Open Letter to TIM- Talking.im - Investment of the Year or a Rat's Nest?

Let’s talk about Tim. What follows is not a post. It is a communication. We have millions of readers, while the TIM telegram group enjoys approximately 6000. TIM is a matter for all people and classes, both inside and outside the TIM project. The following information may then also be important to those who are now or may soon be interested in investing in TIM.

For those of you currently in the TIM telegram group, or perhaps those who work at the foundation, you most likely have an opinion of us formed through numerous statements made by Prabhat Singh (Kumar?). While much of what follows will be critical of him as a CEO, nothing herein is retaliatory or tit for tat. Pinning messages about our professionalism, which are then shared hundreds or thousands of times compels our response to defend our good name, or by inaction accede to these unwarranted claims. Primarily, however, our intent is to bring some clarity to the TIM investors and also to the thousands of new ICO investors that is necessary for a successful TIM ICO. We have no way of knowing how many previously interested investors have simply experienced the current nonsense and have chosen not to invest. Much of the data that follows resides in the public domain and is easily available if you know where and how to find it. Arguably, it is likely many investors do not. We feel it is our responsibility to share what we know and have possession of in order to protect the majority.

Jon and I are simply asking if you might keep an open mind and form your opinion of our professionalism and motives at the end - after you have weighed the facts. On public platforms, Prabhat has accused us of lying, unprofessionalism, not performing and other things. His actions may well rise to be actionably liable.

We've recently arrived at the conclusion that communication with the investors was devolving into chaos that must be negatively affecting the upcoming sale. We reached out to Prabhat to offer our help. Clearly, as our relationship has been misrepresented by him, we felt publishing the factual record was necessary. Please understand that we could have done so long ago when his attacks began, but there comes a time when action is forced upon you. Getting into the mud is extremely distasteful for us and we apologize now.

Notwithstanding numerous past emails, which would only serve to embarrass Prabhat, we’ve chosen to offer the following recent email exchange so you may judge matters. The dates are important.

Below is that email and also Prabhat’s response.

On Mon, May 21, 2018 at 2:41 AM, Gary <[email protected]> wrote:

Prabhat, I am watching the current discussions re. TIM on the telegram and other sites. Our readers are asking questions. I’d like to help if we can be of service. This is not a solicitation. Clearly, any help I can provide will be at no charge. TIM remains important to us. I continue to mention it in posts and feel the TIM landscape is so vast we could reasonably find new and exciting information to share with our readers weekly.Currently, we enjoy a substantial readership Prabhat. I believe it may be in excess of 2 million regular readers worldwide. Any post we make will have approximately 1,000,000 reads in the first 24 hours, often twice that. This does not include our social media footprint of greater size, or the that our news posts are often shared worldwide by other crypto outlets. What this means is we can help, if you think we might be of service. Shortly after writing about TIM we worked on rolling out EBTC’s ecosystem. At the time EBTC had a telegram group under 8000. Within 60 days that group was just under 60,000 Prabhat. During that period our readership more than quadrupled. In hindsight, some may argue as to our part, but EBTC did not. Not once. They enrolled us in their eco group as their sole media and marketing source.

We’ve endured thousands of attacks Prabhat, with some data loss, but our last best numbers indicate that your Tim article to date has had 10-20 million reads. Until two weeks ago it was still averaging 55,000 weekly reads. I reach out to you to inform you that recently the number of reads has increased. This may indicate people are turning to sources outside your telegram group for answers. I’ve been watching. What you are accomplishing is amazing. I have been and remain a huge supporter, believing we have barely scratched the surface of all that your TIM technology will mean to the world. I think you must appreciate that TIM's future is largely tied to a public that watches, but may not as yet be investors. Current interest in TIM far exceeds the people in your Telegram group with whom you communicate. We feel this current interest has migrated far outside your telegram or Facebook groups. Meaningfully addressing TIM’s current circumstance and future plans on a public forum will pay future dividends. Who knows if TIM's goodwill would suffer absent public discourse at this time? In my experience good press is always appropriate, having no downside. If you are interested in shepherding your goodwill or sharing your vision, as any CEO might be, only you can communicate your intentions and I would like to help you to that end.

