Streamity: The Cryptocurrency Exchange Revolution

With the proliferation and the rise of cryptocurrency, the need for new spaces where they could be mobilized, negotiated and protected also grew. This is how the exchange companies emerged, the main channels to negotiate with cryptocurrency and exchange them for fiat money or other cryptographic currencies, which over time have been incorporating various functions.

These new exchanges began to operate as centralized businesses, with characteristics similar to those of a bank, despite the fact that, par excellence, cryptomoney is conceived as decentralized. However, the very growth of the ecosystem has led to the advancement of decentralized exchange platforms.

Under the centralized scheme there are many recognized exchanges, such as Coinbase, Bittrex, Poloniex, Kraken, Bitfinex, Bitstamp and Binance, among others. These are platforms where an intermediary, in this case a specific company, intervenes in the relationship between two people who wish to make an exchange of cryptomoney.

As the crypto-currency market grew, the first centralized exchange businesses that emerged began to perform functions that brought them closer to the classic financial intermediation of the banks, but more adapted to the cryptosphere.

This intermediation includes the conversion of fiduciary money to digital currency, one of its main activities, and it must interact with regulated entities in order to be able to operate with the parities between fiduciary money and crypto-currency. With the emergence of the altcoins, progress was made towards the exchange between cryptographic pairs. There are also different types of wallets available for storing money, even with secured custody. As does Coinbase, one of the centralized exchange houses, which secures funds up to $250,000, and recently launched new products for custody and investment in kryptom currencies.

Something that characterizes centralized platforms is that the user does not own the cryptomoney he or she acquires or exchanges, as he or she does not have the private key to the funds. In addition, the data and operations performed are maintained on a centralized server. This has the disadvantage of increased vulnerability to computer attacks and the risk of fraud by cyber-criminals. There are experiences that have left bitter flavors for investors.

An emblematic example is the case of Mt.Gox, one of the pioneers in the exchange that controlled more than 70% of bitcoin transactions, where thousands of people lost their money due to the disappearance of 850,000 bitcoins in 2014 (200,000 of them were found in 2017).

At Mt.Gox there was a mixture of the two risks, hacking and fraud, because, in the first instance, the CEO, Mark Karpelès, reported being the victim of an attack on the platform. However, the investigations later detected possible alterations in the balance sheets of assets, which led to allegations of theft.

A different but equally onerous attack suffered Bitfinex in 2016 with the hacking of 216,000 bitcoins, and it had to pay the funds to its clients. While in Binance a malicious bot made a massive sale of tokens last March, without the consent of the users. These and many other cases have caused governments to exert more pressure on these platforms through strong regulatory measures. This exposes them to audits, legal controls, payment of taxes, and other requirements that may involve limitations, relocations, and even closures.

In this sense, it is worth remembering the 13 exchange houses that are being investigated by the New York Attorney General's Office in the United States, the Upbit audits in South Korea and the companies that emigrated from New York in 2015 after not obtaining the BitLicence (legal permit to operate). Also, there was the closure and confiscation of the exchange funds, BTC-e, for allegedly being used to launder the stolen funds at MtGox.

I personally think it was a mistake to combine cryptomes that have a decentralized nature with a centralized service, Streamity thinks the same as I do and has therefore created a decentralized application to solve this problem.

What is Streamity?

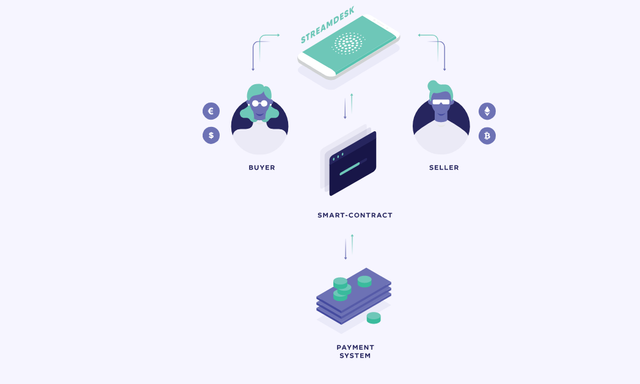

Streamity is a project focused on offering a decentralized platform for exchanging cryptocurrency, its main objective is to offer an ecosystem where users can exchange cryptomes to fiat or vice versa without the intervention of an intermediary through the use of intelligent contracts.

Streamity will guarantee users that they can benefit from the developments of the cryptomarket, without any disadvantages such as the risk of fraud, account theft, etc.

