Loan Scan

Investing into cryptocurrencies is risky. Some of the best investments you can make are long term investments. The more patience you have in cryptocurrency the more time you will take to evaluate your positions and predict the next phase of what is about to happen.

I've made mistakes when investing in cryptocurrencies, but I know I've learned a lot as well. And I feel I will be far more careful about when I purchase specific currencies such as BTC, LTC, and others.

If you're looking for more security in your investments, then you might want to look into lending platforms with strong reputations. There are several current platforms in crypto that will offer you a better return on your investments than your bank account will. For example, most Banks offer up to 1-2% interest per year at best.

The site also allows you to view some different types of loans including loans that have yet to be repaid in order to asses your risk our earning potential on a bunch of the different sites. For example if you look at some of the loans on Maker you can see that about $32 million was taken out this year, while $24 million of that has been paid off so far.

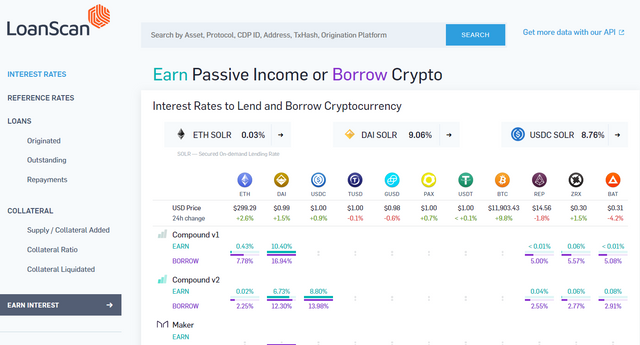

This picture shows the loans taken out since the beginning of June for ETH, Maker DAI, USDC, ZRX, and others.

This is an interesting site and resource you can use to research your potential risks and rewards of hodling your crypto in a stablecoin or ETH in order to generate passive income throughout the year.

Several of these major crypto companies out there offer 6-15% per year for helping them to generate loans in stablecoins including USDC, USDT, and Dai. Dai is the stablecoin of Maker.

This website: https://loanscan.io/interest-rates allows you to view several different companies that offer decentralized stablecoin loans including companies such as Nexo, Dharma, Celsius, Nuo, and a few others.

Nexo has one of the strongest reputations for cryptocurrency lending in my opinion, as Nexo offers $100 million insurance on custodial assets, and they offer some of the highest security for your funds on the market. Nexo also requires no credit checks and allows you to have the convenience of a crypto credit card, so you can have instant access to cash when taking out a crypto loan. https://nexo.io/

Loanscan is a great site in order to view the current loan and lending rates from several of these crypto companies at once. You can see that some of these companies offer generous lending and borrow rates in crypto that are far superior to the rates most, if not all banks would offer.

Please double check the accuracy of this information before you decide to make any investments. I am not your financial advisor.

You received a 10.00% complementary upvote from @swiftcash 🤑

To stop similar upvotes from @swiftcash, reply

STOP.To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.