Communicating with a telegram group may win you the battle and lose us the war. I'm not certain you appreciate how large is the TIM footprint, or the general interest you have created Prabhat.

I am unclear what issues you feel you may have with Jon or CRYPTOCRYTERION. I am not Jon. I apologize for any misunderstanding and I assure you our interest was ever to help you in any way we could. Having no input from you other than the information already made available to the public on your telegram, Facebook or other news sites, gave us, a crypto news and opinion outlet, no meaningful or credible way to appear to be a reporter or foreteller of upcoming events, or particularly a viable partner to TIM.

Having said that, I would like to help. Our readership is asking we say something. Clearly, this sharding, inability to trade TIM tokens, missed release date, continuing ICO sales, pre-sale group, post pre-sale group, locked in v. unlocked in, etc. is confusing. TIM is enjoying a life of its own beyond your groups and that falls into our domain. The community at large is asking for some clarity on just where TIM is going. The opinions people develop today will affect their future interest in TIM. With all the investment opportunities in crypto today anything construed to be poorly run or deemed to be less than transparent will carry such an impression for years, regardless of future accomplishments. If we can share your story with a few million people perhaps we can meaningfully contribute to the future of TIM and Crypto writ large.

I am offering you an outlet to reach millions worldwide to clarify these matters and share your vision. I believe it’s a good story Prabhat that needs telling often. I think TIM may well change this world and be as important to our next 20 years as the Internet has been to our last 20.

I am not a techie. I’m a business analyst in as much as I think outside the box to ask, what if? It’s a shame you and I were not communicating from the start. Never have I encountered anything with the possibilities of TIM tech.

The millions we will reach may well result in tens of millions more. If I can be of assistance in growing your goodwill and positive public opinion or help TIM grow in any way, I remain at your service.

Please understand that we must post something and base our opinions, or best guesses on whatever information is available to us. It would be my sincerest pleasure to write as often as needed and about any subject you feel would benefit TIM and the community.

We also run polls, often having 50,000 to hundreds of thousands respond. If you have a specific demographic or market interest question, please let me know.

Respectfully,

Gary

Prabhat’s response to our offer on the investor's behalf follows.

From: TIM Dev <[email protected]>Sent: Sunday, May 20, 2018 2:43:31 PM

To: Gary

Subject: Re: TIM

I have faced a lot of criticism due to unprofessionalism.

I am not interested in dealing any further.

Best

Notwithstanding a few typos, this was a rushed offer to the CEO of the TIM Foundation to help FOR FREE when some clarification was clearly needed. NOTICE that clarification has still not taken place. If you consider the date sent it could be argued that we foresaw the current chaos and were trying to help by using our platform and communication skills to assist the investors and world in understanding the current state of TIM. Prabhat declined our help, which MAY have been of immense value to you. Clearly, PRABHAT feels we insulted him by suggesting in some way he was less than professional. He did not accuse us of lying or failure to live up to our agreements, as he’s told the public. Perhaps the point you might take away is simply that the man running this investment and holding your futures is willing to put his feelings and ego ahead of your investment futures. If the upcoming ICO fails or if customers witnessing the current goings on become reluctant to risk their business with this foundation, we will never know if our offer might have made a difference; that horse is long from the barn.

Talking about TIM is not a simple subject these days, and it should be. The reason for the confusion is well founded in a lot of hidden information and intentionally VAGUE or inept communication. When smart people ask a question, answering it honestly and fully is always the best course.

The sad fact is that the obscured information is of little consequence, BUT perhaps embarrassing TO those responsible. What should have been a simple 100% positive multi-platform press release explanation has DEVOLVED into an ongoing Telegram disaster happening 20 words at a time. If you are on the sidelines, this is akin to witnessing a train wreck in slow motion. For every answer the TIM team gives that may resolve one person’s issues, it angers or confuses others. The reason? There are multiple classes of investors all having come at different times with different understandings. Most appear unaware of the others causing answers for some to confuse or conflict with others. There have been at least 5 token smart contracts written and closed, several in the past few days. There have been over 900 changes to the whitepaper in the past week. And there is much more. As it stands now, this one step forward 6 back pace, puts Prabhat Singh is in real jeopardy of losing the entire community and also ensuring the ICO is a failure. While what follows will be objectively brutal to some, Jon and I want to do all we can to dispel and clear the confusion and make a case for the success of the TIM project.

Keep in mind, we hold 180,000 TIM tokens already, they are physically in our wallet. OUR INTENTION IS MERELY TO CLARIFY (We are not looking for anything at this point but to clarify.) On a side note - Why pay someone when you're not happy with the service they performed a month prior? As to the ongoing questions in the chat groups (One of which was deleted.) - you SHOULD notice a strange trend. Someone asks a question, an admin answers, and then scrubs the original question. This leaves a literal internal narrative only where it appears the administrators are talking to themselves.

After the insults and accusations made public by Mr. Singh, one may fairly ask why is this important to us at all. Jon and I are here to find legitimate ICOs, and tell people about them. The reason our name is Crypto Criterion is that while most of our readers are concerned with token metrics, we are concerned with project metrics. It’s clear that the majority of investors who look at an ICO probably read the whitepaper. They may even understand the technology. Few however appreciate the real truths that govern business, truths applicable to any business. Many companies fail from underfunding. But underfunding is nothing more than the scab on the cut. Underfunding is the first EVIDENT failure made by a inept management team. Which means what is most important is the people you are entrusting with your future. Printing CEO on a 2x3 card does not make it so. We vet the team. So do the customers.

If the highly regulated and ethically sensitive financial companies become aware of this investor dissatisfaction or think for a moment there exists potential litigation for breach, slander, liability - they will run away. Or if they simply read these group conversations, reviewing the minute-by-minute data changes and THEN determine that the management of this company is unreliable, or in some way not up to the task, Banks will not walk, they will run away. None of these companies will involve themselves if even the appearance of impropriety or of poor investor relations exists. For that reason, the current matters need to be explained, understood and resolved quickly, or the Tech will not matter, and TIM will be back to a taxi company in a blink. Right now, if I were an interested bystander witnessing the confusion, obfuscation, contradictions, retractions, anger by the team or the apparent shills insulting anyone asking an unscripted question; I'd be worried. The many changes to the site, graphs, and contract, as well as the banning of investors from Telegram if they disagree or demand more than some cryptic reply about future news is a startling fact that anyone can corroborate on their own.

To add to these matters, Prabhat has locked himself into a cast-in-stone ten-day ICO sale window at a time when ETH network gas prices alone could kill any ICO. This is not taking into consideration the current minimum buy-in of $1000 USD. Perhaps it should have been a 60-day sale, and perhaps the smaller BUYERS should HAVE BEEN CONSIDERED. for when you give only ten days to act. Unfortunately, PRABHAT gave himself no wiggle room. This ICO will go off and may well collapse of its own weight. Perhaps hard money INVESTORS will buy ANY SURPLUS regardless, but what about the simple ICO investors? What happens if the sale only caps at $10 million not $19 million and we burn 50 million tokens? Will the Seed people buy the balance? Will Prabhat engineer yet another ICO? We have no idea. But history may provide answers.

Clearly more and more people daily are asking themselves, what? We have no idea what’s what with TIM's management right now. Outwardly, the growth and future prospects, if reported honestly, suggest TIM may well be the first monster Blockchain company. With the numbers and story changing daily on the TIM home site or from minute to minute on Telegram, it’s very difficult to rest our reputation on an unqualified endorsement. But an endorsement this will be. It must, however, be with full transparency derived from the information, as we understand it. A phoenix rises from ashes, not from glitter.

