Rookie breakdown of the top 20 Crytpos

Hello,

In an effort to teach myself via the more experienced Crypto investors out there, I was curious what kind of feedback regarding the following weighted Stochastic method I put together the other night. As a forewarning my experience is primarily with Stock/Bond analysis and Asset Allocation. The volatility of Crypto has me believing that my typical methods need to be tweaked.

I'm looking for a solid method to time my purchases as I build toward a diversified portfolio.

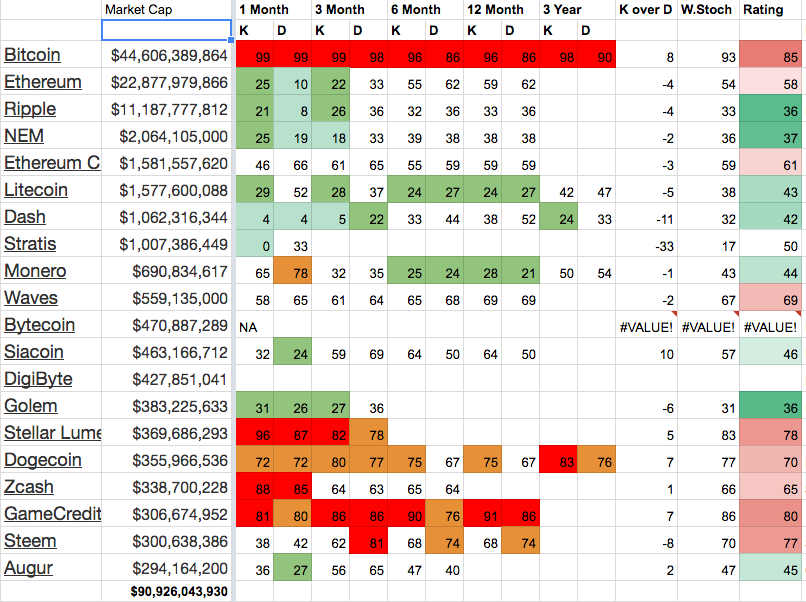

For the top 20 Market Cap Cryptos I gathered their Stochastic K% and D% values (from Crytocompare) for each time period shown below.

The K:D average - if below 20 indicates undersold and thus a buy signal, if over 80 it's over purchased, and thus look for value trade.

The K:D delta - should indicate the trend for that time period, if positive, should indicate a raising purchase point and a soft signal to buy.

The K:D Delta is then subtracted from the K:D average to provide an overall buy or trade signal.

Weights are by time as this will lower volatility in the final result (i.e. the three month is weighted 3 times as much as the one month. The three year is weighted 12 times as heavily as the three month.)

This method led to my trading out some Etherium for Golem (as I held way more ETH than BTC at this time).

That's my utilization of stochastics as part of the technical analysis. I think I can add another indicator by comparing the change between the K:D Delta from one time period to the next to increase signal strength there i.e. a positive K:D that is below 20 would be a much stronger buy signal than a negative K:D in the same range.

My idea then strategically would be to return to this chart monthly, or bi-weekly, and rebalance my portfolio opportunistically and not just automatically. A 'Smarter' Cost Dollar Averaging approach to purchases.

The actual portfolio holdings I'll have to save for another day, as that is a fun theory all onto itself.

Thanks for reading and any constructive feedback you might share.

This is extremely useful. Though, as a rookie, I'm not familiar with stochastic K% and D%. I could google this, but I thought I'd ask instead... what resource do you think is most valuable for understanding these concepts?

I would love to feel a bit more rational with my investment decisions.

Thanks for reading.....I'd suggest investopedia.com, they have some good starter articles:

This is also a good breakdown for crypto specific technical analysis: http://www.coindesk.com/bitcoin-traders-know-technical-analysis/

Hope it helps!

I enjoyed the article. How about a daily chart example? Pick a coin and chart the price and your indicators for April through May.

Interesting idea. If I get the downtime I'll knock that out for you.

I intentionally avoid short term analysis as I get pulled in to the immediacy of it and find myself day trading again. Though it has cruised my mind to write an API for that exact thing.

As profitable as day trading can be, it can also override things like eating, exercise, going outside.....:) Worse yet crypto is 24 hours around the clock.