, according to Bloomberg, “Jamie Dimon and Warren Buffett Have the Last Laugh on Bitcoin” saying,

“The cryptocurrency experts, who clearly didn’t see this coming, are blaming all sorts of temporary culprits — from jittery markets to “hard forks” (blockchain jargon for radical technical changes in a digital currency). But they’re kidding themselves. This is a long-term unraveling of all of the lies, exaggeration and populist fantasies that drove last year’s market mania.”

Who are these “cryptocurrency experts who clearly didn’t see this coming” that they imagine? TDV has been the leader in covering cryptos since 2011 and you’ll never see a quote from me on the mainstream television programming.

The last time they let me on there I made the host look like a fool so I’m now banned… just like I am from Fakebook.

Bitcoin has been declared dead over 300 times by talking heads in its short history and, guess what, it’s still not dead.

The fact of the matter is that this is a completely normal market retracement to a wild and crazy 2017.

And, the fundamentals have never been better.

Bitcoin is close to overtaking MasterCard in daily transactions, recently transacting $8 billion per day compared to Mastercard’s $11 billion. And the owners of the New York Stock Exchange are launching a crypto market, Baakt, which institutional investors can access in January.

Where will bitcoin go from here? No one knows for sure. But we are nearing our price target now with a potential low near $3,500.

The next bull run, likely to commence at some point in 2019, will likely make last year’s high look as laughable as 2013’s $1,300 high in terms of being so low that you can barely see it on the long term chart now.

.png)

But, that said, there are a tremendous amount of dangerous events going on in the cryptocurrency space, the least of which are the recent “Hash Wars” which could see most cryptos go to $0 and just a few do tremendously well.

You’ll never hear about any of that in the fakestream media television programming or from your financial advisor though, so you need to armed with the best information to make fortunes in the next crypto bull market.

All this weekend, and through until the end of “Cyber Monday” we are offering 50% off our TDV newsletter basic subscription at dollarvigilante.com/flashsale and also offering 25% off of both the coming Anarchapulco and TDV Summit events from February 12-17th in Acapulco, Mexico.

For less than $10/month you can get our insights into crypto, precious metals as well as becoming a Prior Taxpayer (PT) and much more by subscribing to our newsletter.

And, if you want to meet many other real experts, not TV programming propagandists, like Doug Casey, G. Edward Griffin, Ron Paul and dozens of crypto experts, come check out Anarchapulco (which is running Cryptopulco throughout the four day event) and the TDV Summit.

When bitcoin was nearing $20,000 I remember countless people lashing their own backs and wishing they had another chance to buy bitcoin below $5,000.

Now’s your chance. Make sure you get access to the best information to make an informed decision.

The Rothschild’s are a nefarious bunch of criminals but they know markets. And, Baron Rothschild once said, “The time to buy is when there's blood in the streets.”

The blood is in the streets. So, what are you going to do?

Wise man. I was one that took this advice (not from u) ;)

Buying of course.

Bought last night dropped 15% minutes after it. If you want to be a successful trader. Watch when I power up then put in a short trade. Haha my luck is a joke.

Posted using Partiko Android

@dollarvigilante, right on jeff! These types of articles are why I started following you in the first place. I’m gonna try to make it to Acapulco next year, too, I said the same thing this year and didn’t make it. 2019 is looking better. Not as good as the buying price of Bitcoin... but better.

And a big huge :cheers: on that federal reserved stance.

Lol, bro but seriously the bounce back time has came

So we've been following and subbed to Jeff and TDV since around $100 BTC, I remember distinctly I found him while I was doing my heavy reading and research on blockchain etc from my hammock around ~2013.

Anyway, as he rightly points out in this post. The TDV team have been consistently spot on with every call. At least in the time we've been following, almost 6 years now.

Ridiculously good content!!!

Gosh! I was so triggered by the title...