Hedge Funds are Dangers to Crypto

I am still puzzled by the 24 seconds (2 blocks) of Brave's Basic Attention Token (BAT) crowdsale.

I have never bought through an ICO but definitely couldn't participate as many others. I personally think the Brave team is tackling an issue that needs immediate attention/implementation:

Nuking annoying ads, nuking middlemen and making it easy for users to directly pay publishers for content they like.

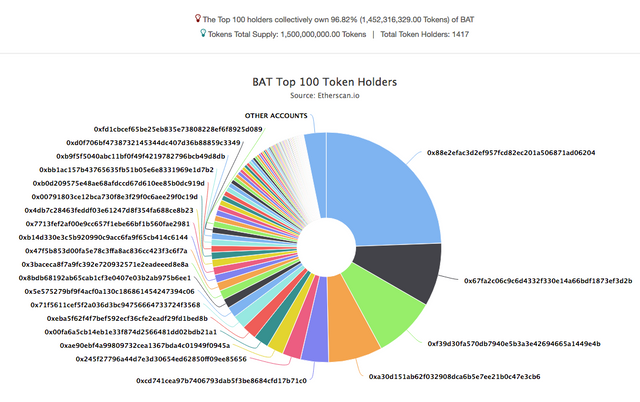

The irony is that Ethereum and the coins on top of it, are supposed to be "distributed". Then how come we get this scenario:

Source: Etherscan

one address buying 24.42% of the BATs.

Greed will ruin crypto. For instance if Satoshi kept all the Bitcoins for his/her-self, bitcoin wouldn't be worth a dime. We've been promised decentralization through participation, fun, experiments, innovations. Let's keep it that way.

There is an issue on the Ethereum EIPS repos to make write much fairer contracts. This should be a priority.

For instance, I waded through a bunch of bitcoin articles but nothing is close as to the first time you buy something with bitcoin. In the back of my mind, I was like holy-shit, this thing actually works. Then realized that this thing has never been shutdown and operates 24/7 and no holidays, let's appreciate how robust it is (I mean it was bootstrapped).

The counter intuitive thing with bitcoin is that sharing some bits of it to total newcomers just grow the ecosystem much more, everyone benefits. Quoting Metcalf’s law, the value of the network is proportional to the square number of users in it. Doing anything (power grabs, greed) just discourage both individuals, small players and newcomers.

i.e: Keeping all coins to yourself and not sharing with anyone else may render them worthless in the long term.

The total supply will never be more than 21 million bitcoins and we (human beings) are more than 7 billion. If you own a single bitcoin right now consider yourself lucky and privileged. If you own more use it, buy stuff, help others get their “ahah” moments.

Greed can just ruin everything.

If we have figured out how to deal with internet traffic congestion with packet routing we can surely write contracts to rate-limit the people/entities driven by uncontrolled greed. They are toxic to any crypto ecosystem.

People looking for quick money schemes with no appreciation to the financial innovations, are on this bucket too.

On the positive side though, the BAT contract was audited by Open Zeppelin by Manuel Araoz. I think these are extremely valuable because most users won't carefully read and figure out critical bugs (like malfunctions contracts that will burn users coins a.k.a. hard earned money).

Though it would be great if they included another team for a macro analysis like what could potentially happen if some entities acted in hostile manners (toxic behaviors).

I am quiet surprised that Vitalik, Vlad, or the Ethereum crew didn't press on coming up with a concrete plan. My main suspicion is that a Hedge fund or a bunch of them were behind this. The only one I have heard about is Polychain Capital.

Ultimately, a hedge fund is totally a bad idea. Getting a bunch of money from rich dudes and gals, who won't care about how the financial innovations and "ahah" moments but only the profits will only stifle innovations or rig it in vicious ways.

I'm all for ICOs, they are great. In a way that's crowdfunding on steroids, cutting out the middlemen (Kickstarter / Indiegogo, ...) and giving the ability with anyone with a digital wallet to participate.

We will make mistake writing faulty contracts and hopefully we will learn from our mistakes. But we know in the back of our heads:

Greedy big players will just discourage newcomers at the very least and spoil everything.

Takeaways:

- Hedge Funds == bad in crypto land.

- We need to incorporate rate-limiting against hostile/greedy buying in the ERC20 token standard.

Good reads:

I understand what you're saying. Too few participants in the market with disproportionate leverage can sway the price of any asset countering the 'free market' ethos (look at silver).

I believe this is more of an issue for cryptos which are inflationary, where the coin supply is essentially never ending.

However on the other side of the (Bit)coin, I think currencies like Bitcoin have a trump card where deflation is built into the design. It's always going to get more scarce and more expensive as a result.

The closer it gets to its 21 million limit, the more expensive it will inevitably get.

If we have a situation where one or two players have so much more than anyone else then yes, they can influence the price and create fluctuations in the price but in terms of long term trend, I believe the price will tend to be going up and then stablise.

Let's say it's stabilised and a big market participant wants to disrupt by dumping a ton of bitcoins into the market ..this won't do anything but depress the price for a short time and as people realise the opportunity to buy bitcoin, it will rise and stablise again.

It'll be a self correcting mechanism.

Hedge Funds, Fractional Reserves, Traditional Banking and Finance are all the reasons why Bitcoin was created in the first place.

But it seems human greed always finds a way into the best ideas..

With the crypto boom, they are starting to realize that it is not a fad anymore. Big players are getting scared so they'll get into the acceptance phase.

What I fear the most is them corrupting some devs, with parties, and other luxuries to rig the system to their benefits.

We can use technology for good or very evil ways. In the case of the Blockchain innovation, it would be very evil if a country banned cash and forced a population to use the centralized national coin (because you know security, evil hackers out there... ignoring such things as privacy and so on).

I guess before the revolution there will be a Coin War with the banks...

One funny thing on your point on Satoshi he holds around 1 Million btc, this was a really big part of the "nertwork worth" for a really long time.

This rant caused me to create https://www.cryptomilli.com to re-iterate the point that you don't need a hedge fund or any institutions to manage your crypto investments.