Becoming a Profitable Trader With Technical Analysis PART ONE - Philosophy and Risk

Hello Steemians!

It seems to be a common trend on Steemit to post charts analyzing and giving predictions about all the hot crypto coins using big words and offering very little substance for someone who isn't a professional trader. We all want to make money so I thought I would share my accumulated knowledge from the last 10 years of trading to try and shed some light on the subject and give some people the ability to test the predictions they see on Steemit. I will make several posts covering the basics and how to use them and if there is interest I will delve into it further, for this series I will post every day and follow this outline for my posts:

Becoming a Profitable Trader With Technical Analysis

Part One: Philosophy and Risk

Part Two: Charts and Patterns

Part Three: Indicators

Part Four: Strategies for Short Term and Long Term

Part Five: Analyzing Popular Steemian's Techniques

My Background

My background is a mixed one, I did not go to school for anything related to finance or investing, quite the opposite actually, I studied philosophy with a focus on science. The story of how I came to be a trader happened when I was 21 and sitting with a friend from university in a bungalow in Thailand. Before this I had very little interest in investing, charts or any of that but my friend said something to me and it set my mind on fire and since then I have consumed at least 100 books on the subject out of pure fascination. What he told me was:

These charts do not only represent the value of an asset, they are a representation of human psychology. It is the sentiment of the people that moves those candles up and down, not just the inherent value of the asset.

Now this may seem obvious to a lot of you but at the time I was absolutely fascinated by this idea and I was instantly hooked. I consumed book after book about chart patterns, indicators, strategies and risk analysis and started trading FOREX (foreign exchange of currencies) a few months later. Over the last decade I have made more than I lost but make no mistake I have lost significant chunks of money and any trader who says they haven't are either lying or brand new to it and had a run. I still trade now, but not very aggressively, in the FOREX markets and I dabble in the crypto markets but I haven't made any really significant short term trades so I mainly just hold coins in my portfolio. However, I still use chart analysis daily on certain coins to test the general sentiment of the market and I will show you how to do this as well.

What is Technical Analysis?

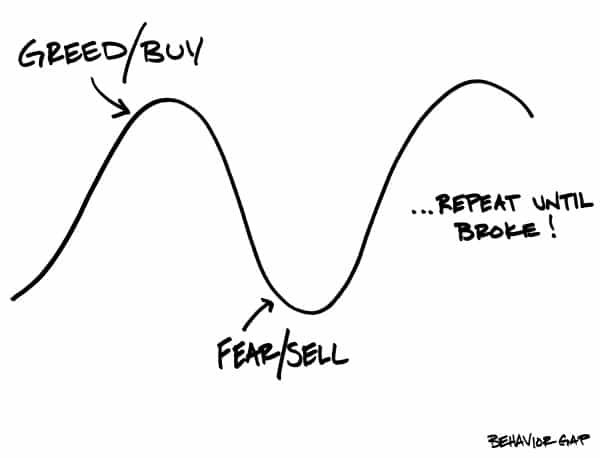

Technical analysis is analyzing past market data and using this information to make informed prediction about the future of an asset in either the short term or the long term. The analysis mainly focuses on the price and volume traded of an asset and can be a very effective tool but is not an exact science, it is a game of probabilities. It's about analyzing supply and demand of any given asset and forecasting the future based on the current market sentiment. It boils down to two fundamental human conditions:

Fear and Greed

Fear that we don't have enough vs. The insatiable want for more when we do

or in crypto terms

FUD vs. HODL

In my opinion this is one of the most useful things to understand about all charts because it is very easy to get lost in the indicators and strategies and forget the basics of what it is you are doing.

Technical vs. Fundamental Analysis

The flip side of the analysis coin is fundamental analysis which is looking at the asset's general health and going through financial statements and background of the asset. In FOREX this means looking into the governments behind the currencies you are trading, how they are run, when they are releasing tax reports, their energy supplies, etc. In the crypto world this means reading the white paper, checking out the history of the developers, the realistic application of the coin, seeing which venture capital firms are interested, etc. Fundamental analysis is a must if you plan on holding an asset or coin for the long term and I urge you all to read up on anything you plan to invest in for the long haul and not just follow the tips of others. I have used fundamental analysis a few times independent of technical analysis a few times to great success, a few examples are:

- The 2015 Collapse of Crude Oil: I worked in the industry and the writing was on the wall so I went short on WTI Crude

- The United States 2016 Federal Election: I had a feeling Trump would win so I shorted(profiting from a drop in price) the Dow Jones and went long(profiting from increase) the next day. Actually I made these trades from a hostel in Indonesia

- Reading the white paper for Ethereum in early 2017: This one was a no brainer, I just wish I had invested more

There are a lot of people who favor fundamental analysis and will often talk down on technical analysis as pseudo science or a guessing game but this is not a whole truth.

Why Technical Analysis Works

As I said earlier, every chart is a representation of human psychology and it is this simple fact that makes technical analysis a profitable endeavor. Human beings are creatures of habit and if you look closely at anything we do you will notice that

Patterns arise in everything we do!

