The Hype Cycle.

Many of you were drawn to the crypto currency space during the last bubble. If not, then likely the previous one. Either way, both exhibit the same human psychology of masses. The hype and "fear of missing out" is what is often attributed to the titanic price rises in each cycle and to extent, it is true. However, many people don't know is that the rises in price are not directly the result of mass buying. Quite the opposite. Prices are driven up by large interests to bait the unsuspecting speculators to provide liquidity to secure an exit.

How many times have you looked at a rise in price and thought it must be a lot of people getting excited and buying? It's the easiest way to explain an otherwise very stochastic market phenomenon but today, we'll break that fallacy and reveal what is REALLY going on.

Large interests do not trade.

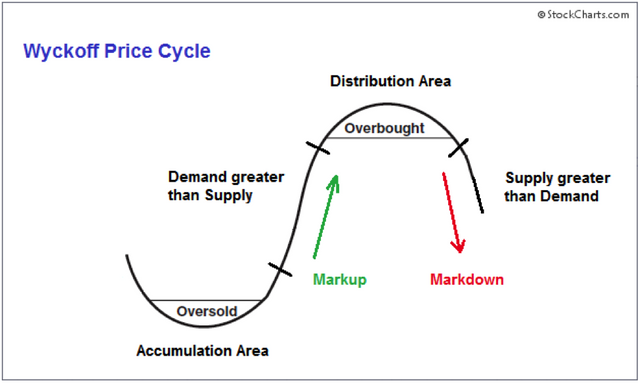

They market make. A lot of people assume market maker(s) are secret whales who just buy up the price to make everyone rich whilst taking on extreme amounts of counter-party risk. That is simply not how markets work. For the sake of this piece, I will refer to the market maker(s) as the MM. The MM can otherwise be known as the "Composite Man", a term coined by Wyckoff to encapsulate the large interests and MM's as a single entity. Most of the time, those who make dents in markets are not a single entity but are likely colluding with other large interests to a degree that they have control of the supply at a particular price range.

Principally, MM's provide liquidity and are always market neutral. That means, they make money from being both on the bid side and the ask side of the orderbook and make money from the spread. They can also hedge their positions through "options" or "futures" contracts to maintain position neutrality. In reality, the composite man builds a core position by exhausting the supply (sell, or buy) in a particular range whilst keeping their foot prints to the minimum. Prices can fall but the price action may not mean a lot of people are selling. On the other side, the price can rise, and it can also mean not a lot of people are buying.

MMs can initiate a "hype cycle" when their positions are ready. This means, all of the people who are building positions, buying, or selling have done so and liquidity at a certain price range has dried up. In this example, we'll assume that sellers are exhausted and we're coming to the end of bearish trend.

The beginning phases.

In terms of price, the hype cycle actually begins before the asset has any notable rally. The last hostile movement to the downside is accompanied by large retail selling - an opportunity to pick up a significant amount of a supply at heightened retail emotional states. In order for the accumulation phase to end, both time and further selling liquidity need to be absorbed. In Bitcoin, this can take anywhere from 6 months to 18 months. Usually sometime in between.

On the charts, this is evidenced by retreating volatility, narrowing price ranges, and generally trend-less price action.

As we can see from this chart showing Bitcoin prices in 2014-2015, the sideways consolidation lasted for over 290 days from the date of capitulation, to the breakout to the upside. What is important to note is at this point, all the sellers have stopped selling "at any price" and a clear basing of price has happened. This is the MM accumulation phase. Most people will be bearish so weak hands will sell during this period either from capitulating, or not being able to hold through the "boring sideways action."

Markup phases.

