Bitcoin, Altcoins, Fiat Relationships

This might seem pretty basic to some, but I think it's worth a mention.

Simply put, I've noticed that because Bitcoin is an intermediary between dollars and altcoins, we can find bear and bull signals by observing the interplay of these three.

I'm no master trader, but this analysis has helped me increase my portfolio by a few percentages here and there. Here's what I have been doing to make my predictions:

First, consider that for Bitcoin's price to be going up, one of three scenarios is occurring:

- A lot of people are trading fiat for BTC

- A lot of people are trading altcoins for BTC

- A lot of people are trading both altcoins and fiat for BTC

Conversely, when Bitcoin's price is going down, one of three scenarios is occurring:

- A lot of people are trading BTC into fiat

- A lot of people are trading BTC into alt coins

- A lot of people are trading BTC into altcoins and fiat

I like to think of the cryptocurrency market as a whole, because I try to trade with big swings rather than compete with robots for micro trades. For the purposes of this post, when I say "bull" or "bear" market, I'm referring to the entire crypto market. In a bull market, fiat is moving into crypto. In a bear market, fiat is moving out of crypto. But whichever way it moves, it typically moves through bitcoin on its way.

So what? I'll tell you what.

Say the price of BTC shot up 8% yesterday, and then it dips 4% today. You're wondering if it's going to keep going up or down. I'm wondering, too, so what I do is I look at the prices of the top 10-20 altcoins and compare movement.

If altcoins are up while BTC is down, then the correction in BTC was likely bulls rebalancing their portfolios into other coins, rather than cashing out. They are not harvesting; they are planting the seeds yet more future growth. There are never any guarantees, but this is a good sign for BTC to keep rising. If you missed that dip, it's too late; keep holding your BTC for the next surge. If you're looking for a little more risk/reward, start pumping BTC into altcoins at BTC's next apparent peak -- to beat the rush of others doing the same.

On the other hand, if altcoins have stayed stable or are also falling while BTC is falling, then all of that BTC is being turned back into fiat. This is a very strong bearish indicator, and might be a good time to liquidate a portion of your holdings so you'll have it available to buy back in at the bottom.

Using similar logic:

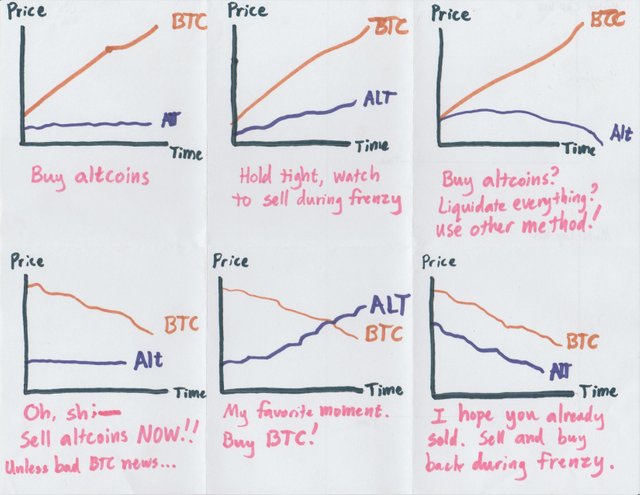

If BTC is up and altcoins are flat, expect altcoins to rise (especially the ones that have lagged behind the growth of their peers lately. Check for news items that might be holding them back)

If BTC is up and altcoins are up, hold tight and watch for the buying frenzy that precedes the collapse. It usually spikes up before crashing down, and these can be the most lucrative moments you'll encounter.

If BTC is up or flat and altcoins are down, this could be the start of a liquidation out of altcoins, or it could be an expectation of BTC growing rapidly soon. This scenario defies unambiguous analysis by this method. Use other analysis.

If BTC is down and altcoins are up, this is a bullish signal. BTC is very likely to catch up soon, and I'd rebalance alt into BTC if I were you.

If BTC down and altcoins are flat, check for bad news specific to BTC. If you can't find anything, then all of your altcoins are probably about to follow Bitcoin down the drain. Sell like you need it for last month's rent!

If BTC is down and altcoins are also down, well, I don't think you need this method to tell you that's a bear market. If you haven't missed all the good exit points, get out when you can! Then watch for the selling frenzy that almost always precedes the recovery.

Visual Aid:

Remember, no one has figured out a truly reliable method of analysis, and all trades come with risks. Don't take risks you can't afford to lose, and make sure to apply as many forms of analysis as you know how to (and time allows) before making your decisions for yourself.

Oh, and I kept saying "price" but actually I'm talking about market cap. In a preponderance of cases, shifts in price move in lockstep with shifts in market cap, but not quite always. When the supply of a coin changes dramatically, prices may move equally dramatically while market cap remains stable. When selling, you can often get away with just watching price. When buying, market cap should be a critical part of your consideration.

Cool insights, thanks.