These patterns are also found in the charts for every stock, currency, commodity, and crypto coin in existence. Given enough data a person can become incredibly accurate in their predictions but it takes a lot of focus and, more importantly, skill. One of the problems many new traders experience is seeing patterns that aren't actually there and cursing the system over a bad trade when a little more analysis and secondary confirmation would have shown them it was a bad move. Like I said, patterns arise in everything we do and it seems most new traders always follow this same pattern, mainly because they are seeing the money in every trade. The most important thing is to

Make a trade because it is a good trade, not because it will make you money!

I stress this to everyone I have taught and it is one of the hardest lessons to learn as a trader and it took me a long time to learn it too, trust me, I blew up a few accounts before this clicked with me.

Risk Levels and How to Keep Them Low

Trading vs. Poker

When I was in university I used to play a bit of competitive poker to keep the bills paid and I read all the books from the power players like Doyle Brunson and this brought me to the realization that it is not really gambling, but rather making moves based on probability. Trading and poker have a lot in common in this sense, the uninitiated will tell you that trading is gambling and that you shouldn't do it because of the risk of losing your shirt. But in reality trading is the same as poker but instead the table is the economy(or crypto markets) and the players are other traders(me and you) and institutions(whales or large banks). Everyone at the table is playing their hands by there own set of guidelines but the truly great players seem to know what will happen before it does and always seem to come out on top. There are also the fish who willingly throw away their money based on guess, and the whales who will push you around with the weight of their stack. Sound familiar?

Well one of the most common similarities with poker is the idea of going on tilt after a bad loss. This means that you have a loss then become desperate to get your money back and make terrible decisions in the process causing you to lose more. This happens to every trader at one point or another and the answer to this is simply stated but much harder in practice.

Discipline - The Best Way To Succeed at Anything

Knowing when to accept a loss and walk away is one of the hardest things anyone can do in any part of life and trading is no exception. I was told long ago that the key to being successful at trading meant keeping a clear head all the time (no alcohol) and focusing on what is in front of you and not what you want to see. At the time I didn't fully appreciate what that meant but through a few failures I started to see the point and the concrete of a simple idea set in my mind.

Wait for the market to come to you, if you rush in you will make mistakes, the perfect trade will come when you follow your rules and strategies to a tee!

This essentially became my daily mantra and I saw great success in a very short time but eventually I had a bad trade and went on tilt and lost most of my account. I took a break from the markets and re evaluated things and got back in with a clear head and added one important line to that mantra.

Know when to walk away!

And so my journey to complete discipline continued and every win and loss started to fade away and was replaced with the question, was that a good or bad trade? and not did I make or lose money? Every trade executed should be calculated before you press the button and you NEED to set a number that is fixed to exit if you lose, it cannot move no matter how much you think it will turn around and go your way.

Essentially the key to developing the discipline of a great trader takes dedication to a set of rules that will not change and the experience that comes from breaking those rules. These are my rules for day trading:

- Keep a clear head everyday

- Avoid too many indicators, too much clutter creates confusion

- Always have an exit plan before the trade begins, win or lose

- Every trade has to be verified in at least 2 timeframes

- Stick with the the strategy even if no opportunities arise

- Don't be afraid of a day without a profit

Basically, the key to mitigating risk is to just be aware of yourself and your flaws because, without a doubt, you are your own worst enemy. If you take stock of yourself you will know how to build your rules and what needs to be emphasized. I, for example, will often rush into things before knowing 100% it is the right move so I tailored my rules partially around that and it has worked well for me.

There are a lot of places where you can learn about technical analysis but what I am trying to offer here is a simplified look at every aspect and an attempt to answer the why questions with something a little more than because I said. There is a lot of confusing terminology and ideas and I will do my best to explain the psychology behind things like chart patterns and strategies. I hope you enjoyed this article and check out the next ones! Thanks for reading!

GREAT job! ... follow @lurehound

Good article. It blows my mind how value is determined. Resteemed

Yeah it really is crazy when you think about it. No currency has an intrinsic value, its all perception and strength. When Nixon took the US off the gold standard it really revolutionized the way we look at money and because of that we now have a whole new world of crypto. Crazy

It'll be an interesting future.

Great read. I've been hodling for a while, but only just got into actively trading. Seems like a good time to learn, with the markets taking a dip. Looking forward to learning more! Thank you.

I am glad you liked it! Yes it will be open season when this market turns around and I know these tags will loaded with posts full of analysis so I hope that some people can verify for themselves. I will be posting everyday for the next four days so if you have any questions dont hesitate to ask, I will do my best to answer!

I needed this, thank you for this post!

Check me out @felixsteemit

This post has received a 2.04% upvote from @msp-bidbot thanks to: @travelstheworld. Delegate SP to this public bot and get paid daily: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP Don't delegate so much that you have less than 50SP left on your account.

You got a 1.46% upvote from @minnowvotes courtesy of @travelstheworld!

This post has received gratitude of 0.92 % from @appreciator thanks to: @travelstheworld.

You got a 0.65% upvote from @allaz courtesy of @travelstheworld!

You got a 8.33% upvote from @redlambo courtesy of @travelstheworld!

This post has received a 2.08% UpGoat from @shares. Send at least 0.1 SBD to @shares with a post link in the memo field.

To support our daily curation initiative, please donate 1 SBD or delegate Steem Power (SP) to @shares by clicking one fo the following links: 10 SP, 50 SP, 100 SP, 500 SP, 1000 SP, 5000 SP.

Support my owner. Please vote @Yehey as Witness - simply click and vote.