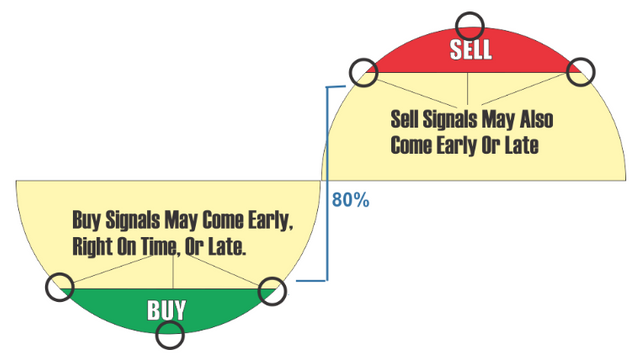

After a period of controlling a price range, the liquidity from the counter-party dries up. That is, aside from the selling pressure applied by the large interests, there is little selling left at those prices. Effectively, the MM has absorbed the selling from weak hands and are actually more likely to lose control to other large interests who recognise the bottoming market structure.

At this point, several test "pumps" are made to test selling pressure at the higher extremities of the range. These always collapse but it is usually the last opportunity for the MM to pick up some supply before they begin the mark up phase.

During mark up phases, MMs have already accumulated a very large core position and the cheapest direction to move the price is UP - in other words, they make what they hold worth more. In the wild west of crypto, where trades are mostly anonymous and exchanges are not at liberty to reveal who is executing what, it is easy for MM's to wash trade their way up the price. This is exactly what is happening. Instead of hoards of new investors coming in which is what the MM's want you to think, what is actually happening is that they are buying through their own sell orders (either with the same account or another account and moving money over) and creating the mark up. Early on in the mark up phase, the MM will show large volume but will be reluctant to really let the rest of the market buy much. This is because any coins bought by others will only mean sellers getting in the way and ultimately the MM making less money.

Every markup will be followed by a shake out to reduce the counter-party as much as possible from hitching a ride.

To accompany the price action upwards, more hyped up news and mass adoption narratives are thrown into the mix. The MMs have their hands dipped in every news outlook possible to try drive mass hysteria and euphoria.

Evidence of supply

After a few mark up cycles, the rest of the market begins to really take an interest. The control of the coins remain high, but they will soon be holding more coins than they want to, and be more depleted of fiat. The rest of the market is also beginning to enter the manic fomo phases and are becoming more expensive to "buy out" as the price goes higher. Up till now, the MM has not been relinquishing their core position. In-fact, they may have even increased their position through market buying through many small fish.

At this point, because of the multiple mark-up phases, the market is ripe and ready to get dip in and get their hands wet. The MM has conditioned the market to buy the dip, and to their unsuspecting menial trading careers, they are about to buy a never ending dip.

The MM begins to unload their core position creating the same "buy the dip" opportunities, except this time, they're letting go of their coins and buying up "dust" to hold up the price. By now, the market is most definitely reversing but the majority of the market are still in mass hysteria. Rallies after the reversal dip are instigated by the MM through buying thin order books to give the appearance of rallies. As people have been conditioned for years to buy the dip, the market maker will find liquidity at every dip that they wouldn't have before.

Nobody wanted to buy at 7k the first time it got up there, but once it's been to 20k and back, it looks like a bargain right? Well that's the psychology that the MM plays the market with to capture as much liquidity as possible. To secure their exit.

MM's know that in order to secure a high average exit. They need to take the price sufficiently high enough that they can continue to sell with enough interests buyers by the time they exit their whole position. And if they hyped up effectively, they may even be able to secure an exit significantly higher than the price of their core position.

Distribution and Markdown

People assume that the most amount of buying happens on the way up, but its actually the opposite. Distribution is where the market reverses as the supply moves from the large few interests, into the hands of the many. This completes a transfer a wealth from the many to the few, and the asset traded was just a medium for this transfer of wealth to happen.

Bitcoin is an attractive medium for transferring wealth from the many to the few because of it's anarcho capitalist narrative. It is also a young and mostly immature asset class which has yet to prove it's real value to the world. These uncertainties, regulatory grey areas and early day characteristics make it a very ripe instrument to push around if you have the money and by all means, large interests are actively doing this day in and day out.

*Altcoins are no different in terms of market hype dynamics. They simply operate on smaller floats, and smaller time horizons.

Congratulations @holdo! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.