Block66 - Securitizing Mortgages on the Blockchain

.jpeg)

Home advance, one of the various biological frameworks that helped build this world. In the earlier years, contracts ha recolored some thought and various people are tending on home advances. Being said that, the focal point of the home credit system and now everything is executed hasn't changed much in the earlier years. But as our existence kept improving, the old biological network of the home advance structure isn't any more favorable and people stand up to various difficulties while endeavoring to attract with it.

It might obvious after that introduction. We are examining Block66, a blockchain undertaking to improve how contracts work, make it more accommodating and obviously, make the experience more updated.

What is Block66

.png)

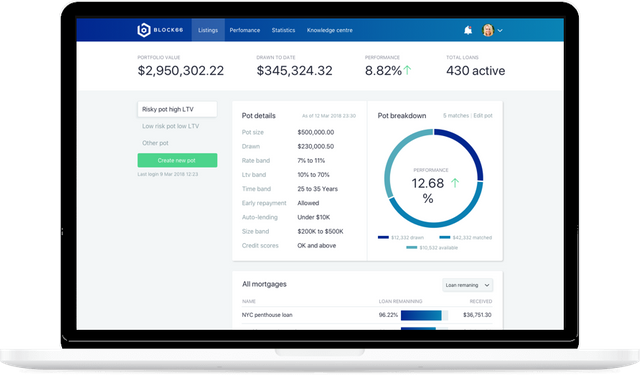

Block66 is the place borrowers and advance experts relate in one business focus with full straightforwardness. Block66 intends to empty the tendency to go to the nearby banks or credit affiliations and make the experience of advance master and borrower more fulfilling than whenever in ongoing memory. The business focus itself will be public, clear and exceedingly motorized to ensure the customer experience is fast and keep the dealings continue perfectly. Not simply that, Block66 will offer lower cost and lower peril than the customary home advance system.

Block66 won't work like the regular home advance structure. It's based on blockchain and sharp contracts are a big bit of it. A similar number of things will be motorized, rather than holding up in the line or sitting tight for a long time, with Block66 it will be possible to do the whole thing brisk and viably with substantially less process. Block66 will give probably the best features for better advancing and borrowing learning which can't be found wherever right now.

Market Potential

The market of offering, advancing and borrowing are up 'til now creating well ordered. The USA alone has a profound home advance market of $9.9 trillion and the worldwide has an immense market of more than $32.9 trillion. In this monstrous market, some bank pioneers are rising and taking control of the offering system completely. Especially in the US, verifiably 50% of total credits were given by three best banks alone. This has some incredible drawbacks as in 2016, the rate dropped by 21% which is bad for the market.

While standing out high-pay countries from low with typical pay countries, the high-pay country has an ordinary of 21% individual with remarkable credits where low to average pay countries simply has 2.4%. The perfect model would the country India with only 2.3% individual having a home credit.

This two prescribe an enormous open entryway in the home advance publicize and that and in addition insinuates that not very many people have a relationship with a tolerable home credit. Block66 is concentrating on these people and partner them together

• Borrowers

• Lender

• Broker

• Underwriters

• Solicitors

Existing Problems

Starting at now made reference to before, the whole structure hasn't changed much in the earlier years and it's undoubtedly stacked up with various problems. They obstruct the system, makes it long and costly. Some of them are below.

Tight Criteria

The criteria to get a home credit has changed and has become considerably more firmly in the earlier years. For example, the center budgetary appraisal from 2005 to 2016 has extended from 700 to 732. This is bad news for a few people as these criteria can't be met easily and finally bringing down the overall public who are truly getting the home advance.

Paperwork and Time

The written word required for a home advance is a gigantic aggregate as a considerable measure of records are required. Both borrower and bank need to contribute a lot of vitality gathering assorted records, sharing them, responding to requests and various distinctive things. This whole technique is astoundingly inefficient and isn't invaluable for anybody. In the US and Canada, a single home credit application takes around 45 days to proceed completely.

Transparency and Fraud

In the home credit promote, there's a colossal absence of straightforwardness. When in doubt, borrowers are constrained to trust in brokers where is unquestionably not a single bit of straightforwardness and not simply that, borrowers have no genuine method to check the moneylender number on the contrary side. Trusting in brokers has incited various cheats.

Barrier

There's a barrier for budgetary expert/moneylenders to enter the market. Especially little moneylenders have it disagreeable as the time designation is unnecessarily like 5-25 years. Yield is most time around 4-10% which isn't profitable for 5-25 years hypothesis.

