NEO inflation - how will it affect price of "Chinese Ethereum"?

NEO is one of the cryptocurrencies that have recently gained investor awareness. Shortly after the rebranding, the new version of Antshares became one of the top 10 cryptocurrencies in terms of capitalization. Tokens and NEO's network differ significantly from other popular blockchain networks. New tokes enter the market in waves rather than gradually as rewards for completing blocks, so NEO inflation is expected. What will be the impact of the planned introduction of additional 15 million NEO tokens on October 16?

Many investors and NEO followers have become used to the constant circulating and total supply values. It is precisely the amount of circulating tokens that will soon increase. The release model of the new NEO tokens will vary from those known from Bitcoin or Ethereum. Contrary to these, the new tokens are not a reward for mining blocks, but will be released according to the inflationary model assumed in the white paper.

NEO inflation model

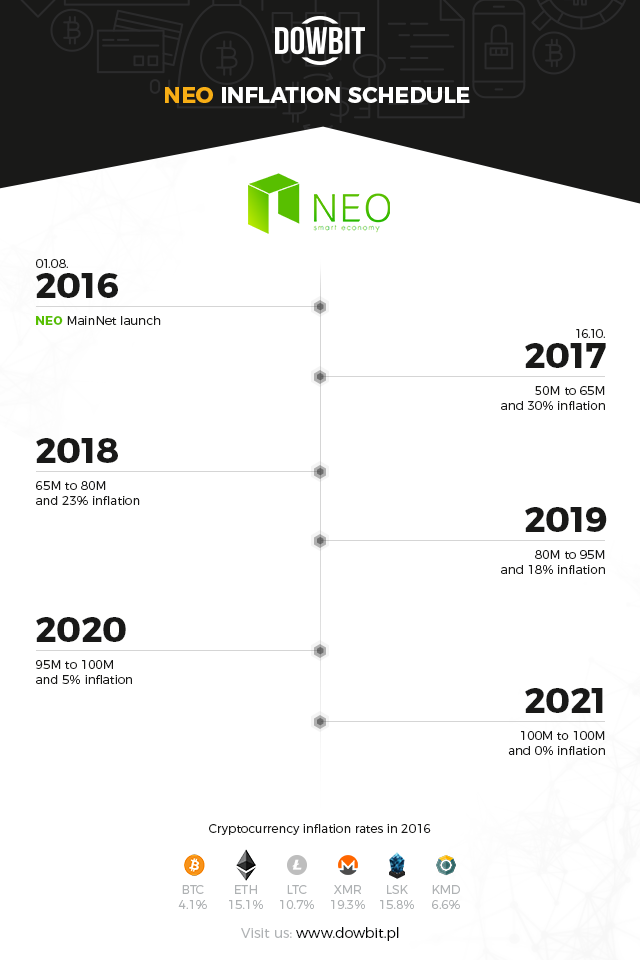

Ultimately, 100 million NEOs are to be available for users. The first round od additional tokens beyond orignal value of 50 million NEO was to be made available one year after the launch of the main project network, which took place on 1 August 2016. Until the,n they had been "locked" by means of a smart contract. Subsequent tranches of tokens are to be released in the upcoming years according to the following timetable

- Year 1: 50 million tokens in circulation = 0% inflation

- Year 2: 50 to 65 million tokens in circulation = 30% inflation

- Year 3: 65 to 80 million tokens in circulation = 23% inflation

- Year 4: 80 to 95 million tokens in circulation = 18% inflation

- Year 5: 95 to 100 million tokens in circulation = 5% inflation

- Year 6 and following.: 100 million tokens in circulation = 0% inflation

Compared to other cryptocurrencies, 30% in the first year may also be worrying, but inflation is falling to more rational levels in the following years and will eventually disappear completely.

Why bother?

At first, the proposed model may seem to be harmful to NEO holders - in theory the value of their investment will decrease. However, it is worth taking a closer look at what the funds raised in subsequent emissions will be used for.

- 10 million tokens (10% of the total) will be allocated to motivate NEO developers and project management board members

- Another 10 million tokens will be allocated to other developers responsible for the development of the entire NEO ecosystem.

- 15 million tokens will be invested in other blockchain projects based on NEO

- The last 15 million tokens will remain in reserve as contingency

Caution required

Recently, the NEO price has been subject to significant fluctuations. After having been priced at $50 for a short period of time in August, the "Chinese Ethereum" was severely affected by the ICO and exchange bans in China in September. In the nearest future, we are facing a series of events which makes it difficult to correctly predict trends related to NEO.On 18th of October, a meeting of the Communist Party will take place, during which Xi Jinping, the General Secretary of the Communist Party of China, will fight for re-election. Many analysts expect that, once he has restablished his position in the party, the chairman will take a more liberal course in relation to cryptocurrencies. At the same time, the approaching Bitcoin hard forks make many investors give up on altcoins in favor of BTC. Taking into account the possible price leaps of NEO due to the emission of new tokens, we recommend to remain very careful.

?keep up the good work?

Que buen trabajo ;)