Crypto volatility: The phantom chicken and egg problem

Price volatility was the defining feature that garnered cryptocurrencies attention and made Bitcoin a mainstream name. It was only when the technology was reframed from the perspective of money that people started jumping on board the train in hopes of not missing out the next gold rush. What was equally important was that the technology and the accompanying applications built around it managed to bypass traditional monetary systems allowing anyone and everyone to join this train. All of this while the authorities tried to come to grips with how to categorize and rein in this driverless train barelling through the wild west.

Throughout all of this, what was interesting was that no institutional money had formally entered this cryptocurrency space. Leaving discussions about the underlying blockchain technology aside, the reason for this usually boiled down to cryptos being too volatile for day-to-day use. This was a legitimate concern as there was a reason why all these institutions were still dependent on the financial industry which we all share a love-hate relationship for: they played a vital role in stabilizing the monetary systems which enable trade. In essence, one of the reasons we 'love' the financial industry is because they provided certainty that the price of things around us did not fluctuate from one day to the next.

This is an often underappreciated aspect of the financial system as the only one thing we hate more than banks is uncertainty. But as I argue here, our need to quantify the world around us goes against the chaotic nature of reality. As such, the monetary system that we use today is just a relative approximation of the world around us where value is assigned rather than generated by the item itself. At its most basic, cryptocurrencies are volatile today due to a volume/maths problem but at the fundamental level, volatility is also the outcome of human subjectivity. Essentially, we are trying to solve a chicken or egg dilemma in order to chase a mirage.

Which came first?

A lot of the volatility in the crypto market is a result of a basic maths problem:

Without a sufficiently high capitalization, large trades can result in significant price movements. However, more money will only come in when there is less uncertainty around price movements.

As such, we are stuck in a chicken and egg dilemma which faces any institution, currency or asset as it tries to scale. A startup raising its valuation by a million dollars might double its share price while that same million dollars might be a rounding error for multinationals. On a more personal level, it is the same reason why I would be excited to get $10 off a $20 meal but will be disgusted if the car dealer offers me a $10 discount on a $10,000 car.

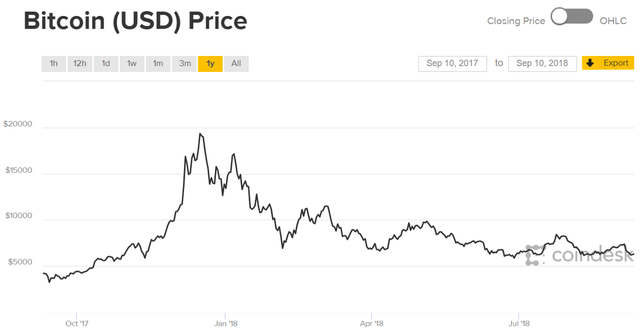

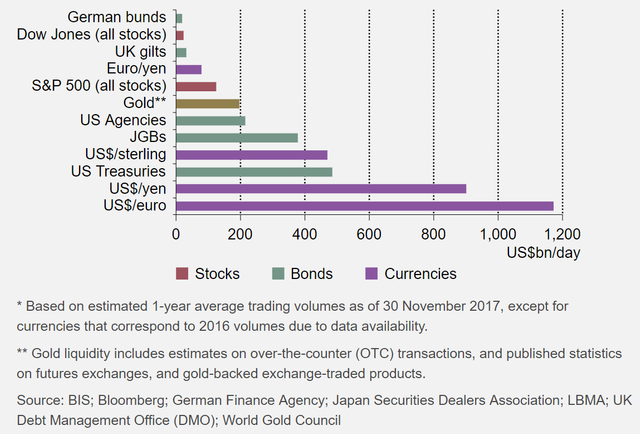

For scale, the daily dollar trading volume for cryptos sits around $12bn (Sept 2018, I had to change this number a few times while drafting) while the NASDAQ alone sits at $130bn. Moreover, the gold market trades close to $200bn daily while the USD/EUR pair alone trades more than a trillion. No matter how cryptos are classified (asset, collectible or currency), it is clear that it is still in the very early stages.

This is taking into account that due to lack of regulations on ICOs, some cryptos have extremely unrealistic valuations. For example, if only 20% of the coins are distributed onto the market at a total of $10m, the market cap for that token will be at $50m. Although the 20% figure is generally around the standard distribution for companies going through an IPO, it must be noted that there is very little in the way of someone just creating an ICO. Moreover, holding/lockup requirements can currently only be enforced via code so in most cases, people will just have to trust that the creator will only sell after the stated period. Sites like Coinmarketcap do address this issue via using circulating supply instead of total supply in their metrics but are less stringent with regards to their listing criteria.

An interesting characteristic of the crypto markets which arises due to it operating in a fiat dominated world is that ICOs create market sell offs via a crypto liquidation effect. Essentially, as cryptocurrencies are not widely accepted (yet), the only way its monetary value can be realized is through exchanging it to cash. Additionally, as is the case for majority of ICOs now, users will have to purchase crypto (usually ETH) first in order to even participate in an ICO. All of this, coupled with thin order books (due to much of the supply being in off-exchange wallets, such as this wallet which holds 111,114 BTC), amplifies the volatility in the crypto markets.

Ultimately, the first movers bear the brunt of the risks hence why the promised payoffs are so enticing. However, the amount of risk which a day-to-day business will have to undertake to utilize cryptos is still unacceptably high. This is especially so for alternative tokens. As the crypto market grows, the volatility will slowly but surely decrease as can be seen from Bitcoin's decreasing volatility. It is also important to put this into perspective as gold is probably more volatile then what most people think with annual movement consistently entering the double digit percentages.

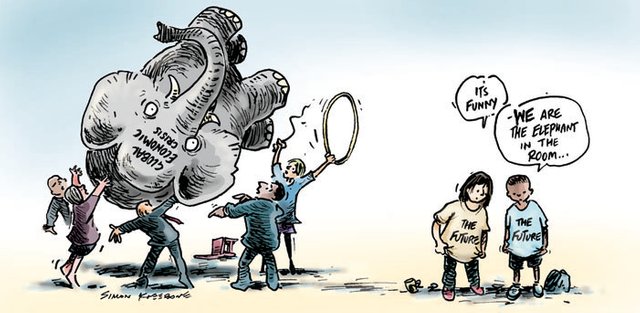

An elephant walks into the room…

All of this trading of course doesn't address the elephant in the room which is that much of it is actually a zero-sum game with no actual value being generated. To be clear, this is not exclusive to cryptos as stock exchanges such as NASDAQ experiences daily trade volume of ~1% ($130bn of $11tn market cap) even though global GDP growth tends to hover around 3% annually (barring any shocks). Nonetheless, the ratio of daily trading volume to total market cap for cryptos is much higher at ~5% ($13bn of $240bn market cap). All of this is to say that much of the profits from trading actually comes at the expense of another player.

Of course, the ratio of speculative money in the crypto market needs no introduction given that most people will be able to define a lambo better than explaining DLT. The community itself is made out of people who thrive on volatility and are therefore more likely to trade just for short-term profits. Moreover, the lack of regulation on market manipulation also results in exploitation of the market itself as can be seen here. Even when users play within the rules, the prominence of trading bots in the crypto market amplifies the market swings much like how high frequency trading (HFT) caused the flash crash in 2010 (HFT has since been discouraged via regulating trade times, I recommend the book Flash Boys if you're interested).

Putting aside all the talk about getting rich for a while, it must also be noted that the nature of many cryptos also lends itself to greater volatility:

- Virtually no minimum trading value: Transaction costs becomes the main barrier and even then transaction costs can be in the fractions of a cent (depending on the chain)

- Absolute transaction costs: The cost for transacting 1 coin or 1,000 coins is the same at any given time

- Easier access to cryptos: As long as the user has a smart device, internet, and money, the user can obtain crypto without having to verify their identity or having access to a bank. The number of users on crypto exchanges surpasses those in traditional brokerage institutions

- Digitally tradeable: The technology itself ensures ownership of the digitized asset negating the need for auditing or even physical movement of the asset

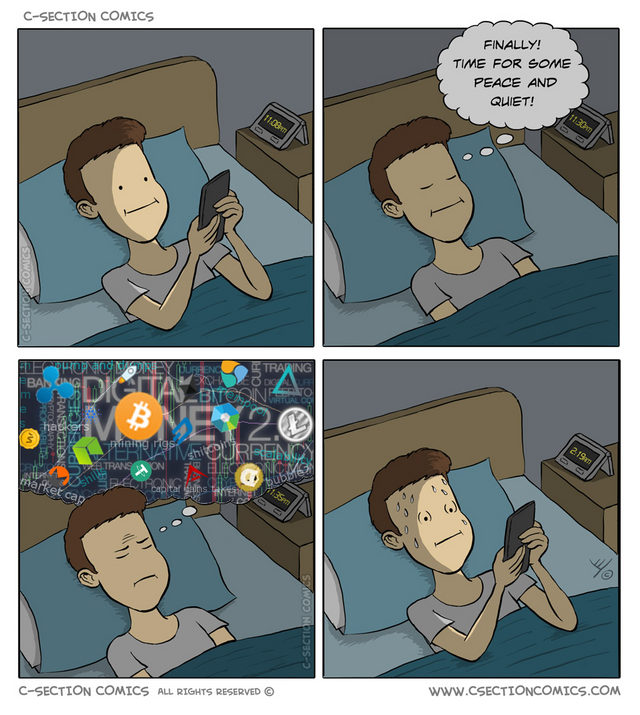

- Market never sleeps: Exchanges are open 24/7 resulting in many sleepless nights

Consequently, this reduced friction to trade results in greater volatility as well as many anxiety disorders. Nonetheless, the incidence of these disorders were minimized in the small group of people who started contributing towards the community.

The stablecoin mirage

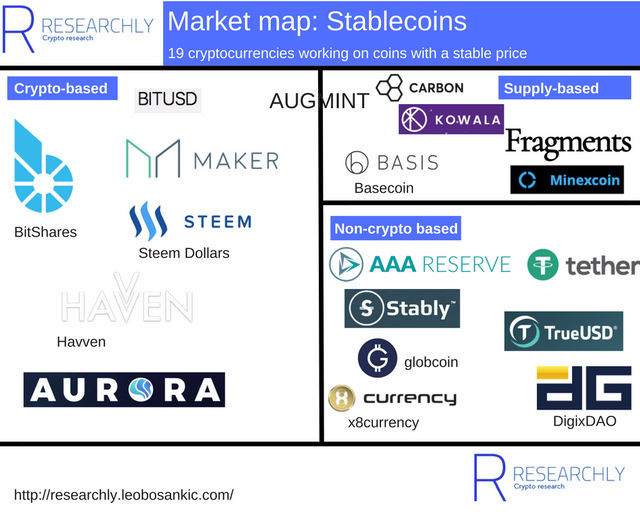

Of this group of contributors, there are those who chase the holy grail of crypto: the stablecoin. It is envisioned that with the creation of a stablecoin, an asset that maintains a stable value against a target price, it will provide stability, scalability, and resiliency. This would significantly reduce the risks of entering the market therefore paving the way to mass adoption. The stablecoin is definitely a goal that the community should strive for but I think it is also important to acknowledge that the perfect stablecoin is also a mirage.

This is because the perception of an asset's value is mostly based on expectations about its adoption by the community. In other words, we assign value to the world around us rather than deriving value from the item itself. An important implication of this is that the dollar value that we see on any item is actually a function of demand and supply. In effect, this value is relative as we all derive different amounts of utility from each item. Essentially, our need to quantify the world makes it possible for trade but simultaneously goes against the chaotic nature of reality. As such, completely decentralized stablecoins is likely just a fantasy as it will have to be totally abstracted from the real world and in doing so becomes completely useless.

One consequence of this abstract nature is that it becomes even harder for people to assign a value for intangible assets and what could be more intangible than information being stored in cryptographically-secured blocks running on a distributed digital network. As such, perceptions around cryptos are much more volatile and easily influenced by media outlets. To makes matters even worse, cryptos are the perfect fodder for mainstream media as I argue here. As a result, the volatility is amplified even further as it is driven by a lot of rumors without much technical analysis. Often times, an opinion from an influential figure can dictate the market direction as all the speculators buy and sell on the news.

Decentralized = volatile? (Warning: skip if you don't like technical stuff)

A question that then needs to be asked is whether decentralized networks are inherently more volatile. A lot of the stability in current markets are maintained via the various banks, monetary authorities and government policies. We might say that they have done a bad job historically given the many spectacular crashes but how much better will a decentralized system fare?

A good point of reference for this would be the IMF. The IMF was established as a multilateral institution to coordinate exchange rate arrangements among nations. Their immediate focus was on avoiding the competitive devaluations of the 1930s while also encouraging liberalization of the world trade system. It was anticipated that there would be a worldwide system of 'fixed, but adjustable' exchange rates, with adjustments coming only when there was 'fundamental disequilibrium'. As such, the IMF operated on the basis that exchange rates were generally stable enough for trade to be conducted but intervention was required during any black swan events, the trigger for which was usually the inability of a country to continue servicing its debt voluntarily.

There is a lot of debate on whether the 'austerity' measures required for IMF aid were too strict or even if the measures taken were effective at all but one thing is certain, even in hindsight, people can't seem to agree on whether the IMF served its purpose of of economic stabilization (this is a good read for IMF effectiveness). If subject matter experts can't agree on a result post-fact, what about a decentralized vote on the future exchange rates to stabilize currencies. The free markets might be a solution but it must be noted that globally, there have been many celebrities who were elected as leaders only for their incompetency to become apparent.

The answer then as always is that it depends. It can be said that decentralized systems are inherently more volatile as it will be more susceptible to social contagion but centralized solutions are not immune either. Centralized solutions modifies or keeps free market mechanisms in check but the lack of transparency leads to a lot of uncertainty and blind institutional trust. The debate around trust in institutions vs trust in networks is a whole other argument but what is certain is that the way incentives are structured and the limits placed on a system will critically affect the stability of a system.

As a general rule, countries tend to stabilize their currency by trying to match their money supply with changes in Real GDP (nominal) and inflation rates. This is achieved via a mix of reserves maintained by trusted institutions (Federal Reserve, European Central Bank, etc.) and complex financial mechanisms (bonds, collateralized debt obligations, etc.). Consequently, the dual nature of currencies being both a medium of exchange and a store of value will have to be balanced within this framework.

In theory, this should ensure currency stability but as always human unpredictability ruins any perfect system. Essentially, the value of a dollar will be dependent on the expectations which they have on its value in the future which leads to positive/negative feedback loops. If enough people believe their dollar will be worth less in the future, they will start spending/selling it resulting in a self-fulfilling cycle.

The inverse of this brings an interesting thought experiment: If people expect a currency/asset's value to rise, they will continue pumping money into the asset up till a point where all the value that people want to store has been put into the asset. In effect, the more money people put in an asset in hopes of realizing a profit, the more the asset will function as a store of value especially if the asset is fixed in supply as most cryptos are. A possible result of this is that if an asset captures a large enough volume and proportion of an economy, it can actually function as a stabilization mechanism due to the same volume paradox we were addressing before. This is an effect some smaller countries do make use of by pegging their currencies to USD.

If this does happen to cryptos, it brings up the question again of whether a stablecoin is needed when the large majority of value will likely be locked up in the most likely candidate: Bitcoin. Granted, there still needs to be a medium of exchange role for day-to-day usage but this could be carried out by other coins/tokens or even in the same design as gas in Ethereum. Bitcoin will effectively function as a decentralized global reserve but rules will have to be in place to avoid any major runs. It will be interesting to see how this plays out especially given the single utility token model that many ICOs adopt today.

I would highly recommend this article on the DAI for those interested in the more technical aspects.

Balancing abuse of power with social contagion

This is what lies at the core of human civilization since the days of Plato's Republic. When power is concentrated, it lends itself to abuse but without the lack of authority, coordinating society falls apart. This extends into our value systems as well because money is effectively the most direct way society organizes itself. As such, the underlying consensus mechanism of a system will dictate the expectations regarding how value is distributed.

Although it can be argued that expectations and social contagion are what led to extreme volatility, much of this speculation is based on uncertainty due to the lack of transparency around pricing of risk. This is not to say that increased transparency via the blockchain will reduce uncertainty as this will definitely result in information overload for the masses (we all seek the laziest route after all). However, distributed ledger systems is a step in the right direction as more trust is distributed to networks rather than walled-off institutions. Moreover, programmable money will enable higher resolution for monetary policy.

Ultimately, it all comes back to the human element whereby people still prefer stable and relatively secured growth for their investments over time (except traders, they are a different breed altogether). As it stands now, the crypto market is still not large enough and by extension, not stable enough, for mainstream adoption. Moreover, volatility impacts are compounded by the ratio of speculative money in the market, lack of regulation, as well as natural characteristics of many cryptos: reduced trading friction, abstraction from physical world, and hard to understand fundamentals. Reduced stability is definitely the most important non-technical hurdle cryptos must overcome but it must also be recognized that true stability is also a phantom.

In the next article, I will be diving into why many of today's' tokens will essentially be worthless if they do become mainstream (the token velocity problem). Till then, thanks for reading and I would love to hear your thoughts on this. :)

Coins mentioned in post: