In Search of a Conservative Crypto Portfolio for The Long Game

I know, conservative investment and crypto seem to be a contradiction in itself, given the volatility and open questions regarding regulations and scamming potential right now.

There may be a couple of lucky kids who made a fortune with the right market timing or meme coins alongside a couple of unfortunate people who lost a lot of money investing in crypto and consider it all a scam. The truth lies somewhere in the middle: Until crypto gets a broader adoption and acknowledgment, we will continue to witness high volatility and pump&dump-schemes as well as scams left and right.

Considering cryptocurrencies as only one use case for the underlying blockchain technology, one might ask how he could participate in the rise of this technology in the long term rather than desperately trying to market-time the next bull run.

Blockchain technology and web3 will be the basis of so many apps and platforms that we can't even imagine them all. Taking just one example in web3 social media, you already see here on Steemit or over at the DESO blockchain and its adjacent apps how powerful blockchain social media is to flip the creator economy upside down. Long gone were the days where creators were churning out tons of content for free in exchange for vanity metrics like followers, whereas the mighty gatekeeping platforms like Facebook and Twitter cashed in on ad revenue and made billions on it.

On web3 social media, a creator is awarded coins when he produces excellent content that is of value to the recipients. Creators can turn their content into NFTs and even profit on resales through royalty payments. On the DESO blockchain, there are options to let other people like your investors or friends participate in resale royalties. This opens up a whole new game of creator-consumer loyalty without a third party controlling and cashing out on this relationship.

And this is only one use case of mighty blockchain technology.

My point here:

Let's not focus too hard on making quick money on crypto investing/trading itself, but try to focus on how we can participate in the rise of the underlying technology and profit from this in the long run.

- One step could be moving to blockchain media outlets like Steemit and DESO for creating while onboarding as many people as possible and start earning creator rewards in native coins. Once the platforms get wider adoption, the earned coins will rise in value.

- Another step could be investing in the native blockchain coins rather than in the latest fancy dApp or to-the-moon project that will soon be forgotten.

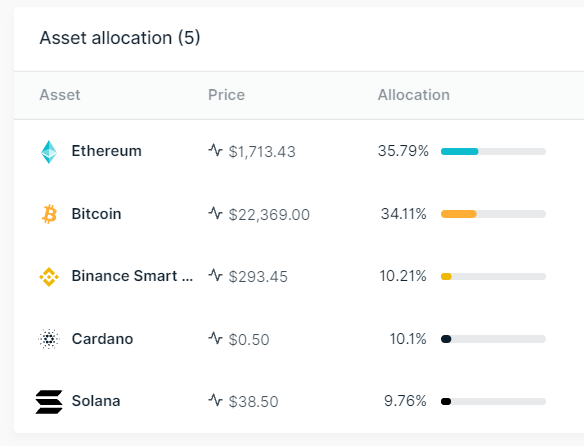

I recently built myself what I would consider a conservative portfolio, as it over-values the biggest names and only contains layer-1 technologies, as they're seemingly the basis for everyone else to build on. Please see the screenshot below for my current allocation:

Image source: Screenshot by the author

My line of thought is to invest in the "companies" producing the shovels and pans rather than going on to mine gold by myself. As the technology gets adopted, the infrastructure provider will profit automatically. Not as much as some wild projects that rises in terms of four figure, but a slow'n'steady slope upwards in the long run.

What do you think of this allocation? Do you think it should contain other protocols than the ones already mentioned? Please feel free to start a discussion over here, as supposedly many people including me are interested in a way to invest in web3 in the long run.

Disclaimer: This article is for informational purposes only and shouldn't be regarded as investment advice. Please consult a finance professional before making major financial decisions.

I know too little about the subject to start this discussion. Other users here are much more advanced and active. But - this much is certain for me: whoever warns about the risks of cryptocurrencies should please also view shares, derivatives and other "old" speculative objects with the appropriate restraint. Otherwise, we are all more or less active spectators of a rapid development. We should take responsibility for ourselves and for our actions - then blockchain & co. can be a wonderful thing...

Um diese Diskussion zu starten, verstehe ich zu wenig von der Materie. Andere User hier sind da viel weiter und auch viel aktiver. Aber - soviel ist für mich sicher: wer vor den Risiken bei Kryptowährungen warnt, soll bitte auch Aktien, Derivate und andere "alte" Spekulationsobjekte mit entsprechender Zurückhaltung betrachten. Ansonsten sind wir alle mehr oder eben weniger aktive Zuschauer einer rasanten Entwicklung. Wir sollten die Verantwortung für uns selbst und für unser Tun übernehmen - dann können Blockchain & Co. eine wunderbare Sache sein...

Das stimmt wohl: Auch vor blockchain und crypto hat es schon Spekulation und vor allen Dingen auch Betrug beim Thema Finanzanlagen gegeben. Man erinnere nur an die Volksaktie oder die windigen Finanzdienstleister.

Mit dem Versprechen auf schnellen Reichtum und ein sorgenfreies Leben wurde den Leuten schon immer das Geld aus der Tasche gezogen. Hier bin ich aber immer gut mit diesen zwei Merksätzen gefahren: "Was ich nicht verstehe, kann ich auch nicht kaufen" und "Wenn etwas zu gut klingt, um wahr zu sein, dann ist es meist nicht wahr."

Wie du schon gesagt hast: Wie sind selbst für unser Tun verantwortlich.