Explain it with MEMES #3 Banks get out-innovated and start to BAN Crypto transactions. Their competition.

Banking institutions are like any other corporation. They've gotten so big that dozens of emails, memos, committees, hearings and then a consensus must be reached before any major change can occur.

The world changes much more rapidly, mostly due to new technology. Therefore Banks are slow to adapt.

example

Technology introduced the ATM machine. Then online banking. Followed by Apps".

Yet to this day. Most ATM machines use a system that more closely resembles a commodore vic20.

(low tech screen, limited options, terrible UX/UI interface and navigation)

And high fees for no real reason whatsoever.

For over 20 years, they failed to update the software to include the most basic of transaction services.

installing a webbrowser interface to your online banking platform would have been most effective.

(though higher risk) but rather than deal with the challenge, They paid the price. It was easy for them.

The cost? Your convenience.

You spent your time, paying bank service fees, installing apps, learning to navigate through multiple platforms.

They could have solved it easily, by integrating with apps linked to ATM's as pickup points linked to your device.

Was their business strategy profitable? How well are their systems working out for them?

and now with crypto / blockchain (what is crypto/blockchain?) the are behind again.

Small scale investors want access to investing in technology startups and projects.

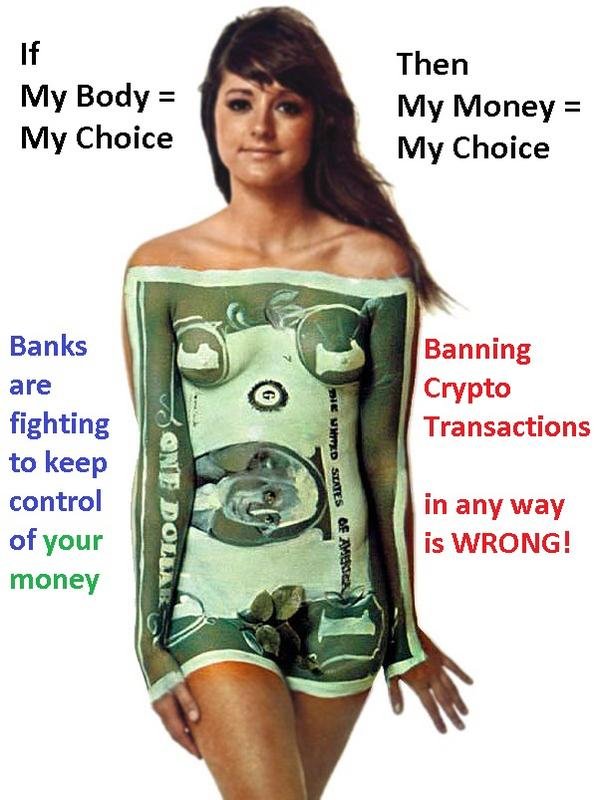

The citizenry is not happy with the cost and methods of control employed by the banking institutions.

The banks could've adapted, reducing costs, improving services, or creating a system of their own (an exchange) perhaps with tokens of their own allowing people invest in those markets.

Instead they resist. A battle begins and soon a war erupts between traditional banking institutions and decentralized crypto currencies designed to supplant them.

I'm sure the bankers see what is happening , and feel helpless that their organizations are so slow to react.

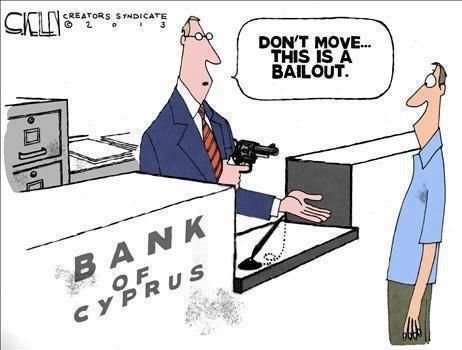

First really serious attempt to stem the money flow...

To reduce the loss of capital due to people moving their money OUT OF BANKS.

The institutions in the US Started banning some transactions.

Starting with Credit cards. (to protect the people, is their claim)

Yet deciding where and on what you spend your money feels like they are overextending their reach of power.

https://www.theguardian.com/business/2018/feb/05/lloyds-bank-bans-buying-bitcoins-credit-cards

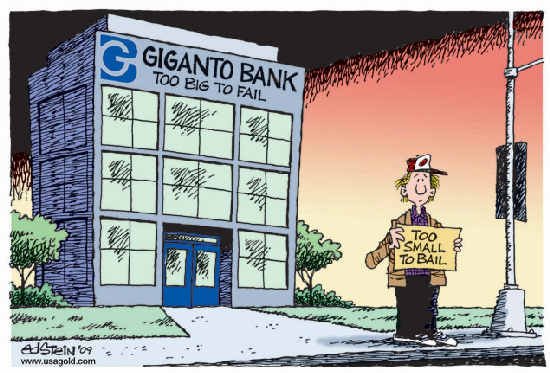

There are several reasons why they have been doing this. Mainly, because your money being in their bank let's them use that money to make more. Loans, and fractional lending.

And it has yet to happen Canadian banks (which claims to have a more open approach to innovation,

but the reality is that Canada often waits to see what the US will do before they act.)

An innovative company would be ahead of the issues, not lagging behind.

I think it's a stalling tactic. They are concerned. People are moving their savings Our of the bank and into new startups, because the odds and rate of return on investment, investing in technology, is MUCH MUCH better than investing in aging institutions that are resistant to innovation, and overly driven by trying to maintain the status quo.

The memos are flying, the emails are circulating the meetings are happening.

One day soon. Your bank will have it's own crypto-currency type token. It may provide abilities to invest , purchase or trade in additional currencies and may start to realize that its failure to adapt to changes in technology are more expensive than shifting the business model to be more of a tech innovator rather than a late adopter. I hope they do soon. it's a small price to pay, hiring innovators.

But I fear it is an unlikely change. It seems that our society is structure in such a way that....

Those with all the money never pay the price of failure.

The price paid for resistance to change, in this instance, is your freedom.

Crypto is future!

And the future is now!

I completely agree.

yes, my money my choice !!

ripping post, very good !!