How Block66 will Help

Block66 can affect this Mortgage industry from various perspectives. Not simply that, it can give a much smoother and fruitful course for moneylender and borrowers. In their whole technique, the blockchain will have a significant impact.

Criteria

The criteria to enter the market in the customary structure is a big one. Especially the credit band score which is hard to meet. Block66 won't stretch out the issue to a ridiculous degree. With block66 a center money related evaluation of 661-780 which is a gigantic improvement differentiated and the present structure. It will allow more people to get into the structure.

Barrier

With the help of Block66, credit pros will little proportion of store can in like manner enter the market. With the Proof of Loan disengaged into tinier divisions, enables anybody to enter with no problem and finally extending liquidity and viability.

Transparency

Everything that is done inside the Block66 organize is recorded on the blockchain and can be gotten to by anybody. This shows straightforwardness which is non-existent in the present structure. Close by that, all moneylenders will give their criteria and essentials ahead of time in this way make everything more clear. Block66 will enable borrowers and broker to approach many advancing offer over the stage.

Automated

Block66 will embed the robotization wherever possible and adventure current advancement. As an issue of first significance, robotization will improve the whole system and make it speedier, profitable. Enabling the advance authority and borrowers to work simply more capably. Block66 will in like manner attempt to embed robotization on report checking but to guarantee the endorsement, there will be lenders. Rather than holding up 45 days and ceaseless hustle, Block66 gives a fundamentally less requesting course of action.

Security

Undermines this side are typical. Motorization is extraordinary but it can moreover attract swindler. Most fakes are either caused by broker, borrower. Besides, because of a considerable measure of volume, all over they go missed and unchecked. Block66 systems will hail unruly articles for review by virtual agents and credit experts making blackmail altogether more clear to spot.

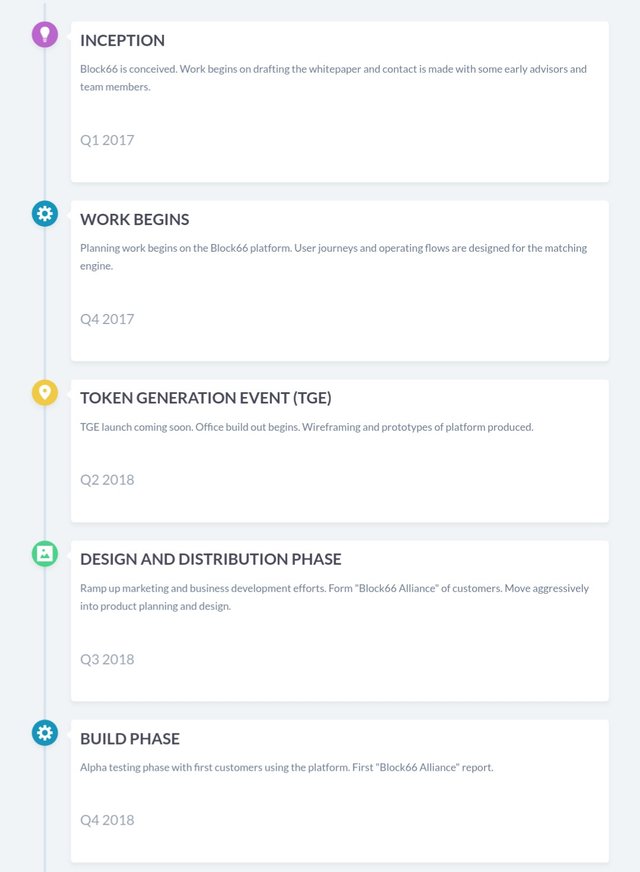

Roadmap

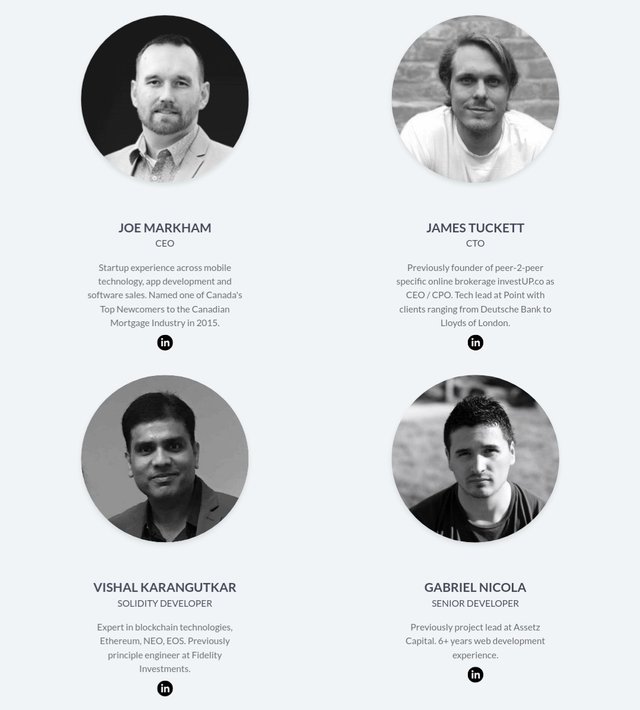

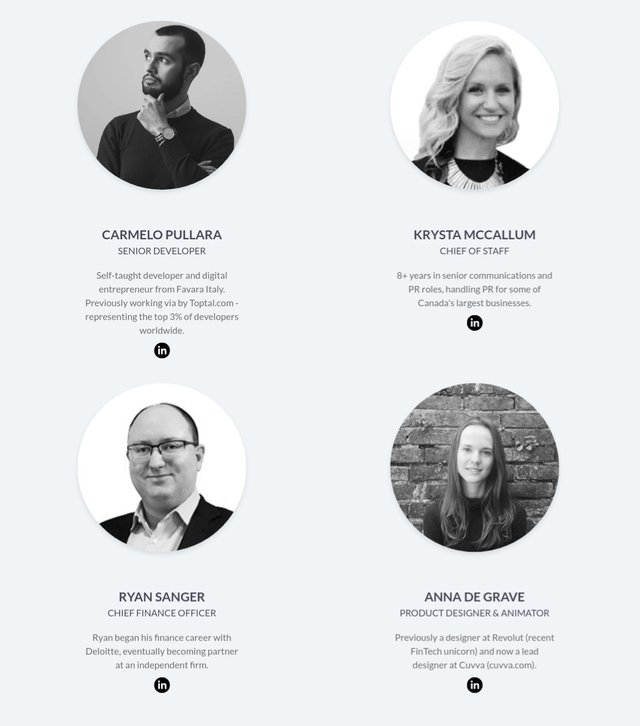

Team

ICO Details

• Token Symbol: B66

• Token Protocol: ERC20

• Total Supply: 300,000,000 B66

• Token Sale Amount: 135,000,000 B66

• Token Price: $0.10

• Soft Cap: $2m

• Hard Cap: $12.285m

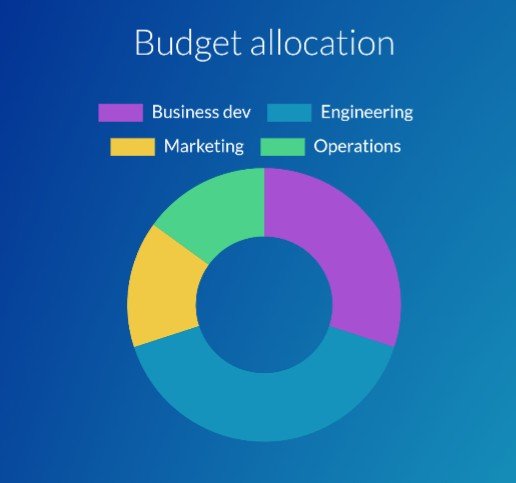

Distribution

Conclusion

Block66 masterminding is greatly exceptional. Starting at now, there are a couple of endeavors for land but no that are working for home advance plan. The capability of Block66 is massive as they have a perfect orchestrating about how to execute everything.

Discover more about Block66 in these connections:

Website: https://block66.io

Facebook: https://www.facebook.com/Block66Official

Twitter: https://twitter.com/Block66_io

Telegram: https://t.me/block66_Official

Whitepaper: https://block66.io/topics/b66/resources/Block66_Whitepaper_English-update.pdf

My Profile

BTT Username: Sakib0194

BTT Profile: https://bitcointalk.org/index.php?action=profile;u=1841935;sa=summary

Telegram Profile: https://t.me/Sakib0194

Bounty0x Username: Sakib0194

ETH Address: 0x8c26fD54c42B06593258b86b9D0F91CC9e5E64e5

They really knows what they are doing

Undoubtedly a really cool project. I have seen this on some big media site.