If You Haven’t Lost Digital Assets, Are You Even a Crypto Trader?

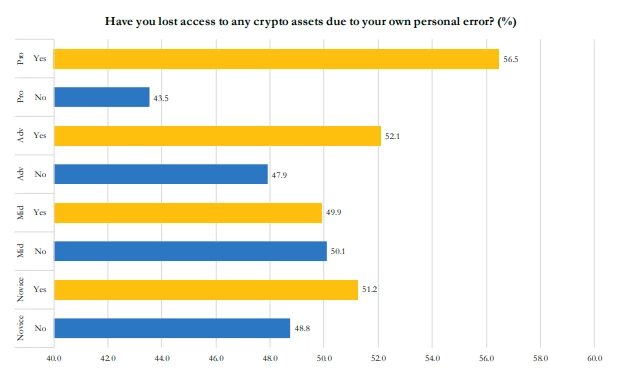

There is no pride in the reality of this headline. It is the unfortunate reality of the ecosystem today. The truth is that the majority of Digital Asset traders have lost access to their crypto assets due to their own personal error. A recent study by Overbit found that these errors were most likely to happen amongst professional traders. Why is it that professional traders, those with the most experience, deepest technical proficiency, and most capital on the line, are the ones that are the most likely to have lost crypto assets due to a personal error?

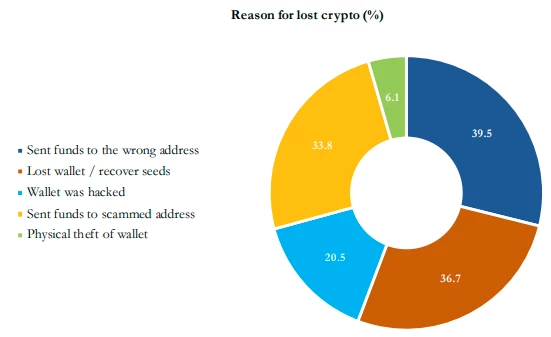

The study found that a shocking 56.5% of pro trader respondents had lost assets due to their own error. Among all respondents, the most common reasons for the loss were sending funds to the wrong address (39.46%), followed by loss of access to a wallet (36.73%). Over one third of traders who had lost crypto assets due to a personal error lost them to a scam, which asked them to send funds to a fake address.

The reality is that managing a whole portfolio of Digital Assets is hard work for novices and pro traders alike. The decentralized nature of the blockchain ecosystem means that traders have multiple exchanges, wallets, and other platforms to place trades, secure funds and manage their Digital Asset portfolio. Pro traders especially take an active management approach while seeking the highest returns, constantly shifting between assets, exchanges, and platforms. With each platform having its own unique workflow and nuance, mistakes can be easy to make and impossible to rectify.

In the constant shuffle between different services, traders do make mistakes as they constantly change between decision making processes. There is a never ending balance of System 1 and System 2 thinking. Decisions about trades can happen quickly, as traders can immediately spot market opportunities. They can also happen slowly, as they DYOR and plan their approach. But the process of actually taking action and placing the trade is almost always System 2. What should be as simple as buying anything else online has devolved into a time confusing and error prone process of transferring funds, shuffling between platforms, and laboring through inconsistent processes.

Copying the wrong address, misplacing a critical password, or just simply not double checking while trying to capture a fleeting arbitrage opportunity - The reasons for an error are endless, but the results are all the same: traders lose what is rightfully theirs because of shortcomings in their tools.

At TradingBull we have studied loss aversion and understand that the loss of your assets hurts much more than the joy of your unrealized gains. We see no reason why the majority of traders end up making these personal errors that result in loses, missed opportunities, and personal anguish. By uniting all of your Digital Asset trading platforms within a single interface, TradingBull eliminates many of the common errors the majority of traders try, yet often fail to avoid each day. TradingBull gives traders the peace of mind that they will not fall for these mistakes by giving them the tools and resources they need. With TradingBull, traders take back control of their Digital Asset and surround themselves with the resources they need to manage their Digital Assets portfolio.

Check out our website, join our Telegram, ask us about our platform, stay tuned about our upcoming IBCO!

Daniel Pinto - Market Analyst @ TradingBull.io

More info:

Website: TradingBull.io

Pitch Deck / Whitepaper / Tokenomics

BCOs in the past: DeFi Prime: “Bonding Curves Explained”

Contact: [email protected]

Twitter: @_Digital_Assets

Telegram: https://t.me/TradingBull_DA