Risk-managing in crypto. [ MEME edition ]

Did you wake up today, checked Blockfolio and wondered if THIS IS THE END?!

Are you constantly wondering if you should put more into crypto, cash out some, sell some coins, buy other coins, put it into ICOs or maybe btc or....

Can you sleep well at night?

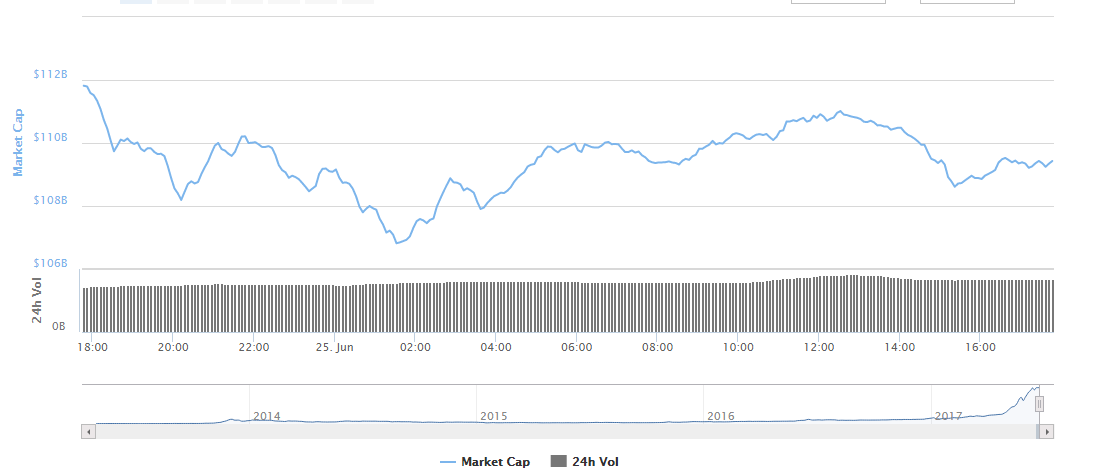

All these are important questions which helps me diagnose you "failure to manage your risk". Some are in the last stages of despair and some have just caught it. We all have it to some degree, because Crypto markets are crazy and it's easy to get sweeped by all the madness. Before you know, you sold your car for a BAG of STEEM/BTC/ETH/SHIT.

Then the market goes down hard.

Now what?

Now what indeed.

I can only give you my very unprofessional take on this subject. I have asked a few smart people how this works for them and generally they all say the same things. Let's look at the top 3 things you can do:

Don't invest more than you can afford to lose

This is the golden rule. Don't lose your head and take a credit or shatter your savings to get into crypto and "not miss the boat". Yes, the opportunity might be immense. Yes, the profits might be huge and rapidly dwindling if you wait too much. Yes, it's the revolution and we are early.

but.

Yes, all this could go to hell tomorrow.

Look, I am a believer and very "bullish" on crypto as a whole. I never sell crypto basically because I believe in this and I feel like a traitor to move to fiat ( though maybe I SHOULD do that, see next point ) but this does not mean I am not a realist as well. Crypto is a very profitable market right now BECAUSE it's super volatile and uncertain. This is what most new people seem to forget. Especially if you joined recently on the craze, please take a step back and realize there are so many possible threats to crypto looming out there:

- Government interference

- Bugs in code we are yet to discover

- Quantum computers ( yes, we are working on this but...)

- AI

- Failure to go mainstream and loss of momentum

- Many unexpected things like a new better technology and/or who knows what?!

Look, all these have various probabilities attached to it. That's what risk-management mean: estimate your risk and then act on the estimation! If you think there's 10% chance that Trump will announce banning all the crypto by end of the year, you should do smething different than fi you think there's a 90% chance of this happening. Makes sense?

Most people don't take all this in consideration and eventually, when something happens, they ask themselves?

What were the odds?!

Well, what were?

As a poker player, please let me tell you, smart people make money off of your ass because you don't know the odds.

In this case, odds are unclear but you need to think of these a little before you do anything.

In my case, I think the payout can be amazing and so, I am willing to take the risk of losing it ALL..but only "this much".

How much is "this much"?

Enough that matters for you, but not enough to make you puke if blockfolio shows 0$ tomorrow <--- how I decide.

When I'm over that amount I try to ...

Diversify

I hear that all the time. WHAT should I diversify into?! Should I sell eth for btc? Or maybe get into this new blockchain ANS?!

ADVISE ME PLEASE!

Here's the thing. You should treat ALL crypto as one unit in your diversification strategy. You know what diversification is?

Bonds, Stocks, Real estate, CASH, antiques, Gold

Here's what diversification isn't:

ETH, STEEM, BTC, NEM, BTS, BNC

Notice the difference?

Here's how I think about it. You can do good investment and bad investments in crypto, that's 100% sure. You can do your research, invest in the most promising crypto coins out there and play it AS SAFE AS possible. But it is STILL CRYPTO [ and if this does not rings alarm bells, please re-reade the first point].

Imagine you're a bank robber. You are a PRO. You take all precautions, you have a plan and you follow it to a T, you got a great team, a great exit strategy and a time limit. It's as safe as it can be. BUT YOU ARE STILL ROBBING BANKS!

Stop robbing banks and try to put a little in your safe-box in all forms you can think of.

I like the idea of buying "land". They don't make it anymore :)

There really might be Warren quote for anything so here's one about diversification:

"Diversification is a protection against ignorance. It makes very little sense for those who know what they're doing."

But think back to my analogy. It makes a lot of sense for someone robbing banks, even a very good bank robber :)

Don't take my word for it.

Anyway, you crypto total investment should never be over 50%. That's a general idea that I think stands true for everyone but also...is my last point here

Know Yourself

Are you risk inclined or risk adverse?

Are you emotional and prone to do stupid shit when stuff happend or are you cold AS ICE?

Are you a weak hand?

It's important to know what good ol' W.B reffer to as "temperament".

"The most important quality for an investor is temperament, not intellect

What all this means is that you need to do YOU. Accept yourself and don't play at someone else because you are not someone else ( hello, mr obvious! ) but also because you have only a very superficial understanding of how someone else functions.

If you are not a trader, don't trade like you ( better HODL maybe? )

If you are not an investor, do this as a hobby and live vicariously through your crazier friends.

And of course..

IF you are crazy, go crazy :) [ but never over 50%!! Don't be a stupid bank robber! ]

Manage your risk by managing what you can handle and how much. Know yourself :)

Was this useful for you?

I hope so!

Leave a comment and let's see what I missed.

r.

PS: extra meme for the true fans!

thanks @boog

As I am reflecting a bit and still new to crypto I might bought into a bit to much, as nervous as I get still in some dips.

While my whole values are still diversified atm I am only concentrating on crypto atm and checking way to often what is happening since I am not trading.

But I used to make my money as a poker player so I am used to ups and downs and can proud myself by not panic selling anything.

common behavior!

Have faith in the tech and in your smart diversification and you should weather this storm :)

Good luck, my friend. It's gonna be bumpy :)

I have had sleepless nights over crypto before. I sometimes wake at 2am can can't sleep without checking prices and even making a few trades on my phone.

:) you're in too deep :D

This is bad by my friend, reduce your positions and get healthy sleep!

haha I sooo relate. Have done some stupid sh%^ because of it too. Kicking myself for missing the ETH flash crash. As a NY state resident, GDAX is one of the few exchanges we're allowed on due to ridiculous over regulation - I'm always on there. Of course, the one day I'm not, and I miss the opportunity of a life time. Sigh.

@razvanelulmarin

Another excellent post from you. While I fairly agree with you, I think you can still manage your crypto portfolio better by just not putting all the money on ETH and ETH based tokens or BTC and BTC based technologies.

for sure. that's another post altogether and you're better off reading @wingz latest posts on portofolio :)

Thanks for sharing wingz post, very insightful!

he's awesome and smarter than me in every way

Don't invest more than you can afford to lose

This is the golden rule.

"Can you sleep well at night? " ...No

"The most important quality for an investor is temperament, not intellect"...Well said

Here just to thank you for you advice.

I found here really helpful post. for new investor.

Upvoted for the good content

Followed as I am happy to be one of your followers

Thanks for sharing

Keep it up

One extra rule to add. Don't start playing with daily trading when under influence of any drug, especially alcohol.

And those who have episodes of manic cognitive arousal (Bipolar Personality Disorder), should not daily trade during those periods :-)

oh damn. that's true. hide your passwords!

That too, but under such conditions it is easier to make irrational, careless/carefree, and spontaneous decisions about spending more than you are able to lose or get into higher risk gambling behaviour.

:) but you look like you can handle it. if not you then who?!

I messed up few times for above mentioned reasons. Not much @logic in that :-P

first time it's a honest mistake.

The rest are on you! :))

I might bought into a bit too much as a newbie. But I strongly believe in this and am not panic in the dip. Will continue to do monthly purchase regardless it's up or down. Hopefully it turns out to be a good strategy.

could be. Invest in some crypto funds as well :)

Thanks, like what? And how? Is there any 101 manual? Sorry, will try to look it up but if you could shed some lights it would be a lot easier. Thanks

Always do you your own research :)

I agree with you over all. However, I think you bank robber analogy is not appropriate when it comes to cryptocurrency. You are implying that by investing in cryptocurrency we are doing something wrong or illegal and that there will be legal consequences.

It is absolutely true that investing in cryptocurrency is far riskier than almost any other type of investment, but it also has the greatest possible reward.

A more fitting example would be something like starting a new restaurant. It's a big risk because most fail in the first year, but there is always more opportunities for people who do their homework, have a solid strategy, and don't rush into something they don't fully grasp.

I disagree.

It's the PERFECT analogy.

Restaurant business is a known quantity..most fail, yes but enough don't.

Crypto might be a huge success but also a subnote in history books.

Again, that's just my view on it. It's a shiftsand. Treating crypto like any other business is a mistake....

I would advise you to watch one of my favorite speakers on cryptocurrency and why this is simply the natural evolution of money and finance. If you have 30 mins, watch this at 1.5 speed. You will not regret it: Andreas M. Antonopoulos

thanks a lot, man!

I always appreciate information. I will certainly watch it!

Totally agree. There's no precedent ! There's literally no other industry where you can make (and lose) so much as crypto. 100% onboard with the bank robbing analogy.

Really good post!!

Not too sure if agree with your view on diversification, but that goes to show I need read up more :)

hey! I never said I WAS RIGHT

Resteemed & Upvoted! Your posts are so complex man! Awesome job 🔥🔥🔥

damn. thanks! :)