Digitex: The new futures exchange model

On the other hand, we are used to no service is free. However, the team behind Digitex Futures Exchange wants to end this concept and be a free commission tool. The proposal is to eliminate commissions and replace them with the use of an Ethereum-based token: DGTX.

All transactions carried out within the platform are dominated by DGTX. What does this mean? That all users must have DGTX to make commission-free movements. This encourages the massive use of the token by traders, allowing the exchange to replace the commission charged by selling a small number of DGTX annually.

The decentralized government system allows users to decide on the issuance of new tokens.

The futures

Futures are contracts set for a specific date to buy something. Contracts of this type are of great importance in the world of commerce since they facilitate the stabilization of the prices of goods and cryptocurrencies.

An exchange without commissions is no longer just a dream

The DGTX token replaces the commission fee by dominating all transactions that occur on the platform. It is a protocol token compatible with ERC-223 in the blockchain of Ethereum. Instead of charging commissions, new tokens will be created.

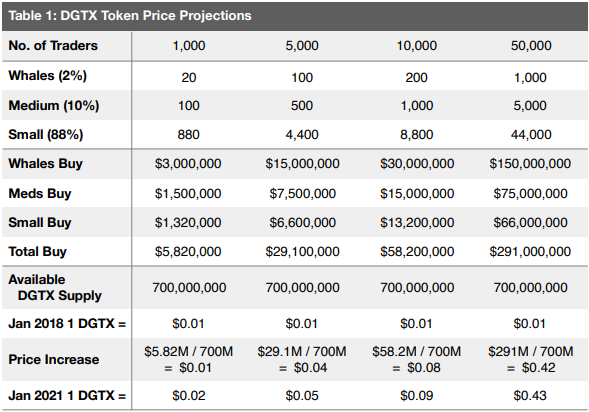

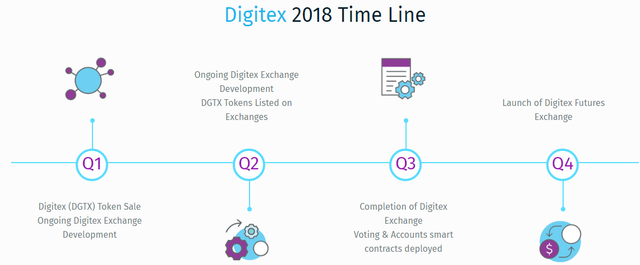

The DGTX token acquires its value as it is necessary for commerce without commissions. All traders must have these tokens in order to open new businesses and markets. Also, is important to know that there will be no new tokens issuance until two years after the platform is launched since the costs will be supported with the income of the DGTX ICO.

During this period, users will be constantly acquiring DGTX tokens. It is expected that by 2021, the Digitex Futures Exchange will start creating new tokens to cover the following operating costs:

- Development of software.

- Servers.

- Equipment.

- Marketing.

All this will be submitted to vote and each user will have a voting power proportional to the number of tokens he has, that is 1 DGTX = 1 vote.

Key elements of the DGTX token

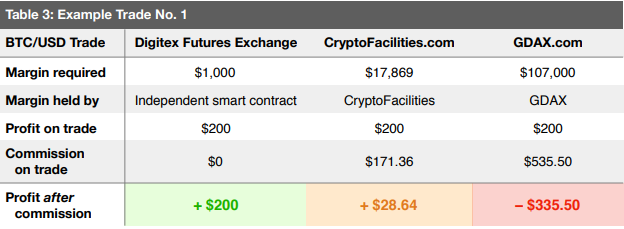

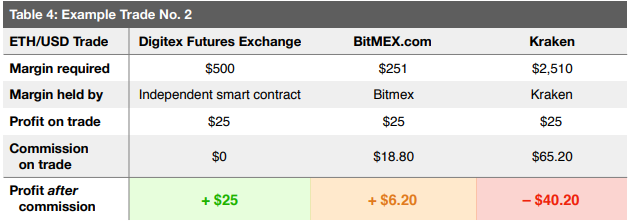

The owners of DGTX have the right to participate in the buy and sell of contracts on the price of Bitcoin against the US dollar. The same can happen with crypto-currencies such as Ethereum or Bitcoin. All this without having to pay commissions. In The Digitex Futures Exchange, any transaction involving cryptocurrencies is more profitable.

- "DGTX is the protocol token that is the native currency of the Digitex Futures Exchange.

- The tick value of every Digitex futures market is 1 DGTX token.

- Margin requirements on each Digitex futures market are payable in DGTX tokens because profits and losses are denominated in DGTX tokens.

- Account balances on the Digitex Futures Exchange, which are held by an independent smart contract, are denominated in DGTX tokens.

- It is the creation of new DGTX tokens after approximately 2 years that allows the exchange to operate without needing to charge transaction fees.

- New token issuance causes inflation but it also creates high demand for DGTX tokens by subsidizing commission-free futures markets that attract large numbers of traders who must buy DGTX tokens to participate.

- DGTX is an Ethereum based, ERC-223 token that will be freely tradable for Bitcoin, Ether and many other cryptocurrencies on the Digitex platform through integration with trustless, decentralized token trading protocols such as swap.tech, 0xproject.com and bancor.com.

- Traders can eliminate DGTX price risk from their trades with the DGTX Peg System"

Digitex-Whitepaper.v.1.1

Token Supply and Distribution

During the first sale, 1 billion DGTX will be available. They will be distributed as follows:

- 65% goes to the public: it will be sold in exchange for Ethereum. Beginning January 15, 2018. The price is USD $ 0.01 per DGTX

- 20% Digitex market makers: destined to automatic trading bots whose algorithms are programmed to create liquid futures markets.

- 10% Digitex team and advisors: to pay for the work of the team that belongs to the project.

- 5% referrals

Use Case

Laura is a trader who has 5 bitcoins and is worried about the market decline. Digitex offers her an alternative to cover her position. how? selling future contracts of DIGITEX BTC / USD. If the price falls, she will not have to worry. To achieve this, she had to buy DGTX tokens to cover the costs of operations.

With this platform, she has no loss of BTC and does not have to pay commissions that decrease her assets. On the contrary, all operating costs are covered with DGTX token.

Digitex Website

Digitex Website

Decentralized Exchange:

The concept of being a decentralized free of charge commissions promises to revolutionize the way of trading. Digitex Futures Exchange combines a centralized matching engine & order book with a decentralized exchange, being the perfect formula!

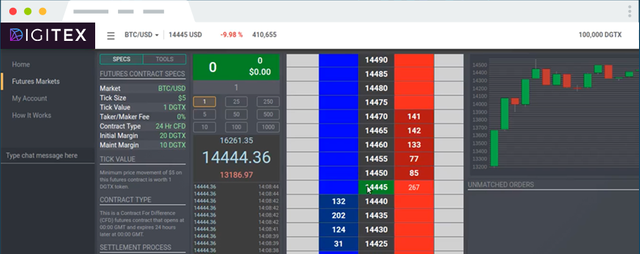

Futures contract specifications

There are three contracts that can be of great benefit to traders, using the three cryptocurrencies with the highest demand: BTC, ETH and, LTC.

"Futures Contract: BTC/USD (Bitcoin against the US Dollar)

Tick size (minimum price increment): $5 USD

Tick value: 1 DGTX

Taker/Maker Fee: 0%

Funding Costs: 0%

Initial Margin: 20 DGTX

Maintenance Margin: 10 DGTX

Contract Type: Contract For Difference (CFD)

Contract Duration: 24 Hours

Settlement Date: Daily at 00:00 GMT

Settlement Price: BitcoinAverage.com spot price of BTC/USD at 00:00 GMT,

rounded up or down to the nearest $5.

Settlement Process: Cash settled in DGTX tokens at Settlement Price.

All open positions remain open by being rolled over into the new contract which

opens at 00:00 GMT.

Futures Contract: ETH/USD (Ethereum against the US Dollar)

Tick size (minimum price increment): $1 USD

Tick value: 1 DGTX

Taker/Maker Fee: 0%

Funding Costs: 0%

Initial Margin: 20 DGTX

Maintenance Margin: 10 DGTX

Contract Type: Contract For Difference (CFD)

Contract Duration: 24 Hours

Settlement Date: Daily at 00:00 GMT

Settlement Price: BitcoinAverage.com spot price of ETH/USD at 00:00 GMT,

rounded up or down to the nearest $1.

Settlement Process: Cash settled in DGTX tokens at Settlement Price.

All open positions remain open by being rolled over into the new contract which

opens at 00:00 GMT.

Futures Contract: LTC/USD (Litecoin against the US Dollar)

Tick size (minimum price increment): $0.25 USD

Tick value: 1 DGTX

Taker/Maker Fee: 0%

Funding Costs: 0%

Initial Margin: 20 DGTX

Maintenance Margin: 10 DGTX

Contract Type: Contract For Difference (CFD)

Contract Duration: 24 Hours

Settlement Date: Daily at 00:00 GMT

Settlement Price: BitcoinAverage.com spot price of LTC/USD at 00:00 GMT,

rounded up or down to the nearest $0.25.

Settlement Process: Cash settled in DGTX tokens at Settlement Price.

All open positions remain open by being rolled over into the new contract which

opens at 00:00 GMT."

Benefits of using Digitex

- Zero commissions for using the service

- Decentralized balances accounts

- Automated markets

- Native currency of the platform

- Decentralized government based on blockchain Privacy

- High-volume markets

Conclusion

As a trader, my main objective is to achieve the greatest profit possible by paying the minimum amount of commissions. Currently, this is complicated, especially to move coins that have as much demand as Bitcoin or Ethereum.

Another problem is the security of the exchanges. Many users have lost their saved funds in exchanges that for many reasons stop to operate forever.

Digitex Futures Exchange wants to become the perfect tool for trading. By providing a decentralized exchange and eliminating the commissions completely, it means the perfect place to handle your cryptocurrencies.

For more info: watch this video!

Info & Resources

- Digitex Website

- Digitex WhitePaper

- Digitex Blog

- Digitex Telegram

- Digitex Reddit

- Digitex Facebook

- Digitex Twitter

- Digitex YouTube

Sponsored Writing Contest by @originalworks

digitex2018

digitextwitter

This post has been submitted for the OriginalWorks Sponsored Writing Contest!

You can also follow @contestbot to be notified of future contests!

Coins mentioned in post: