NEOUSD analysis: as low as possible?

NEOUSD updated trading scenario. Is NEO worth buying? Where will the “Chinese Ethereum” stop falling down?

In this post I applied the following tools: fundamental analysis, all-round market view, market balance level, volume profile, candlestick patterns, trendline analysis.

Dear friends,

I go on my series of cryptocurrency price predictions. Today, I would like to analyze NEOUSD.

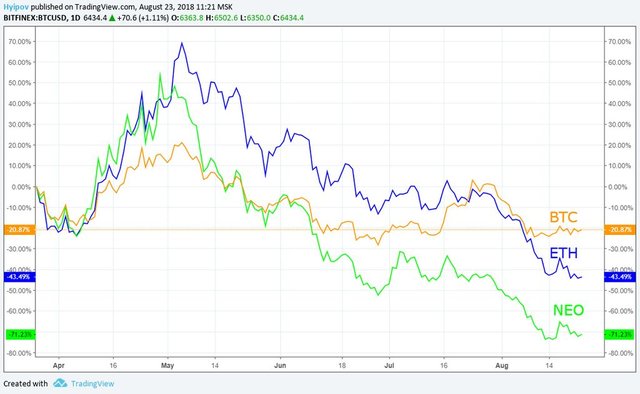

If you compare the NEO trendline with Bitcoin and Ethereum, you’ll notice that the “Chinese Ethereum” is performing far worse than the other two (see the green line in the chart above).

In the chart above, it is clear that NEOUSD ticker is trading 50% lower than the market.

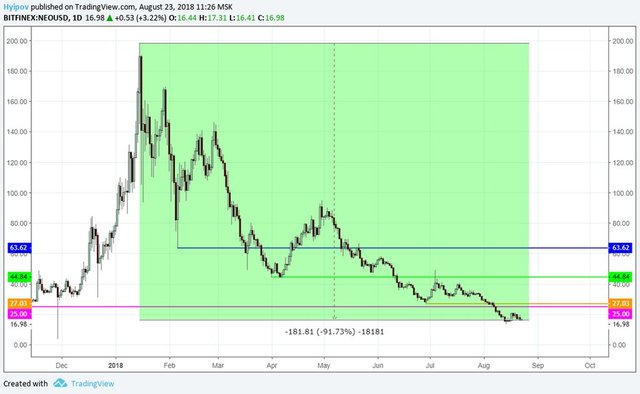

If you try to analyze NEO bearish trend in more detail, you’ll see that the total correction is 90% from the price high.

At the same time, NEO price has broken almost all support levels by now.

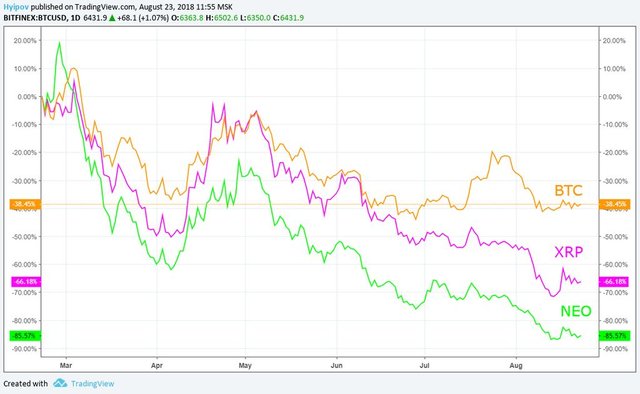

I won’t deny that the situation for all cryptocurrencies is rather negative now, but still, there are some coins that even in this context perform quite well.

According to the NEO trend, it is not of that kind. Even Ripple, despite all its flaws, looks better, according to the trading dynamics.

The matter is that NEO is not supported by its developers.

Having spent quite much time, I managed to find the reason. It’s all results from the fact that NEO, in fact, is a centralized network. The developers, presented by Da Hongfei (NEO creator) states that the issue of the complete network decentralization would be discussed only after the blockchain is updated and stabilized.

On the other hand, many criticize the updated version itself, which is called NEO 3.0. It is because the new one suggests the NEO divisibility.

Investors worry that NEO divisibility will send the rate down.

Another negative factor is that GAS distribution is to be changed. Earlier, each, even passive, NEO holder received a kind of reward in the form of GAS tokens. Due to these rewards, NEO long-term holding yielded an obvious profit, as the GAS price was increasing, following the NEO price.

However, Hongfei is concerned by the growing number of the lost keys to the wallets, where a certain amount of NEO is kept. As a result of the immediate distribution among all wallets, a part of the GAS amount is also missing on the lost wallets. This problem was called the “black hole addresses”.

After the updated 3.0 version is developed, the GAS tokens will be distributed only among active users, who participate in voting and reach consensus.

Another change, able to trigger the NEO selloffs, is the introduction of GAS tokens annual inflation. I haven’t found any details of the innovation, but the talks about the inflation concept introduction alone can make NEO lose its appeal for long-term investing. It should result from higher risk of lower passive income due to the declining GAS rate amid the inflation expectations.

To be fair, I must note that the update version has certain positive points. For example, they are planning to introduce sharding for NEO 3.0 that will allow processing transactions tenfold faster.

Also, the new version will make the network more stable and the smart contracts will become more steady and safe.

Another news bit, able to affect the NEO rate in the near future, is about NEO Blockchain Challenge that will be held in Tokyo since August 24 till August 26.

This event is, basically, a big contest of various software designers and developers, who are going to write codes in the NEO blockchain. The contest prize pool is worth as much as 2 000 000 JPY.

I’m sure this event is to draw more attention to NEO, as a development platform and should improve its status for common people. Besides, it is a perfect chance to present the blockchain capacity to the wide audience.

I think these are all fundamental factors for now.

Let’s move on to NEO technical analysis.

In the monthly NEOUSD chart, you see that trading volume of the last two bars is increasing, and the August candlestick hasn’t closed yet; and so, the coin is being bought at the current levels, supporting bulls. On the other hand, the candlestick low hasn’t reached the support level at 13.19 USD, marking the low 50 cents higher, suggesting strong buyers in the zone.

The manipulators’ willingness to support the NEO rate is reasonable, as the next important level will be the price low at around 3.74 USD. Such a drop will scare off many NEO holders, making investors ignore the coin for a long time.

The NEO weekly chart proves the buyers’ support by two big volume bars (marked with the green circle).

The NEOUSD ticker has dived rather deep below Keltner channel's lines. Now, its bottom border at 27.99 and the central channel line at 41.49 are the closest growth targets for the ticker, in case it goes up.

In the NEOUSD daily chart above, there is a clear bearish trend. Two things stand out. It is a very large trading volume, suggested by both volume-by-price and volume-by-time indicators, and a series of bullish convergences, which indicate that the instrument is rather oversold and is going to go up.

These two components make up a strong critical mass for the price surge.

Based on my experiment strategy, I calculated the most appropriate Renko brick size for the NEO 4H chart. I got it equal 6 USD.

These above charts, do not, unfortunately encourage buying NEO. There are sell signals in the candlestick chart, sent by both moving averages’ meeting place and MACD. Renko proves this idea, sending similar signals to sell NEO.

Summary:

From a fundamental point of view, until the NEO blockchain update is complete and the arguments are settled down, it involves very high risks for any holder. Therefore, I don’t think the long-term investors will support the token in the near future.

On the other hand, technical analysis indicates more active NEO purchasing at the current levels, which is a sure sign of the NEO price growth, and so, it suggests that there is some point in short-term speculating.

Nevertheless, I can’t say, the NEO trend is likely to reverse soon. Before the ticker goes down in the bearish correction, it is likely to make another try to test the support level at 13.19 USD.

That is my NEOUSD trading scenario.

I wish you good luck and good profits!

Regards,

Mikhail @Hyipov by liteforex.com

wow, this is a great analysis. thanks! You win a new follower.

Wow, this is a great

Analysis. thanks! You win

A new follower.

- criptoreview

I'm a bot. I detect haiku.

Coins mentioned in post: