Highlights from the Virtual Currencies Senate Hearing

Disclaimer: The following article does not represent IoTeX’s views. The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of any agency of the U.S. government.

We watched the 2 hours 11 minutes and 36 seconds Virtual Currencies Senate Hearing (The Oversight Role of the U.S. Securities and Exchange Commission and the U.S. Commodity Futures Trading Commission), so you don’t have to.

Who was talking?

The Honorable Jay Clayton, Chairman, U.S. Securities and Exchange Commission (SEC); and The Honorable J. Christopher Giancarlo, Chairman, U.S. Commodity Futures Trading Commission (CFTC).

Why now?

Bitcoin has been pretty volatile in terms of its valuation for the past 14 months. Just look at the cryptocurrency market on Monday, it went into a free fall mode (-24% within 24 hours), plunging straight down to $6,000 on early Tuesday morning. Ethereum was down almost 30% at $589. No one really knows if there is a floor for cryptocurrency. The recent drop in cryptocurrency valuation led to a series of suicide prevention notes posted on cryptocurrency subreddit. Because of all of these market uncertainties, Congress wanted a better understanding of how cryptocurrency will fits into the existing landscape of financial regulations in the U.S.

Take-away points from the hearing

1.There was no consensus reached at this hearing. Essentially, what a senate hearing does is that witnesses are called in to give testimonies on a specific topic. This is followed by senators questioning the witnesses on various topics to address current gaps in regulations.

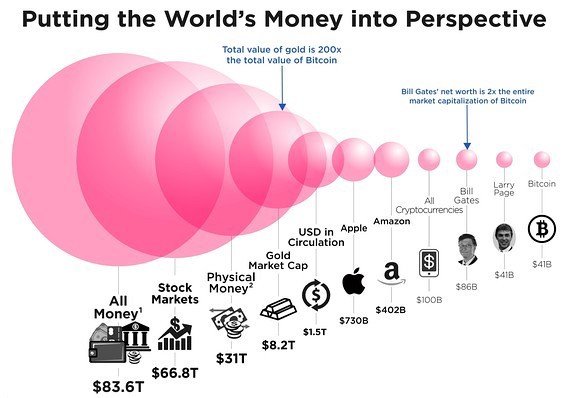

2. There is a lot of potential growth for cryptocurrency. Christopher Giancarlo, Chairman of the U.S. Commodity Futures Trading Commission emphasized on the perspective that regulators should take when they look at Bitcoin.

Perspective is critically important. As of the morning of February 5, the total value of all outstanding Bitcoin was about $130 billion based on a Bitcoin price of $7,700. The Bitcoin “market capitalization” is less than the stock market capitalization of a single “large cap” business, such as McDonalds (around $130 billion). — Written Testimony of Chairman J. Christopher Giancarlo before the Senate Banking Committee, Washington, D.C.

Image credit: MarketWatch

3. SEC will crack down on ICOs that are not registered. Jay Clayton, Chairman of the U.S. Securities and Exchange Commission, was not happy with the fact that in 2017, not a single ICO was registered with the SEC. These companies raised about $4 billion USD via ICO in 2017. Cryptocurrency startup bros think they can get away with it? Clayton thinks not. Tokens that are not registered as security are violating laws.

4. SEC will crack down on market manipulations. Right now, there is nothing to stop a bunch of cryptocurrency holders from getting together and selling their cryptos all at the same time (this is called market manipulations). This is actually great news for people who own small amounts of cryptocurrency because more regulations on market manipulations will take away some of the volatility associated with cryptocurrency investment.

5. Not one agency currently has direct oversight for cryptocurrency. Why is that so? Security regulation traditionally falls under SEC while commodity regulation falls under CFTC. Cryptocurrency is a medium of exchange, means of account (security), and a storage of value (commodity). There is some overlapping jurisdiction over crypto for both the SEC and CFTC.

6. Christopher Giancarlo is awesome (he is in fact trending on reddit).

He totally seems like an “All American Dad” who teaches his kids the right values in life and is in the know for all millennial lingos. Like #HODL. At 1:23, Giancarlo: I tell my children that if it sounds too good to be true, it is. Great parenting advice there!

If you are not going to watch the whole thing and want to skip straight to the questioning, then you should start at 00:38.

Some “interesting” stuff from the hearing

- SEC is undergoing an hiring freeze due to budget issues. Senator Brown was like… how is SEC going to patrol the cryptocurrency market if you don’t have enough po-po. The short answer from Clayton was: I need more money for my agency. Looks like SEC is not going to crack down on ICOs that soon- at least not until the FY18 budget allows them to hire more federal regulators.

- 100% of the senators started out their life with #2 pencils and papers (they really love them). Virtual “anything” is new to them and they learn things like Bitcoins from their kids.

- CFTC has their shit together: (a) They have a chief innovation officer and a lab CFTC, which is a innovation hub located in NYC. (b) All they really wanted is to protect consumers from fraudsters and they will bring civil lawsuits to crypto Ponzi schemes. They brought three civil lawsuits last month to some of these Ponzi schemes. One of them is called MyBitCoin AKA MyBitCon. (c) Through their research, they found that most consumers are googling about cryptocurrency at their local libraries. They are beefing up the librarians’ knowledge on cryptocurrency to teach the general public to stay away from fraudulent products.

- Senator Warren as usual is fierce about protecting consumers (1:08). Senator Warren: Do you support SEC policy of letting company sell shares in initial offering, while inhibiting investors who have been defrauded to bring class action lawsuit?

Clayton: Let me get to the bottom of this. I don’t want to prejudge the issue…

Senator Warren: SEC’s job is not to throw investors under the bus. #throwingshade - Clayton probably does not really care if you lose all of your money in cryptocurrency.

Clayton: Pumping all of your money in emerging technology has a very high likelihood of not working out for the individual. There will be winners but many losers. - Senator Kennedy was super observant and commented on the fact that no one really reads the disclosure for any investment products. Why bother with disclosures if most of the consumers don’t read it? Amen, no one reads it unless you are a lawyer trying to find a loophole to sue. By the way, Senator Kennedy is usually long winded and was put on probation by his fellow senators last time when he went over his time limit for questions. But we are like, you just wasted 20 seconds on explaining your probation.

- Social influencers can potentially be sued if they endorse a non-registered ICO and shit hits the fan.

- Bad hombres like North Korea and other terrorists will be watched closely via SEC’s dark web working group

- Our senate is very concerned about Venezuela’s controversial plan to create an oil-backed cryptocurrency to evade U.S. sanctions. The short answer on this topic from SEC and CFTO is that they are working on it but it is difficult because no agency has true authority to govern international governments and their actions.

- Despite an hour long debate on the various downfalls of crypto, CFTC and SEC remain positive about the future development of blockchain applications.

A strangely philosophical thought from the hearing

How do you place value on something that is virtual?

Clayton: Well, it depends on how much someone is willing to pay for it.

So how much is the public willing to pay for cryptocurrency?

Overall feels

Regulation is coming.

Let’s be real. We knew regulations would come someday.

**How will this hearing impact consumers?

**Consumers are better protected if SEC and CFTC can weed out scammers and Ponzi schemes.

How does this hearing impact crypto startups?

Clarity on regulation will help startups navigate the process of ICO better. Regulation will help the integration of blockchains with the mainstream market in the long run. We will continue to watch the legislation scene closely.

What is the overall direction for the crypto market?

The senate has recognized that crypto is a huge market that is expanding at an unimaginable speed and blockchains need to be integrated with the core of our financial market to reap the benefits. Essentially, they are taking the same approach as they did for the internet — and that seemed to work out pretty well so far.

About IoTeX

IoTeX is dedicated to creating the next generation of the IoT-oriented blockchain platform. The cutting edge blockchain-in-blockchain architecture will address the scalability, privacy, isolatability, and developability issues relating to the IoT DApps and ecosystem growth. By combining token incentives with our vibrant, global community, we believe we can crowdsource top industry and community talents to push the frontier of blockchain 3.0.

Telegram: https://iotex.io/telegram

Twitter: https://twitter.com/iotex_io

Original author of the content. Authorized reposting of the original article from IoTeX Medium publication. All rights reserved.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/@iotex/highlights-from-todays-virtual-currencies-senate-hearing-74bc5233513