Jon and I have been attempting to put a story together for 9-days and have thrown 7 completed articles away. We’ve spent no less than 30-hours on the phone in the past week discussing nothing but TIM. To add to the confusion, our network of blockchain people, who should know, are suffering in the dark with us. If together we can’t figure this out, there are just 2 reasonable answers in our opinion, someone doesn’t want it figured out, or the people in charge don’t know either. There also exists a third, much more intricate option: perhaps there is something hiding in plain sight that nobody wants to be seen.

Failing to anticipate or credit the confusion that would/must follow this discussion, and rather than posting a clear, well considered and dependable explanation of what is happening, thus lifting the veil from all the subplots, Prabhat Singh (after changing his name to Prabhat Kumar) evidently thought it more important to clear up the confusion of his name. While almost certainly an innocent act, every executive would understand the optics. When you have the myriad of concerns we have right now, the team tasked with clearing the smoke away should not be adding wood to the fire. In this phase, even the first time investor would credit PR and optics being of far more import than virtually all other considerations. In this day, with all the crypto scams of the past, public confidence in the veracity of the management team is a currency far more valuable than the TECH. Possibly 1 out of 100 people understand the tech, the rest FORM their opinions and decisions to invest based on their assessment of management and their outward appearance of trustworthiness. I cannot imagine the damages such an act would result in should a CEO in a US IPO change his name or alter the stock allocations continuously in the days prior to a launch. I’ve seen this dismissed on the telegram group, which speaks volumes about the investors. This is not a game folks. Words and acts matter far more than many clearly understand.

Recently everyone in the US was asked to file SEC accredited investor forms. Prabhat said not to worry; "TIM was not believed to be a security." It says it is a security in the Whitepaper. I understand the Howey test. If any token was ever a security it’s TIM. I’M TOLD PRABHAT CLAIMS TO HAVE A LEGAL OPINION NOW THAT TIM IS UTILITY. I do not think it’s arguable at all. TIM IS A SECURITY. IF AMAZON ISSUES A TOKEN MEANT FOR CUTOMERS TO SHOP WITH, THAT IS A UTILITY TOKEN. YES, YOU CAN TWIST LOGIC AND CLAIM THAT BECAUSE PEOPLE USE THE TIM COIN ON THE BLOCKCHAIN IT’S A CURRENCY INTENDED FOR CUTOMER-2-TIM FOUNDATION COMMERCE, BUT THAT’S REDICUOLOUS. EVERYONE BUYING TIM TO TRANSACT ON TIM’S BLOCKCHAIN RAISE YOUR HAND. EVERYONE INVESTING IN TIM TO GET RICH AND SHARE IN REVENUE RAISE YOUR HANDS. SECURITY HAS IT. The distinction, while creating rights and remedies are not critical to TIM’s viability. It does, however, emphasize that you cannot have a CEO making instant legally binding statements on a telegram site that investors may then legally rely on. It’s downright dangerous for the investors, the seeders, and the company as a whole.

It’s not TIM tech that concerns us at all. It’s a CEO apparently "learning" as he goes, or indifferent to these realities - this is not to say that the man is not very intelligent. I would NEVER argue THAT. It may sound as though I’m not on board with TIM but despite Prabhat’s continued need to announce he "off-boarded" us, (that’s a story for the future) WE ARE all in. The facts are TIM seems 100% real from a technology point of view. The financial world will discover TIM. It is more likely than not TIM investors MAY be the next generation of Facebook or early Apple investors.

I want to make the case strongly for Prabhat and TIM. The ever-changing stories and metrics make that problematic from an empirical standpoint. Without intending any slight whatsoever, if you are going to communicate to a financial world that largely communicates in English, you should accept your communication limitations and hire a spokesperson for your company. If you add the language issues, which were the genesis of our difficulties with Prabhat originally, to his constant attempts at being cryptic or using incomplete sentences in his posts, it becomes clear why many are confused. A good CEO does not feel the need to be the hero in every story.

I could compare charts or the ever-changing facts and excuses, but I’d never get this done. So I’ll try to clear up a bunch of things:

• Prabhat began sales of TIM3 in late 2017/ early 2018. (We never received any information when requested to fill in this basic information.)

• Prabhat also began sales of TIM after this. This suggests that while selling TIM3, he was already aware that he would be selling TIM. (Simple logic based on the ticker symbol. The project is called TIM. Why else would you save the "better" ticker symbol for a later sale unless you knew it would happen?)

• TIM was the first TIM token. It poses questions why he would enter into an expensive TIM3 sale and concurrently begin selling TIM.

• The buyers were unaware of these facts as very few were involved prior to this change-over period.

• The second sale of TIM that began on 1/19/18 continues today as the presale. (Theoretically, this is what is referred to as Stage 1 in other sales since the presale was a very long one.)

• There have been numerous "TIM Tokens" to date: TIM3, TIM, STIM etc.

• The original TIM3 contract called for specific performance. The fundamentals follow: There were to be 41 million tokens sold. 37 million were reportedly sold in a successful ICO/Presale. The token allotment math was changed to reflect positively. The sale was a "failure" based on given metrics. The promised end price for one or more investor classes for the TIM3 token was $1 by the end of the ICO. (If you invested 1 penny you were "guaranteed" 100 times your money back.) The Tokens were to be saleable at $1.00 and would be on exchanges AT THE TIME THAT SALE ENDED (Four or more months ago.)

• The original TIM3 tokens are valueless other than representing a claim of a like amount of the new ICO tokens. (TIM)

There is one more issue for 187 of the original presale investors. Tim is a hybrid token which shares the revenue of the foundation. We have been surprised to discover most have no idea what they’ve invested in. In all fairness, Prabhat Singh is not merely a genius with the tech, but he’s also an extremely forward-looking investor-centric individual. TIM is the first of its kind. 100% of on-blockchain and 15% of off-blockchain incoming revenue is distributed to the tokens in real time by smart contract. This is why you may be stupid, disgustingly, filthy rich. Not because TIM trades on KuCoin. Any changes made make the previous comments invalid, as well as confusing invesors with what their current status is, as well as the status of their investment.

Consider the billions of dollars reasonably coming into Tim in several years. All that money goes to minting new tokens and being divided equally and shared with the token holders on a per-token basis. The function of this will be difficult to implement given the different investor classes, the different weighted tokens, the "sharding" phenomenon and the actual hard cap versus the amount of tokens sold. As it stands you are pretty much paying to mint your own tokens in the future, the same tokens you were promised 10x, then 6.67x, then a whole host of other allotment multipliers to make the value represent the $1.00 USD quoted.

For current and new investors, despite all the questions, there are no issues. TIM is a 100% buy and you need read no more. The 187 or so original investors will experience some dilution of revenue sharing from the understanding associated with the TIM3 sale. Originally they were investing in a token cap of 41 million tokens. So each token was 1/41-millionth of 100%. This works like this. Under that agreement, if there were $110,000,000 IN REVENUE to share, each token holder (assuming 41 million tokens) would get $2.682 per token times your total tokens.

Under the new metrics, they will now own 1/110 million tokens. Under the same terms, they would now receive $1 per token or $1.69 less each. Yes, it’s a hit but in Prabhat’s defense, in addition to being incredibly smart, he SEEMS TO BE is an extremely honorable man. And that is enough for me. Recall that in his original deal with these 187 original investors he had promised them $1 in value for each TIM3 at the end of the ICO. With him now selling tokens for $.15 (15 cents) he’s devalued their tokens by 6.6666 times. To make up for this he’s making everyone whole by giving each of them 5.67 tokens for each one they own. $1/$.15 = 6.67. They all have one token. Over the next 3 years, Prabhat will give them 5.67 more for each one they have. The incredible thing is this: While his communication skills just plain suck, and would give many pause about his reliability, from a legal standpoint - when the original TIM3 smart contract defaulted his obligations to them in real terms LIKELY ended. But since those terms were agreed to he is honoring them. What should be most important to anyone on the fence is this; it appears that he is paying for these tokens himself. Now for the 187 of which we are a part, yes there is a loss, but clearly, Prabhat understood that a 41 million token supply would hinder TIM’s growth - resulting in a greater share of a smaller pool for us. If you are launching a tech the world "needs to have" then 41 million tokens cannot saturate or service that need, nor could that small amount be transacted enough to mint sufficient new tokens to keep pace with growing demand. Clearly, Prabhat put the brakes on, rethought the numbers, settled on 110,000,000 meeting future needs and while also providing for growing adoption.

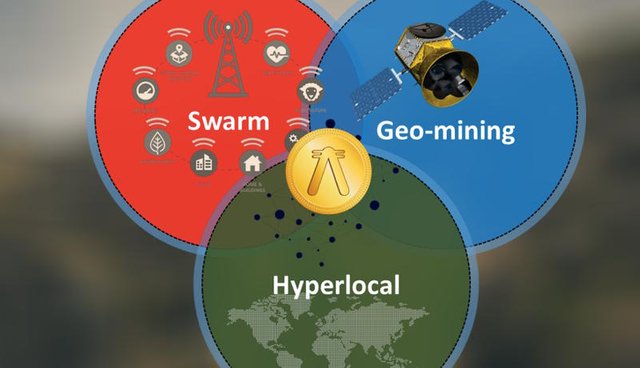

On a final note, I would just like to make an observation regarding the scope of this technology. When we were first hired to bring a US presence to TIM and market it to the masses we were told that it was a "geolocation" token that would be used for "automatically hailing a taxi" and the like. Obviously, this seemed like an extremely viable and necessary blockchain technology that could be used in innumerable projects. A quick, or better yet, a VERY in-depth look at the entire TIM site (www.talking.im) would make it seem as though the project I am referring to is now defunct. Although this technology can still be used for the original applications mentioned, the scope of the project has taken a dramatic turn towards a "world currency" that banks can use to transact via the blockchain. I believe this new application to be a million times more powerful, while still keeping the viability of the original goal. While this change is necessary for the growth of TIM, I believe it should be noted that this change went without mention. One day the scope was changed and that was it, without explanation TO PRIOR INVESTORS WHO MAY HAVE RELIED ON THE GEOLOCATION COURSE FOR INVESTING. THE GEO TRACKING SEEMS TO HAVE TAKEN A BACK SEAT. THERE ARE MANY HIGH-SPEED TRANSACTIONAL TOKENS. IF TIM’S SPEEDS ARE REAL TIM MAY WELL CRUSH RIPPLE AS THE WORLD’S LEADING TRASACTIONAL PLATFORM.

So for my fellow investors, Prabhat could have and should have simply been forthcoming with his investor/partners. Hopefully in the future when - not if, he makes an error he will simply ADMIT IT - explain it and move on. As to the sharding, BOUNTY, BONUS OR WHATEVER IT IS TODAY, if a smaller percentage means having 10,000 dollars rather than a larger % share MEANING ONLY $1000 - sign me up. I was not angry because shit went wrong. I hate being treated like a mushroom. Hopefully, readers will factor our rocky relationship and accept the affirmative case we make for TIM being a credible investment.

THE TECH IS THE TECH. IT'S REAL OR IT'S NOT. AS FAR AS WE ARE CONCERNED ALL THE CURRENT PROBLEMS AND CONFUSION STEM FROM EXTREMELY INDIFFERENT OR POOR COMMUNICATION, NOT THE TECH. SO IT STILL ALL HANGS ON A MANAGEMENT TEAM FOR WHICH WE HAVE RESERVATIONS - SO MAKE YOUR OWN DECISIONS.

Thank You for Reading,

Gary and Jon

Posted from my blog with SteemPress : https://www.cryptocriterion.com/open-letter-to-tim/