StreamDesk, the core part of Streamity's ecosystem, which will ensure the exchange of user assets through the P2P network and smart contracts, is a decentralized application that provides a fair, reliable, transparent and user-friendly service that encourages users to invest in kryptomes without fear of losing their money in the process.

Apart from the exchange service, StreamDest will also offer news, analysis, many educational and investment resources so that both experienced and novice users can have enough knowledge to invest in tokens efficiently and not lose money in the process.

StreamDesk is the first P2P application to use smart contracts to protect transactions and users, smart contracts are a great advantage for users as they eliminate middlemen and thus avoid fraud and high commissions by which the user loses much of their profits during the investment.

For more information watch this short introduction:

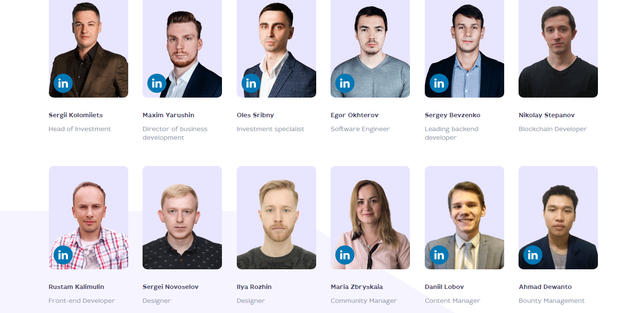

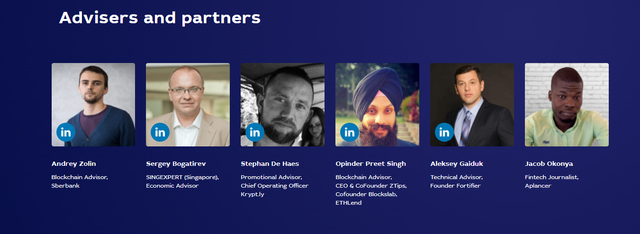

Team

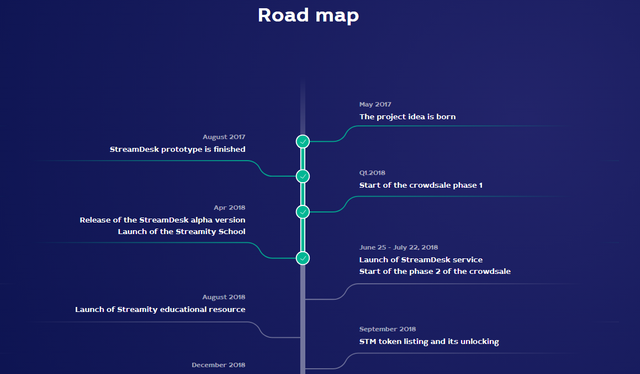

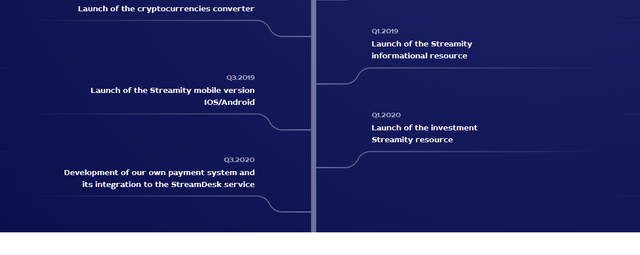

Roadmap

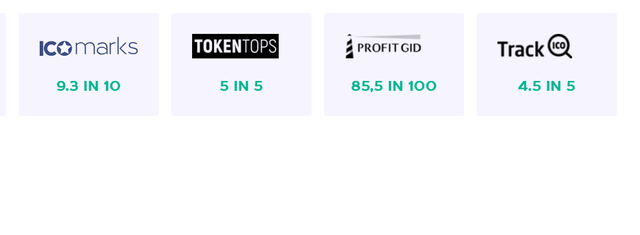

Expert Rating

More Information & Resources:

- Streamity Website

- Streamity OnePager

- Streamity WhitePaper

- Streamity Youtube

- Streamity Facebook

- Streamity Medium

- Streamity Twitter

- Streamity Telegram

- Streamity Bitcointalk

streamity2018

Source

Plagiarism is the copying & pasting of others work without giving credit to the original author or artist. Plagiarized posts are considered spam.

Spam is discouraged by the community, and may result in action from the cheetah bot.

More information and tips on sharing content.

If you believe this comment is in error, please contact us in #disputes on Discord